INVESTOR & ANALYST DAY June 19, 2019 www.matw.com | Nasdaq: MATW © 2019 Matthews International Corporation. All Rights Reserved.

DISCLAIMER Any forward-looking statements contained in this presentation are included pursuant to the “safe harbor” provisions of earnings before the impact of investing and financing charges and income taxes, and the effects of certain acquisition the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown and ERP integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from measure may be useful to an investor in evaluating operating performance. It is also useful as a financial measure for management’s expectations. Although the Company believes that the expectations reflected in such forward-looking lenders and is used by the Company’s management to measure business performance. Adjusted EBITDA is not a statements are reasonable, no assurance can be given that such expectations will prove correct. Factors that could measure of the Company's financial performance under GAAP and should not be considered as an alternative to net cause the Company's results to differ materially from the results discussed in such forward-looking statements income or other performance measures derived in accordance with GAAP, or as an alternative to cash flow from principally include changes in domestic or international economic conditions, changes in foreign currency exchange operating activities as a measure of the Company's liquidity. The Company's definition of adjusted EBITDA may not rates, changes in the cost of materials used in the manufacture of the Company's products, changes in mortality and be comparable to similarly titled measures used by other companies. cremation rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company operates, changes in product demand or pricing as a result of domestic or international competitive The Company has also presented adjusted net income and adjusted earnings per share and believes each measure pressures, unknown risks in connection with the Company's acquisitions, cybersecurity concerns, effectiveness of the provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s Company's internal controls, compliance with domestic and foreign laws and regulations, technological factors beyond management in assessing the performance of its business. Adjusted net income and adjusted earnings per share the Company's control, and other factors described in the Company’s Annual Report on Form 10-K and other periodic provides the Company with an understanding of the results from the primary operations of our business by excluding filings with the U.S. Securities and Exchange Commission (“SEC”). the effects of certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of our operations. These measures provide management with insight into the earning value for shareholders excluding The information contained in this presentation, including any financial data, is made as of March 31, 2019 unless certain costs, not related to the Company’s primary operations. Likewise, these measures may be useful to an otherwise noted. The Company does not, and is not obligated to, update this information after the date of such investor in evaluating the underlying operating performance of the Company’s business overall, as well as information. Included in this report are measures of financial performance that are not defined by generally accepted performance trends, on a consistent basis. accounting principles in the United States (“GAAP”). The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of Lastly, the Company has presented net debt and the ratio of net debt to adjusted EBITDA and believes each measure certain items that management believes do not directly reflect the Company’s core operations including acquisition provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to management in assessing the overall indebtedness and leverage. These measures provide the Company with an operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and understanding of its leverage before the impact of investing and financing charges and other charges that do not postretirement expense. Management believes that presenting non-GAAP financial measures is useful to investors reflect the ordinary earnings of the Company’s operations. These measures may be useful to an investor in evaluating because it (i) provides investors with meaningful supplemental information regarding financial performance by indebtedness and leverage of the business. excluding certain items that management believes do not directly reflect the Company’s core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and Rider 21-A strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that Cash dividends have been paid on common shares in every year for at least the past forty-nine years. It is the may be useful to investors in evaluating the Company’s results. The Company believes that the presentation of these present intention of the Company to continue to pay quarterly cash dividends on its common stock. However, there is non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the no assurance that dividends will be declared and paid as the declaration and payment of dividends is at the discretion reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors of the Board of Directors of the Company and is dependent upon many factors, including but not limited to the and trends affecting the Company’s business that could not be obtained absent these disclosures. Company's financial condition, results of operations, cash requirements, future prospects and other factors deemed relevant by the Board. The Company believes that adjusted EBITDA provides relevant and useful information, which is used by the Company’s management in assessing the performance of its business. Adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management’s evaluation of its operating results. These items include stock-based compensation, the non-service portion of pension and postretirement expense, acquisition costs, ERP integration costs, and strategic initiatives and other charges. Adjusted EBITDA provides the Company with an understanding of © 2019 Matthews International Corporation. All Rights Reserved. 2

AGENDA & WELCOME 9:00 AM Welcome & Overview Joe Bartolacci, President and Chief Executive Officer Joe Bartolacci, President and Chief Executive Officer 9:05 AM Business & Financial Review Steve Nicola, Chief Financial Officer and Secretary Gary Kohl, President, SGK Brand Solutions 9:30 AM SGK Brand Solutions Greg Babe, Chief Technology Officer 10:15 AM BREAK Brian Dunn, Executive Vice President, Strategy & Corporate Development 10:25 AM Industrial Technologies Paul Jensen, Division President, Industrial Technologies Steven Gackenbach, Group President, Memorialization 11:05 AM Memorialization Brian Dunn, Executive Vice President, Strategy & Corporate Development 11:45 AM Q&A All Leadership 12:00-1:00 PM LUNCH © 2019 Matthews International Corporation. All Rights Reserved. 3

JOE BARTOLACCI President & Chief Executive Officer STEVE NICOLA Chief Financial Officer & Secretary © 2019 Matthews International Corporation. All Rights Reserved.

A market-leading global company serving the consumer products, memorialization and industrial technologies markets. Nasdaq: MATW Founded 1850 Common Shares Outstanding 31.7 million Market Capitalization $1.2 billion Annualized Dividend / Yield $0.80 / 2.2% Recent Price $36.63 Institutional Ownership 84% 52-Week Range $33.73-$61.25 Insider Ownership 3% Average Trading Volume 128k Fiscal Year End September 30 (trailing three months) Market data as of June 14, 2019 [Source: NASDAQ IQ]; ownership as of most recent filings. © 2019 Matthews International Corporation. All Rights Reserved. 5

ROOTED IN IDENTIFICATION PRODUCTS FOUNDED in 1850 TODAY • Marking Products • Industrial Technologies • Printing Plates • SGK Brand Solutions • Bronze Plaques • Memorialization © 2019 Matthews International Corporation. All Rights Reserved. 6

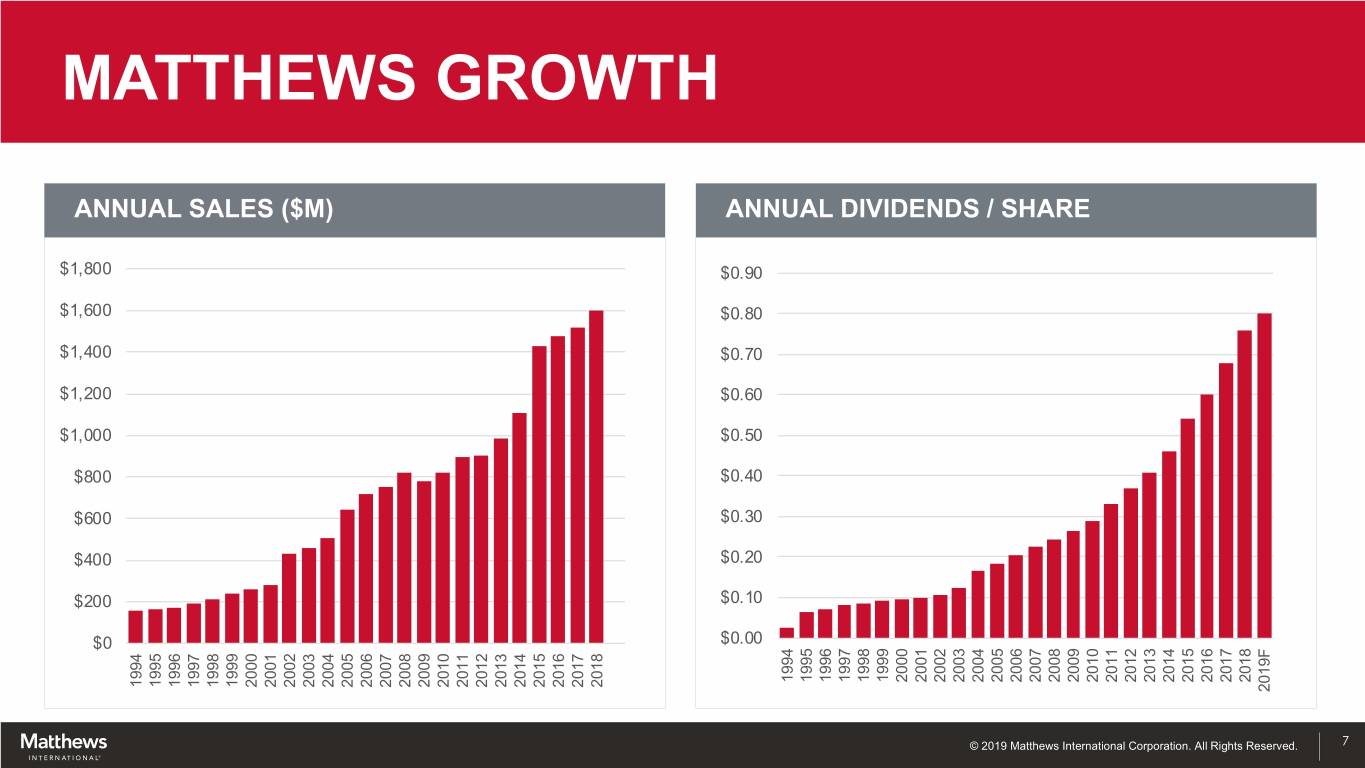

MATTHEWS GROWTH ANNUAL SALES ($M) ANNUAL DIVIDENDS / SHARE $1,800 $0.90 $1,600 $0.80 $1,400 $0.70 $1,200 $0.60 $1,000 $0.50 $800 $0.40 $600 $0.30 $400 $0.20 $200 $0.10 $0 $0.00 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019F © 2019 Matthews International Corporation. All Rights Reserved. 7

GLOBAL PRODUCTS AND SERVICES ACROSS DIVERSE BUSINESSES AMERICAS EUROPE ASIA-PACIFIC / OTHER 67% 28% 5% 11,000 EMPLOYEES | 6 CONTINENTS © 2019 Matthews International Corporation. All Rights Reserved. 8

MATTHEWS TODAY LEADING POSITION IN STABLE MARKETS Primarily #1 or #2 in markets where we compete or positioning to be there Stable markets High customer retention rates New product development and innovation of existing products Strong cash flow and history of annual dividend increases Target 14% return on invested capital © 2019 Matthews International Corporation. All Rights Reserved. 9

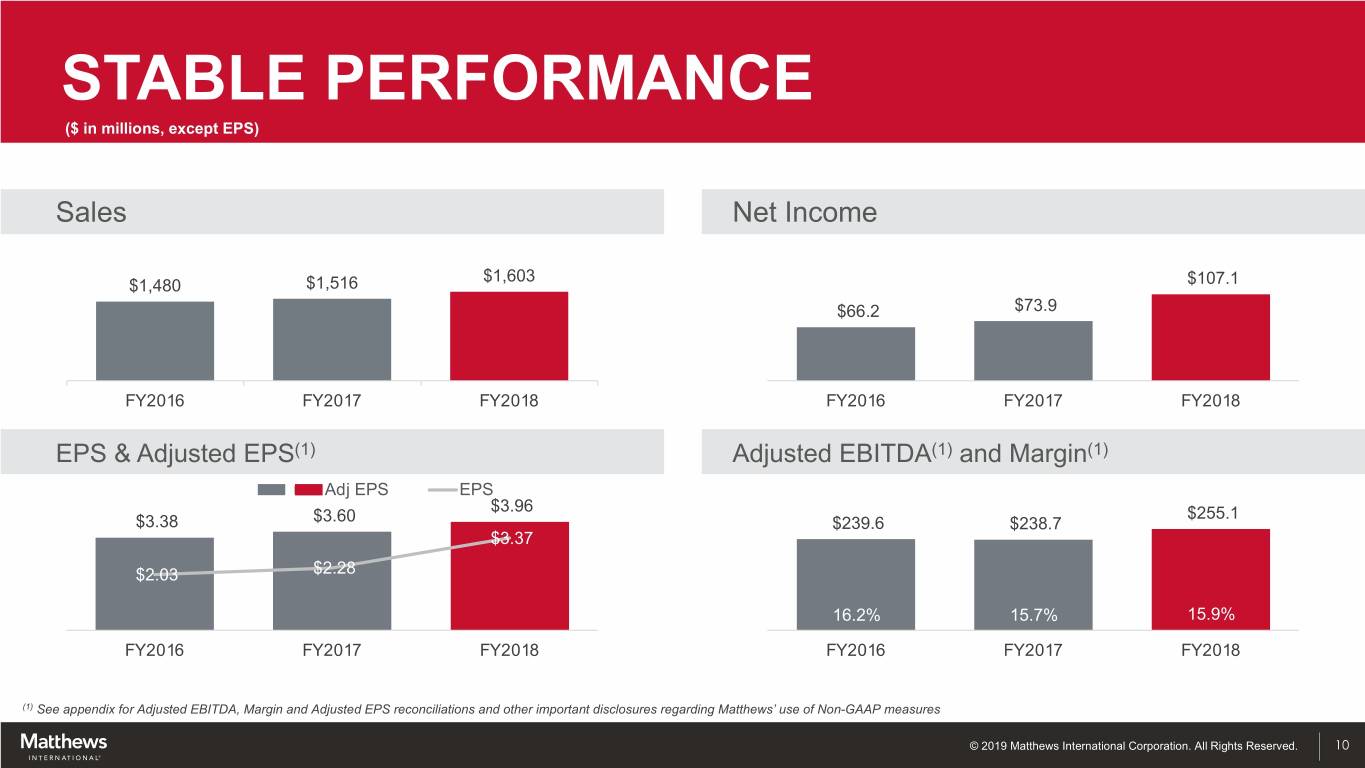

STABLE PERFORMANCE ($ in millions, except EPS) Sales Net Income $1,603 $1,480 $1,516 $107.1 $66.2 $73.9 FY2016 FY2017 FY2018 FY2016 FY2017 FY2018 EPS & Adjusted EPS(1) Adjusted EBITDA(1) and Margin(1) Adj EPS EPS $3.96 $255.1 $3.38 $3.60 $239.6 $238.7 $3.37 $2.03 $2.28 16.2% 15.7% 15.9% FY2016 FY2017 FY2018 FY2016 FY2017 FY2018 (1) See appendix for Adjusted EBITDA, Margin and Adjusted EPS reconciliations and other important disclosures regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 10

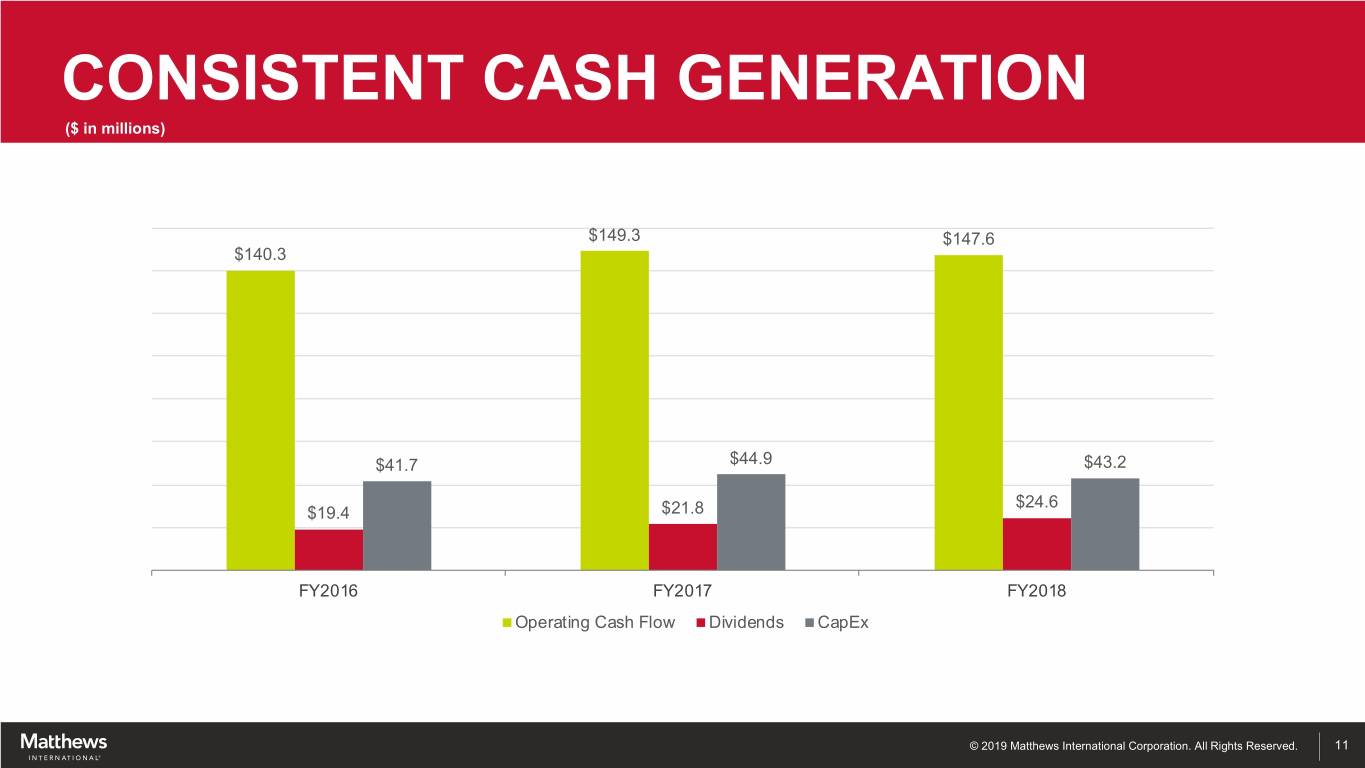

CONSISTENT CASH GENERATION ($ in millions) $149.3 $147.6 $140.3 $41.7 $44.9 $43.2 $24.6 $19.4 $21.8 FY2016 FY2017 FY2018 Operating Cash Flow Dividends CapEx © 2019 Matthews International Corporation. All Rights Reserved. 11

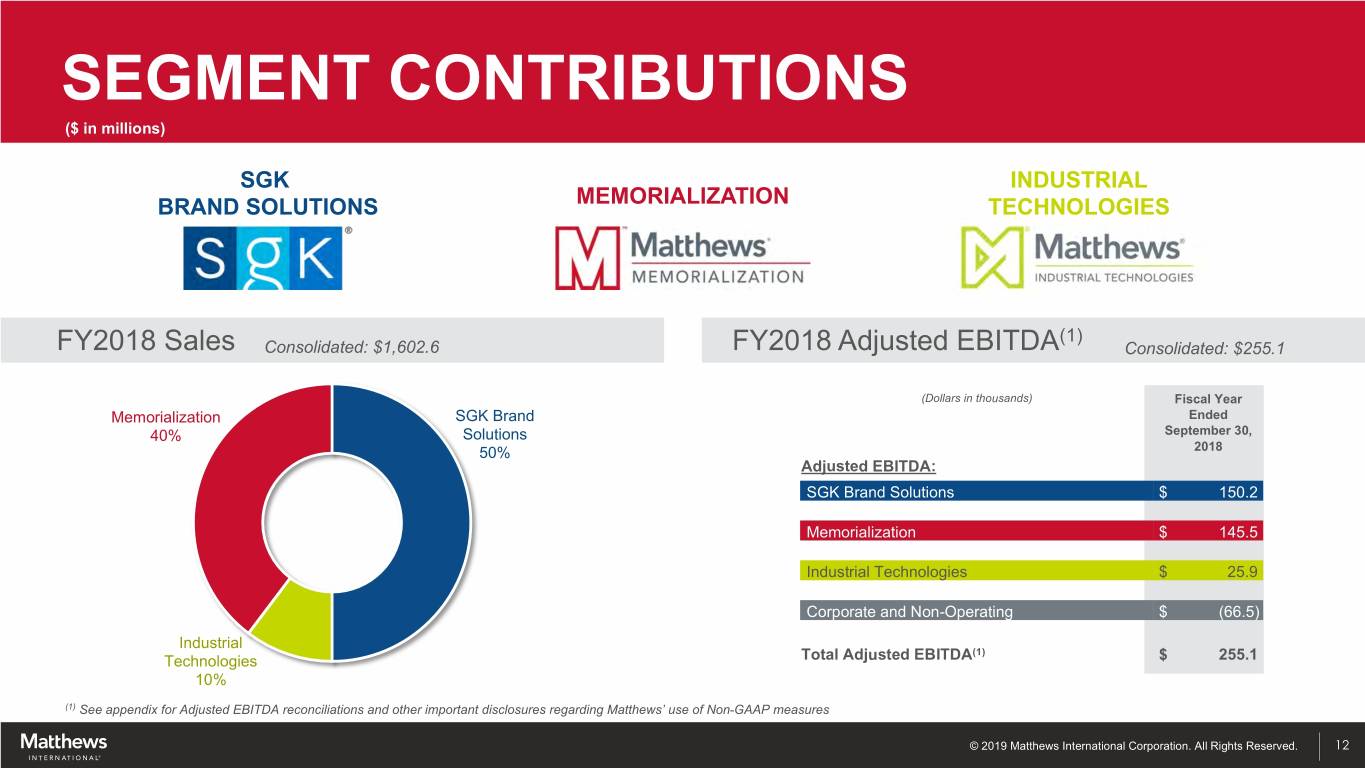

SEGMENT CONTRIBUTIONS ($ in millions) SGK INDUSTRIAL BRAND SOLUTIONS MEMORIALIZATION TECHNOLOGIES (1) FY2018 Sales Consolidated: $1,602.6 FY2018 Adjusted EBITDA Consolidated: $255.1 (Dollars in thousands) Fiscal Year Memorialization SGK Brand Ended 40% Solutions September 30, 50% 2018 Adjusted EBITDA: SGK Brand Solutions $ 150.2 Memorialization $ 145.5 Industrial Technologies $ 25.9 Corporate and Non-Operating $ (66.5) Industrial (1) Technologies Total Adjusted EBITDA $ 255.1 10% (1) See appendix for Adjusted EBITDA reconciliations and other important disclosures regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 12

