UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

__________________________________________________________________________________________________________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

__________________________________________________________________________________________________________________________

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under § 240.14a-12

MATTHEWS INTERNATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

N/A

__________________________________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(I)(4) and 0-11.

(1) | Title of each class of securities to which transaction applies: |

N/A | |

(2) | Aggregate number of securities to which transaction applies: |

N/A | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

N/A | |

(4) | Proposed maximum aggregate value of transaction: |

N/A | |

(5) | Total fee paid: |

N/A | |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) | Amount Previously Paid: |

N/A | |

(2) | Form, Schedule or Registration Statement No.: |

N/A | |

(3) | Filing Party: |

N/A | |

(4) | Date Filed: |

N/A | |

2020

NOTICE

OF

ANNUAL

MEETING

AND

PROXY

STATEMENT

Notice of the

ANNUAL MEETING OF THE SHAREHOLDERS

To be held February 20, 2020

To Our Shareholders:

The annual meeting of the Shareholders of Matthews International Corporation (“Matthews” or the “Company”) will be held at 9:00 AM (EST) on Thursday, February 20, 2020, at the Renaissance Baltimore Harborplace Hotel, located at 202 East Pratt Street, Baltimore, Maryland 21202 (the "Annual Meeting"), for the purpose of considering and acting upon the following:

1. | To elect three (3) directors of the Company for a term of three (3) years; |

2. | To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm to audit the records of the Company for the fiscal year ending September 30, 2020; |

3. | To provide an advisory (non-binding) vote on the executive compensation of the Company’s named executive officers; and |

4. | To transact such other business as may properly come before the meeting. |

Shareholders of record as of the close of business on December 31, 2019 will be entitled to vote at the Annual Meeting or any adjournments thereof.

Please indicate on the enclosed proxy card whether you will or will not be able to attend the Annual Meeting. Return the card in the enclosed envelope as soon as possible. If you receive more than one proxy card (for example, because you own common stock in more than one account), please be sure to complete and return all of them.

We hope you can be with us for this important occasion.

Sincerely,

/s/ Steven F. Nicola

Steven F. Nicola

Chief Financial Officer and Secretary

January 21, 2020

Matthews International Corporation

Proxy Statement

Table of Contents

Page | |

Proposal 1 – Election of Directors | |

Proposal 2 – Selection of Independent Registered Public Accounting Firm | |

Proposal 3 – Advisory (non-binding) vote on the executive compensation of the Company's named executive officers | |

CEO Pay Ratio | |

Shareholders Sharing the Same Address | |

Shareholder Proposals for the 2021 Annual Meeting | |

Matthews International Corporation

Two NorthShore Center

Pittsburgh, PA 15212 - 5851

412-442-8200

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to Be Held on February 20, 2020

The Company’s 2020 Proxy Statement and the Annual Report to Shareholders for the fiscal year ended September 30, 2019 are available free of charge on the Company’s website at http://www.matw.com/investors/sec-filings.

PROXY STATEMENT

The accompanying proxy is solicited by the Board of Directors of Matthews International Corporation (“Matthews” or the “Company”) whose principal executive offices are located at Two NorthShore Center, Pittsburgh, Pennsylvania 15212. This proxy statement is being sent and made available to shareholders on or about January 21, 2020.

Execution of the proxy will not affect a shareholder's right to attend the meeting and vote in person. Any shareholder giving a proxy has the right to revoke it at any time before it is voted by giving notice to the Corporate Secretary or by attending the meeting and voting in person.

Matters to be considered at the annual meeting of the shareholders of the Company (the "Annual Meeting") are those set forth in the accompanying Notice of Annual Meeting of the Shareholders (the “Notice”). Shares represented by proxy will be voted in accordance with instructions. In the absence of instructions to the contrary, the proxy solicited will be voted FOR the proposals set forth therein.

Management does not intend to bring before the meeting any business other than that set forth in the Notice. If any other business should properly come before the meeting, it is the intention of management that the persons named in the proxy will vote in accordance with their best judgment.

1

OUTSTANDING STOCK AND VOTING RIGHTS

The Company has one class of stock outstanding: Class A Common Stock, par value $1.00 per share, referred to as the "Common Stock."

Each outstanding share of Common Stock of the Company entitles the holder to one vote upon any business properly presented at the shareholders' meeting. As provided in the Company’s Articles of Incorporation, cumulative voting is not applicable to the election of directors.

The Board of Directors of the Company has established December 31, 2019 as the record date for shareholders entitled to vote at the Annual Meeting. The transfer books of the Company will not be closed, but only shareholders of record as of the close of business on December 31, 2019 will be entitled to vote at the Annual Meeting. A total of 31,290,095 shares of Common Stock are outstanding and entitled to vote at the meeting. A quorum (the presence in person or by proxy of the majority of the voting power of the Common Stock) is required to transact business at the Annual Meeting. The holders of 15,645,048 shares will constitute a quorum at the Annual Meeting.

