Third Quarter Fiscal 2019 Earnings Teleconference August 2, 2019 www.matw.com | Nasdaq: MATW Joseph C. Bartolacci President and Chief Executive Officer Steven F. Nicola Chief Financial Officer

DISCLAIMER Any forward-looking statements contained in this presentation are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from management’s expectations. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove correct. Factors that could cause the Company's results to differ materially from the results discussed in such forward-looking statements principally include changes in domestic or international economic conditions, changes in foreign currency exchange rates, changes in the cost of materials used in the manufacture of the Company's products, changes in mortality and cremation rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company operates, changes in product demand or pricing as a result of domestic or international competitive pressures, unknown risks in connection with the Company's acquisitions, cybersecurity concerns, effectiveness of the Company's internal controls, compliance with domestic and foreign laws and regulations, technological factors beyond the Company's control, and other factors described in the Company’s Annual Report on Form 10-K and other periodic filings with the U.S. Securities and Exchange Commission (“SEC”). Included in this report are measures of financial performance that are not defined by generally accepted accounting principles in the United States (“GAAP”). The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company’s core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. The Company believes that adjusted EBITDA provides relevant and useful information, which is used by the Company’s management in assessing the performance of its business. Adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management’s evaluation of its operating results. These items include stock-based compensation, the non-service portion of pension and postretirement expense, acquisition costs, ERP integration costs, and strategic initiatives and other charges. Adjusted EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income taxes, and the effects of certain acquisition and ERP integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating operating performance. It is also useful as a financial measure for lenders and is used by the Company’s management to measure business performance. Adjusted EBITDA is not a measure of the Company's financial performance under GAAP and should not be considered as an alternative to net income or other performance measures derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the Company's liquidity. The Company's definition of adjusted EBITDA may not be comparable to similarly titled measures used by other companies. The Company has also presented adjusted net income and adjusted earnings per share and believes each measure provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in assessing the performance of its business. Adjusted net income and adjusted earnings per share provides the Company with an understanding of the results from the primary operations of our business by excluding the effects of certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of our operations. These measures provide management with insight into the earning value for shareholders excluding certain costs, not related to the Company’s primary operations. Likewise, these measures may be useful to an investor in evaluating the underlying operating performance of the Company’s business overall, as well as performance trends, on a consistent basis. © 2019 Matthews International Corporation. All Rights Reserved. 2

FINANCIAL OVERVIEW

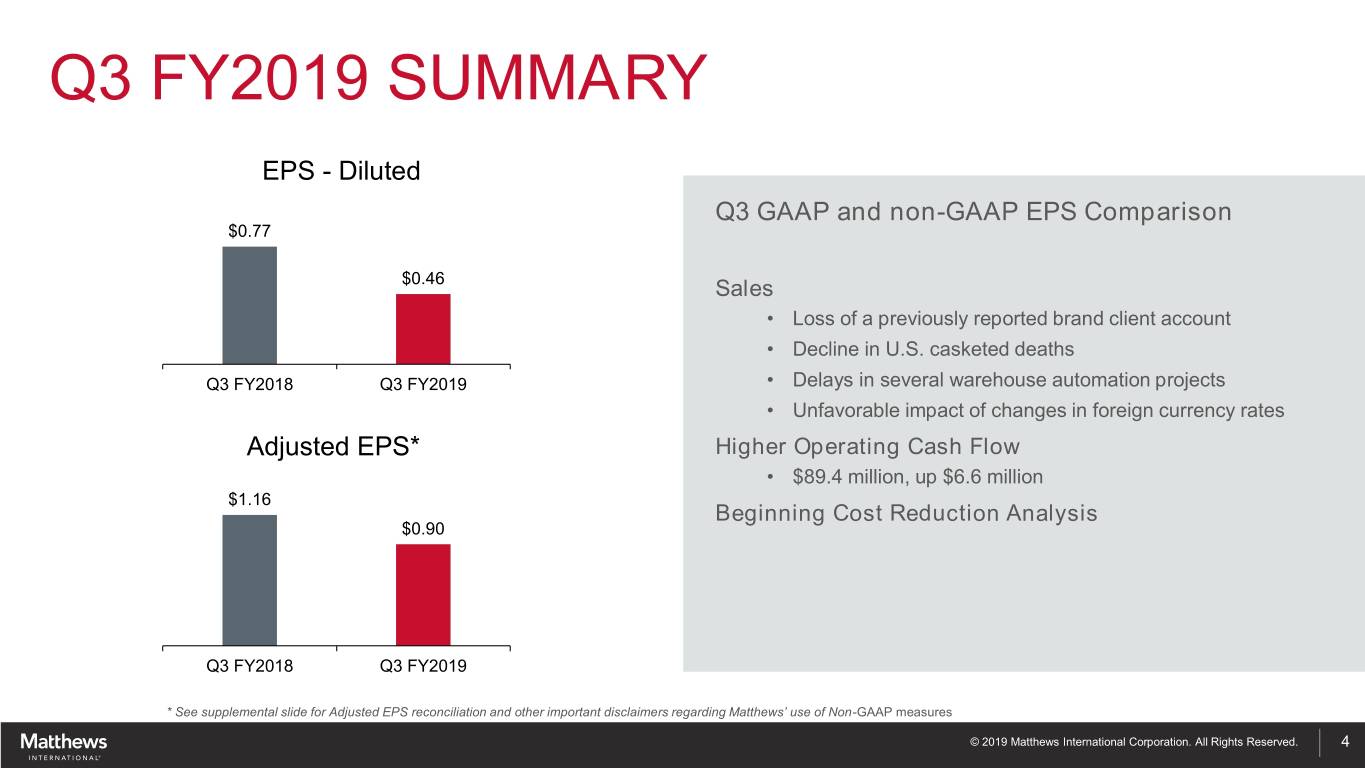

Q3 FY2019 SUMMARY EPS - Diluted Q3 GAAP and non-GAAP EPS Comparison $0.77 $0.46 Sales • Loss of a previously reported brand client account • Decline in U.S. casketed deaths Q3 FY2018 Q3 FY2019 • Delays in several warehouse automation projects • Unfavorable impact of changes in foreign currency rates Adjusted EPS* Higher Operating Cash Flow • $89.4 million, up $6.6 million $1.16 Beginning Cost Reduction Analysis $0.90 Q3 FY2018 Q3 FY2019 * See supplemental slide for Adjusted EPS reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 4