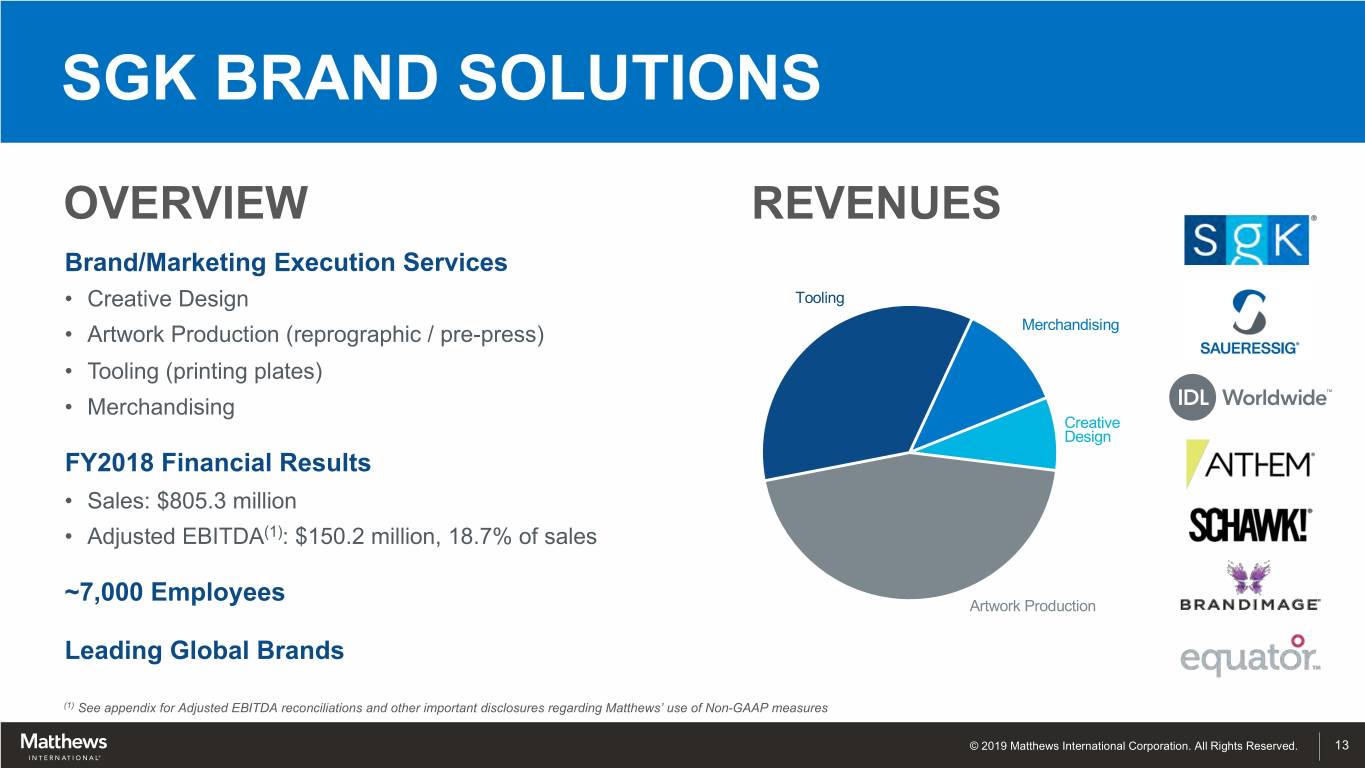

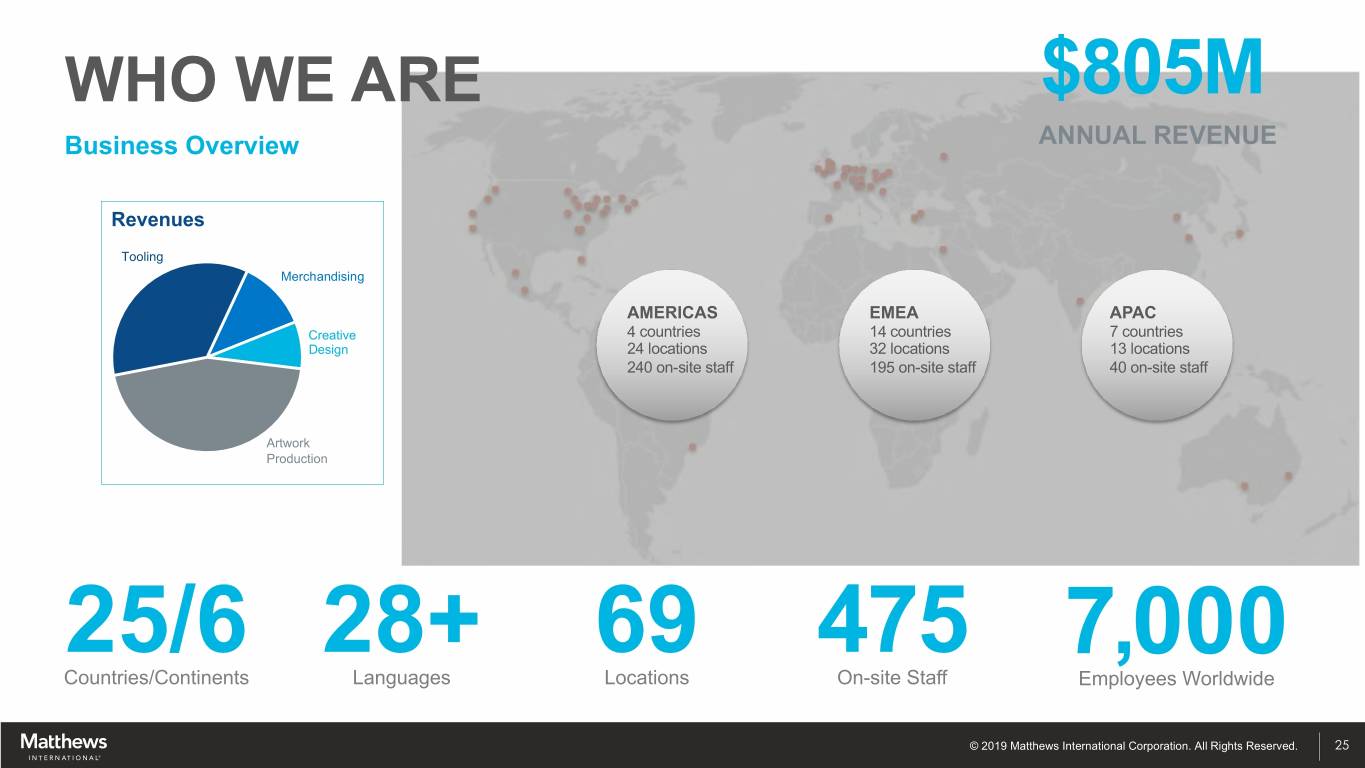

SGK BRAND SOLUTIONS OVERVIEW REVENUES Brand/Marketing Execution Services • Creative Design Tooling • Artwork Production (reprographic / pre-press) Merchandising • Tooling (printing plates) • Merchandising Creative Design FY2018 Financial Results • Sales: $805.3 million • Adjusted EBITDA(1): $150.2 million, 18.7% of sales ~7,000 Employees Artwork Production Leading Global Brands (1) See appendix for Adjusted EBITDA reconciliations and other important disclosures regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 13

SGK BRAND SOLUTIONS SERVICING GLOBAL AND REGIONAL CLIENTS FOOD/ GLOBAL GLOBAL OTHER • Longstanding relationships with BEVERAGE PHARMACEUTICAL RETAILER LEADING a large, blue chip customer base CLIENTS CLIENTS CLIENTS BRANDS consisting of many Fortune 100 and Fortune 50 companies • “Strategic” relationships rather than “vendor” relationships – more valued client engagement • Critical service provider in marketing execution of top world-wide brands, particularly where global consistency is highly valued © 2019 Matthews International Corporation. All Rights Reserved. 14

SGK BRAND SOLUTIONS DIFFERENTIATORS TRENDS STRATEGY • Global footprint, regional • Branded vs. private label • Maximize cash flow via low relationships difficult to reproduce single-digit organic revenue • Centralizing, with local adoption growth, acquisition synergies, • #1 global market share • Online marketing, consistency operational improvements • Execution capability, local know- with on-shelf • Organic – develop print how consultation solutions and outsourced marketing services • Acquisition – extend capabilities and geographies © 2019 Matthews International Corporation. All Rights Reserved. 15

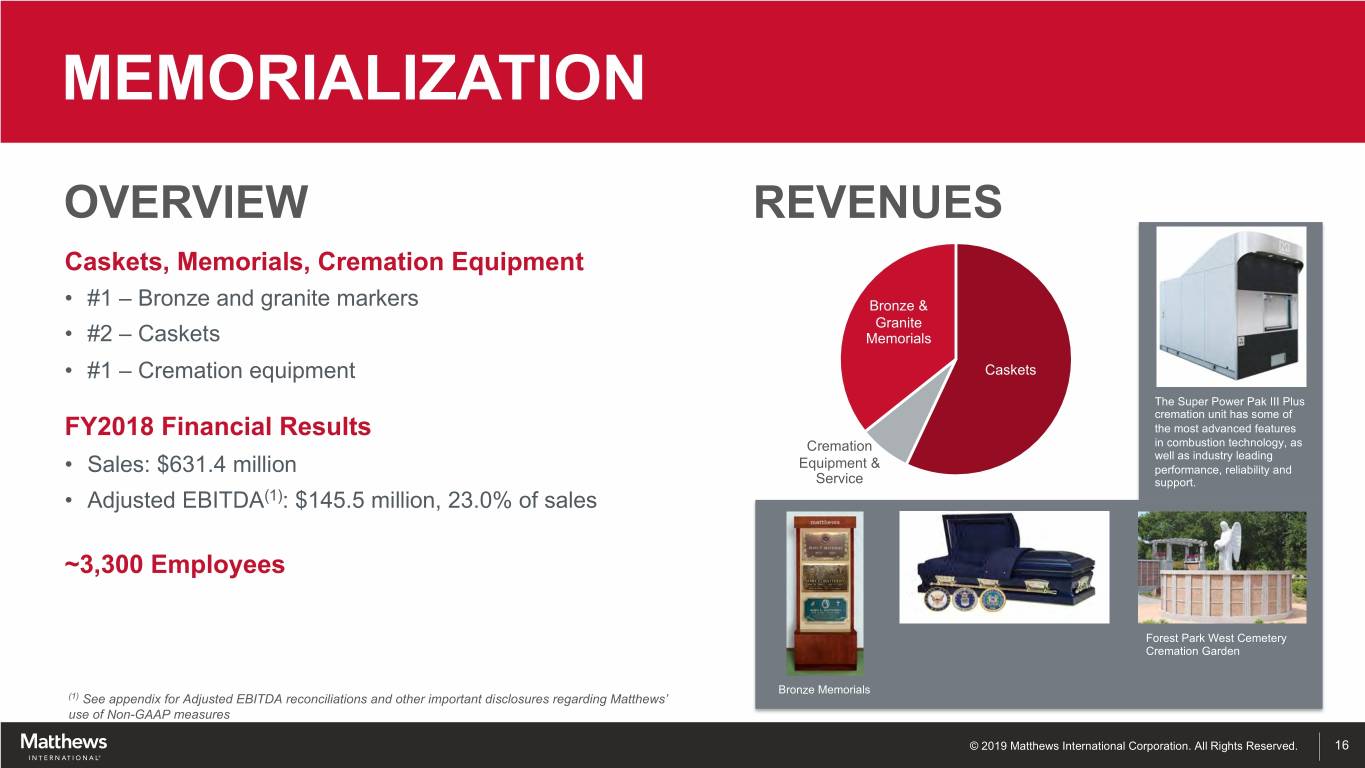

MEMORIALIZATION OVERVIEW REVENUES Caskets, Memorials, Cremation Equipment • #1 – Bronze and granite markers Bronze & Granite • #2 – Caskets Memorials • #1 – Cremation equipment Caskets The Super Power Pak III Plus cremation unit has some of FY2018 Financial Results the most advanced features Cremation in combustion technology, as well as industry leading • Sales: $631.4 million Equipment & performance, reliability and Service support. • Adjusted EBITDA(1): $145.5 million, 23.0% of sales ~3,300 Employees Forest Park West Cemetery Cremation Garden Bronze Memorials (1) See appendix for Adjusted EBITDA reconciliations and other important disclosures regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 16

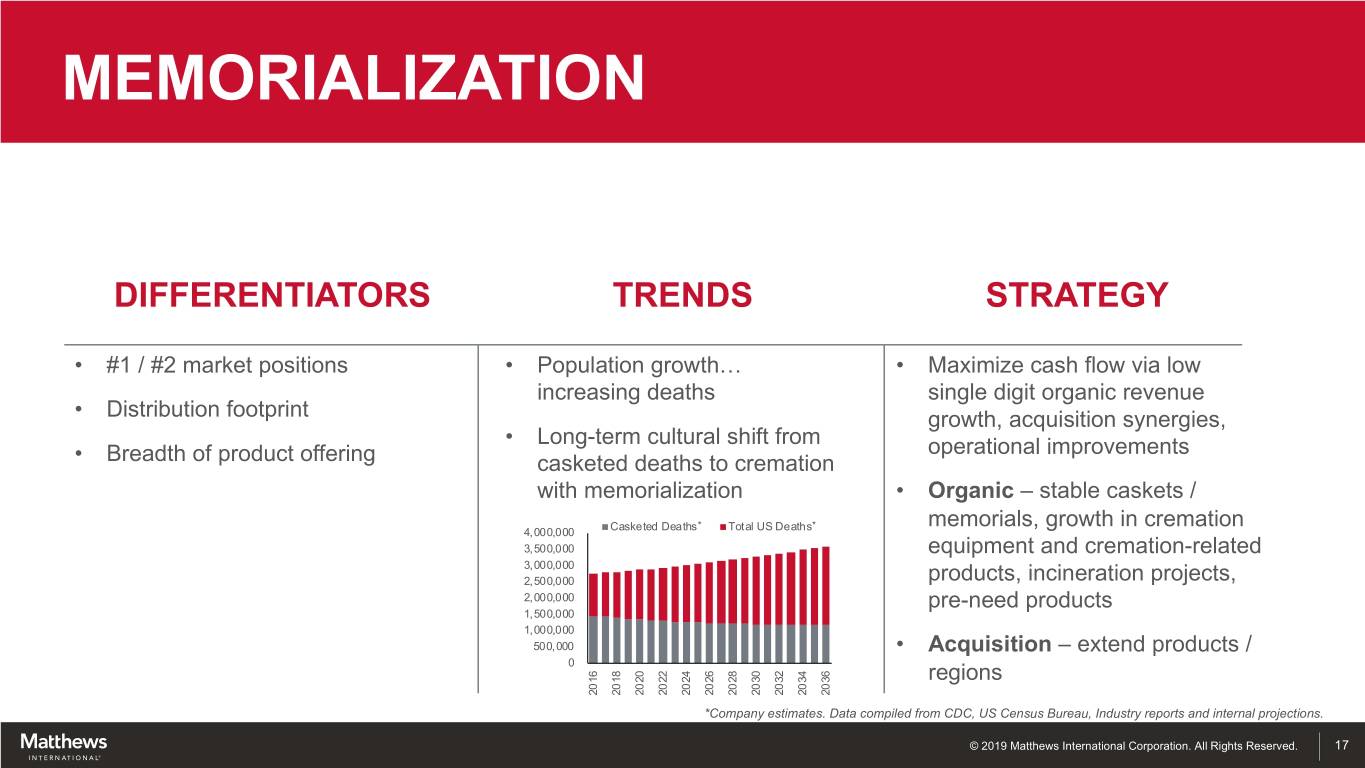

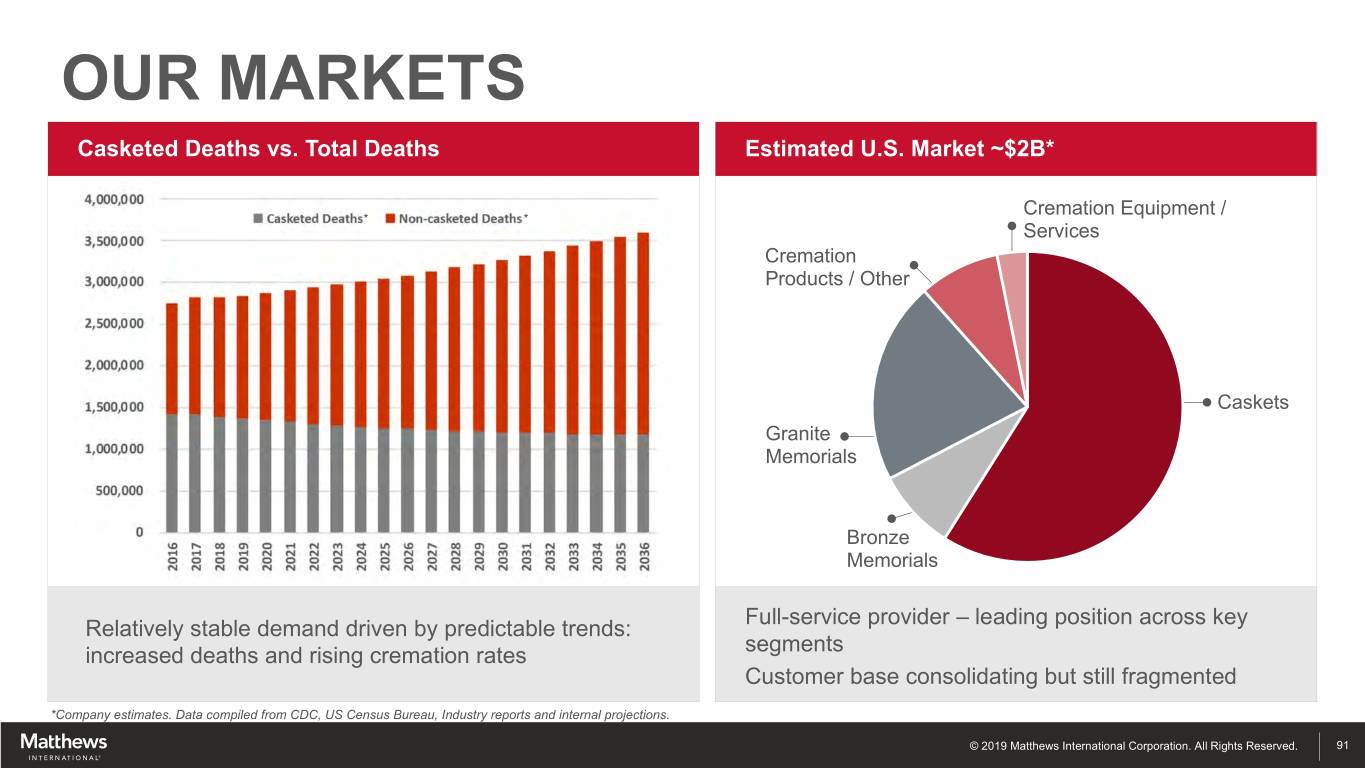

MEMORIALIZATION DIFFERENTIATORS TRENDS STRATEGY • #1 / #2 market positions • Population growth… • Maximize cash flow via low increasing deaths single digit organic revenue • Distribution footprint growth, acquisition synergies, • Long-term cultural shift from operational improvements • Breadth of product offering casketed deaths to cremation with memorialization • Organic – stable caskets / Casketed Deaths* Total US Deaths* memorials, growth in cremation 4, 000,000 3, 500,000 equipment and cremation-related 3, 000,000 2, 500,000 products, incineration projects, 2, 000,000 pre-need products 1, 500,000 1, 000,000 500, 000 • Acquisition – extend products / 0 regions 2016 2018 2020 2022 2024 2026 2028 2030 2032 2034 2036 *Company estimates. Data compiled from CDC, US Census Bureau, Industry reports and internal projections. © 2019 Matthews International Corporation. All Rights Reserved. 17