Broker Authority to Vote

Abstentions and broker non-votes (explained herein) will be counted for purposes of determining a quorum. If your shares are held in street name, follow the voting instructions that you receive from your broker, bank or other nominee. If you want to vote in person, you must obtain a legal proxy from your broker, bank, or other nominee and bring it to the Annual Meeting. If you do not submit voting instructions, your broker, bank, or other nominee may still be permitted to vote your shares under the following circumstances:

• | Discretionary items - The ratification of the selection of the independent registered public accounting firm (Proposal 2) is a discretionary item. Generally, brokers, banks and other nominees that do not receive instructions from beneficial owners may vote on this proposal in their discretion. |

• | Non-discretionary items - The election of directors (Proposal 1) and the advisory resolution to approve executive compensation (Proposal 3) are non-discretionary items and may not be voted on by brokers, banks or other nominees who have not received voting instructions from beneficial owners (referred to as “broker non-votes”). |

2

GENERAL INFORMATION REGARDING CORPORATE GOVERNANCE

Board of Directors

The Board of Directors (sometimes referred to throughout the remainder of this Proxy Statement as the “Board”) is the ultimate governing body of the Company. As such, it functions within a framework of duties and requirements established by Pennsylvania statute, government regulations, court decisions and the Company’s organizational documents. Generally, the Board reviews and confirms the basic objectives and broad policies of the Company, approves various important transactions, appoints the officers of the Company and monitors Company performance in key results areas. The Board also has oversight responsibility of the processes established to report and monitor systems for material risks applicable to the Company. The full Board regularly reviews enterprise-wide risk management, which includes risks in the areas of compliance, operations, strategy, reporting, treasury, enterprise value, and insurable risks. In addition, each Board committee plays a significant role in carrying out the risk oversight function. The executive committee of the Board (the "Executive Committee") assists in monitoring and assessing relevant risks between the times at which the full Board convenes. The nominating and corporate governance committee of the Board (the "Nominating and Corporate Governance Committee" or "Corporate Governance Committee") oversees risks related to corporate governance and ethics. The audit committee of the Board (the "Audit Committee") oversees risks related to financial reporting and control; environmental, health and sustainability matters; management policies and guidelines; legal claims and issues; and information technology. The finance committee of the Board (the "Finance Committee") oversees the Company’s financial policies, strategies and capital structure. The compensation committee of the Board (the "Compensation Committee") oversees risks related to human resources, succession planning and compensation. The special committee of the Board (the "Special Committee") provides oversight of integration planning and implementation of the Company's significant acquisitions.

Board Composition

The Articles of Incorporation of the Company provide that the Board of Directors has the power to set the number of directors constituting the full Board, provided that such number shall not be less than five or more than fifteen. Until further action, the Board has fixed the number of directors constituting the full Board at ten, divided into three classes. The terms of office of the three classes of directors end in successive years.

After reviewing the independence standards contained in the Nasdaq listing requirements, the Board of Directors has determined that each of its directors is independent under these standards, other than Joseph C. Bartolacci, the Company’s President and Chief Executive Officer; David A. Schawk, retired Group President of the Company’s SGK Brand Solutions segment; and Gregory S. Babe, the Company’s Chief Technology Officer.

In the event a nominee does not receive a majority of votes cast, such director is required under the Company’s Corporate Governance Guidelines to conditionally resign from the Board. Acceptance of such resignation is at the discretion of the Board.

The Company’s Corporate Governance Guidelines provide that an employee member must offer to submit his or her letter of resignation as a director upon his or her retirement or termination of employment, and if such offer is accepted, such employee member can remain on the Board for a period of no longer than one year following retirement from, or termination of, employment with the Company. Further, the Company’s Bylaws and Corporate Governance Guidelines provide that no person may be eligible for nomination, nor elected to fill a vacancy on the Board of Directors after attaining 75 years of age, and any director that, if nominated would attain 75 years of age during such term as a director, shall retire from the Board of Directors immediately prior to the next annual meeting of the shareholders following such director attaining 75 years of age.

3

The Board has currently determined that an independent, non-employee member should be appointed to serve as Chairman of the Board. The Board believes that separation of the positions of Chairman of the Board and Chief Executive Officer, with the appointment of an independent, non-employee director as Chairman of the Board, strengthens the Company’s corporate governance. John D. Turner is the Company’s current independent, non-employee Chairman of the Board.

Mr. Turner and the other independent directors meet at such times as are necessary and generally on the dates of regularly scheduled Board meetings. The independent directors met a total of five (5) times in fiscal 2019.

During fiscal 2019, there were six regularly scheduled and three special Board meetings.