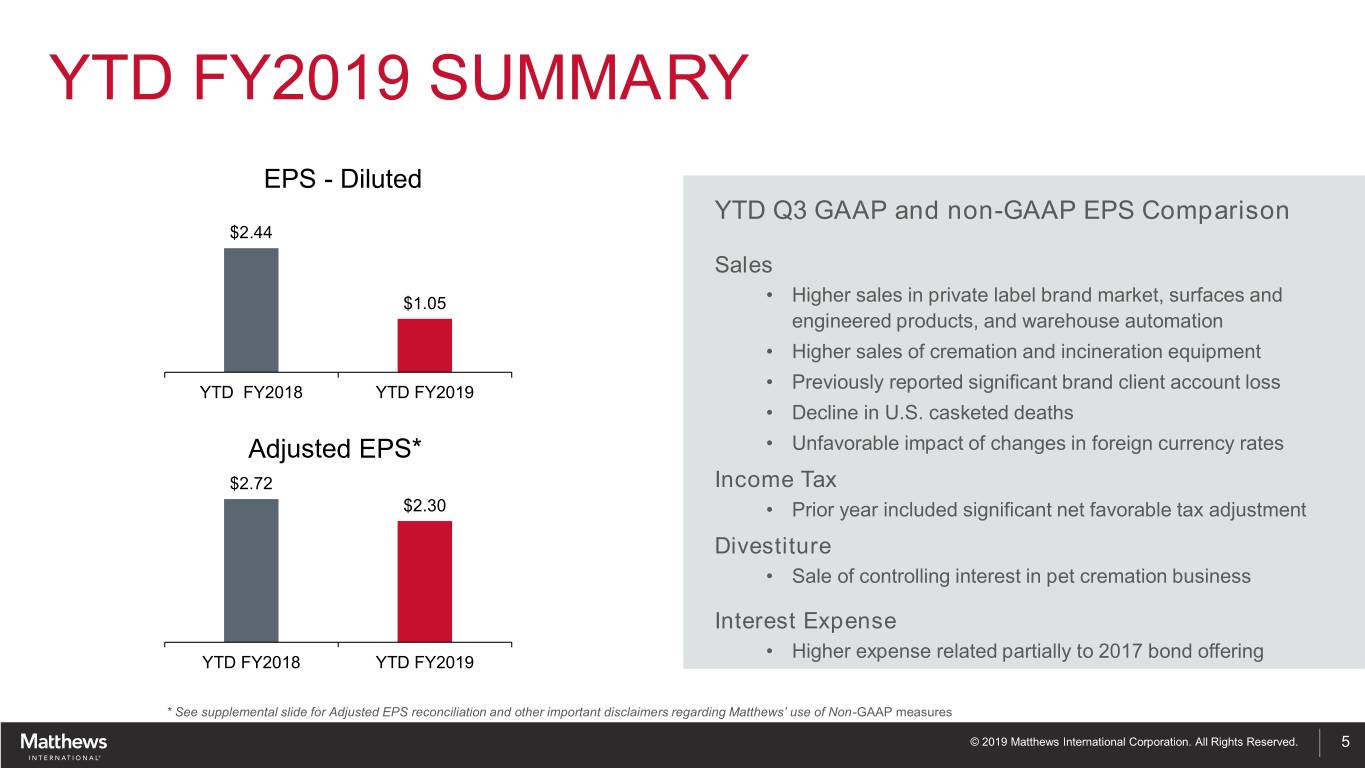

YTD FY2019 SUMMARY EPS - Diluted YTD Q3 GAAP and non-GAAP EPS Comparison $2.44 Sales $1.05 • Higher sales in private label brand market, surfaces and engineered products, and warehouse automation • Higher sales of cremation and incineration equipment • Previously reported significant brand client account loss YTD FY2018 YTD FY2019 • Decline in U.S. casketed deaths Adjusted EPS* • Unfavorable impact of changes in foreign currency rates $2.72 Income Tax $2.30 • Prior year included significant net favorable tax adjustment Divestiture • Sale of controlling interest in pet cremation business Interest Expense • Higher expense related partially to 2017 bond offering YTD FY2018 YTD FY2019 * See supplemental slide for Adjusted EPS reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 5

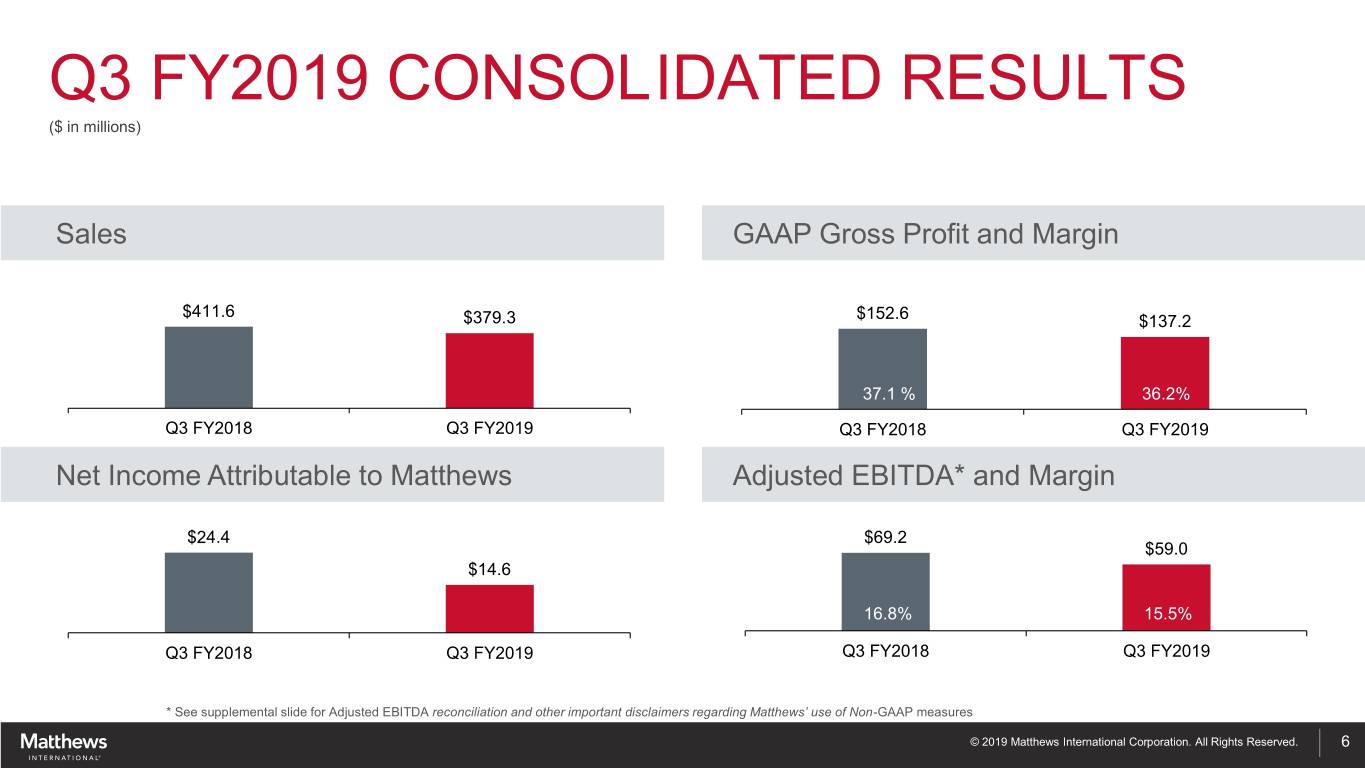

Q3 FY2019 CONSOLIDATED RESULTS ($ in millions) Sales GAAP Gross Profit and Margin $411.6 $379.3 $152.6 $137.2 37.1 % 36.2% Q3 FY2018 Q3 FY2019 Q3 FY2018 Q3 FY2019 Net Income Attributable to Matthews Adjusted EBITDA* and Margin $24.4 $69.2 $59.0 $14.6 16.8% 15.5% Q3 FY2018 Q3 FY2019 Q3 FY2018 Q3 FY2019 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 6