INDUSTRIAL TECHNOLOGIES OVERVIEW Products & Services • Product Identification Equipment / Consumables • Warehouse Automation • Applied Technologies High Growth, Disruptive Opportunities FY2018 Financial Results • Sales: $165.9 million • Adjusted EBITDA(1): $25.9 million, 15.6% of sales • Product development costs ~500 Employees (1) See appendix for Adjusted EBITDA reconciliations and other important disclosures regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 18

INDUSTRIAL TECHNOLOGIES DIFFERENTIATORS TRENDS STRATEGY • Broad marking product offerings, • New product development focus • Product development to disrupt including equipment, inks and on total cost of ownership market place service • Growth in e-commerce • Proprietary software to facilitate • Leading warehouse fulfillment warehousing, logistics tracking throughout warehouse systems provider to customer doorstep • Innovative mindset • Acquisitions to fill-out solutions portfolio © 2019 Matthews International Corporation. All Rights Reserved. 19

VALUE CREATION ORGANIC • Expanding market penetration with existing products • Synergies and manufacturing / cost structure improvements • New product introductions ACQUISITIONS • Support segment business plans; fill product / geographic gaps • Leverage existing operating infrastructure • Achieve long-term annual return (EBITDA) on invested capital of at least 14% SHARE REPURCHASES • Opportunistic - Repurchase in periods of excess cash flow - Current remaining authorization: 1.1 million shares © 2019 Matthews International Corporation. All Rights Reserved. 20

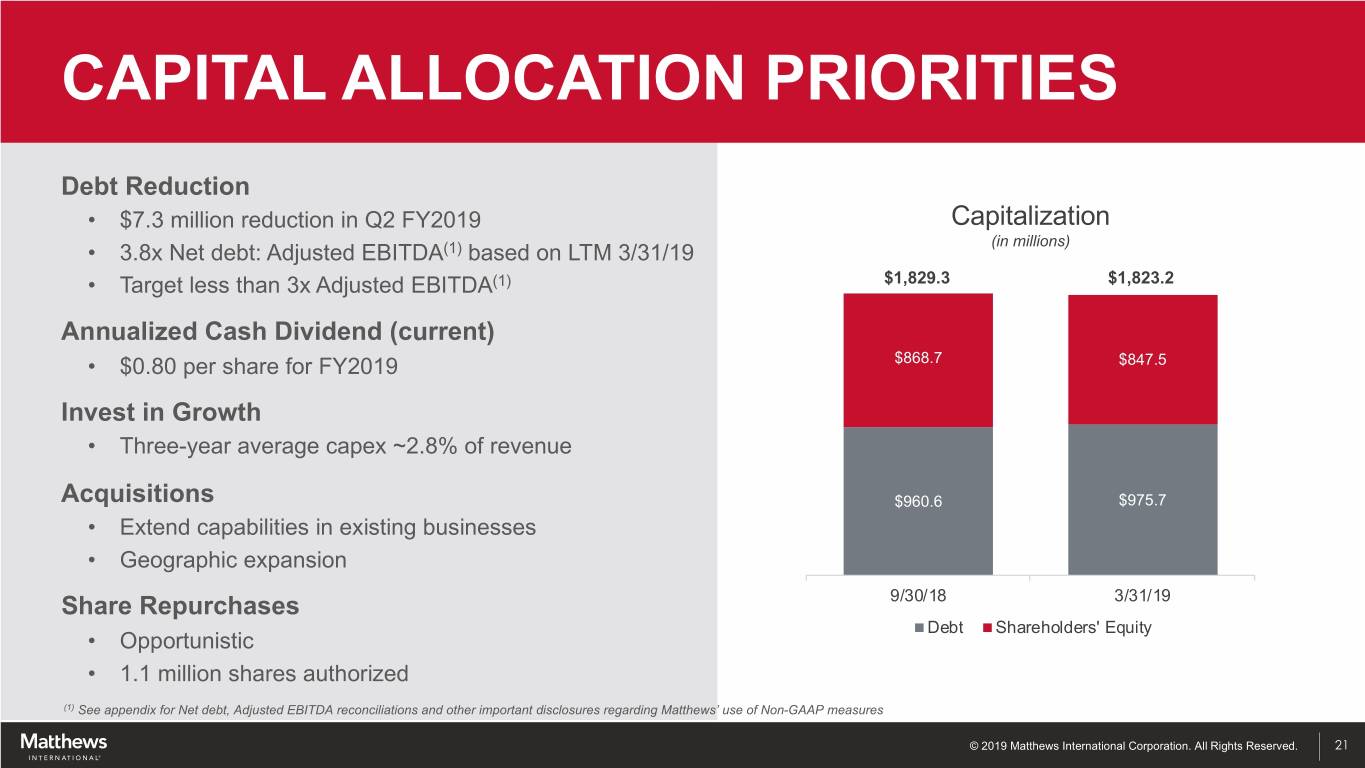

CAPITAL ALLOCATION PRIORITIES Debt Reduction • $7.3 million reduction in Q2 FY2019 Capitalization (in millions) • 3.8x Net debt: Adjusted EBITDA(1) based on LTM 3/31/19 • Target less than 3x Adjusted EBITDA(1) $1,829.3 $1,823.2 Annualized Cash Dividend (current) • $0.80 per share for FY2019 $868.7 $847.5 Invest in Growth • Three-year average capex ~2.8% of revenue Acquisitions $960.6 $975.7 • Extend capabilities in existing businesses • Geographic expansion Share Repurchases 9/30/18 3/31/19 Debt Shareholders' Equity • Opportunistic • 1.1 million shares authorized (1) See appendix for Net debt, Adjusted EBITDA reconciliations and other important disclosures regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 21

INVESTMENT HIGHLIGHTS LEADING MARKET POSITIONS STRONG CASH FLOW STABLE END MARKETS TRACK RECORD OF SUCCESSFUL ACQUISITION INTEGRATION © 2019 Matthews International Corporation. All Rights Reserved. 22

GARY KOHL BRAND President, SGK Brand Solutions SOLUTIONS © 2019 Matthews International Corporation. All Rights Reserved. 23

WHO WE ARE OVERVIEW © 2019 Matthews International Corporation. All Rights Reserved. 24

WHO WE ARE $805M Business Overview ANNUAL REVENUE Revenues Tooling Merchandising AMERICAS EMEA APAC Creative 4 countries 14 countries 7 countries Design 24 locations 32 locations 13 locations 240 on-site staff 195 on-site staff 40 on-site staff Artwork Production 25/6 28+ 69 475 7,000 Countries/Continents Languages Locations On-site Staff Employees Worldwide © 2019 Matthews International Corporation. All Rights Reserved. 25

WHAT WE DO CREATIVE DESIGN, ARTWORK PRODUCTION, TOOLING © 2019 Matthews International Corporation. All Rights Reserved. 26

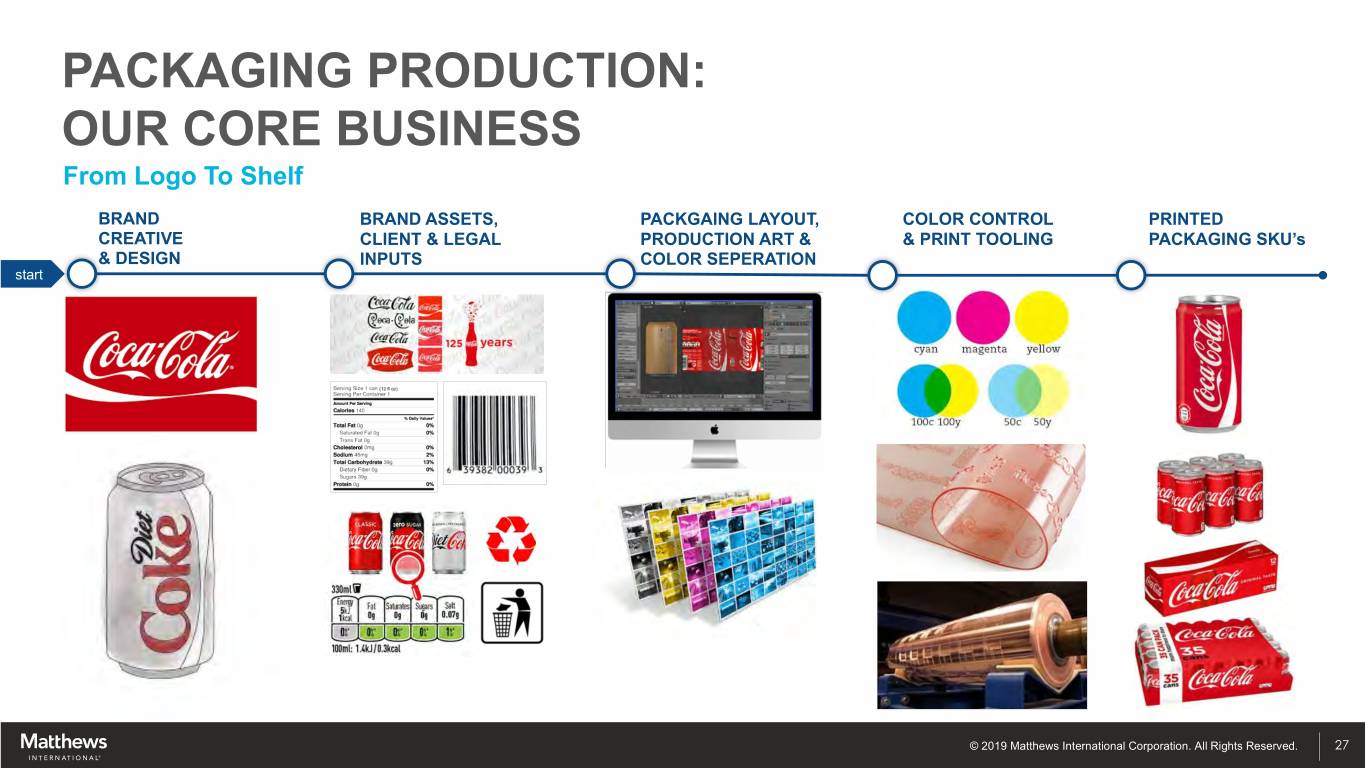

PACKAGING PRODUCTION: OUR CORE BUSINESS From Logo To Shelf BRAND BRAND ASSETS, PACKGAING LAYOUT, COLOR CONTROL PRINTED CREATIVE CLIENT & LEGAL PRODUCTION ART & & PRINT TOOLING PACKAGING SKU’s & DESIGN INPUTS COLOR SEPERATION start © 2019 Matthews International Corporation. All Rights Reserved. 27

EXTENDING OUR CORE BUSINESS From Shelf To Experience displays circular in-store print events digital out of home social © 2019 Matthews International Corporation. All Rights Reserved. 28

HOW WE DO IT TECHNOLOGY AND SCALE © 2019 Matthews International Corporation. All Rights Reserved. 29

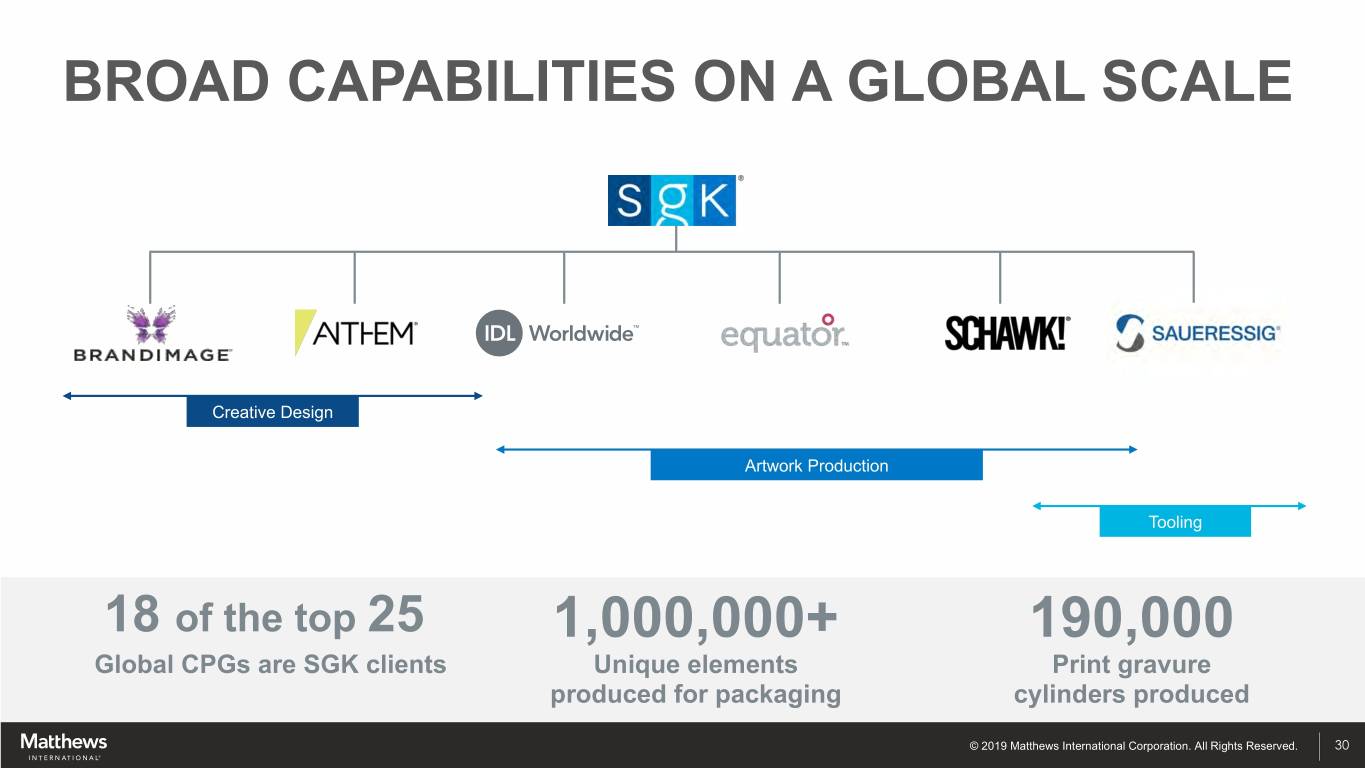

BROAD CAPABILITIES ON A GLOBAL SCALE Creative Design Artwork Production Tooling 18 of the top 25 1,000,000+ 190,000 Global CPGs are SGK clients Unique elements Print gravure produced for packaging cylinders produced © 2019 Matthews International Corporation. All Rights Reserved. 30

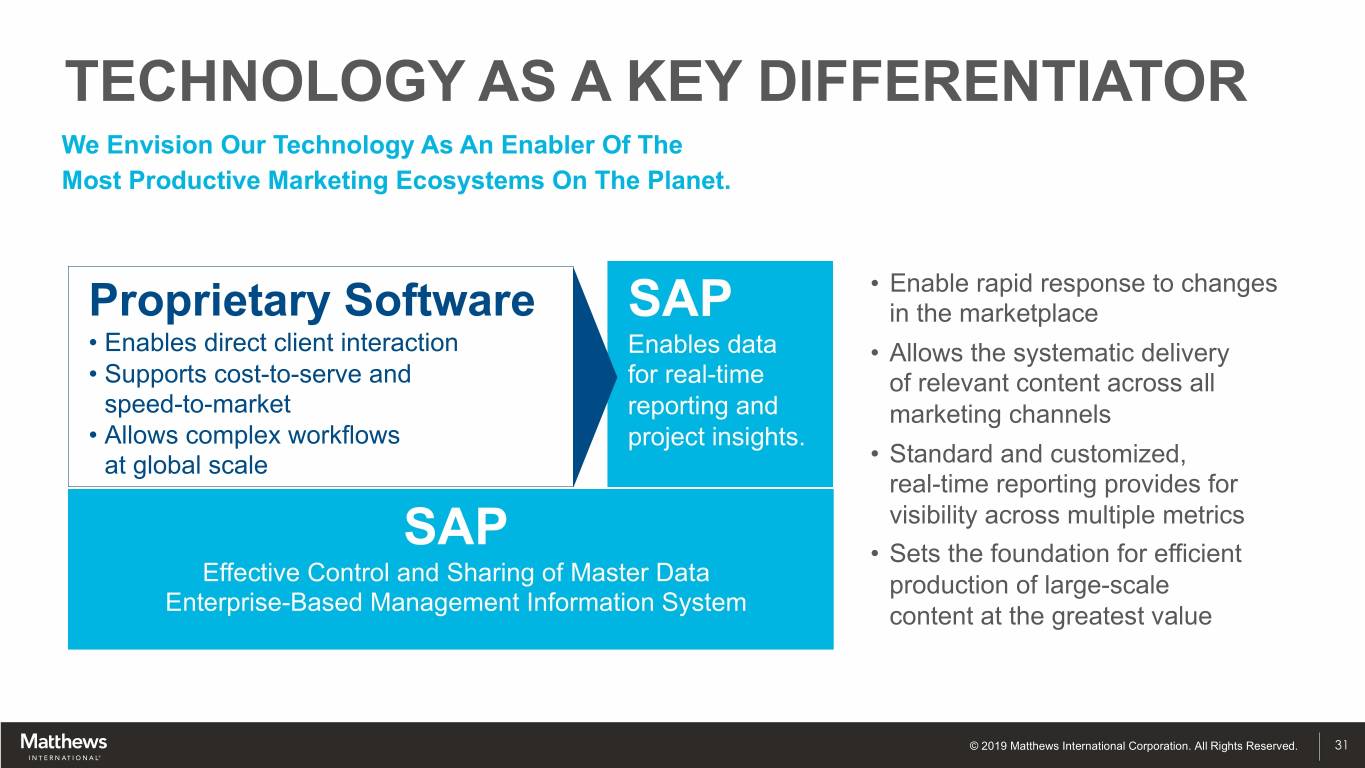

TECHNOLOGY AS A KEY DIFFERENTIATOR We Envision Our Technology As An Enabler Of The Most Productive Marketing Ecosystems On The Planet. • Enable rapid response to changes Proprietary Software SAP in the marketplace • Enables direct client interaction Enables data • Allows the systematic delivery • Supports cost-to-serve and for real-time of relevant content across all speed-to-market reporting and marketing channels • Allows complex workflows project insights. at global scale • Standard and customized, real-time reporting provides for visibility across multiple metrics SAP • Sets the foundation for efficient Effective Control and Sharing of Master Data production of large-scale Enterprise-Based Management Information System content at the greatest value © 2019 Matthews International Corporation. All Rights Reserved. 31

WHO WE DO IT FOR CLIENTS AND CASE STUDIES © 2019 Matthews International Corporation. All Rights Reserved. 32

BLUE CHIP BRANDS TRUST SGK CPG HEALTH PRIVATE LABEL & OTHER CONSUMER BRANDS TECH PRINT © 2019 Matthews International Corporation. All Rights Reserved. 33