Board Committees

There are six (6) standing committees appointed by the Board -- the Executive Committee, the Corporate Governance Committee, the Audit Committee, the Finance Committee, the Compensation Committee and the Special Committee.

Each Committee has the same power as the Board to employ the services of outside consultants and to have discussions and interviews with personnel of the Company and others.

The principal functions of the six standing Committees are summarized as follows:

Executive Committee

The Executive Committee is appointed by the Board to have and exercise during periods between Board meetings all of the powers of the Board, except that the Executive Committee may not elect directors, change the membership of or fill vacancies on the Executive Committee, change the By‑laws of the Company or exercise any authority specifically reserved by the Board. Among the functions customarily performed by the Executive Committee during periods between Board meetings are the approval, within limitations previously established by the Board, of the principal terms involved in sales of securities of the Company, and such reviews as may be necessary of significant developments in major events and litigation involving the Company. In addition, the Executive Committee is called upon periodically to provide advice and counsel in the formulation of corporate policy changes and, where it deems advisable, make recommendations to the Board.

The members of the Executive Committee are John D. Turner (Chairperson), Katherine E. Dietze, Alvaro Garcia-Tunon, Morgan K. O’Brien and Jerry R. Whitaker. The Executive Committee holds meetings at such times as are required. The Executive Committee did not meet in fiscal 2019.

4

Nominating and Corporate Governance Committee

The principal functions of the Nominating and Corporate Governance Committee are to: (1) identify individuals qualified to become members of the Board of Directors; (2) review the qualifications of directors and the composition of the Board of Directors, and recommend to the Board of Directors the director nominees for the next annual meeting of the shareholders; (3) monitor and recommend to the Board of Directors changes, as necessary, to the Company’s Corporate Governance Guidelines; (4) lead the Board of Directors in complying with its Corporate Governance Guidelines; (5) review and make recommendations to the Board of Directors concerning director compensation; and (6) review and approve related person transactions pursuant to the Company’s Code of Business Conduct and Ethics (the "Code of Conduct"). The Nominating and Corporate Governance Committee is also responsible for the annual evaluations of the performance of the Board of Directors and the Committees of the Board, including individual directors. The Committee is committed to ensuring that: (i) the nominees for membership on the Board of Directors are of the highest possible caliber and are able to provide insightful, intelligent and effective guidance to the management of the Company; and (ii) the governance of the Company is in full compliance with applicable law, reflects generally accepted principles of good corporate governance, encourages flexible and dynamic management without undue burdens and effectively manages the risks of the business and operations of the Company. From time to time, the Nominating and Corporate Governance Committee has retained the services of a third-party search firm to assist in the identification and evaluation of potential nominees for the Board of Directors. The Nominating and Corporate Governance Committee operates pursuant to a charter and the Company’s Corporate Governance Guidelines, which are available for viewing on the Company’s website at www.matw.com under the “Corporate” tab in the section entitled “Corporate Governance”. The Board has determined that all members of the Nominating and Corporate Governance Committee are independent in accordance with the listing standards of Nasdaq. The Nominating and Corporate Governance Committee met three (3) times during fiscal 2019. The current members of the Nominating and Corporate Governance Committee are Jerry R. Whitaker (Chairperson), Katherine E. Dietze and Terry L. Dunlap.

Audit Committee

The principal functions of the Audit Committee are to provide oversight of: (1) the integrity of the Company's financial statements, reports on internal controls and other of the Company's financial information; (2) the Company's compliance with legal and regulatory requirements; (3) the qualifications and independence of the Company's independent registered public accounting firm; and (4) the performance of the Company's internal audit function (including disclosure controls and procedures for internal controls over financial reporting) and independent registered public accounting firm. The Audit Committee serves as a vehicle to provide an open avenue of communication between the full Board of Directors and the Company’s financial management team and internal audit department, and the independent registered public accounting firm. The Audit Committee is responsible for appointing the Company's independent registered public accounting firm. The Audit Committee operates pursuant to a charter, which is available for viewing on the Company’s website at www.matw.com under the section entitled “Corporate Governance”.

All of the Audit Committee members, Alvaro Garcia-Tunon (Chairperson), Terry L. Dunlap and Morgan K. O’Brien, have been determined in the Board’s business judgment to be independent from the Company and its management within the meaning of regulations of the U.S. Securities and Exchange Commission (the "SEC") relating to audit committee independence, Nasdaq regulation and the Company’s Corporate Governance Guidelines. All of the Audit Committee members are financial experts, as determined by SEC regulations, and, as such Mr. Garcia-Tunon, Mr. Dunlap and Mr. O'Brien are designated as the Audit Committee financial experts. During fiscal 2019, the Audit Committee met six (6) times.