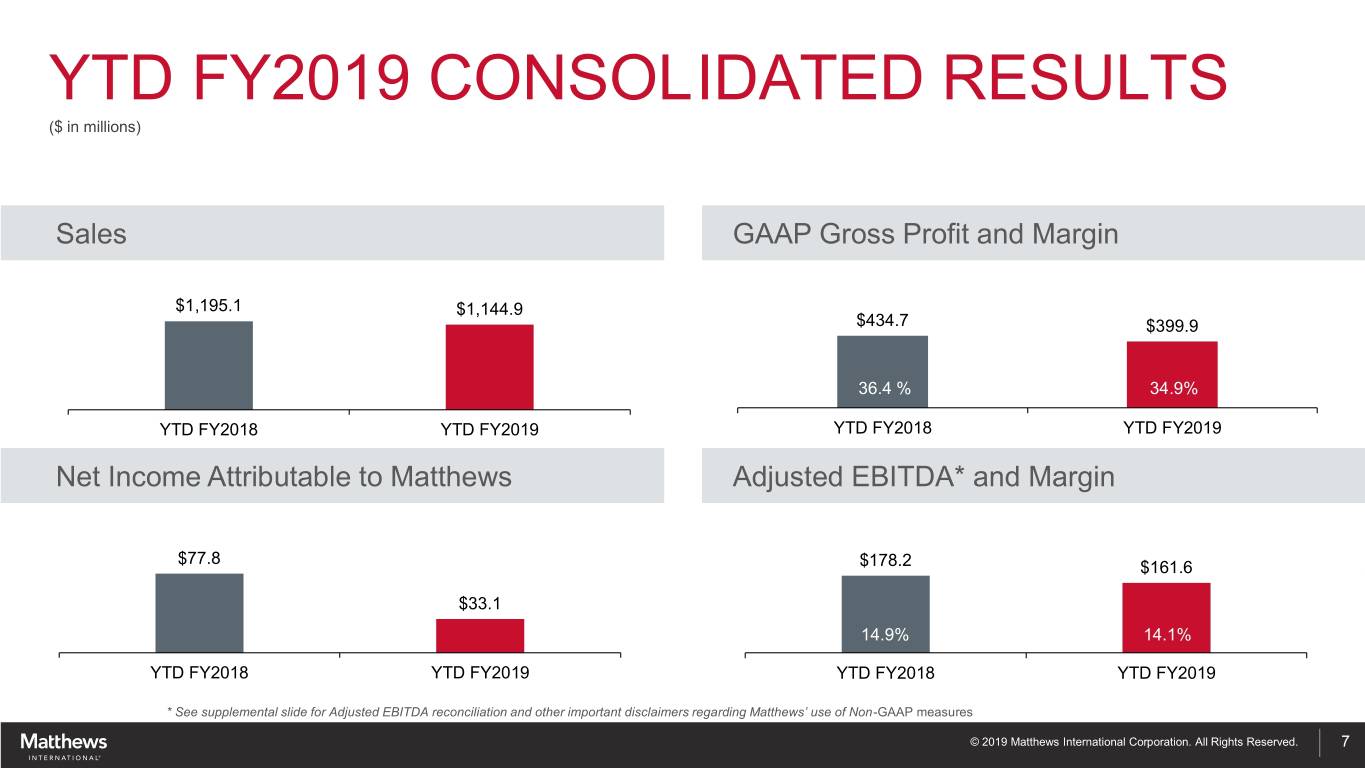

YTD FY2019 CONSOLIDATED RESULTS ($ in millions) Sales GAAP Gross Profit and Margin $1,195.1 $1,144.9 $434.7 $399.9 36.4 % 34.9% YTD FY2018 YTD FY2019 YTD FY2018 YTD FY2019 Net Income Attributable to Matthews Adjusted EBITDA* and Margin $77.8 $178.2 $161.6 $33.1 14.9% 14.1% YTD FY2018 YTD FY2019 YTD FY2018 YTD FY2019 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 7

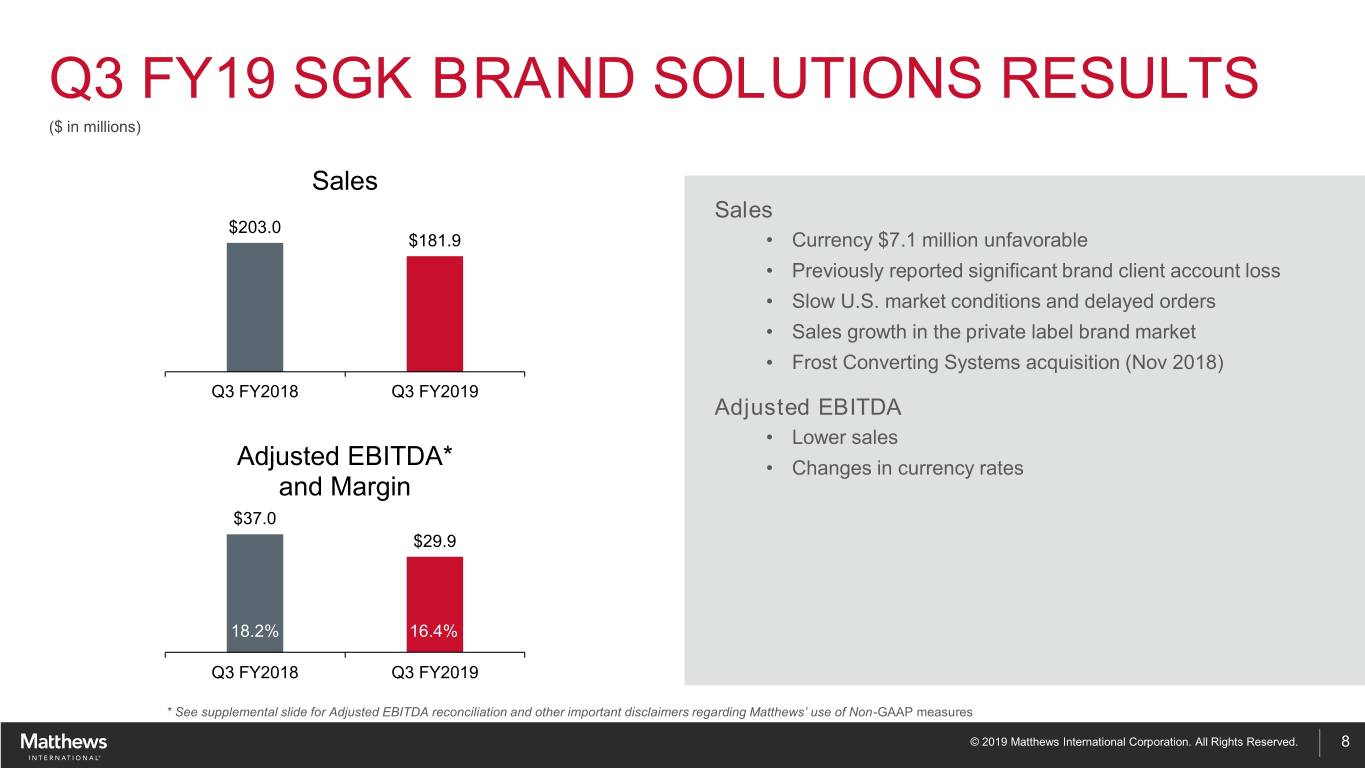

Q3 FY19 SGK BRAND SOLUTIONS RESULTS ($ in millions) Sales Sales $203.0 $181.9 • Currency $7.1 million unfavorable • Previously reported significant brand client account loss • Slow U.S. market conditions and delayed orders • Sales growth in the private label brand market • Frost Converting Systems acquisition (Nov 2018) Q3 FY2018 Q3 FY2019 Adjusted EBITDA • Lower sales Adjusted EBITDA* • Changes in currency rates and Margin $37.0 $29.9 18.2% 16.4% Q3 FY2018 Q3 FY2019 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 8

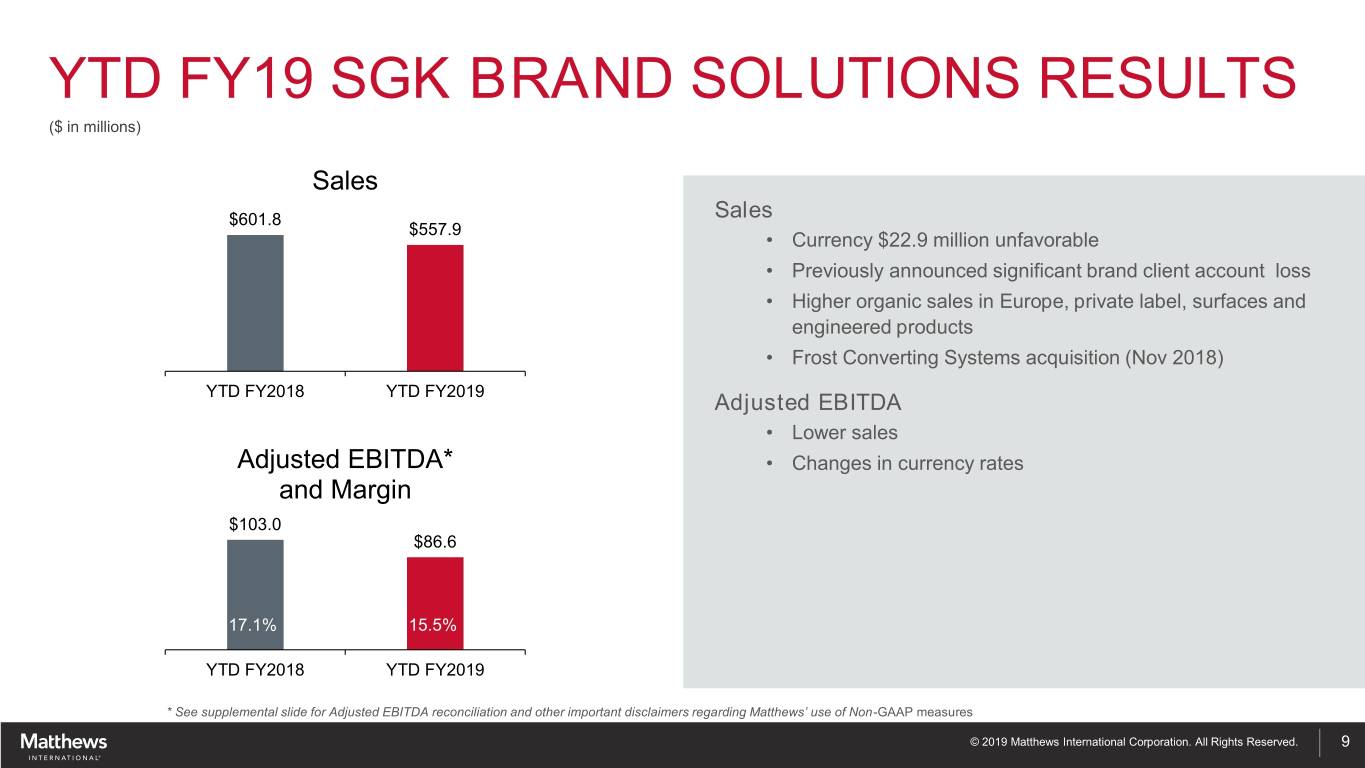

YTD FY19 SGK BRAND SOLUTIONS RESULTS ($ in millions) Sales $601.8 Sales $557.9 • Currency $22.9 million unfavorable • Previously announced significant brand client account loss • Higher organic sales in Europe, private label, surfaces and engineered products • Frost Converting Systems acquisition (Nov 2018) YTD FY2018 YTD FY2019 Adjusted EBITDA • Lower sales Adjusted EBITDA* • Changes in currency rates and Margin $103.0 $86.6 17.1% 15.5% YTD FY2018 YTD FY2019 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 9