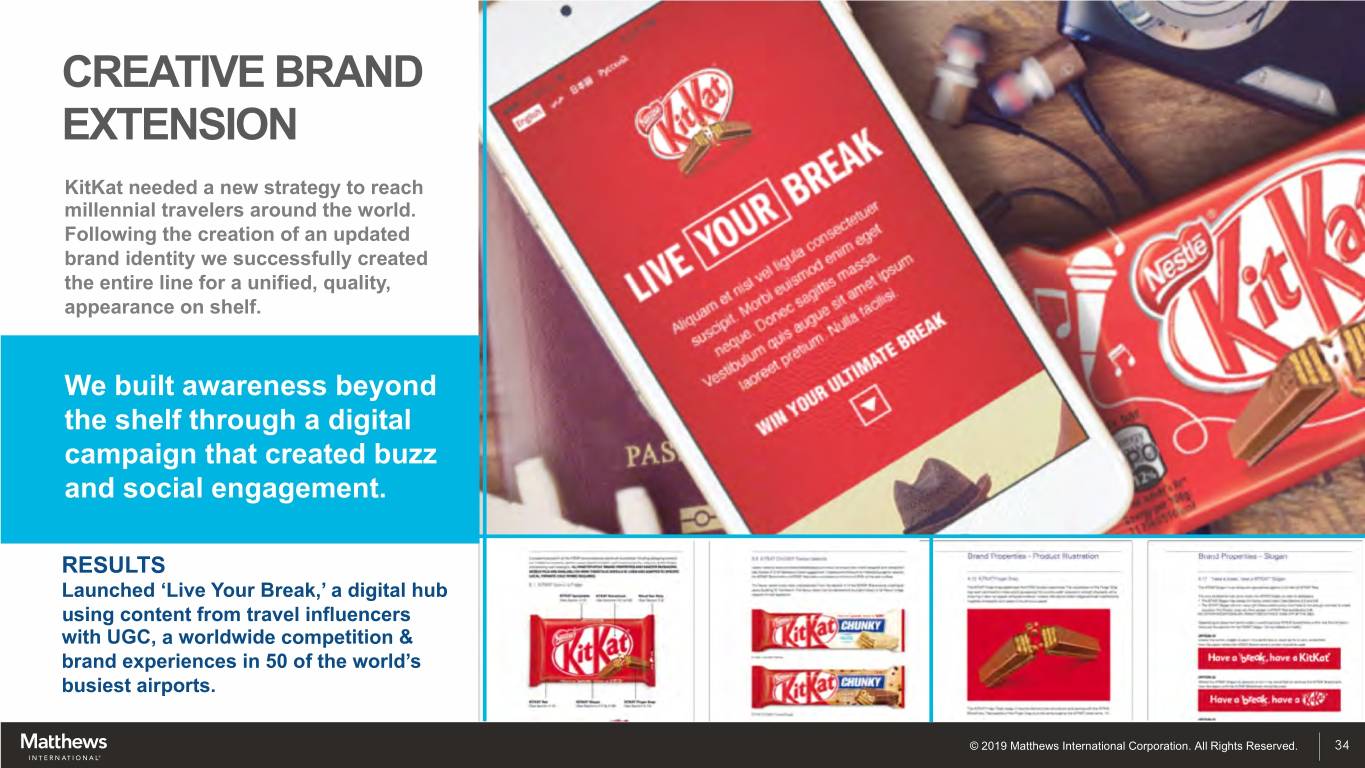

CREATIVE BRAND EXTENSION KitKat needed a new strategy to reach millennial travelers around the world. Following the creation of an updated brand identity we successfully created the entire line for a unified, quality, appearance on shelf. We built awareness beyond the shelf through a digital campaign that created buzz and social engagement. RESULTS Launched ‘Live Your Break,’ a digital hub using content from travel influencers with UGC, a worldwide competition & brand experiences in 50 of the world’s busiest airports. © 2019 Matthews International Corporation. All Rights Reserved. 34

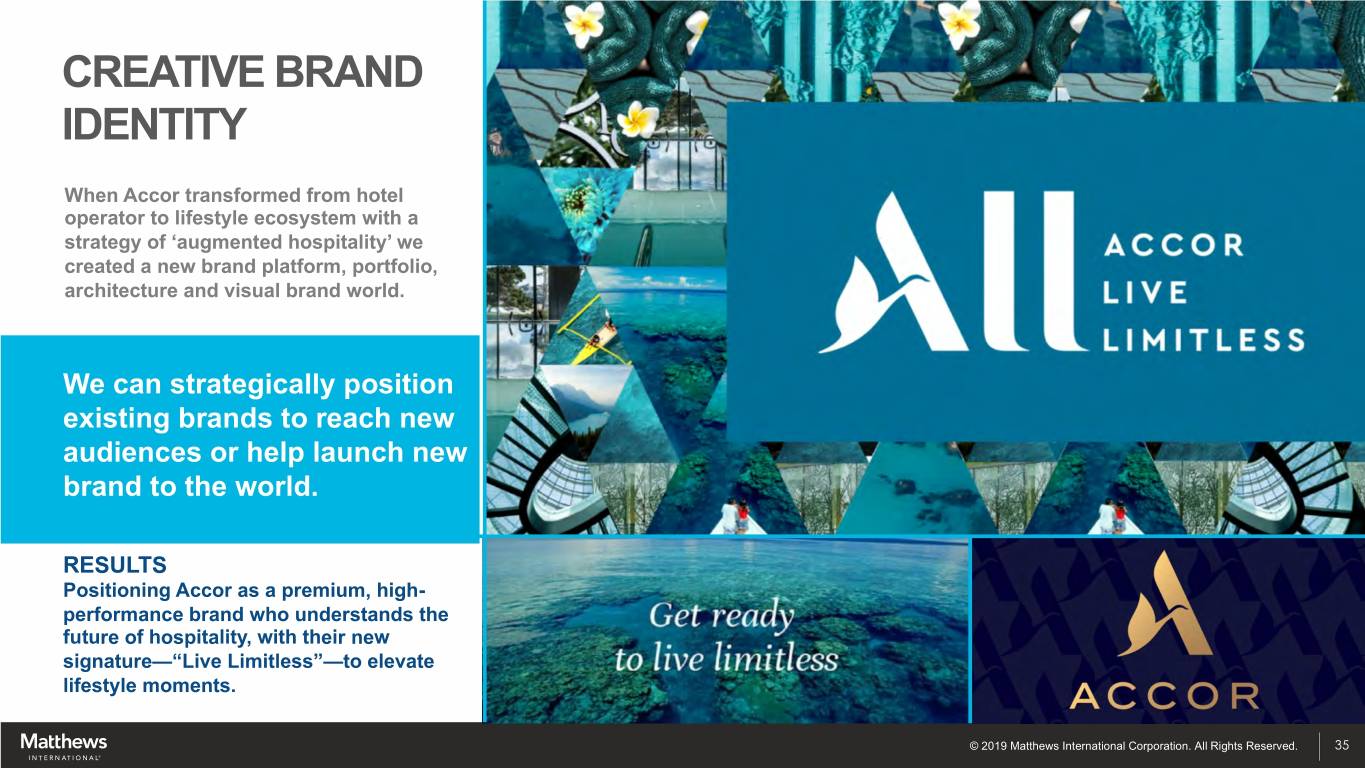

CREATIVE BRAND IDENTITY When Accor transformed from hotel operator to lifestyle ecosystem with a strategy of ‘augmented hospitality’ we created a new brand platform, portfolio, architecture and visual brand world. We can strategically position existing brands to reach new audiences or help launch new brand to the world. RESULTS Positioning Accor as a premium, high- performance brand who understands the future of hospitality, with their new signature—“Live Limitless”—to elevate lifestyle moments. © 2019 Matthews International Corporation. All Rights Reserved. 35

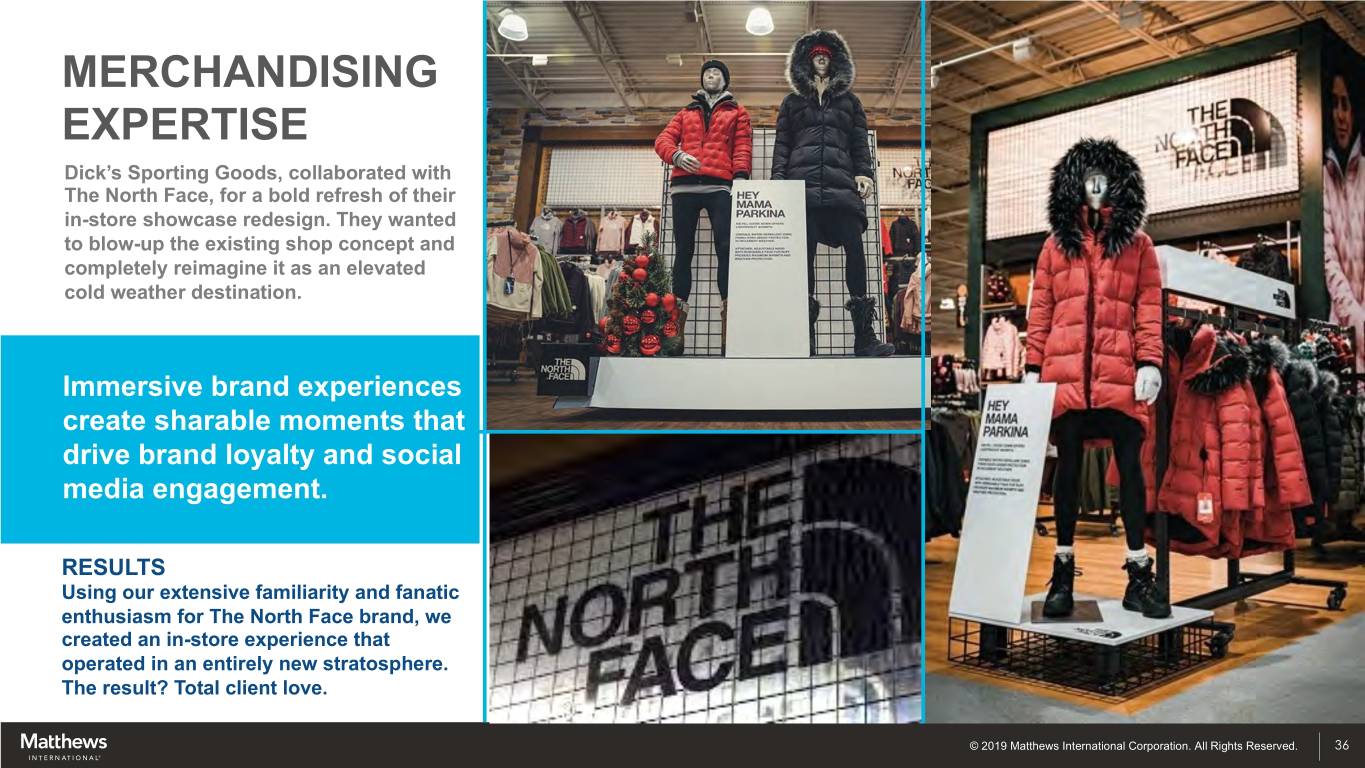

MERCHANDISING EXPERTISE Dick’s Sporting Goods, collaborated with The North Face, for a bold refresh of their in-store showcase redesign. They wanted to blow-up the existing shop concept and completely reimagine it as an elevated cold weather destination. Immersive brand experiences create sharable moments that drive brand loyalty and social media engagement. RESULTS Using our extensive familiarity and fanatic enthusiasm for The North Face brand, we created an in-store experience that operated in an entirely new stratosphere. The result? Total client love. © 2019 Matthews International Corporation. All Rights Reserved. 36

SCALED GLOBAL PRODUCTION Producing 6,000 SKUs across 100 countries, the goals of this project were to flawlessly adapt our client’s strategic design intent in order to drive Colgate brand consistency around the world. 6,000 SKUs 100 Countries 1-Year Deployment RESULTS We simplified and standardized ways of working around the globe. We were able to ensure success and mitigate risk by instituting a cohesive, controlled, global, process. © 2019 Matthews International Corporation. All Rights Reserved. 37

SCALED GLOBAL PRODUCTION OWN-BRAND We partnered with ALDI US to create their beautiful new baby brand “Little Journey” by delivering our end-to-end model across a wide range of products, covering both food and non-food. This exciting opportunity used the full strength of Equator’s end-to-end offering. RESULTS One of the highest selling private brands across ALDI US. Delivery by Equator’s unique model in a competitive and saturated market. © 2019 Matthews International Corporation. All Rights Reserved. 38

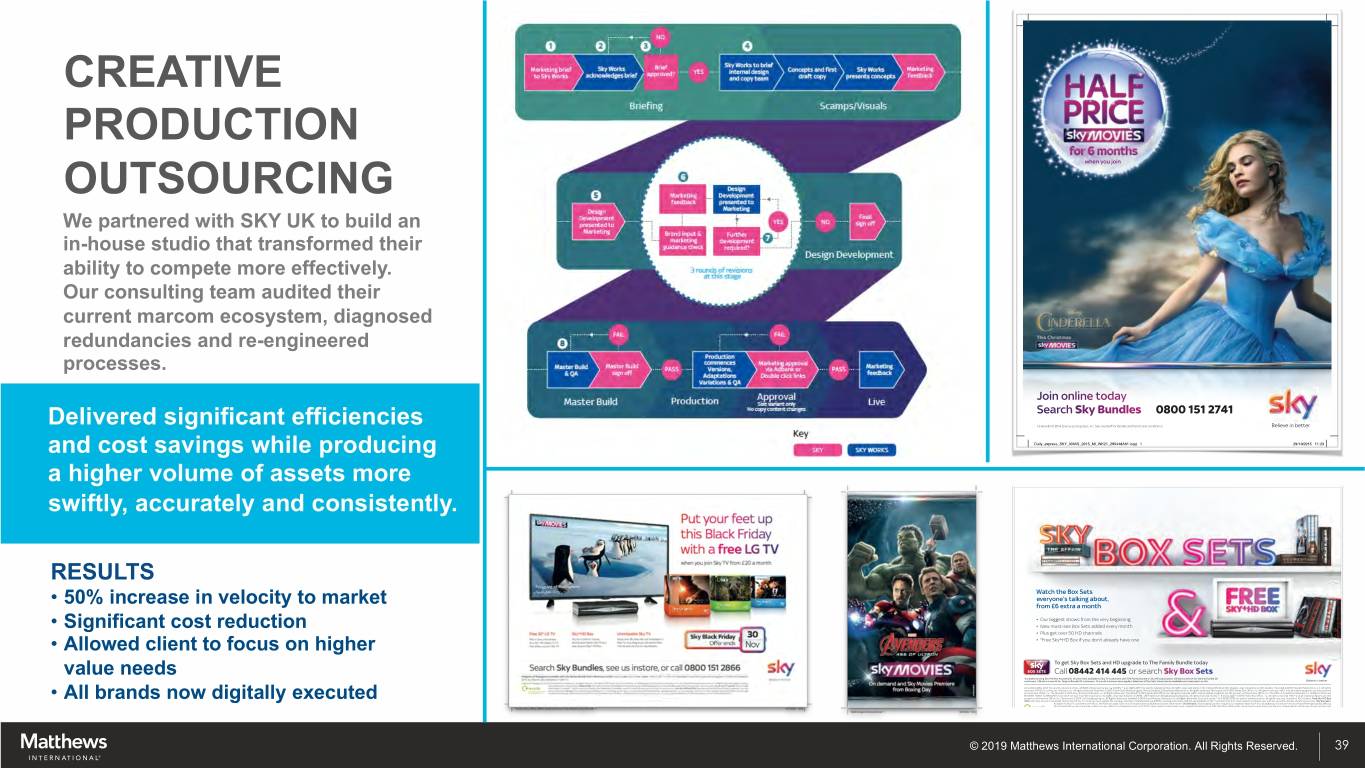

CREATIVE PRODUCTION OUTSOURCING when you join We partnered with SKY UK to build an in-house studio that transformed their ability to compete more effectively. Our consulting team audited their current marcom ecosystem, diagnosed redundancies and re-engineered processes. Join online today Search Sky Bundles 0800 151 2741 Delivered significant efficiencies Cinderella © 2014 Disney Enterprises, Inc. See overleaf for details and terms and conditions. Believe in better and cost savings while producing Daily_express_SKY_XMAS_2015_MI_WK21_295448A01.indd 1 29/10/2015 11:23 a higher volume of assets more swiftly, accurately and consistently. RESULTS Watch the Box Sets everyone’s talking about, • 50% increase in velocity to market from £6 extra a month • Our biggest shows from the very beginning • Significant cost reduction • New must-see Box Sets added every month • Plus get over 50 HD channels • Allowed client to focus on higher • *Free Sky±HD Box if you don’t already have one To get Sky Box Sets and HD upgrade to The Family Bundle today value needs Call 08442 414 445 or search Sky Box Sets *Excludes existing Sky±HD Box households. Sky Box Sets available to Sky TV customers with The Family Bundle or Sky HD subscription. £6 extra a month for Variety Bundle SD customers. £16 extra a month for Original Bundle SD customers. 12 month minimum term applies. Selection of Box Sets shows/series available and varies each month. Believe in better 24 © 2001-2010, 2014 Fox and its related entities. All Rights Reserved. Series 1-9. BONES ™ & © 2005-2015 Fox and its related entities. All rights reserved. Series 1-10. Criminal Minds © ABC Studios. Grey’s Anatomy © ABC Studios. Hannibal ©2015 Chiswick Productions LLC. All rights reserved. ©2015 Sony Pictures Television Inc. All rights reserved. Mad Men © 2015 Frank Ockenfels/Lionsgate. Penny Dreadful © Showtime Networks Inc. All rights reserved. The Sopranos®© 2015 Home Box Office, Inc. All rights reserved. HBO® and all related programs are the property of Home Box Office, Inc. The Blacklist © 2015 Sony Pictures Television Inc. All Rights Reserved. True Blood® © 2015 Home Box Office, Inc. All rights reserved. HBO® and all related programs are the property of Home Box Office, Inc. The Affair © Showtime Networks Inc. All Rights Reserved. MODERN FAMILY © 2009-2015 Twentieth Century Fox Film Corporation. All rights reserved. Artwork: © 2009 - 2015 American Broadcasting Companies. All rights reserved. Series 1 – 6. Entourage® © 2015 Home Box Office, Inc. All rights reserved. HBO® and all related programs are the property of Home Box Office, Inc. Elementary © 2014 CBS Broadcasting Inc. All Rights Reserved. Justified © 2014 Sony Pictures Television Inc. All Rights Reserved. Sons of Anarchy ™ & © 2008-2014 Fox and its related entities. All rights reserved. Scandal © ABC Studios. Free Sky±HD Box • All brands now digitally executed offer: One free box per household. New 12 month Sky TV minimum term applies for existing customers. Standard set-up £60 for existing customers. Self set-up available to Sky± customers for £15. You’ll need to complete your self set-up within 31 days of getting your box. Sky Box Sets: Available to Sky TV customers with HD or The Family Bundle. Selection of shows/series available and varies each month. On Demand: Downloading content requires a compatible black Sky± Box, broadband connection (minimum recommended speed 2Mbps), On Demand self set-up using built-in Wi-Fi or own cable or On Demand connector (£21.95 – limits apply). Downloads count towards Broadband Lite 2GB /Sky Fibre 25GB usage cap and may expire from your Planner. Downloading a 30 minute show typically uses 0.5GB. Content depends on your Sky TV/HD subscription. Downloadable HD content takes longer to start viewing. Sky HD: Some HD channels are available without subscription. General: Prices may go up during your contract. Non-standard set-up may cost extra. Prices may vary if you live in a flat. You must get any consents required (e.g. landlord’s). Prices for Direct Debit payments only. Continuous debit/credit card mandate costs 50p pm. UK, Channel Islands and Isle of Man residential customers only. Further terms apply. Calls to Sky cost 7p per minute plus your provider’s access charge. Calls to 080 numbers are free. Correct at 14 September 2015. © 2019 Matthews International Corporation. All Rights Reserved. 39

TOOLING 10 Global Production Facilities 190,000 Gravure Cylinders Per Year ~3,000,000 Square Feet Of Flexographic Plates Per Year Original design, development, production, color management, customized printing plates and cylinders for all conventional printing procedures. Roller systems especially made to meet the individual requirements of our clients for the processing of roll-to-roll materials. © 2019 Matthews International Corporation. All Rights Reserved. 40

MARKET OVERVIEW MARKET REVIEW AND REACTION © 2019 Matthews International Corporation. All Rights Reserved. 41