5

Finance Committee

The Finance Committee provides oversight of the Company’s financial policies, strategies and capital structure. The Committee’s principal responsibilities include review and monitoring of the Company’s: (1) significant capital expenditures; (2) mergers, acquisitions and divestitures; (3) capital structure, debt and equity offerings; (4) the dividend policy and share repurchase program; (5) risk management programs; and (6) investor relations program. The Committee also provides oversight to the Pension Board on employee benefit plan matters and related plan investment management. Ms. Katherine E. Dietze is Chairperson of the Finance Committee. The other members of the Finance Committee are Gregory S. Babe, Don W. Quigley, Jr. and Jerry R. Whitaker. The Finance Committee met four (4) times in fiscal 2019.

Compensation Committee

The principal functions of the Compensation Committee, the members of which are Morgan K. O’Brien (Chairperson), Alvaro Garcia-Tunon and Don W. Quigley, Jr., are to review periodically the suitability of the remuneration arrangements (including benefits) for the Company's Chief Executive Officer and other members of management of the Company, and to prepare an annual report on executive compensation for inclusion in the Company’s Proxy Statement. The Committee also reviews, at least annually, succession plans for the position of Chief Executive Officer and other senior executive positions of the Company. The Compensation Committee operates pursuant to a charter, which is available for viewing on the Company’s website at www.matw.com under the section entitled “Corporate Governance”. The Board has determined that all members of the Compensation Committee are independent in accordance with the listing standards of Nasdaq. During fiscal 2019, the Compensation Committee met three (3) times.

Special Committee

The Special Committee was initially established in 2014 to provide oversight of integration planning and implementation for the Company’s significant acquisitions. The members of the Special Committee were Alvaro Garcia-Tunon (Chairperson), Gregory S. Babe, Joseph C. Bartolacci, and Terry L. Dunlap. The Committee did not meet in fiscal 2019.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee currently consists of Mr. O’Brien, Mr. Garcia-Tunon and Mr. Quigley. None of the members of the Compensation Committee have ever been an officer or employee of the Company or any of its subsidiaries. None of our executive officers serves or has served as a member of the board of directors, compensation committee or other board committee performing equivalent functions of any entity that has one or more executive officers serving as one of our directors or on our Compensation Committee.

Meeting Attendance

During fiscal 2019, all directors attended at least 75% of Board and respective Committee meetings.

Although the Company does not have a formal policy with regard to Board members attending the Annual Meeting of the Shareholders, it is customary for the Board members to do so, and in general all or most of the Board members have attended annual meetings in the recent past.

6

Compensation of Directors

Director compensation is determined and administered by the Corporate Governance Committee. In performing its duties, the Corporate Governance Committee consults with various independent third-party advisors. In fiscal 2019, the Corporate Governance Committee consulted with Pay Governance, LLC, an independent executive compensation consulting firm.

Under the Company’s 2019 Director Fee Plan, for fiscal 2019 each eligible non-employee director received an annual retainer valued at $85,000, which was payable either in cash or in shares of the Company’s common stock, as determined by the Corporate Governance Committee. If payable in cash, a director may elect to receive the annual retainer in shares of Company Common Stock or Common Stock credited to a deferred stock account as phantom stock. If the annual retainer is paid in shares of Company Common Stock, a director may defer the receipt of such Common Stock into a deferred stock account as phantom stock.

Each non-employee director is also eligible to receive an annual stock-based grant in the form of either non-statutory stock options, stock appreciation rights, restricted shares or restricted share units. The form and value of the awards are determined by the Corporate Governance Committee. The value of the annual grants awarded for fiscal 2019 was $125,000, issued in the form of restricted share units, which vest on the second anniversary of the date of the grant. At December 31, 2019, there were 150,000 shares available for future grant under the 2019 Director Fee Plan, including 23,037 restricted share units that have been granted under the 2019 Director Fee Plan.

The non-employee Chairman of the Board received an additional annual retainer fee of $100,000 in fiscal 2019, which was paid in cash. In fiscal 2019, each chairperson of a committee of the Board received an additional $10,000 retainer fee ($15,000 in the case of the Audit Committee chairperson) for their services as a committee chairperson. In fiscal 2019, the Special Committee did not meet and therefore its chairperson did not receive any additional retainer fee. Directors received no other fees in fiscal 2019.

The Company does not provide any retirement benefits or perquisites to any of its non-employee directors.

7

The following table summarizes the director compensation earned by the non-employee directors of the Company for fiscal 2019.