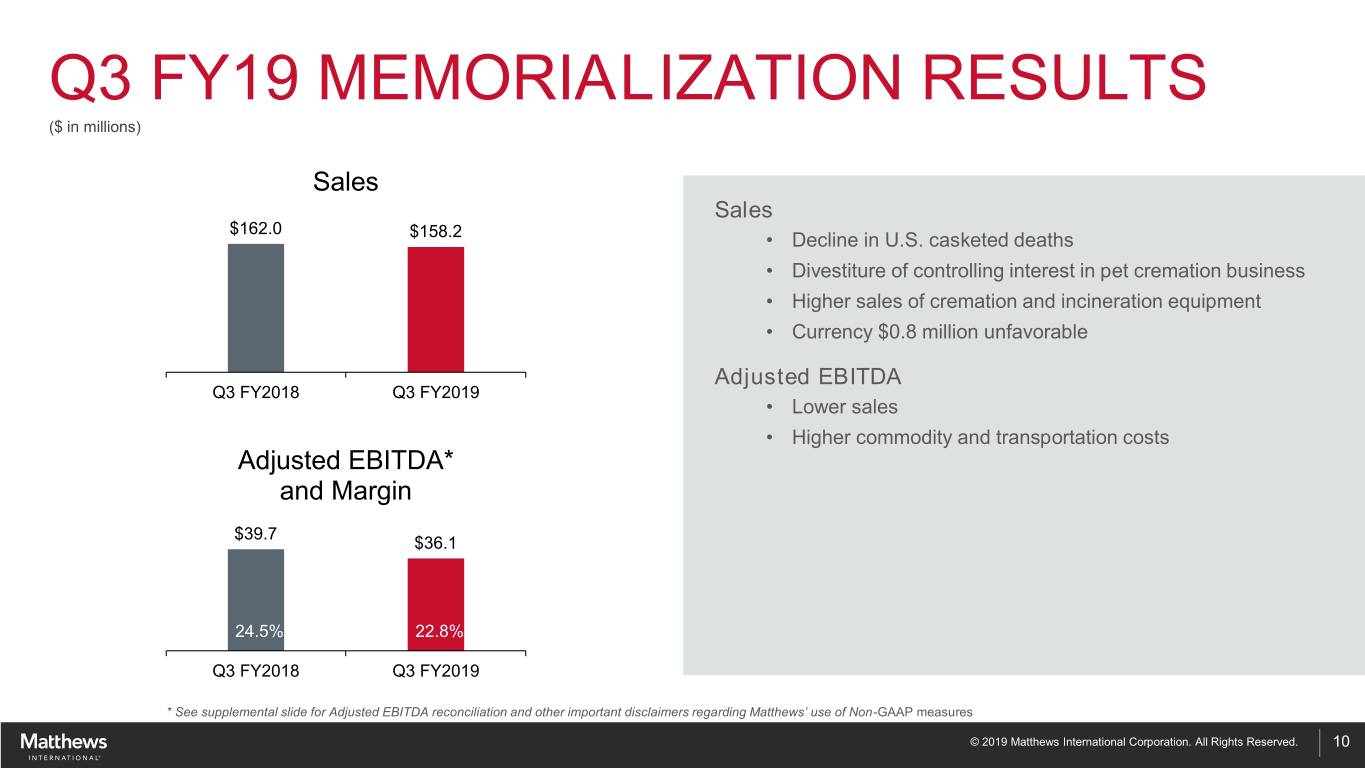

Q3 FY19 MEMORIALIZATION RESULTS ($ in millions) Sales Sales $162.0 $158.2 • Decline in U.S. casketed deaths • Divestiture of controlling interest in pet cremation business • Higher sales of cremation and incineration equipment • Currency $0.8 million unfavorable Adjusted EBITDA Q3 FY2018 Q3 FY2019 • Lower sales • Higher commodity and transportation costs Adjusted EBITDA* and Margin $39.7 $36.1 24.5% 22.8% Q3 FY2018 Q3 FY2019 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 10

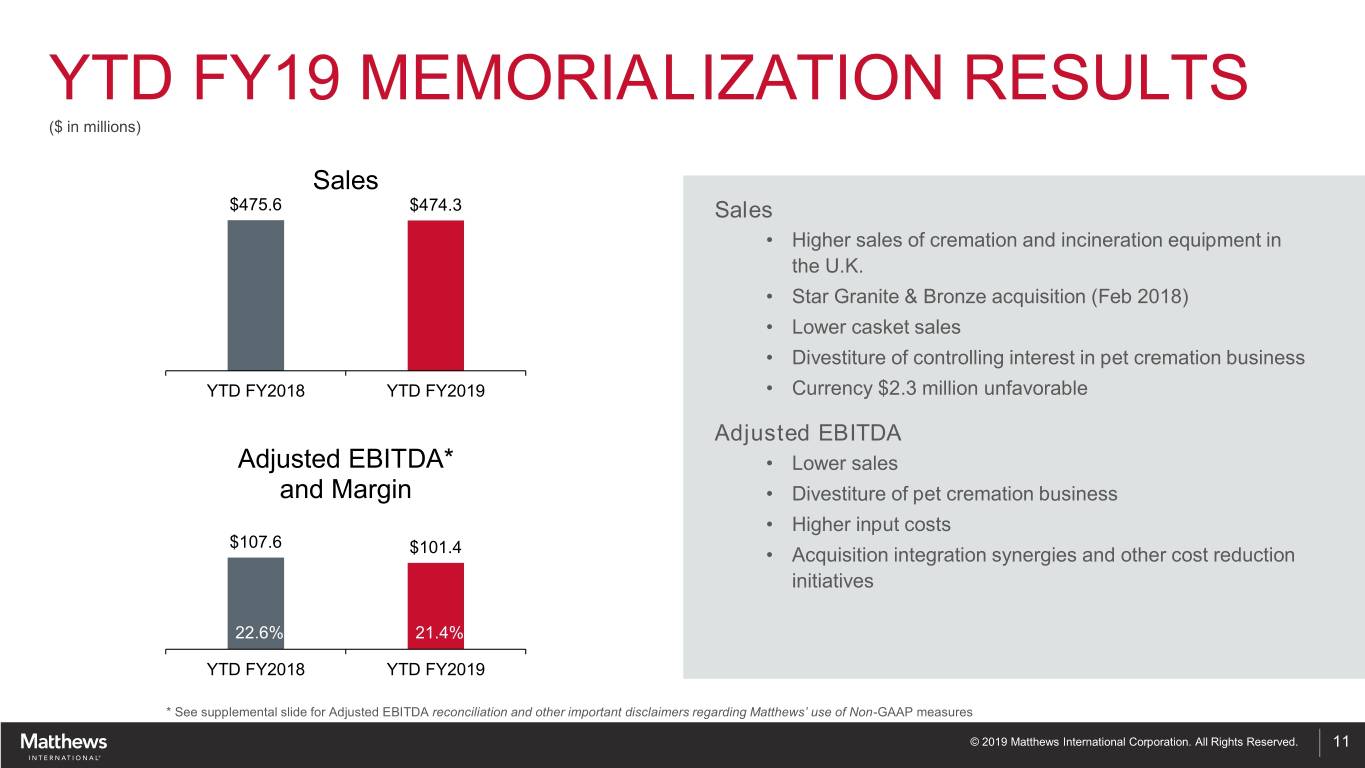

YTD FY19 MEMORIALIZATION RESULTS ($ in millions) Sales $475.6 $474.3 Sales • Higher sales of cremation and incineration equipment in the U.K. • Star Granite & Bronze acquisition (Feb 2018) • Lower casket sales • Divestiture of controlling interest in pet cremation business YTD FY2018 YTD FY2019 • Currency $2.3 million unfavorable Adjusted EBITDA Adjusted EBITDA* • Lower sales and Margin • Divestiture of pet cremation business • Higher input costs $107.6 $101.4 • Acquisition integration synergies and other cost reduction initiatives 22.6% 21.4% YTD FY2018 YTD FY2019 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 11