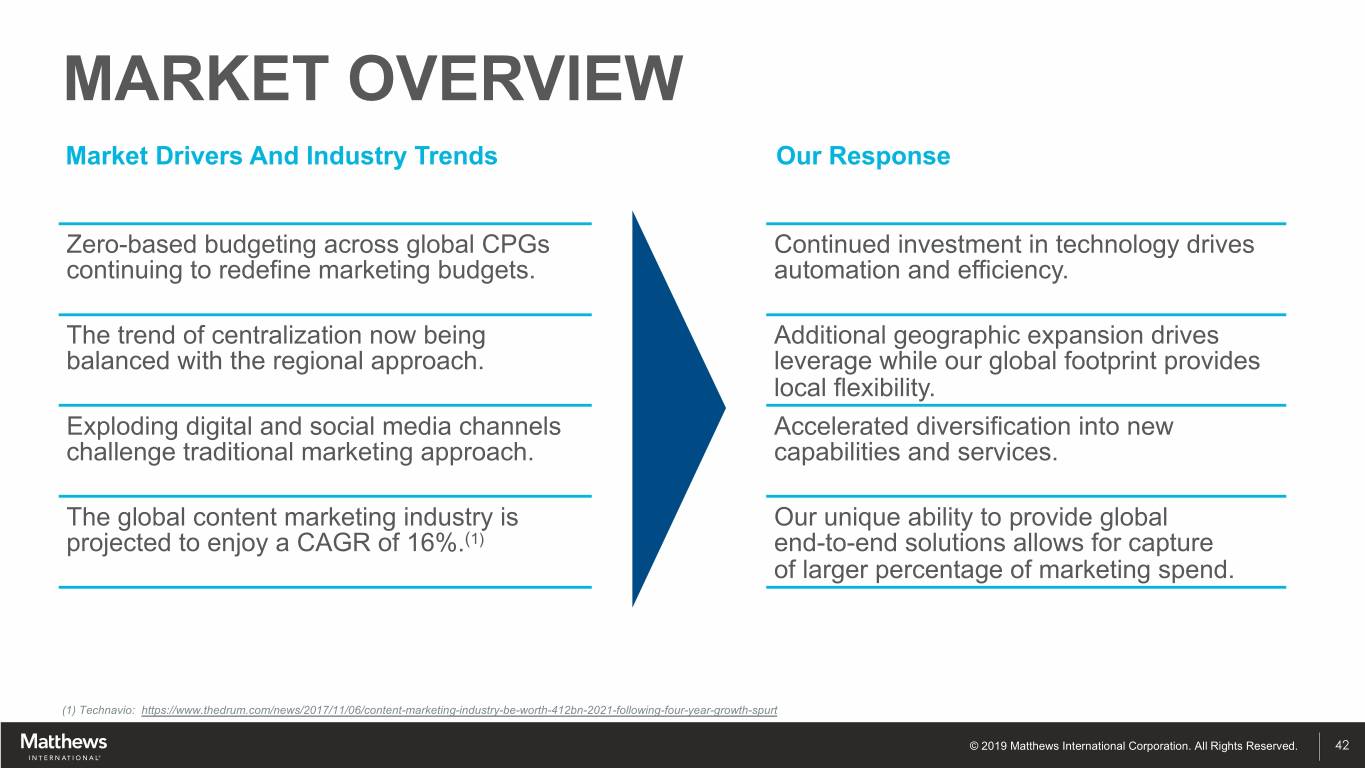

MARKET OVERVIEW Market Drivers And Industry Trends Our Response Zero-based budgeting across global CPGs Continued investment in technology drives continuing to redefine marketing budgets. automation and efficiency. The trend of centralization now being Additional geographic expansion drives balanced with the regional approach. leverage while our global footprint provides local flexibility. Exploding digital and social media channels Accelerated diversification into new challenge traditional marketing approach. capabilities and services. The global content marketing industry is Our unique ability to provide global projected to enjoy a CAGR of 16%.(1) end-to-end solutions allows for capture of larger percentage of marketing spend. (1) Technavio: https://www.thedrum.com/news/2017/11/06/content-marketing-industry-be-worth-412bn-2021-following-four-year-growth-spurt © 2019 Matthews International Corporation. All Rights Reserved. 42

GREG BABE TOOLING Chief Technology Officer EXPERTISE © 2019 Matthews International Corporation. All Rights Reserved. 43

TOOLING EXPERTISE Taking Ideas To Finished Products. We are a leading global designer and supplier of rotary tools and services for printing, texturing and converting of packaging and other web-based materials. © 2019 Matthews International Corporation. All Rights Reserved. 44

EXPERIENCE + PASSION © 2019 Matthews International Corporation. All Rights Reserved. 45

WHAT WE DO PACKAGING AND CONVERTING © 2019 Matthews International Corporation. All Rights Reserved.

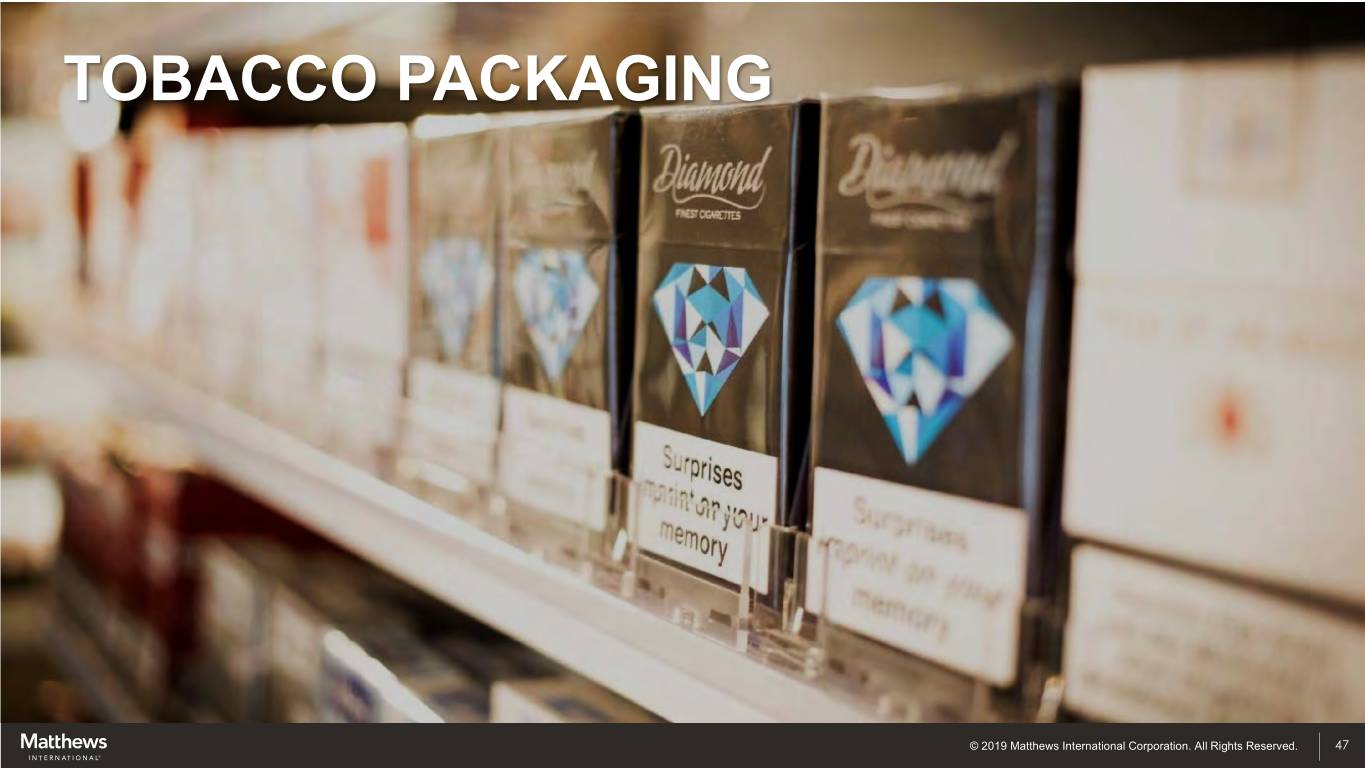

TOBACCO PACKAGING © 2019 Matthews International Corporation. All Rights Reserved. 47

TOBACCO PACKAGING Applications Embossing and Tax label lacquers converting Tipping Inserts Packaging design Micro text Security items Printed poly & hidden images bags © 2019 Matthews International Corporation. All Rights Reserved. 48

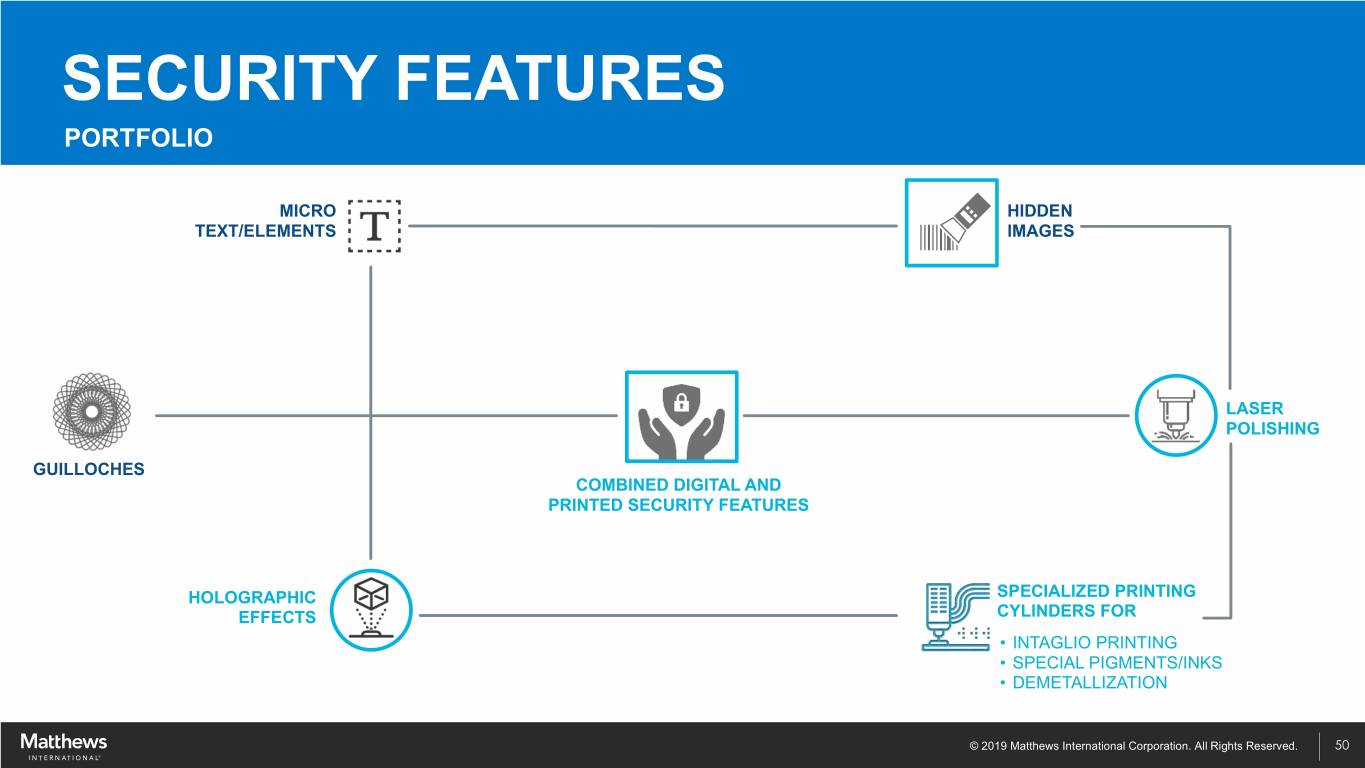

SECURITY FEATURES © 2019 Matthews International Corporation. All Rights Reserved. 49

SECURITY FEATURES PORTFOLIO MICRO HIDDEN TEXT/ELEMENTS IMAGES LASER POLISHING GUILLOCHES COMBINED DIGITAL AND PRINTED SECURITY FEATURES HOLOGRAPHIC SPECIALIZED PRINTING EFFECTS CYLINDERS FOR • INTAGLIO PRINTING • SPECIAL PIGMENTS/INKS • DEMETALLIZATION © 2019 Matthews International Corporation. All Rights Reserved. 50

EMBOSSING TOOLS © 2019 Matthews International Corporation. All Rights Reserved. 51

EMBOSSING TOOLS © 2019 Matthews International Corporation. All Rights Reserved. 52

CUTTING TOOLS © 2019 Matthews International Corporation. All Rights Reserved. 53

CUTTING TOOLS © 2019 Matthews International Corporation. All Rights Reserved. 54

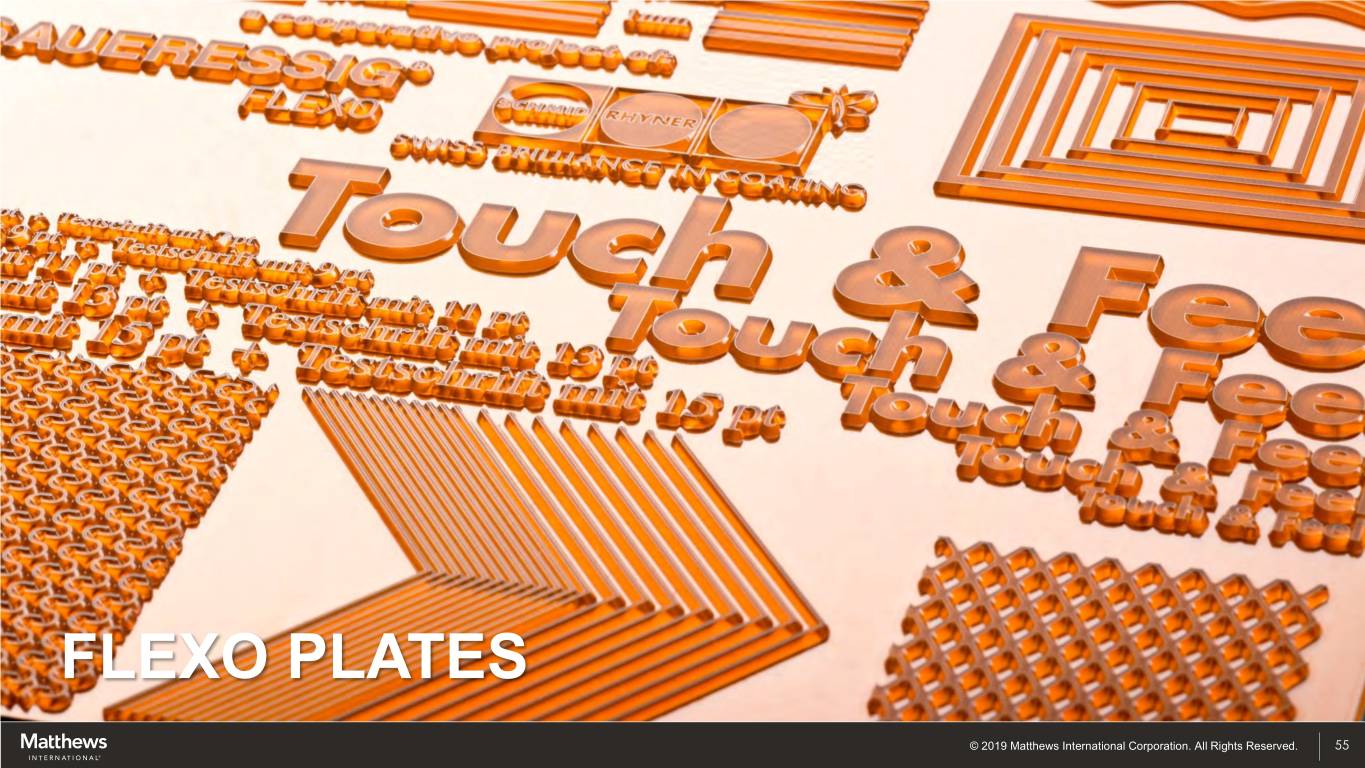

FLEXO PLATES © 2019 Matthews International Corporation. All Rights Reserved. 55

FLEXO PLATES © 2019 Matthews International Corporation. All Rights Reserved. 56

WHAT WE DO SURFACES © 2019 Matthews International Corporation. All Rights Reserved.

SURFACES We Are The Company That Creates The Look, Touch And Function Of The Products In Our Everyday Life • Home • Automotive & Fashion • Energy • Glass • Metal • Nonwovens • Tissue • Plastics Inspired by design. • Coating Driven by technology. © 2019 Matthews International Corporation. All Rights Reserved. 58

NONWOVENS © 2019 Matthews International Corporation. All Rights Reserved. 59

TISSUE © 2019 Matthews International Corporation. All Rights Reserved. 60

FLOORING © 2019 Matthews International Corporation. All Rights Reserved. 61

AUTOMOTIVE & LEATHER © 2019 Matthews International Corporation. All Rights Reserved. 62

CLEAN ENERGY © 2019 Matthews International Corporation. All Rights Reserved. 63

WHAT WE DO ENGINEERING © 2019 Matthews International Corporation. All Rights Reserved.

ENGINEERING Core Products And Services We are a reliable and innovative provider for standard and special models of calenders and systems. • Specialty, Purpose-built Machinery • Automation Advancements • Contract Manufacturing • Technical Rollers • Research & Development • Laboratory Calenders © 2019 Matthews International Corporation. All Rights Reserved. 65

AutomotiveENGINEERING & Leather © 2019 Matthews International Corporation. All Rights Reserved. 66

GLOBAL FOOTPRINT & GROWTH PATHS © 2019 Matthews International Corporation. All Rights Reserved.

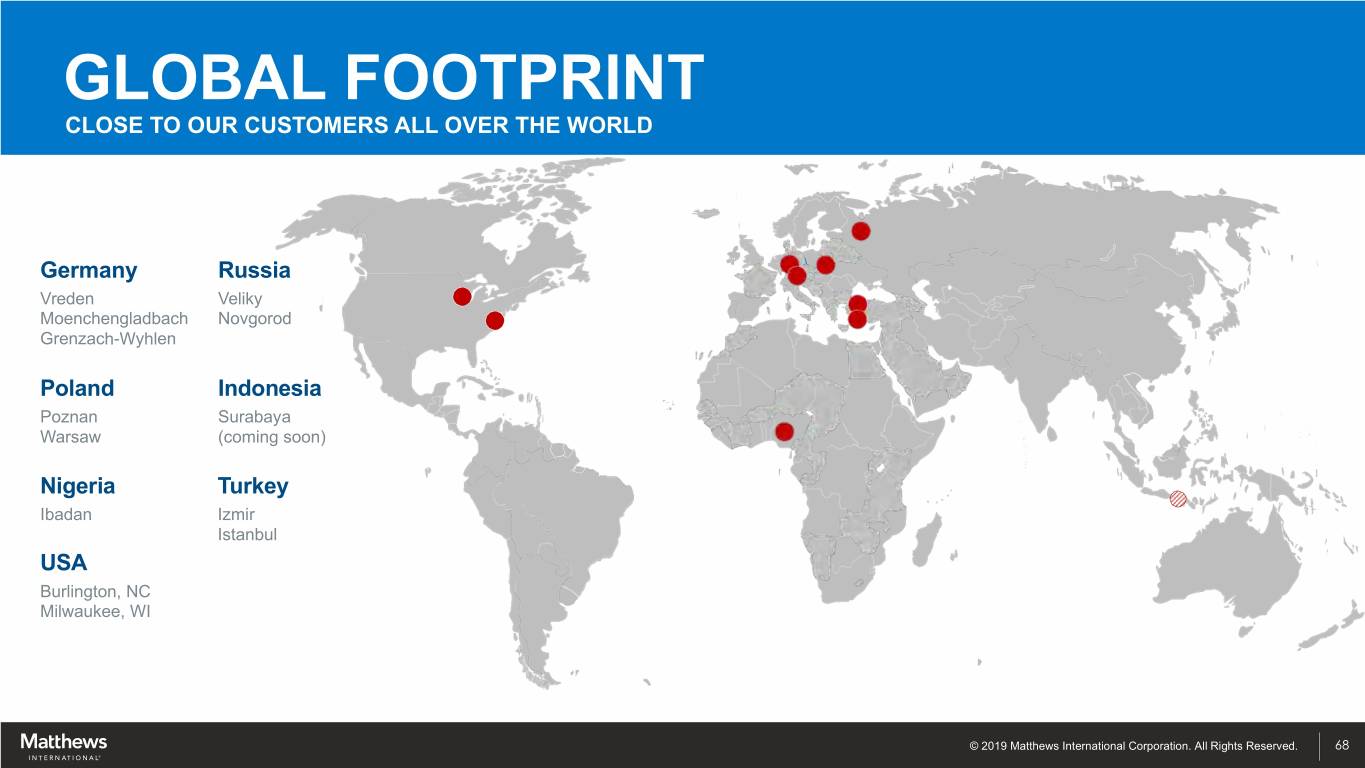

GLOBAL FOOTPRINT CLOSE TO OUR CUSTOMERS ALL OVER THE WORLD Germany Russia Vreden Veliky Moenchengladbach Novgorod Grenzach-Wyhlen Poland Indonesia Poznan Surabaya Warsaw (coming soon) Nigeria Turkey Ibadan Izmir Istanbul USA Burlington, NC Milwaukee, WI © 2019 Matthews International Corporation. All Rights Reserved. 68

GLOBAL PERSPECTIVE REGIONAL GROWTH PATHS Reliability, excellence and innovation are interwoven in Matthews. We owe this global strength to our ability to identify market trends at an early stage and to develop forward- looking products for our business operations across all borders • USA • LatAm • Russia • Nigeria • South East Asia, China and India © 2019 Matthews International Corporation. All Rights Reserved. 69

INNOVATIONS IN-HOUSE DEVELOPMENTS © 2019 Matthews International Corporation. All Rights Reserved.