Non-Employee Director Compensation Table

Name | Fees Earned or Paid in Cash (1) | Stock Awards (2) | Total | ||||||

J.D. Turner | $ | 185,000 | $ | 125,000 | $ | 310,000 | |||

K.E. Dietze | 95,000 | 125,000 | 220,000 | ||||||

T.L. Dunlap | 85,000 | 125,000 | 210,000 | ||||||

A. Garcia-Tunon | 100,000 | 125,000 | 225,000 | ||||||

M.K. O’Brien | 95,000 | 125,000 | 220,000 | ||||||

D.W. Quigley, Jr. | 85,000 | 125,000 | 210,000 | ||||||

J.R. Whitaker | 95,000 | 125,000 | 220,000 | ||||||

(1) | Mr. Garcia-Tunon elected to receive fees of $100,000 in shares of the Company's Common Stock credited to a deferred share unit account as 2,632 phantom shares. |

(2) | Amounts in this column reflect the grant date fair value of awards of restricted share units of the Company’s Common Stock granted during fiscal 2019 computed in accordance with Financial Accounting Standards Board ASC Topic 718; however, the estimate of forfeiture related to service-based vesting conditions is disregarded for purposes of this valuation. There were no forfeitures of restricted awards by any of the directors during fiscal 2019. On March 14, 2019, each of the non-employee directors were awarded 3,291 restricted share units with a grant date fair value of $125,000. |

Access to Directors

The security holders of the Company may communicate in writing to the Board of Directors by sending such communication to the Board or a particular director in care of Steven F. Nicola, Chief Financial Officer and Secretary, at the Company’s principle executive offices. At present, such communications will be directly forwarded to the Board or such particular director, as applicable.

8

PROPOSAL 1

ELECTION OF DIRECTORS

Nominations for election to the Board of Directors may be made by the Corporate Governance Committee or by the shareholders.

Gregory S. Babe, Don W. Quigley, Jr., and David A. Schawk, whose terms of office are expiring, have been nominated by the Corporate Governance Committee to serve for three-year terms that will end in 2023.

Shareholder nominations for directors to be elected at the 2021 Annual Meeting must be submitted to the Company in writing no earlier than 120 days prior to the anniversary date of the 2020 Annual Meeting, or October 23, 2020, and no later than 75 days prior to the anniversary date of the 2020 Annual Meeting, or December 7, 2020. Such nominations must be in writing in accordance with Section 6.1 of the Company’s Restated Articles of Incorporation, and must include (1) the name and address of the shareholder who intends to make the nomination and of the person(s) to be nominated; (2) a representation that the shareholder is a holder of record of Common Stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person(s) specified in the notice; (3) a description of all arrangements or understandings between the shareholder and each nominee and any other person(s) (naming such person(s)) pursuant to which the nomination or nominations are to be made by the shareholder; (4) such other information regarding each nominee proposed by such shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission, had the nominee been nominated by the Board of Directors; and (5) the consent of each nominee to serve as a director of the Company if so elected. The Corporate Governance Committee and Board will consider any candidate for nominee as a director that is properly submitted by a shareholder in accordance with the Company’s Articles of Incorporation and Bylaws and does not maintain a policy with regard to such nominations distinct from such requirements. No such nominations have been received with respect to the 2020 Annual Meeting.

The Company’s process for filling director vacancies includes determination of the professional skills and background desired to serve the best interests and current needs of the Company and its shareholders, possible retention of a third-party search firm to assist in the identification and evaluation of director candidates, consideration of candidates nominated by shareholders (if any), evaluation of a candidate’s credentials and experience by the Nominating and Corporate Governance Committee (including personal interviews with selected candidates), and a formal recommendation by the Corporate Governance Committee to the Board of Directors regarding the candidate considered to be the most qualified to fill the director vacancy.

The Corporate Governance Committee assesses a candidate’s background, skills, diversity, personal characteristics and business experience and applies the following criteria and qualifications: candidates are to be of the highest ethical character, share the values of the Company, have reputations, both personal and professional, consistent with the image and reputation of the Company, be highly accomplished in their respective field, with superior credentials and recognition, and provide the relevant expertise and experience necessary to assist the Board and the Company to increase shareholder value. The Board may prioritize the foregoing criteria depending on the current needs of the Board and the Company. The Board does not have a formal diversity policy for selecting directors, but considers diversity of race, gender and national origin to be relevant factors that are weighed with other criteria in recommending and nominating directors for election to the Board of Directors of Matthews.

9

Under the Company’s Corporate Governance Guidelines, any director who experiences a change in principal occupation or primary business affiliation while serving as a director, must promptly offer to submit a letter of resignation as a director to the Chief Executive Officer and to the Corporate Governance Committee. The Board, with input from the Corporate Governance Committee and the Chief Executive Officer, will consider whether to accept such offer.

The Board of Directors has no reason to believe that any of the current nominees for director will become unavailable for election. However, if any nominee should become unavailable prior to the Annual Meeting, the accompanying proxy will be voted for the election in the nominee's place of such other person as the Board of Directors may recommend in the nominee’s place.