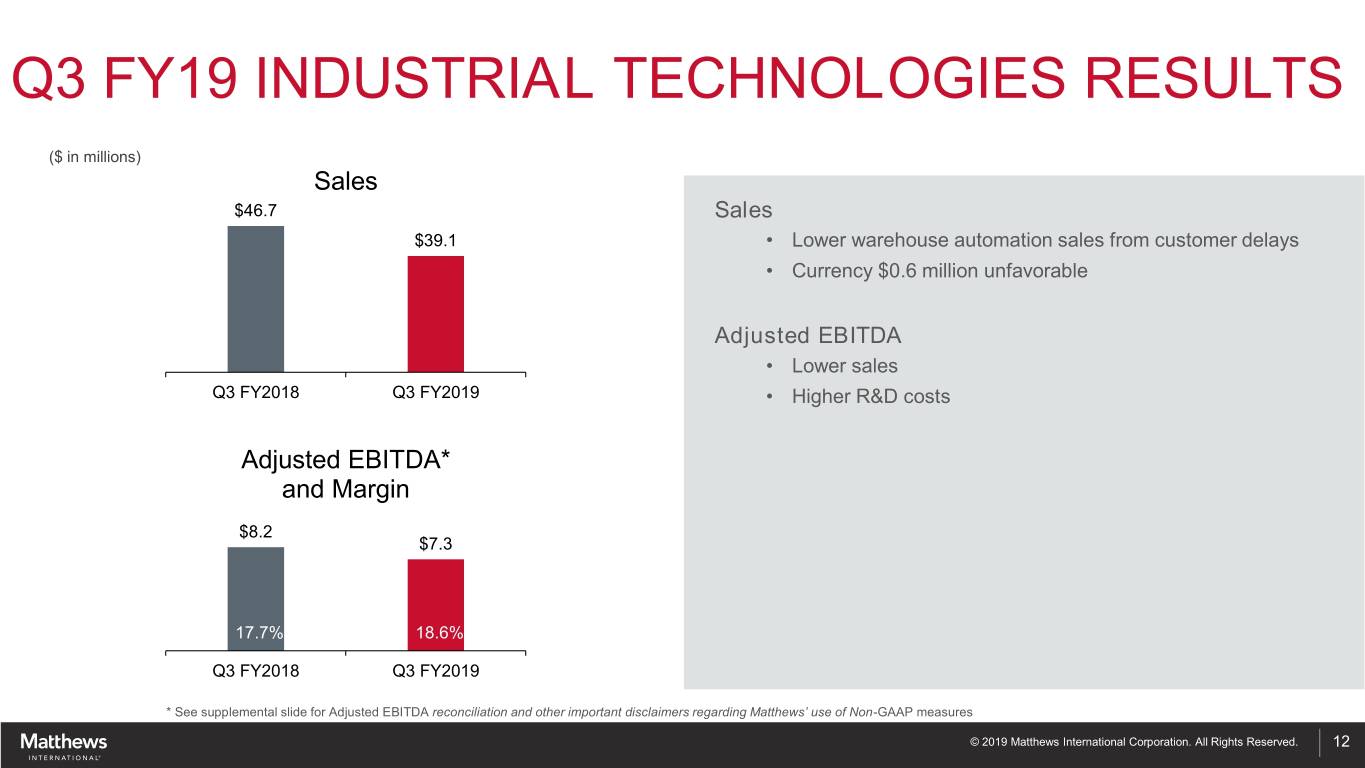

Q3 FY19 INDUSTRIAL TECHNOLOGIES RESULTS ($ in millions) Sales $46.7 Sales $39.1 • Lower warehouse automation sales from customer delays • Currency $0.6 million unfavorable Adjusted EBITDA • Lower sales Q3 FY2018 Q3 FY2019 • Higher R&D costs Adjusted EBITDA* and Margin $8.2 $7.3 17.7% 18.6% Q3 FY2018 Q3 FY2019 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 12

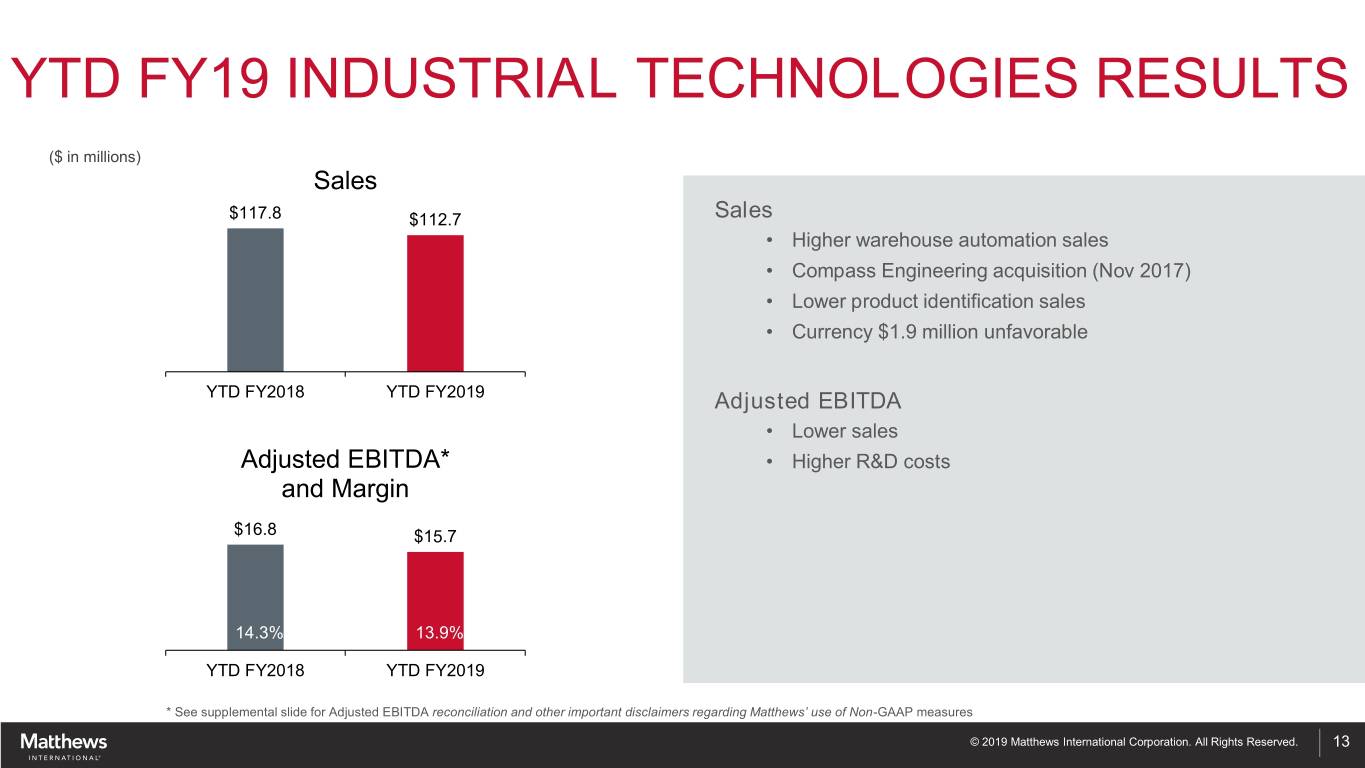

YTD FY19 INDUSTRIAL TECHNOLOGIES RESULTS ($ in millions) Sales $117.8 $112.7 Sales • Higher warehouse automation sales • Compass Engineering acquisition (Nov 2017) • Lower product identification sales • Currency $1.9 million unfavorable YTD FY2018 YTD FY2019 Adjusted EBITDA • Lower sales Adjusted EBITDA* • Higher R&D costs and Margin $16.8 $15.7 14.3% 13.9% YTD FY2018 YTD FY2019 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures © 2019 Matthews International Corporation. All Rights Reserved. 13