INNOVATIVE STRENGTH Exclusive Technology And Sophisticated Know How Through our ingenuity and creativity we create unique solutions and find better ways every day. With a view on the trends of tomorrow, current developments are continuously adapted to the needs of the market. We hold more than 100 patents for exclusive technology innovations. © 2019 Matthews International Corporation. All Rights Reserved. 71

BREAK © 2019 Matthews International Corporation. All Rights Reserved.

BRIAN DUNN Executive Vice President, Strategy & Corporate INDUSTRIAL Development TECHNOLOGIES PAUL JENSEN Division President, Industrial Technologies © 2019 Matthews International Corporation. All Rights Reserved.

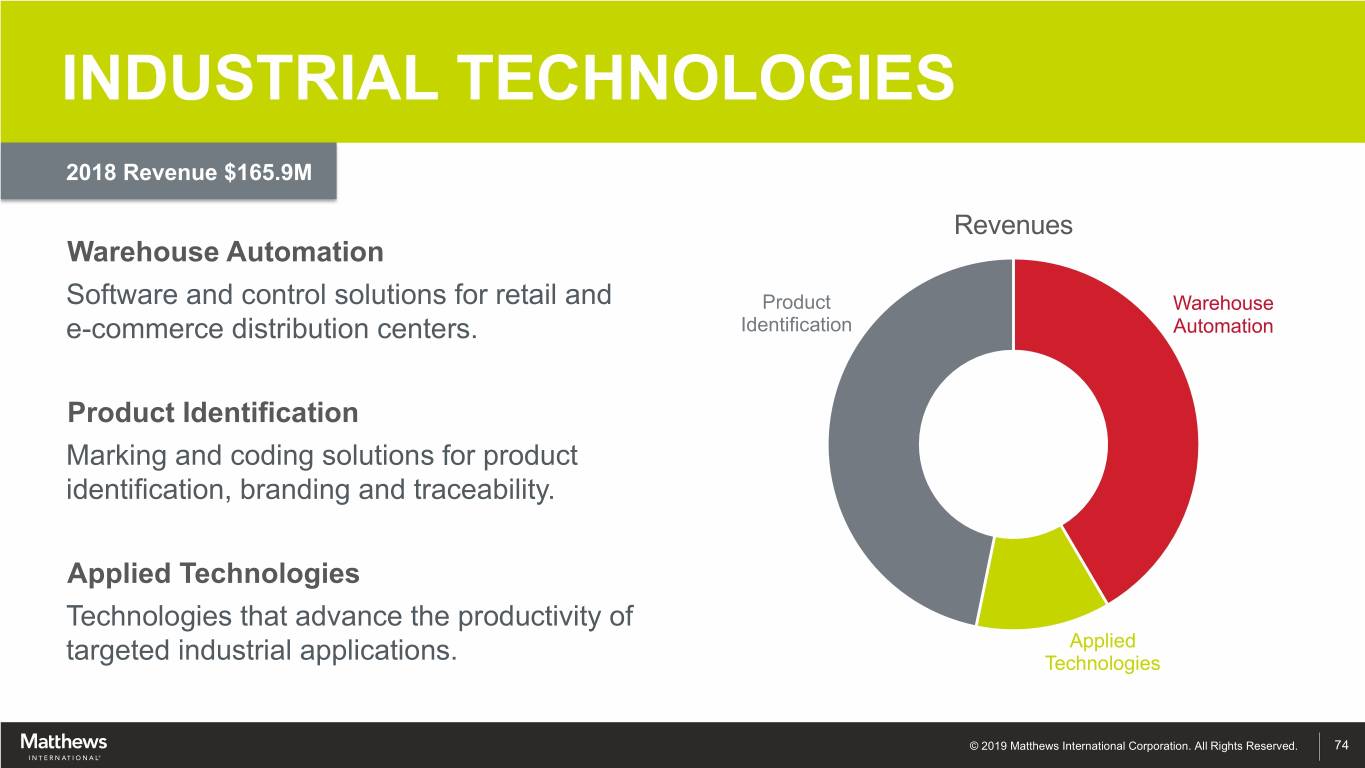

INDUSTRIAL TECHNOLOGIES 2018 Revenue $165.9M Revenues Warehouse Automation Software and control solutions for retail and Product Warehouse e-commerce distribution centers. Identification Automation Product Identification Marking and coding solutions for product identification, branding and traceability. Applied Technologies Technologies that advance the productivity of Applied targeted industrial applications. Technologies © 2019 Matthews International Corporation. All Rights Reserved. 74

WAREHOUSE AUTOMATION © 2019 Matthews International Corporation. All Rights Reserved. 75

WAREHOUSE AUTOMATION CUSTOMERS © 2019 Matthews International Corporation. All Rights Reserved. 76

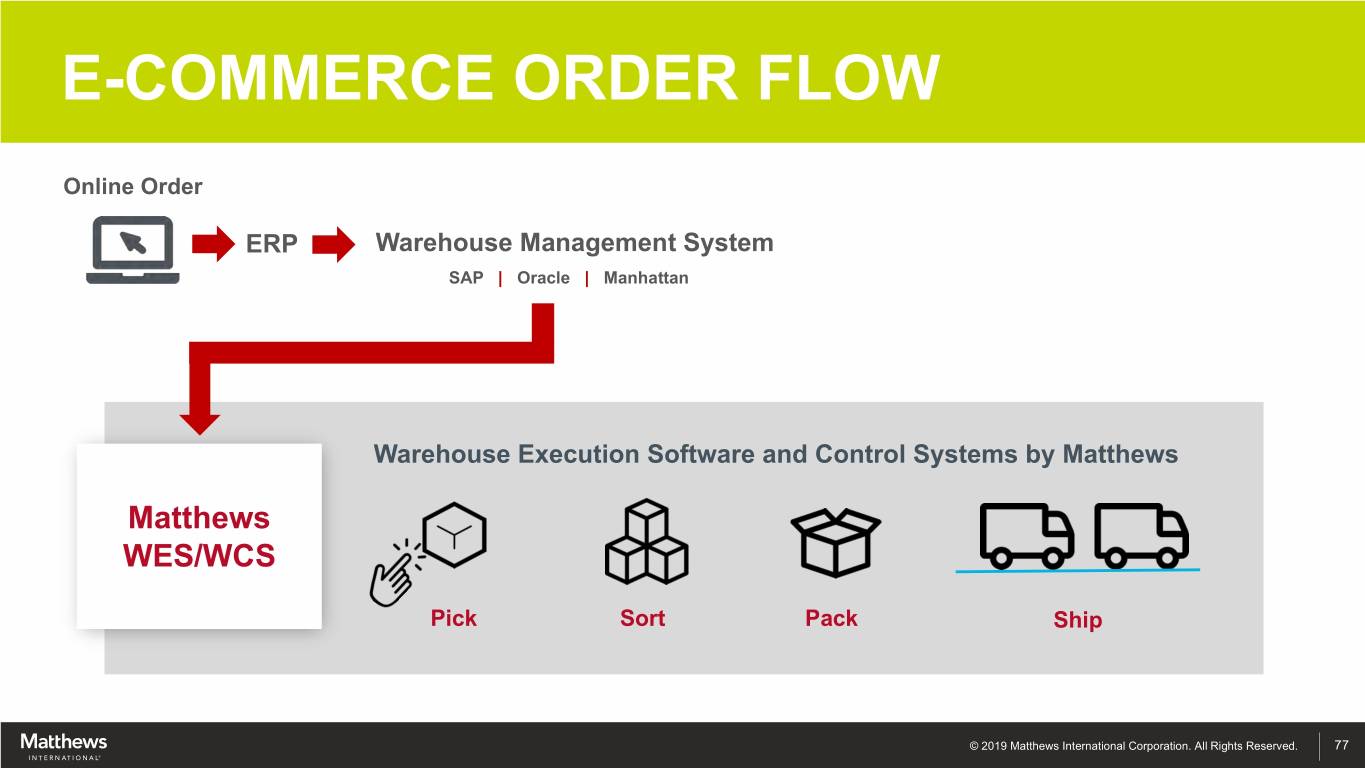

E-COMMERCE ORDER FLOW Online Order ERP Warehouse Management System SAP | Oracle | Manhattan Warehouse Execution Software and Control Systems by Matthews Matthews WES/WCS Pick Sort Pack Ship © 2019 Matthews International Corporation. All Rights Reserved. 77

OPPORTUNITIES FOR INNOVATION Character Recognition Autonomous Vehicle Navigation RAF software sorts mail throughout the The market looks to Matthews as a trail blazer world. This technology can be applied to for applying robotics in fulfillment and distribution parcel sorting in warehouse automation. applications. © 2019 Matthews International Corporation. All Rights Reserved. 78

WAREHOUSE AUTOMATION © 2019 Matthews International Corporation. All Rights Reserved. 79

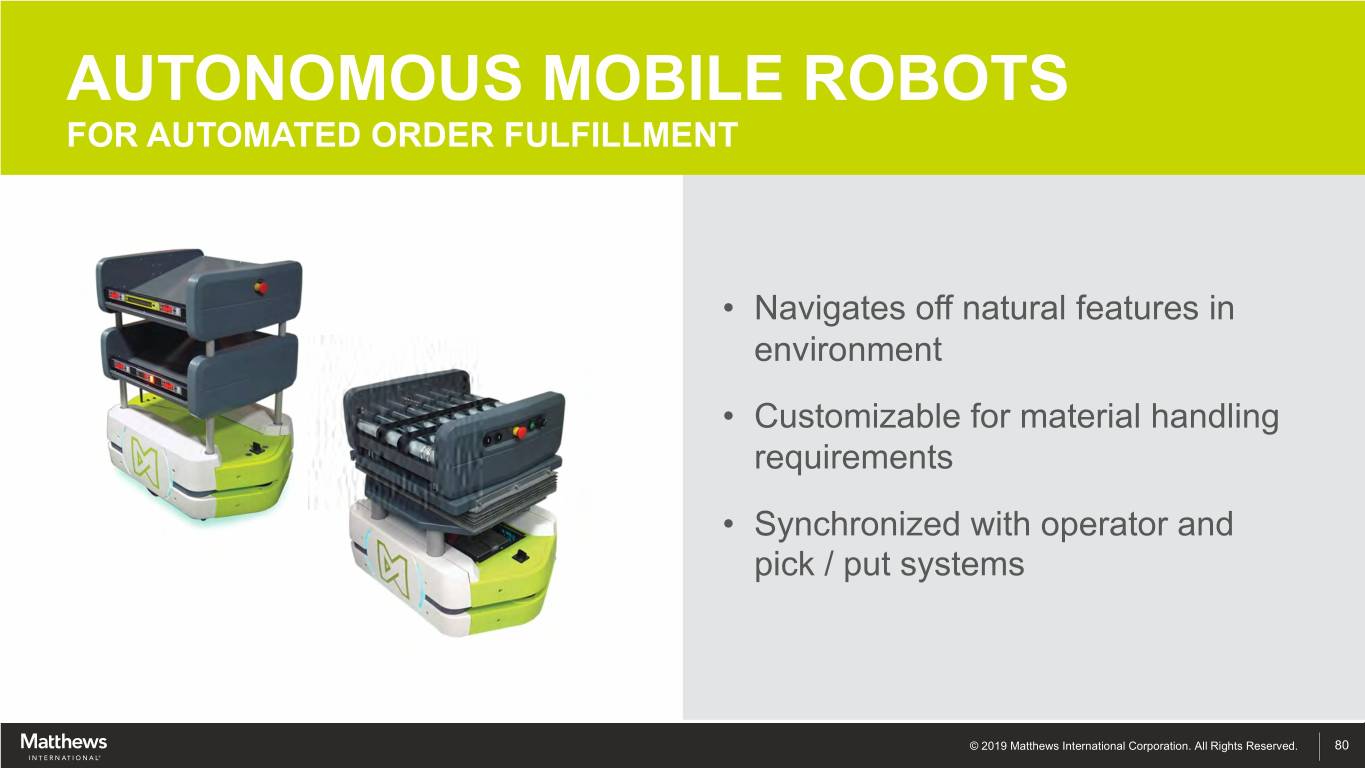

AUTONOMOUS MOBILE ROBOTS FOR AUTOMATED ORDER FULFILLMENT • Navigates off natural features in environment • Customizable for material handling requirements • Synchronized with operator and pick / put systems © 2019 Matthews International Corporation. All Rights Reserved. 80

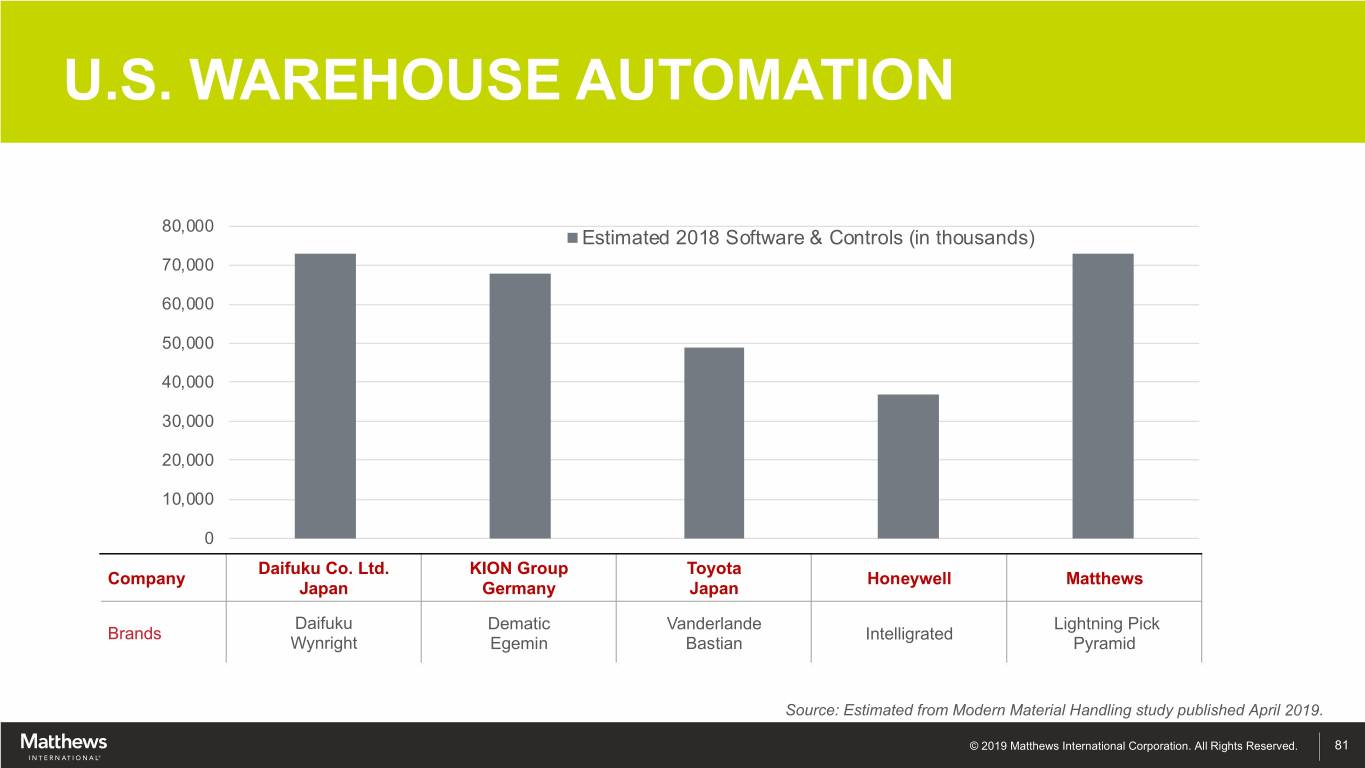

U.S. WAREHOUSE AUTOMATION 80,000 Estimated 2018 Software & Controls (in thousands) 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 Daifuku Co. Ltd. KION Group Toyota Company Honeywell Matthews Japan Germany Japan Daifuku Dematic Vanderlande Lightning Pick Brands Intelligrated Wynright Egemin Bastian Pyramid Source: Estimated from Modern Material Handling study published April 2019. © 2019 Matthews International Corporation. All Rights Reserved. 81

PRODUCT IDENTIFICATION © 2019 Matthews International Corporation. All Rights Reserved. 82

PRODUCT IDENTIFICATION CUSTOMERS © 2019 Matthews International Corporation. All Rights Reserved. 83

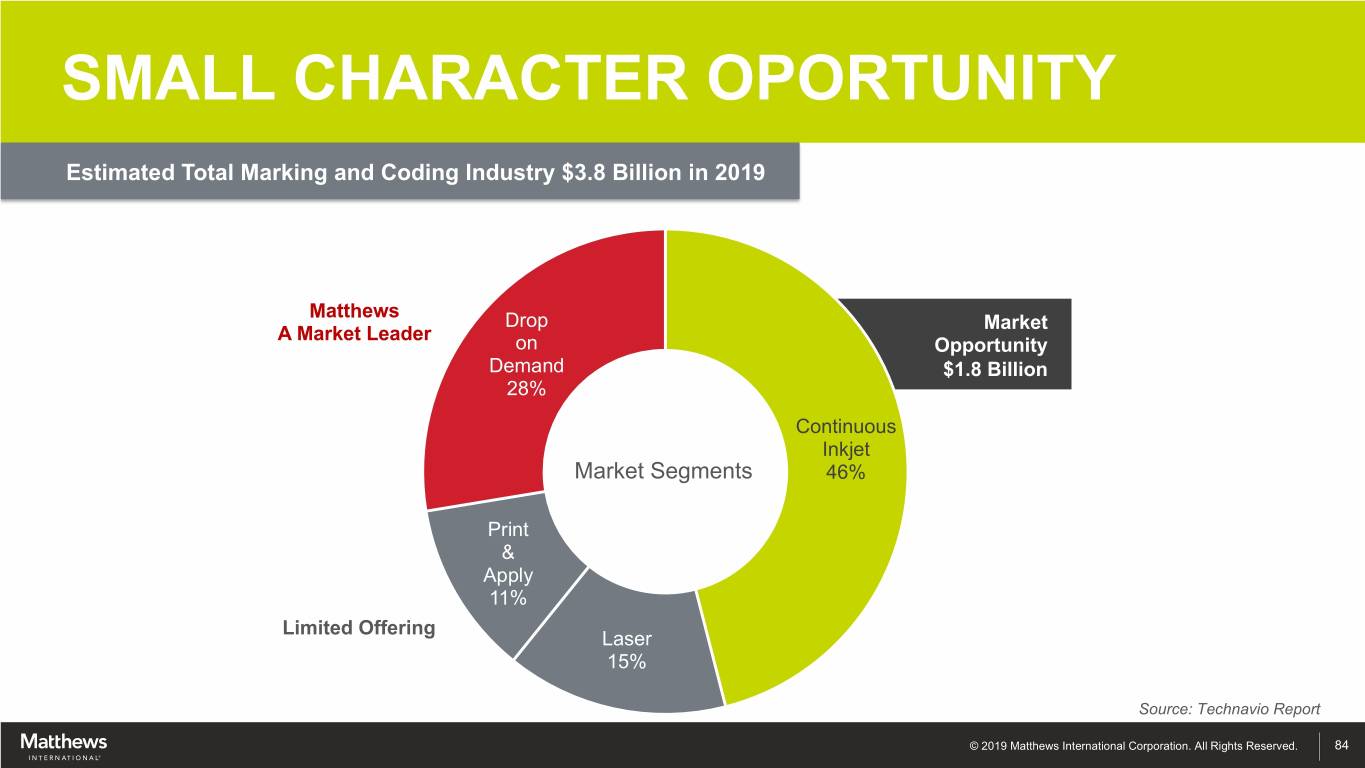

SMALL CHARACTER OPORTUNITY Estimated Total Marking and Coding Industry $3.8 Billion in 2019 Matthews Drop Market A Market Leader on Opportunity Demand $1.8 Billion 28% Continuous Inkjet Market Segments 46% Print & Apply 11% Limited Offering Laser 15% Source: Technavio Report © 2019 Matthews International Corporation. All Rights Reserved. 84