Only affirmative votes are counted in the election of directors. The nominees for election as directors of the Class of 2023 who receive the highest number of votes cast for the election of directors at the Annual Meeting by the holders of the Company’s common stock present in person or voting by proxy, a quorum being present, will be elected as directors. Abstentions, broker non-votes and instructions to withhold authority to vote for one or more of the nominees will result in those nominees receiving fewer votes but will not count as votes against the nominee.

The Board of Directors has implemented a director resignation policy under the Company’s Corporate Governance Guidelines. The director resignation policy requires each nominee to the Board of Directors, prior to any election of directors, to submit a conditional resignation to the Board of Directors in connection with such nominee’s nomination. In the event a nominee fails to receive the vote of at least a majority of the votes cast, the Corporate Governance Committee will make a recommendation to the Board whether to accept or reject the tendered conditional resignation. The Board of Directors must act on the tendered resignation, taking into account the Corporate Governance Committee’s recommendation, within ninety (90) days from the date of the certification of the election results. The Board shall promptly disclose its decision regarding the tendered resignation by furnishing a Current Report on Form 8-K to the SEC, including its rationale for accepting or rejecting the tendered resignation. In making their recommendation and decision, the Governance Committee and Board may consider the following factors or other information that it considers appropriate and relevant: (i) the stated reasons, if any, why shareholders withheld their votes; (ii) possible alternatives for curing the underlying cause of the withheld votes; (iii) the director’s qualifications in light of the overall composition of the Board; (iv) the director’s past and expected future contributions to the Company; (v) potential adverse consequences of accepting the resignation, including failure to comply with any applicable rule or regulation; and (vi) the best interests of the Company and its shareholders. If the Board accepts a director’s tendered resignation, the Board, in its sole discretion, may fill any resulting vacancy or decrease the size of the Board, pursuant to the Bylaws of the Company. If a director’s resignation is not accepted by the Board, such director will continue to serve in accordance with existing Company regulations. Any director whose tendered resignation is being considered shall not participate in the deliberations conducted by the Corporate Governance Committee or the Board.

The Board of Directors recommends that you vote FOR the election of the nominated directors.

10

The following information is furnished with respect to the persons nominated by the Board of Directors of the Company for election as directors and with respect to the continuing directors.

Nominees

Gregory S. Babe, age 62, has served on the Board of Directors since November 2010. Mr. Babe has served as the Company’s Chief Technology Officer since November 2015, and prior to that served as the Company’s Executive Vice President, Global Information Technology and Integration starting in November 2014. Mr. Babe also serves as President and Chief Executive Officer of Liquid X Printed Metals, Inc., a Carnegie Mellon University spin out. From July 2012 to June 2013, Mr. Babe served as Chief Executive Officer of Orbital Engineering, Inc., a privately held engineering services company. Mr. Babe retired as President and Chief Executive Officer of Bayer Corporation and Bayer MaterialScience LLC in June 2012. Mr. Babe was appointed President and Chief Executive Officer of Bayer Corporation and Senior Bayer Representative for the United States and Canada in October 2008. Mr. Babe was responsible for the North American activities of the worldwide Bayer Group, an international health care, nutrition and high-tech materials group based in Leverkusen, Germany. In addition, he held the position of President and Chief Executive Officer of Bayer MaterialScience LLC, a producer of polymers and high-performance plastics in North America, from July 2004 until June 2012. Mr. Babe is considered well-qualified to serve on the Company’s Board of Directors based on his experience as a Chief Executive Officer of a multinational manufacturing company. He possesses a strong background in manufacturing and regulatory and government affairs. Mr. Babe is a member of the Finance and Special Committees. He serves on the board of the Benedum Foundation, where he is a member of the investment committee. Mr. Babe holds a Bachelor of Science degree in mechanical engineering from West Virginia University.

Don W. Quigley, Jr., age 64, has served on the Board of Directors of the Company since September 2015. Mr. Quigley is currently a Senior Advisor for the Boston Consulting Group, a global management consulting firm. Mr. Quigley served as President of U.S. Sales of Mondelez International, Inc., a global provider of snack food and beverage products to consumers from 2012 until his retirement in March 2015. Prior thereto, he served as President, Global Consumer Sales of Kimberly-Clark Corporation from 2004 to 2012, and Vice President of Sales for PepsiCo from 1998 to 2004. Mr. Quigley’s experience and knowledge as a senior sales and marketing executive at consumer products companies is a valuable resource to the Company. Mr. Quigley is a member of the Compensation and Finance Committees. Mr. Quigley received a Bachelor of Science degree in Business from the Kelley School at Indiana University. He currently serves on the board of directors of Gold Eagle Company, a family-owned provider of automotive fluids and additives.