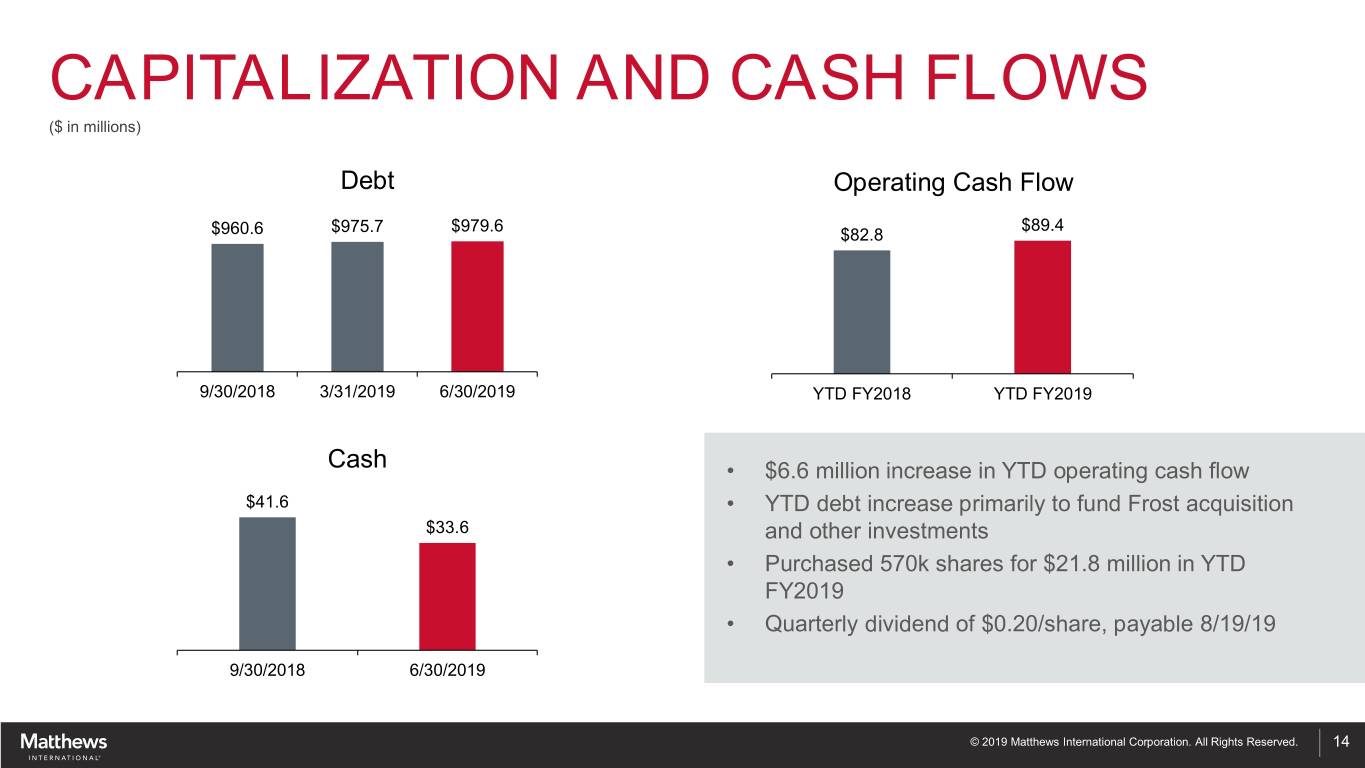

CAPITALIZATION AND CASH FLOWS ($ in millions) Debt Operating Cash Flow $975.7 $979.6 $89.4 $960.6 $82.8 9/30/2018 3/31/2019 6/30/2019 YTD FY2018 YTD FY2019 Cash • $6.6 million increase in YTD operating cash flow $41.6 • YTD debt increase primarily to fund Frost acquisition $33.6 and other investments • Purchased 570k shares for $21.8 million in YTD FY2019 • Quarterly dividend of $0.20/share, payable 8/19/19 9/30/2018 6/30/2019 © 2019 Matthews International Corporation. All Rights Reserved. 14

BUSINESS OVERVIEW

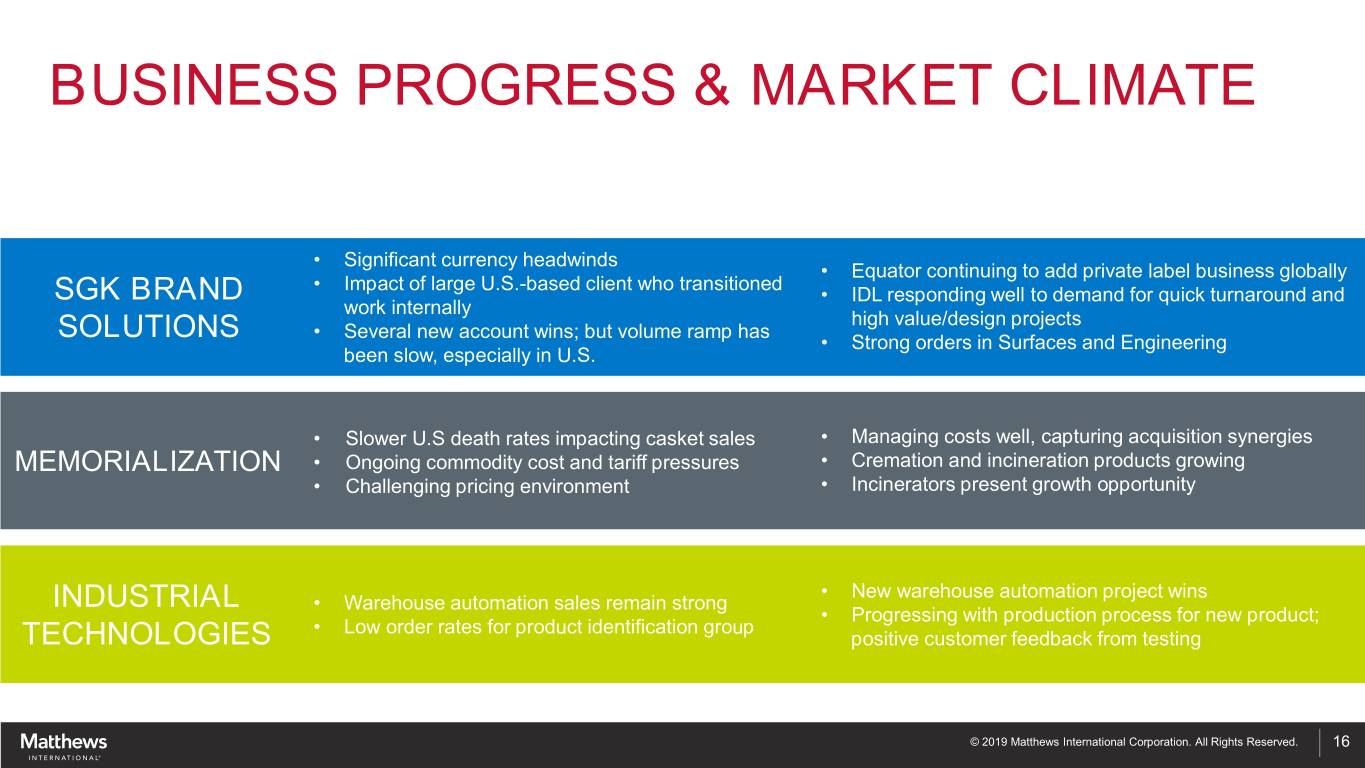

BUSINESS PROGRESS & MARKET CLIMATE • Significant currency headwinds • Equator continuing to add private label business globally • Impact of large U.S.-based client who transitioned SGK BRAND • IDL responding well to demand for quick turnaround and work internally high value/design projects • Several new account wins; but volume ramp has SOLUTIONS • Strong orders in Surfaces and Engineering been slow, especially in U.S. • Slower U.S death rates impacting casket sales • Managing costs well, capturing acquisition synergies MEMORIALIZATION • Ongoing commodity cost and tariff pressures • Cremation and incineration products growing • Challenging pricing environment • Incinerators present growth opportunity • New warehouse automation project wins INDUSTRIAL • Warehouse automation sales remain strong • Progressing with production process for new product; • Low order rates for product identification group TECHNOLOGIES positive customer feedback from testing © 2019 Matthews International Corporation. All Rights Reserved. 16