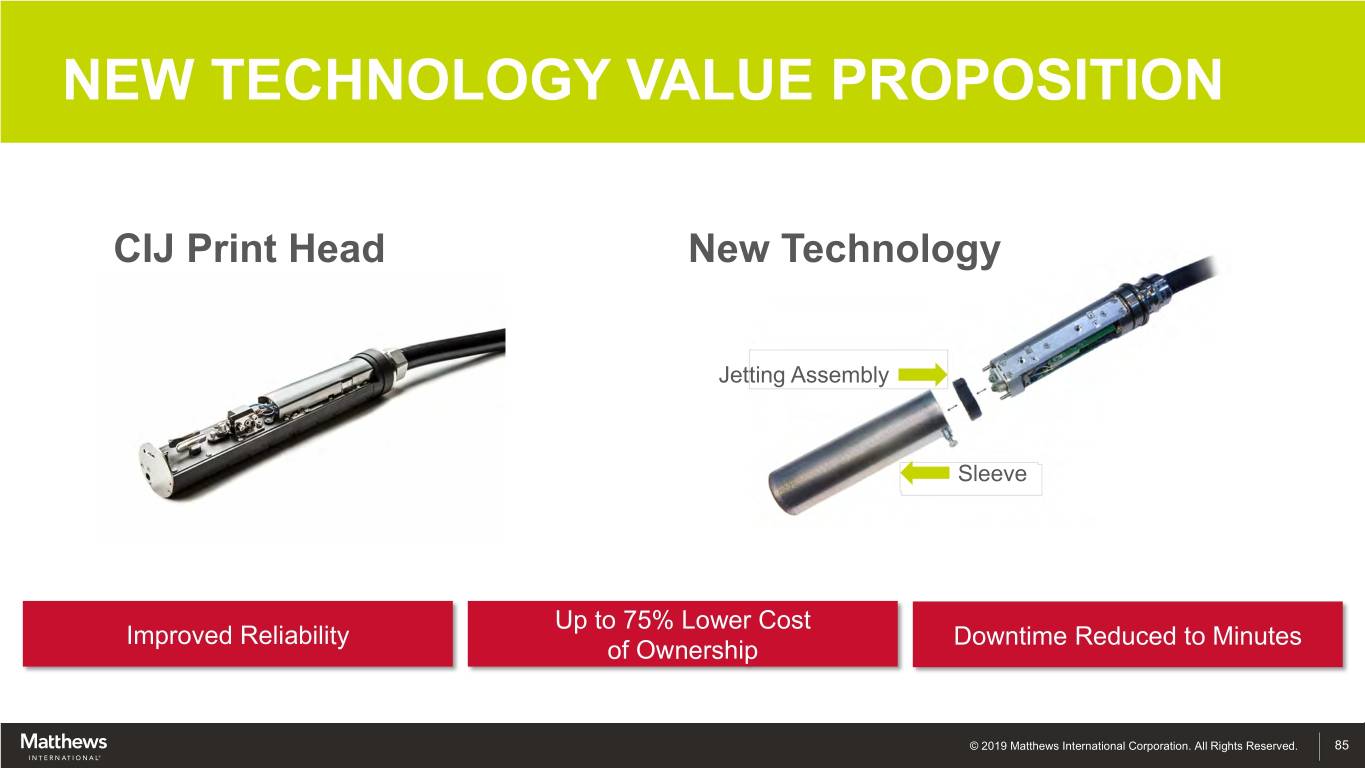

NEW TECHNOLOGY VALUE PROPOSITION CIJ Print Head New Technology Jetting Assembly Sleeve Up to 75% Lower Cost Improved Reliability Downtime Reduced to Minutes of Ownership © 2019 Matthews International Corporation. All Rights Reserved. 85

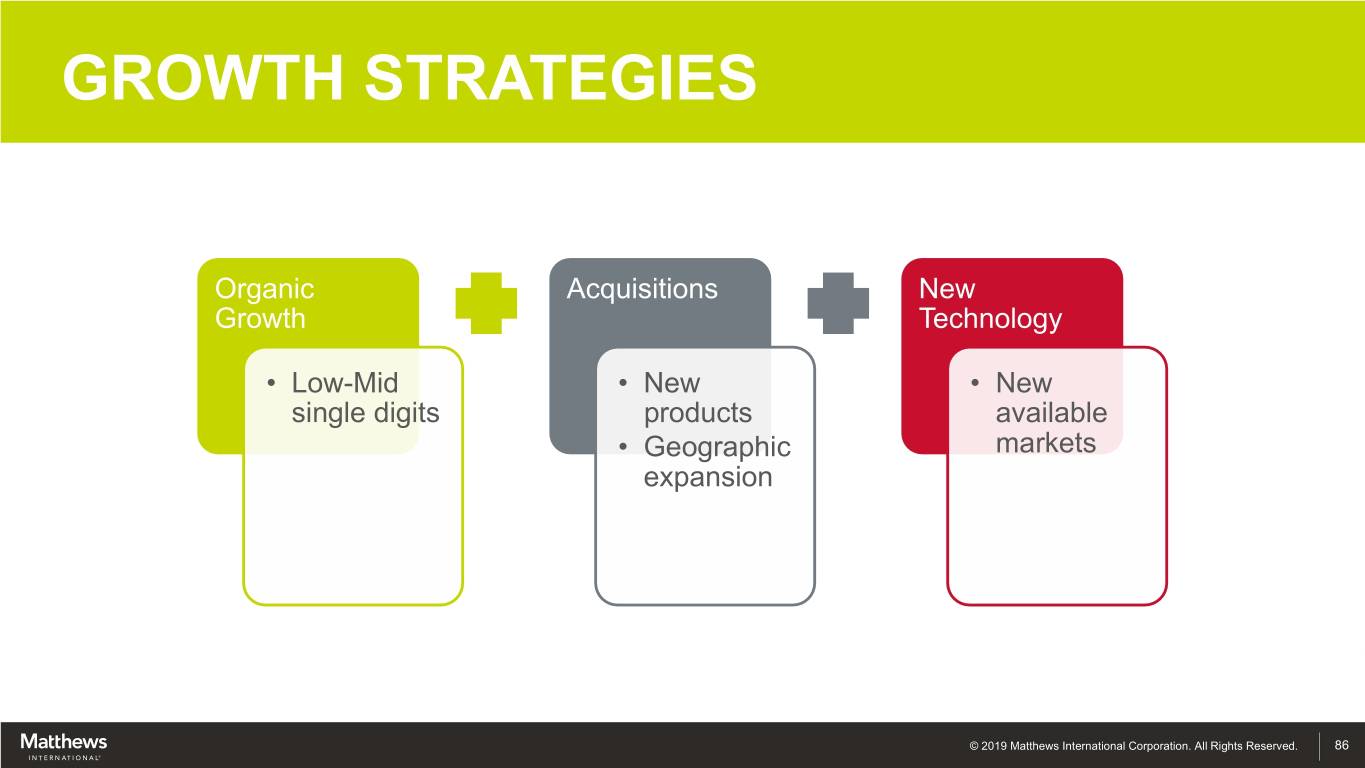

GROWTH STRATEGIES Organic Acquisitions New Growth TheTechnology Opportunity $1.8 Billion • Low-Mid • New • New single digits products available • Geographic markets expansion © 2019 Matthews International Corporation. All Rights Reserved. 86

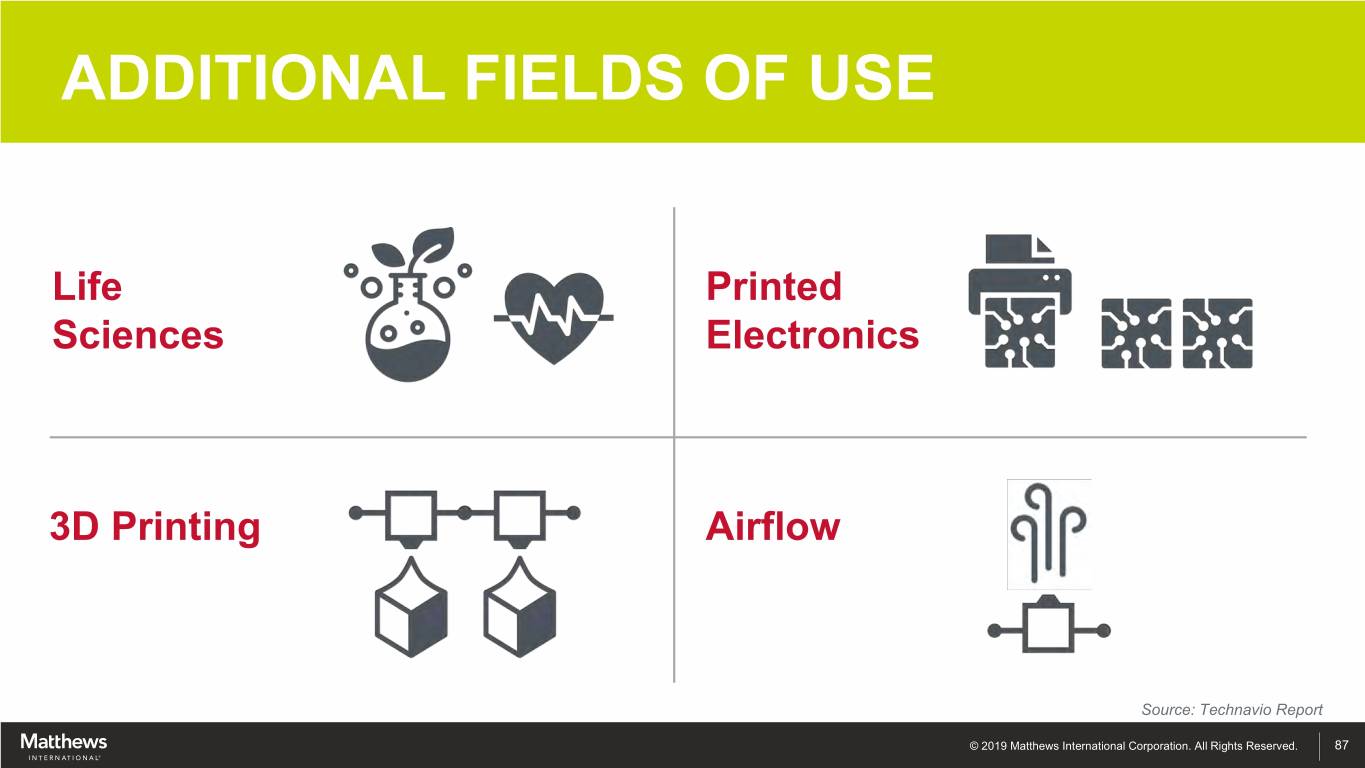

ADDITIONAL FIELDS OF USE Life Printed The Opportunity Sciences Electronics $1.8 Billion 3D Printing Airflow Source: Technavio Report © 2019 Matthews International Corporation. All Rights Reserved. 87

STEVE GACKENBACH Group President BRIAN DUNN Executive Vice President, Strategy & Corporate Development © 2019 Matthews International Corporation. All Rights Reserved.

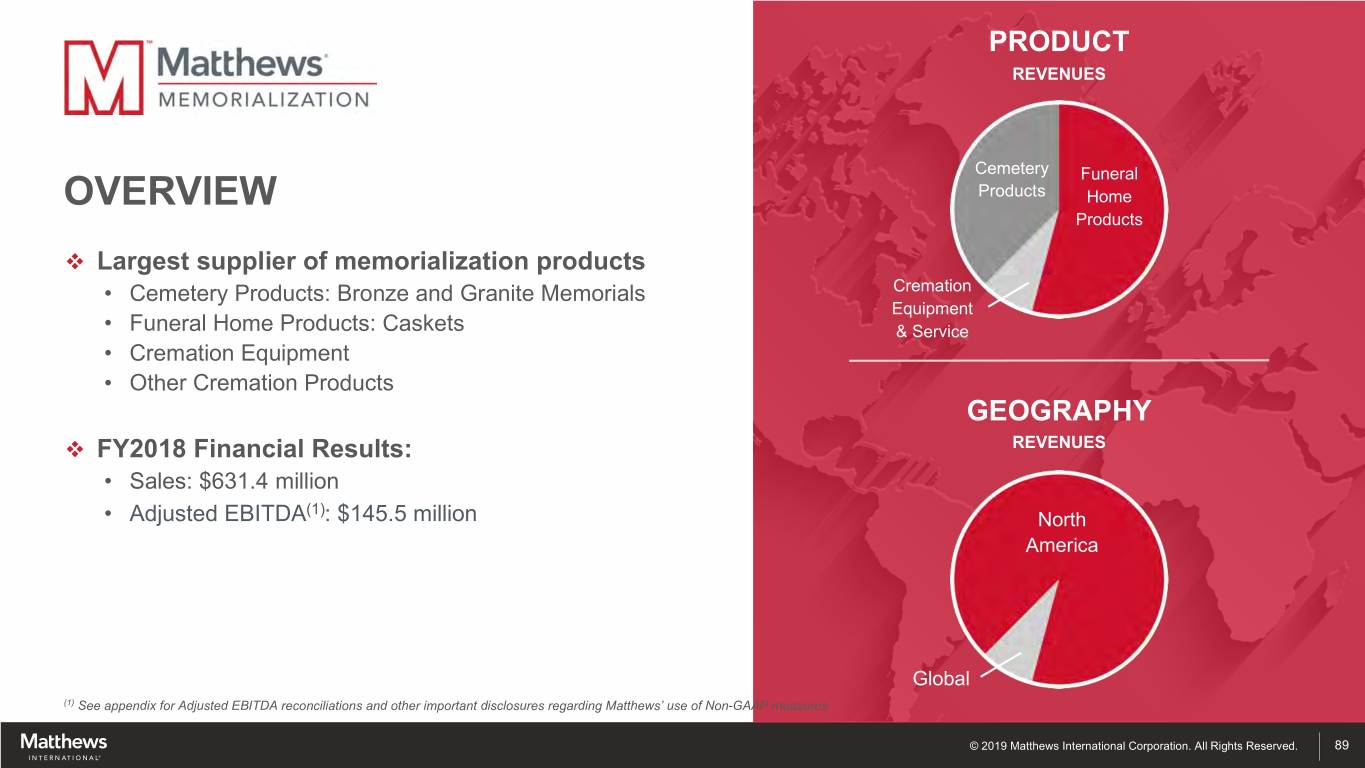

PRODUCT REVENUES Cemetery Funeral OVERVIEW Products Home Products v Largest supplier of memorialization products • Cemetery Products: Bronze and Granite Memorials Cremation Equipment • Funeral Home Products: Caskets & Service • Cremation Equipment • Other Cremation Products GEOGRAPHY v FY2018 Financial Results: REVENUES • Sales: $631.4 million (1) • Adjusted EBITDA : $145.5 million North America Global (1) See appendix for Adjusted EBITDA reconciliations and other important disclosures regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 89

PRODUCTS Cemetery Products Funeral Home Products Cremation Equipment Market Position (U.S.) Bronze Memorials - #1 Caskets - #2 Cremation Equipment - #1 Granite Memorials - #1 Core Geographies North America, Italy, Australia United States Global © 2019 Matthews International Corporation. All Rights Reserved. 90

OUR MARKETS Casketed Deaths vs. Total Deaths Estimated U.S. Market ~$2B* Cremation Equipment / * * Services Cremation Products / Other Caskets Granite Memorials Bronze Memorials Full-service provider – leading position across key Relatively stable demand driven by predictable trends: segments increased deaths and rising cremation rates Customer base consolidating but still fragmented *Company estimates. Data compiled from CDC, US Census Bureau, Industry reports and internal projections. © 2019 Matthews International Corporation. All Rights Reserved. 91

COMPETITIVELY ADVANTAGED MARKET POSITION Business Scope Full-service provider to both funeral homes and cemeteries Commercial Strengths Operational Strengths v Market leader – strong brand and reputation v World class manufacturing network with Lean operating model v Deep customer relationships with strong sales capabilities v National casket delivery network v Value-added services / innovation to help v Superior product quality and service customers grow their business Leadership position and barriers to entry create strong margins and stable cash flow generation © 2019 Matthews International Corporation. All Rights Reserved. 92

ADVANTAGED GO TO MARKET CAPABILITIES © 2019 Matthews International Corporation. All Rights Reserved. 93

KEY STRATEGIES v Pursue growth opportunities in memorialization v Drive operational excellence to manage cost and asset structure v Integrate and pursue tuck-in acquisitions © 2019 Matthews International Corporation. All Rights Reserved. 94

PURSUING GROWTH OPPORTUNITIES IN CORE MARKETS ADDRESSING CONSUMER TRENDS CREMATION PERSONALIZATION © 2019 Matthews International Corporation. All Rights Reserved. 95

PURSUING GROWTH OPPORTUNITIES IN CORE MARKETS ADDRESSING CONSUMER TRENDS TECHNOLOGY PREMIUM SEGMENT © 2019 Matthews International Corporation. All Rights Reserved. 96

DRIVE OPERATIONAL EXCELLENCE TO MANAGE COST AND ASSET STRUCTURE Manage Cost Structure to Improve EBITDA Margin v Continue to use proven Lean techniques to improve quality and reduce waste v Complete acquisition facility consolidations v Lever technology / automation Manage Assets to Deliver Strong Cash Flow v SKU rationalization to optimize inventory v Working capital management v Modest on-going capex requirements © 2019 Matthews International Corporation. All Rights Reserved. 97

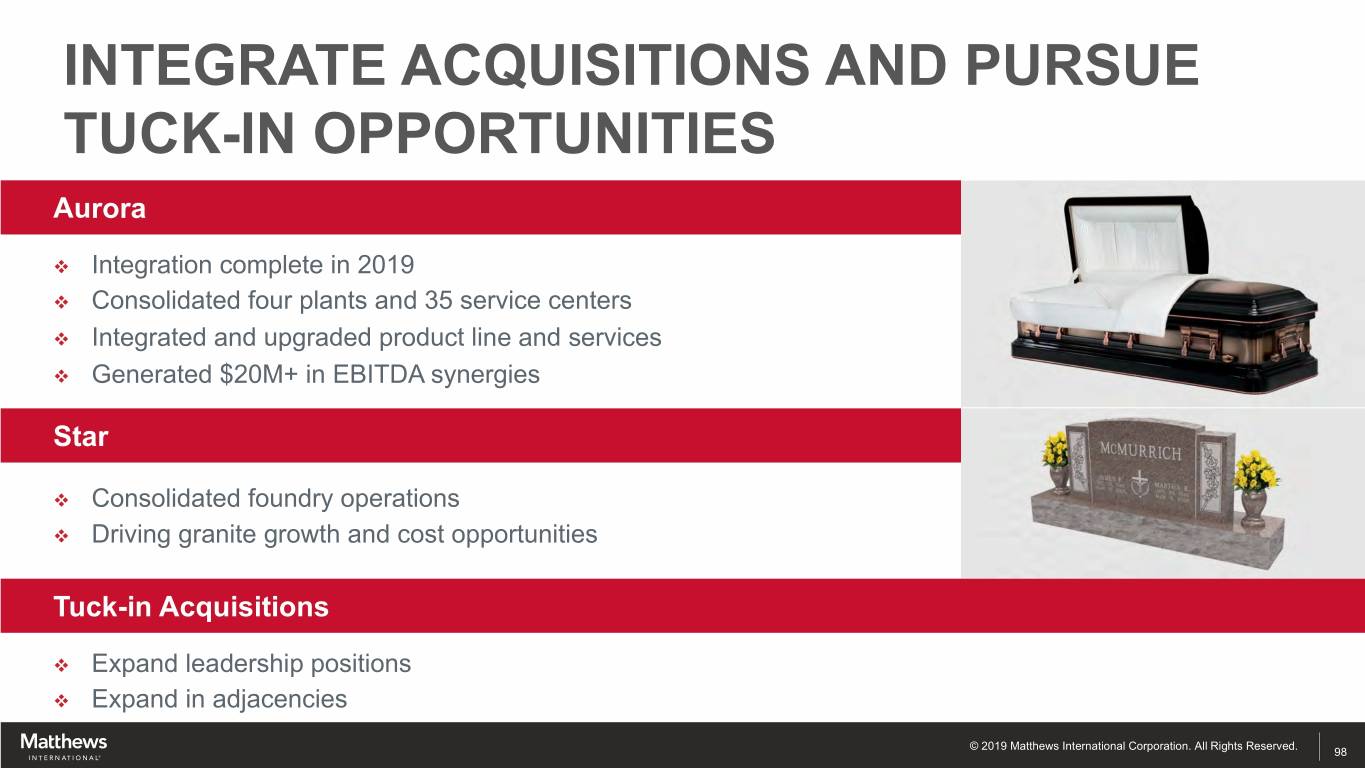

INTEGRATE ACQUISITIONS AND PURSUE TUCK-IN OPPORTUNITIES Aurora v Integration complete in 2019 v Consolidated four plants and 35 service centers v Integrated and upgraded product line and services v Generated $20M+ in EBITDA synergies Star v Consolidated foundry operations v Driving granite growth and cost opportunities Tuck-in Acquisitions v Expand leadership positions v Expand in adjacencies © 2019 Matthews International Corporation. All Rights Reserved. 98