David A. Schawk, age 64, has served on the Board of Directors of the Company since the Company's acquisition of Schawk Inc. ("Schawk") on July 29, 2014. Effective November 1, 2019, Mr. Schawk retired from his role as Group President, SGK Brand Solutions and as an officer of the Company, which he held from July 2014. Mr. Schawk previously served as Schawk’s Chief Executive Officer since 1992, and Chief Executive Officer and President for more than five years prior thereto. He also served on the Schawk Board of Directors since 1992. Mr. Schawk is considered well-qualified to serve on the Company’s Board of Directors based on his experience as a Chief Executive Officer and director of a multinational brand development and brand management company.

11

Continuing Directors

Joseph C. Bartolacci, age 59, was appointed Chief Executive Officer of the Company in 2006, and has served on the Board of Directors since 2005. Prior to his appointment as Chief Executive Officer, he was President and Chief Operating Officer of the Company since 2005. Prior thereto, he held various positions within Matthews, including President, Casket Division; Executive Vice President of Matthews; President, Matthews Europe; President, Caggiati, S.p.A. (a wholly-owned subsidiary of Matthews) and General Counsel of Matthews. Mr. Bartolacci provides management’s perspective in Board decisions about the business and strategic direction of the Company. He has firsthand operating experience in many of the Company’s diverse global businesses and brings a well-developed understanding of the industries in which the Company operates, as well as the opportunities within those industries to drive shareholder value. Mr. Bartolacci received a Bachelor of Science degree in Accounting from Saint Vincent College and a Juris Doctor from the University of Pittsburgh. Mr. Bartolacci serves on the Special Committee of the Board. He also serves on the Company’s Pension Board, the Board of the Jas. H. Matthews & Co. Educational and Charitable Trust, and on the boards of various subsidiaries of Matthews. Other than the Company, Mr. Bartolacci serves on the board of Federated Investors, a global investment management company and publicly-traded company.

Katherine E. Dietze, age 62, has served on the Board of Directors of the Company since July 2008. Ms. Dietze was Global Chief Operating Officer, Investment Banking Division of Credit Suisse First Boston, a financial services company, until her retirement in 2005. She had also held the position of Managing Director, Investment Banking. Prior to joining Credit Suisse First Boston, Ms. Dietze was a Managing Director for Salomon Brothers Inc., a financial services company. Ms. Dietze brings a strong background in global investment and financial matters. With her background in investment banking, Ms. Dietze provides a unique and valuable perspective on global financial markets, investments and financial transactions. Ms. Dietze received a Bachelor of Arts degree from Brown University and graduated from Columbia University with a Masters in Business Administration in Finance and Marketing. Ms. Dietze serves as Chairperson of the Finance Committee and is a member of the Executive Committee. She is also a director and chairperson of the audit committee and a member of the governance committee of Cowen Group, Inc., a financial services firm. She previously served as chairperson of the audit committee and member of both the governance and compensation committees for LaBranche, LLC, a financial services firm purchased by the Cowen Group in June 2011. In January 2011, Ms. Dietze was elected to the board of trustees of Liberty Property Trust, a real estate investment trust, where she currently is a member of the audit committee and chairperson of the governance committee.

Terry L. Dunlap, age 60, has served on the Board of Directors since February 2015. Mr. Dunlap is serving as the Interim Chief Executive Officer and President of TimkenSteel Corporation, a specialty steel producer. He is also the principal of Sweetwater LLC, a consulting firm with a focus on manufacturing and technology. Prior thereto, Mr. Dunlap spent 31 years with Allegheny Technologies, where he served as Executive Vice President, Flat-Rolled Products from May 2011 until his retirement in December 2014, President, ATI Allegheny Ludlum from 2002 to 2014, and Group President, ATI Flat-Rolled Products from 2008 to May 2011. Mr. Dunlap’s experience and knowledge in the global manufacturing industry are valuable resources to the Company's Board. Mr. Dunlap received a Bachelor of Science degree in Marketing from Indiana University of Pennsylvania and attended the Loyola University of Chicago MBA program. Mr. Dunlap is a member of the Audit, Corporate Governance, and Special Committees of the Board. Mr. Dunlap serves on the board of directors of TimkenSteel Corporation, a specialty steel producer, and Ampco-Pittsburgh Corporation, a global producer of forged and cast engineered products. He also serves as the President of the Indiana University of Pennsylvania Foundation Board.