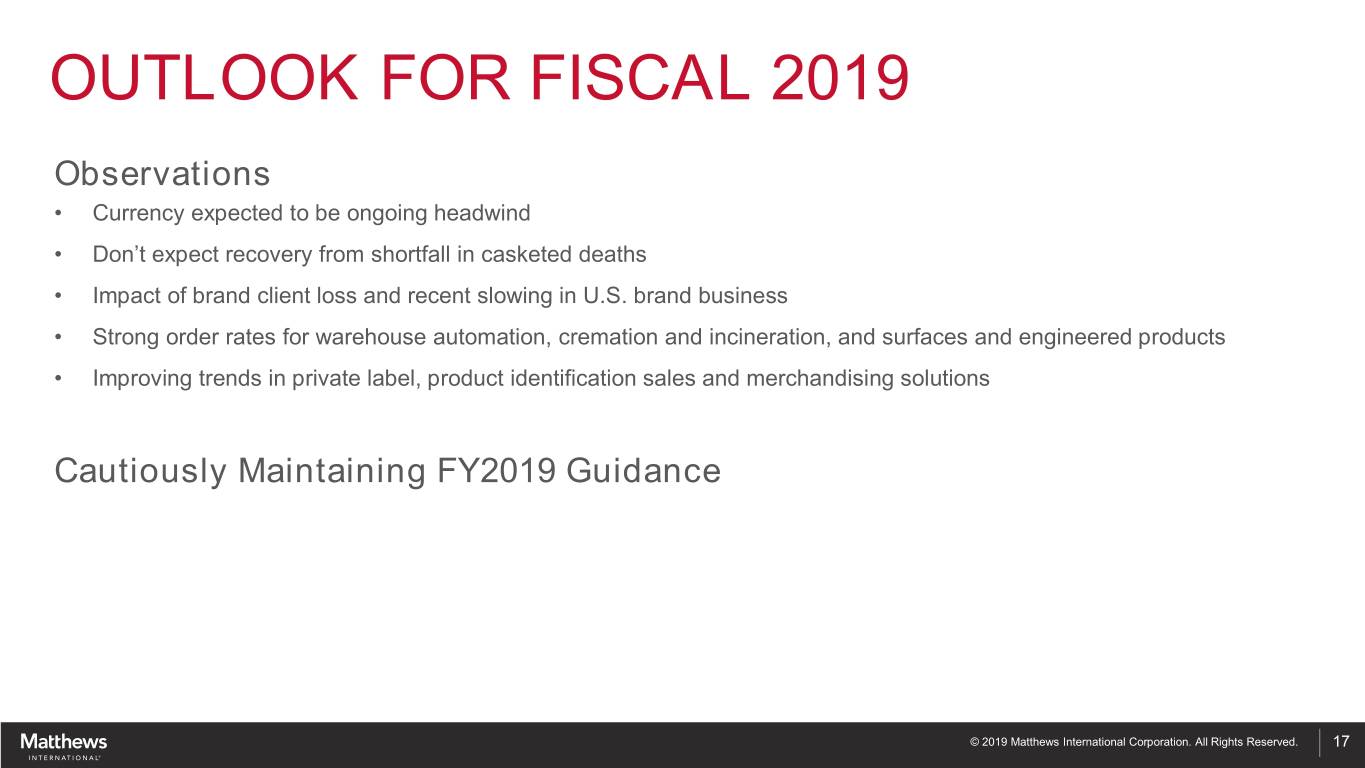

OUTLOOK FOR FISCAL 2019 Observations • Currency expected to be ongoing headwind • Don’t expect recovery from shortfall in casketed deaths • Impact of brand client loss and recent slowing in U.S. brand business • Strong order rates for warehouse automation, cremation and incineration, and surfaces and engineered products • Improving trends in private label, product identification sales and merchandising solutions Cautiously Maintaining FY2019 Guidance © 2019 Matthews International Corporation. All Rights Reserved. 17

SUPPLEMENTAL INFORMATION

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES Included in this report are measures of financial performance that are not defined by generally accepted accounting principles in the United States (“GAAP”). The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company’s core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. © 2019 Matthews International Corporation. All Rights Reserved. 19