KEY MESSAGES Full-service provider with industry leading positions, significant barriers to entry and advantaged capabilities Pursuing strategies to drive Adjusted EBITDA growth in stable market Track record of building business and successful acquisition integration Generate strong margins and predictable cash flow © 2019 Matthews International Corporation. All Rights Reserved. 99

ENVIRONMENTAL SOLUTIONS © 2019 Matthews International Corporation. All Rights Reserved. 100

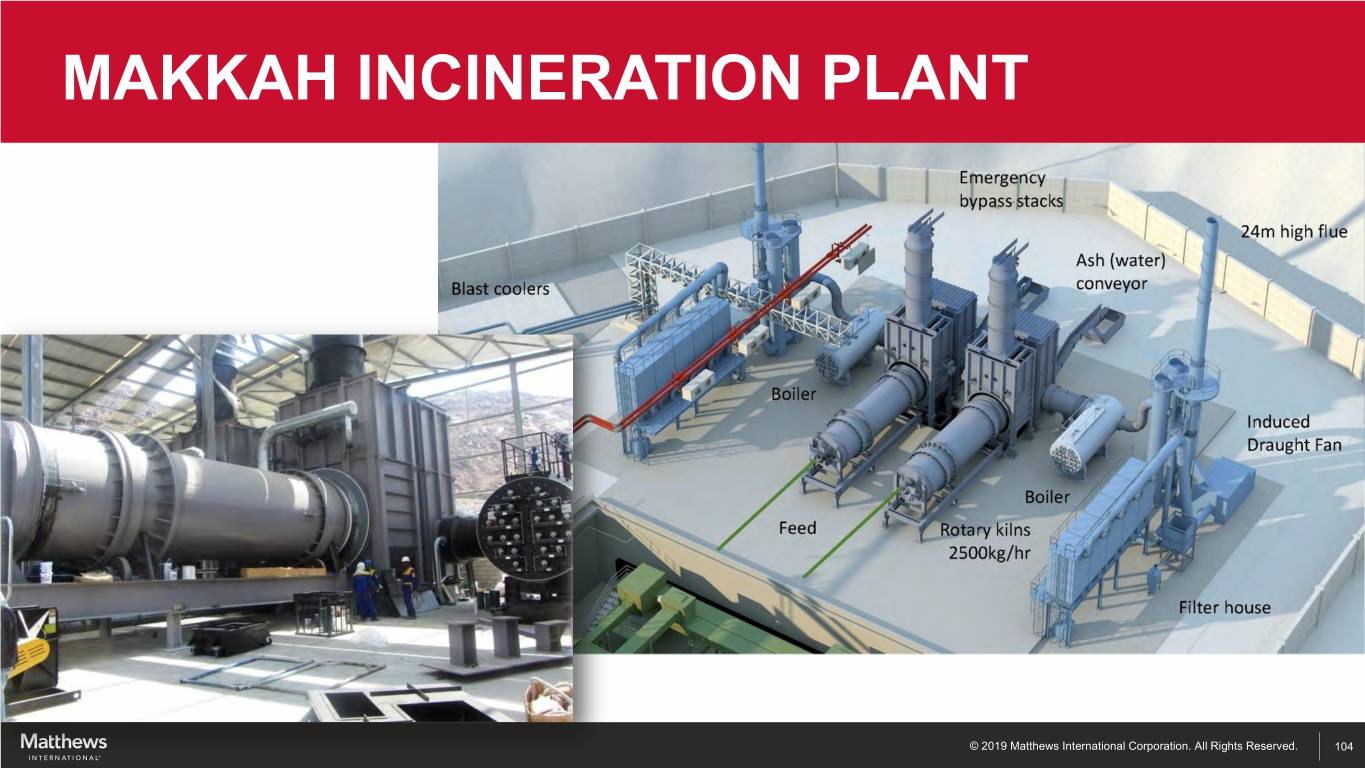

OVERVIEW • Matthews Environmental Solutions Division offers cremation equipment, supplies and incineration equipment for global customers • Cremation equipment is #1 worldwide with a large installed base to complement our position in the Casket and Bronze businesses • Base product revenue augmented with service contracts and operating agreements • Growth opportunities with Incineration for Stand- alone incinerators and Engineered Systems at $5M-$10M per system © 2019 Matthews International Corporation. All Rights Reserved. 101

CREMATOR WITH FILTRATION SYSTEM © 2019 Matthews International Corporation. All Rights Reserved. 102

ISLE OF JERSEY WASTE-ENERGY PLANT © 2019 Matthews International Corporation. All Rights Reserved. 103

MAKKAH INCINERATION PLANT © 2019 Matthews International Corporation. All Rights Reserved. 104

THANK YOU www.matw.com | Nasdaq: MATW © 2019 Matthews International Corporation. All Rights Reserved.

APPENDIX © 2019 Matthews International Corporation. All Rights Reserved. 106

RECONCILIATION OF NON-GAAP FINAL MEASURES Included in this report are measures of financial performance that are not defined by generally accepted accounting principles in the United States (“GAAP”). The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company’s core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. © 2019 Matthews International Corporation. All Rights Reserved. 107

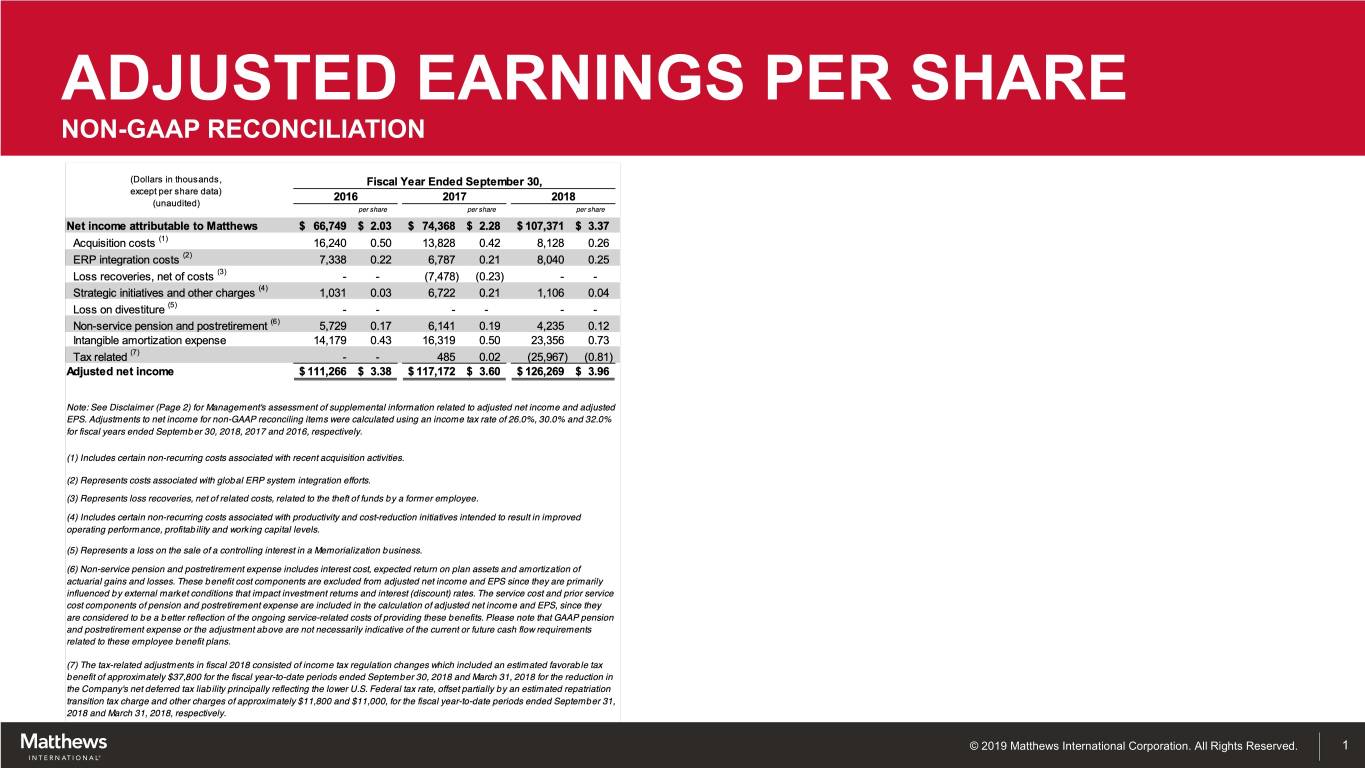

ADJUSTED EARNINGS PER SHARE NON-GAAP RECONCILIATION © 2019 Matthews International Corporation. All Rights Reserved. 1

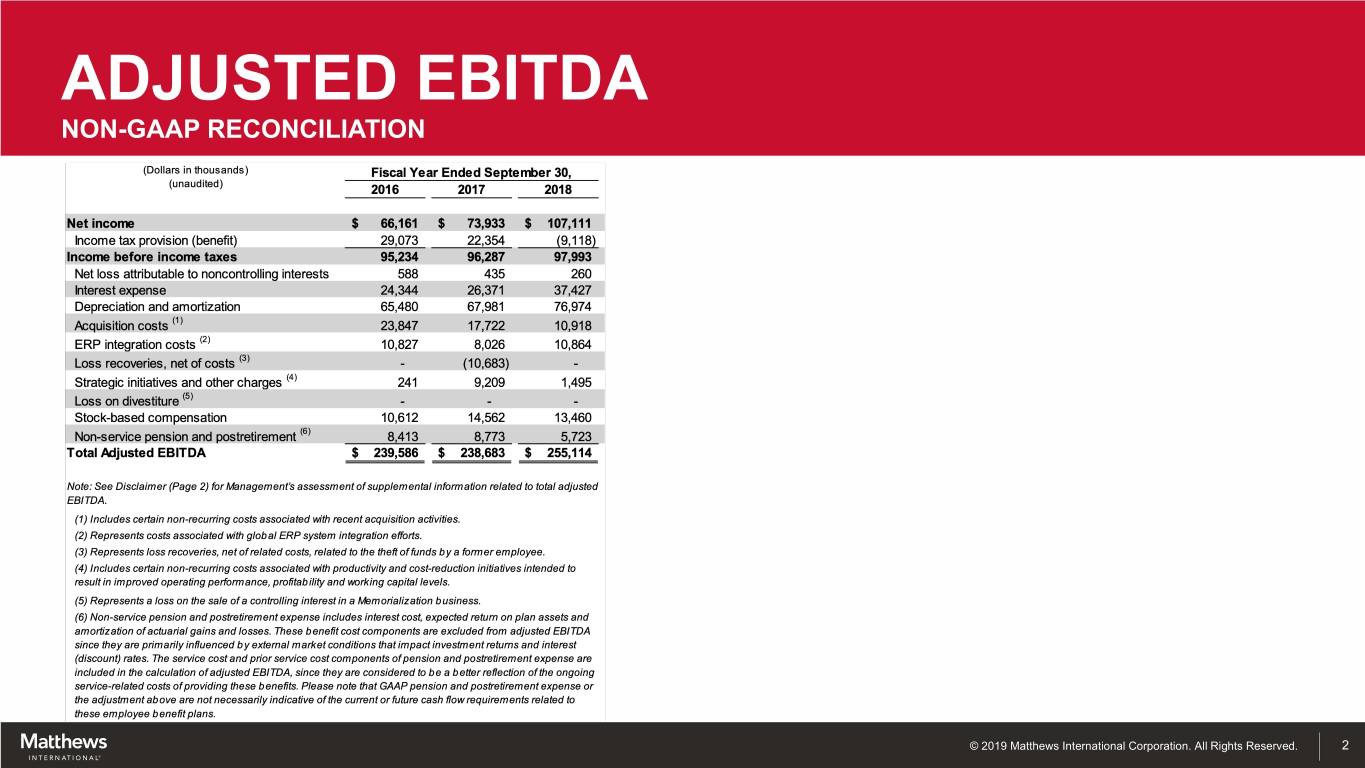

ADJUSTED EBITDA NON-GAAP RECONCILIATION © 2019 Matthews International Corporation. All Rights Reserved. 2

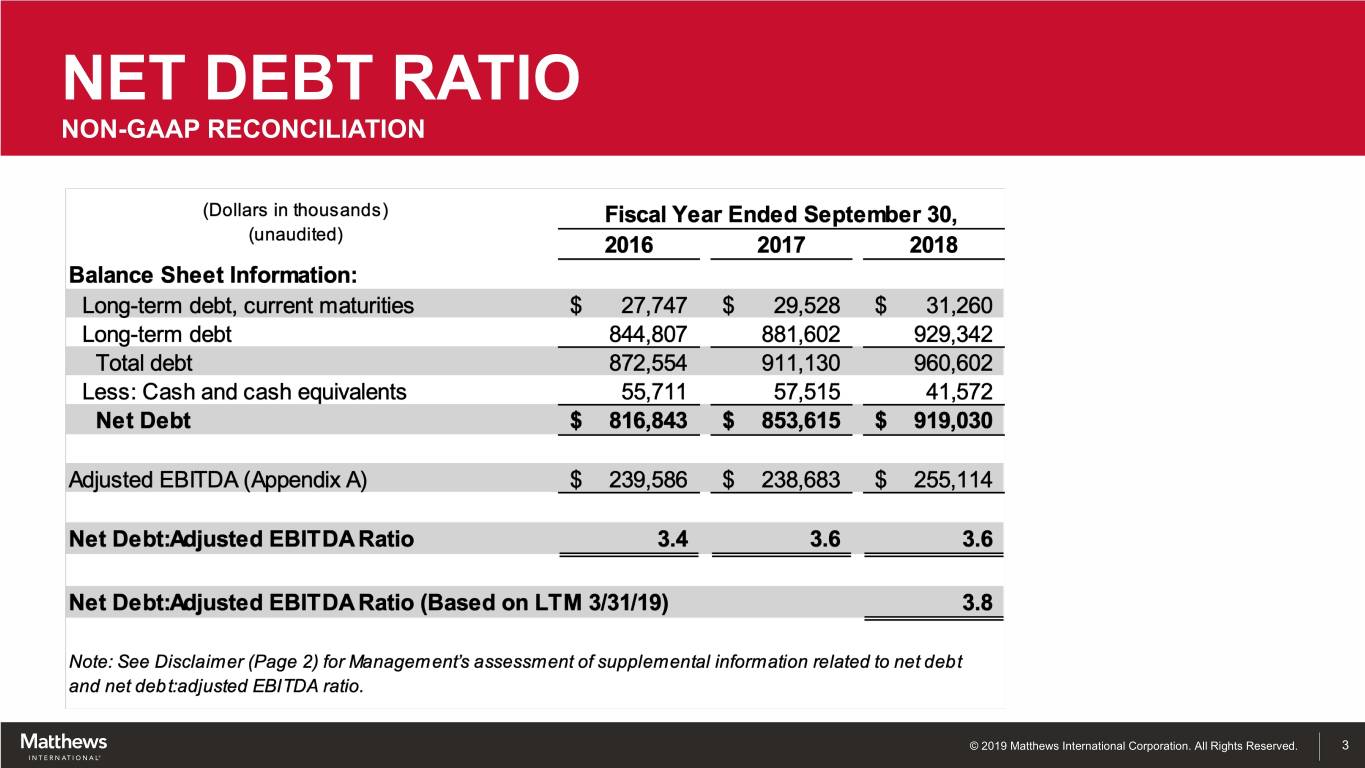

NET DEBT RATIO NON-GAAP RECONCILIATION © 2019 Matthews International Corporation. All Rights Reserved. 3

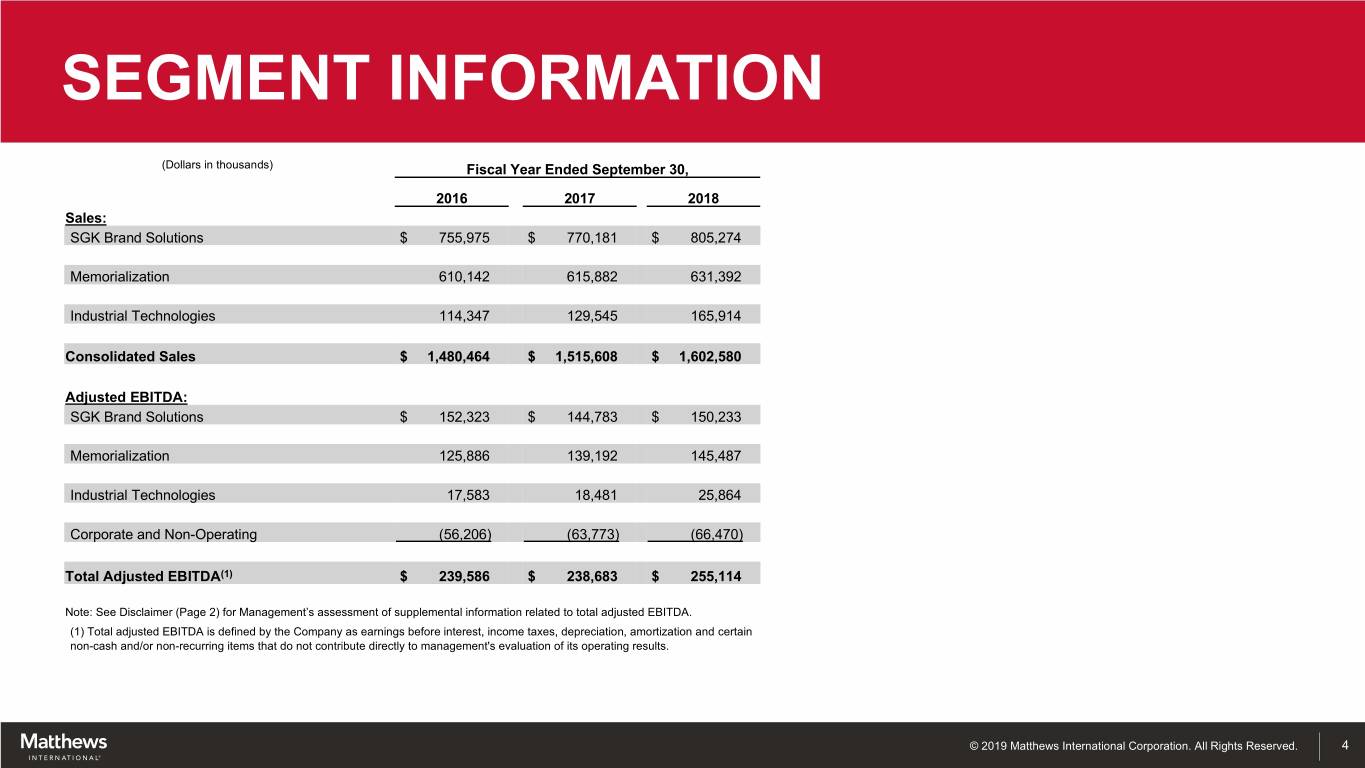

SEGMENT INFORMATION (Dollars in thousands) Fiscal Year Ended September 30, 2016 2017 2018 Sales: SGK Brand Solutions $ 755,975 $ 770,181 $ 805,274 Memorialization 610,142 615,882 631,392 Industrial Technologies 114,347 129,545 165,914 Consolidated Sales $ 1,480,464 $ 1,515,608 $ 1,602,580 Adjusted EBITDA: SGK Brand Solutions $ 152,323 $ 144,783 $ 150,233 Memorialization 125,886 139,192 145,487 Industrial Technologies 17,583 18,481 25,864 Corporate and Non-Operating (56,206) (63,773) (66,470) Total Adjusted EBITDA(1) $ 239,586 $ 238,683 $ 255,114 Note: See Disclaimer (Page 2) for Management’s assessment of supplemental information related to total adjusted EBITDA. (1) Total adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management's evaluation of its operating results. © 2019 Matthews International Corporation. All Rights Reserved. 4