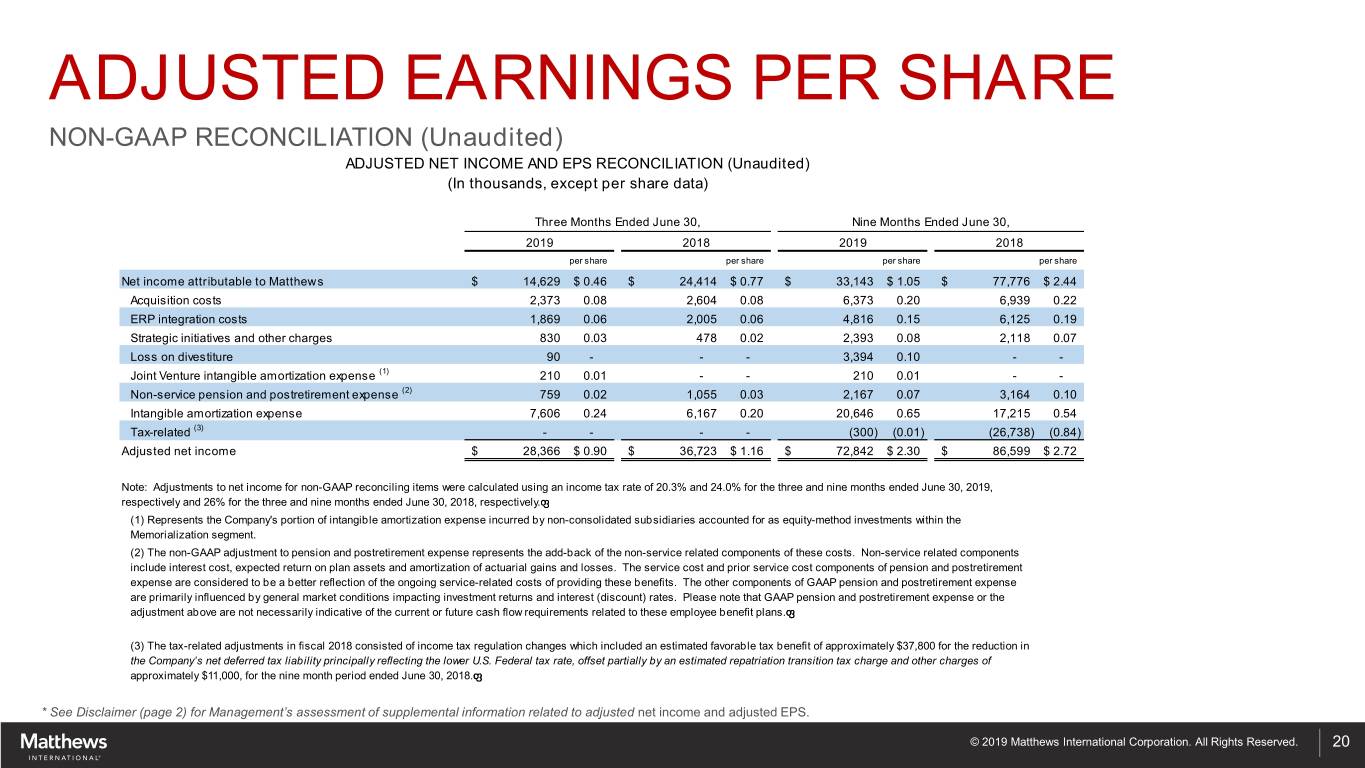

ADJUSTED EARNINGS PER SHARE NON-GAAP RECONCILIATION (Unaudited) ADJUSTED NET INCOME AND EPS RECONCILIATION (Unaudited) (In thousands, except per share data) Three Months Ended June 30, Nine Months Ended June 30, 2019 2018 2019 2018 per share per share per share per share Net income attributable to Matthews $ 14,629 $ 0.46 $ 24,414 $ 0.77 $ 33,143 $ 1.05 $ 77,776 $ 2.44 Acquisition costs 2,373 0.08 2,604 0.08 6,373 0.20 6,939 0.22 ERP integration costs 1,869 0.06 2,005 0.06 4,816 0.15 6,125 0.19 Strategic initiatives and other charges 830 0.03 478 0.02 2,393 0.08 2,118 0.07 Loss on divestiture 90 - - - 3,394 0.10 - - Joint Venture intangible amortization expense (1) 210 0.01 - - 210 0.01 - - Non-service pension and postretirement expense (2) 759 0.02 1,055 0.03 2,167 0.07 3,164 0.10 Intangible amortization expense 7,606 0.24 6,167 0.20 20,646 0.65 17,215 0.54 Tax-related (3) - - - - (300) (0.01) (26,738) (0.84) Adjusted net income $ 28,366 $ 0.90 $ 36,723 $ 1.16 $ 72,842 $ 2.30 $ 86,599 $ 2.72 Note: Adjustments to net income for non-GAAP reconciling items were calculated using an income tax rate of 20.3% and 24.0% for the three and nine months ended June 30, 2019, respectively and 26% for the three and nine months ended June 30, 2018, respectively. (1) Represents the Company's portion of intangible amortization expense incurred by non-consolidated subsidiaries accounted for as equity-method investments within the Memorialization segment. (2) The non-GAAP adjustment to pension and postretirement expense represents the add-back of the non-service related components of these costs. Non-service related components include interest cost, expected return on plan assets and amortization of actuarial gains and losses. The service cost and prior service cost components of pension and postretirement expense are considered to be a better reflection of the ongoing service-related costs of providing these benefits. The other components of GAAP pension and postretirement expense are primarily influenced by general market conditions impacting investment returns and interest (discount) rates. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. (3) The tax-related adjustments in fiscal 2018 consisted of income tax regulation changes which included an estimated favorable tax benefit of approximately $37,800 for the reduction in the Company’s net deferred tax liability principally reflecting the lower U.S. Federal tax rate, offset partially by an estimated repatriation transition tax charge and other charges of approximately $11,000, for the nine month period ended June 30, 2018. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted net income and adjusted EPS. © 2019 Matthews International Corporation. All Rights Reserved. 20

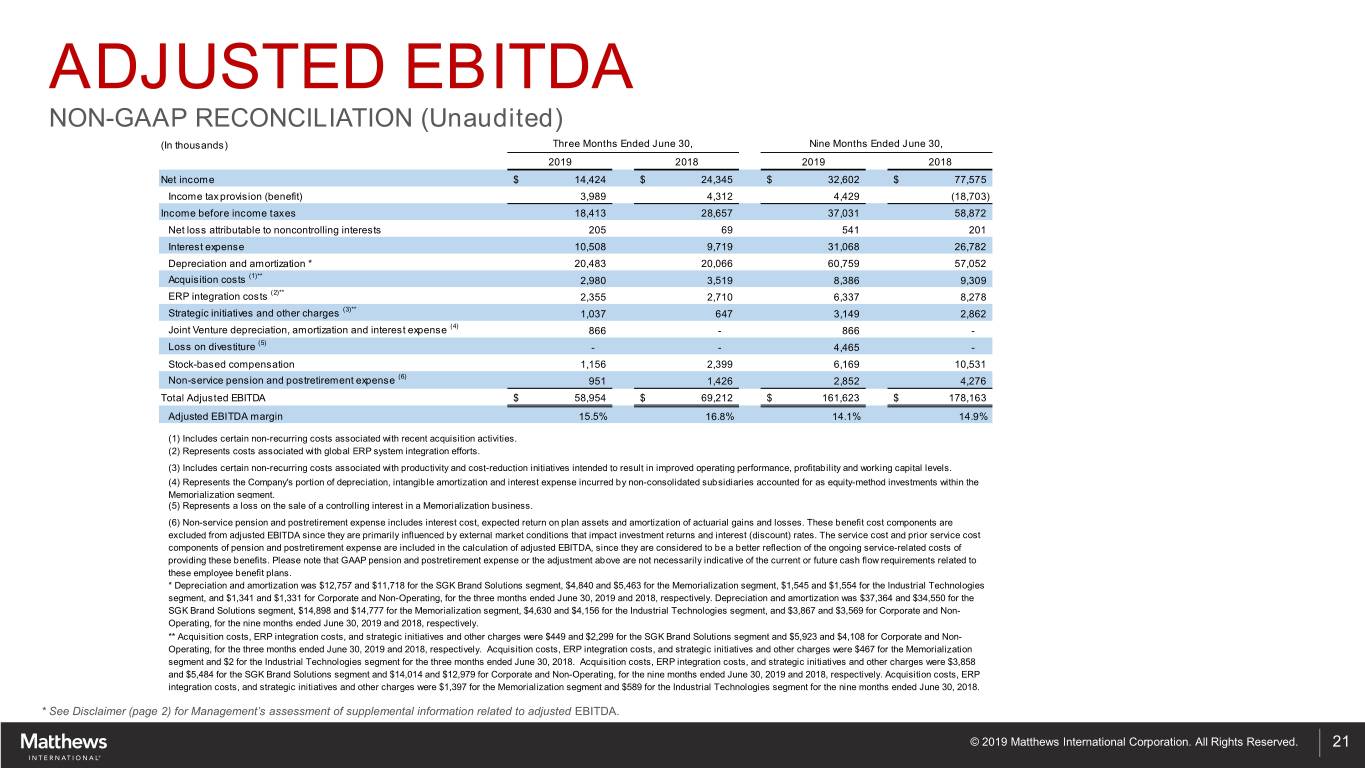

ADJUSTED EBITDA NON-GAAP RECONCILIATION (Unaudited) (In thousands) Three Months Ended June 30, Nine Months Ended June 30, 2019 2018 2019 2018 Net income $ 14,424 $ 24,345 $ 32,602 $ 77,575 Income tax provision (benefit) 3,989 4,312 4,429 (18,703) Income before income taxes 18,413 28,657 37,031 58,872 Net loss attributable to noncontrolling interests 205 69 541 201 Interest expense 10,508 9,719 31,068 26,782 Depreciation and amortization * 20,483 20,066 60,759 57,052 Acquisition costs (1)** 2,980 3,519 8,386 9,309 ERP integration costs (2)** 2,355 2,710 6,337 8,278 Strategic initiatives and other charges (3)** 1,037 647 3,149 2,862 Joint Venture depreciation, amortization and interest expense (4) 866 - 866 - Loss on divestiture (5) - - 4,465 - Stock-based compensation 1,156 2,399 6,169 10,531 Non-service pension and postretirement expense (6) 951 1,426 2,852 4,276 Total Adjusted EBITDA $ 58,954 $ 69,212 $ 161,623 $ 178,163 Adjusted EBITDA margin 15.5% 16.8% 14.1% 14.9% (1) Includes certain non-recurring costs associated with recent acquisition activities. (2) Represents costs associated with global ERP system integration efforts. (3) Includes certain non-recurring costs associated with productivity and cost-reduction initiatives intended to result in improved operating performance, profitability and working capital levels. (4) Represents the Company's portion of depreciation, intangible amortization and interest expense incurred by non-consolidated subsidiaries accounted for as equity-method investments within the Memorialization segment. (5) Represents a loss on the sale of a controlling interest in a Memorialization business. (6) Non-service pension and postretirement expense includes interest cost, expected return on plan assets and amortization of actuarial gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. * Depreciation and amortization was $12,757 and $11,718 for the SGK Brand Solutions segment, $4,840 and $5,463 for the Memorialization segment, $1,545 and $1,554 for the Industrial Technologies segment, and $1,341 and $1,331 for Corporate and Non-Operating, for the three months ended June 30, 2019 and 2018, respectively. Depreciation and amortization was $37,364 and $34,550 for the SGK Brand Solutions segment, $14,898 and $14,777 for the Memorialization segment, $4,630 and $4,156 for the Industrial Technologies segment, and $3,867 and $3,569 for Corporate and Non- Operating, for the nine months ended June 30, 2019 and 2018, respectively. ** Acquisition costs, ERP integration costs, and strategic initiatives and other charges were $449 and $2,299 for the SGK Brand Solutions segment and $5,923 and $4,108 for Corporate and Non- Operating, for the three months ended June 30, 2019 and 2018, respectively. Acquisition costs, ERP integration costs, and strategic initiatives and other charges were $467 for the Memorialization segment and $2 for the Industrial Technologies segment for the three months ended June 30, 2018. Acquisition costs, ERP integration costs, and strategic initiatives and other charges were $3,858 and $5,484 for the SGK Brand Solutions segment and $14,014 and $12,979 for Corporate and Non-Operating, for the nine months ended June 30, 2019 and 2018, respectively. Acquisition costs, ERP integration costs, and strategic initiatives and other charges were $1,397 for the Memorialization segment and $589 for the Industrial Technologies segment for the nine months ended June 30, 2018. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted EBITDA. © 2019 Matthews International Corporation. All Rights Reserved. 21