12

Alvaro Garcia-Tunon, age 67, has served on the Board of Directors since October 2009. Mr. Garcia-Tunon retired as the Chief Financial Officer of Wabtec Corporation, a provider of products and services for the global rail industry, effective January 1, 2014. He continued to work with Wabtec as a strategic advisor through December 2017. Mr. Garcia-Tunon was named Executive Vice President and Chief Financial Officer for Wabtec in February 2012. Prior to that, he was Executive Vice President, Chief Financial Officer and Secretary of Wabtec since December 2010. Prior thereto, he served as Senior Vice President, Chief Financial Officer and Secretary of Wabtec since 2003. Having served as the Chief Financial Officer of a public company with global operations, Mr. Garcia-Tunon has leadership skills in international business, corporate governance and risk management. As a Certified Public Accountant, he also provides the Board and the Audit Committee, of which he is a Chairman, the strong financial and accounting skills required to be considered a financial expert. Mr. Garcia-Tunon is also Chairman of the Special Committee and is a member of the Executive and Compensation Committees. Mr. Garcia-Tunon currently is serving on the board of directors and audit committee of Allison Transmission Holdings, Inc., a global provider of commercial-duty automatic transmissions and hybrid propulsion systems. Mr. Garcia-Tunon graduated from the College of William and Mary with a Juris Doctor degree and is a graduate of the University of Virginia with a Bachelor of Science degree in Commerce and Accounting.

Morgan K. O’Brien, age 59, has served on the Board of Directors of the Company since July 2011. Mr. O’Brien has served as the President and Chief Executive Officer of Peoples Natural Gas Company LLC, a utility serving the southwestern Pennsylvania market, since February 2010. Prior thereto, Mr. O’Brien served as President and Chief Executive Officer of Duquesne Light Holdings, an electric utility company serving western Pennsylvania, since 2001. He held various senior executive positions at Duquesne Light Holdings since 1991. Prior to joining Duquesne Light Holdings, Mr. O’Brien served in various management positions at PNC Bank and at major accounting firms. As a current Chief Executive Officer with more than 10 years experience in that role, Mr. O’Brien brings significant leadership skills to the Board of Directors. With his experience in the areas of accounting and taxation, he also provides the Board and the Audit Committee, of which he is a member, with strong financial skills. Mr. O’Brien is also Chairman of the Compensation Committee and is a member of the Executive Committee. Mr. O’Brien received a Bachelor’s degree in Business Administration and a Masters degree in taxation from Robert Morris University. Mr. O’Brien serves on the board of directors of Peoples Natural Gas Company LLC, HFF, Inc. and on the board of trustees of Robert Morris University. He also serves on the boards of several civic and charitable organizations in Western Pennsylvania.

John D. Turner, age 73, has served as a director of the Company since 1999. Mr. Turner retired as Chairman and Chief Executive Officer of Copperweld Corporation, a manufacturer of tubular and bimetallic wire products, in 2003, where he had served as Chief Executive Officer since 1988. Mr. Turner’s experience, knowledge and expertise as an executive in the metal manufacturing industry are valuable resources to the Company. During his tenure as a director, Mr. Turner has also served or participated on each of the committees of the Board, providing him with the experience and perspective of the Board’s decision making process in all areas of the Company’s operations. Mr. Turner also has experience as a director for several large public companies. Mr. Turner serves as Chairman of the Executive Committee of the Company. Mr. Turner received a Bachelor's Degree in Biology from Colgate University.

13

Jerry R. Whitaker, age 69, has served on the Board of Directors of the Company since July 2011. Mr. Whitaker was President of Electrical Sector-Americas, Eaton Corporation, a global manufacturer of highly engineered products, until his retirement in June 2011. Prior thereto, he served in various management positions at Eaton Corporation since 1994. Prior to joining Eaton Corporation, Mr. Whitaker spent 22 years with Westinghouse Electric Corporation. Mr. Whitaker’s experience and knowledge as an executive in global manufacturing industries and acquisition integration are valuable resources to the Company. Mr. Whitaker is the Chairman of the Corporate Governance Committee and a member of the Finance and Executive Committees of the Company. Mr. Whitaker received a Bachelor of Science degree from Syracuse University and a Masters in Business Administration from George Washington University. He currently serves as a director on the boards of Crescent Electric Company, an independent distributor of electrical hardware and supplies, where he is a member of the compensation committee, The Milliken Company, a privately-held diversified industrial company, where he is a member of the compensation committee and serves as chairman of the audit committee, and Sealed Air Corporation, a global leader in packaging, food safety and hygiene, where he serves as chairman of the Board of Directors. Mr. Whitaker also serves on the advisory board of the School of Engineering at Syracuse University.

The term for each nominee and director is listed below:

Nominees: | Term to expire at Annual Meeting of Shareholders in: |

Gregory S. Babe | 2023 |

Don W. Quigley, Jr. | 2023 |

David A. Schawk | 2023 |

Continuing Directors: | |

Joseph C. Bartolacci | 2021 |

Katherine E. Dietze | 2021 |

Morgan K. O’Brien | 2021 |

Terry L. Dunlap | 2022 |

Alvaro Garcia-Tunon | 2022 |

John D. Turner | 2022 |

Jerry R. Whitaker | 2022 |

14

PROPOSAL 2

SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Company's Board of Directors has appointed Ernst & Young LLP as the independent registered public accounting firm to audit the records of the Company for the year ending September 30, 2020.

The Audit Committee has determined that it would be desirable as a matter of good corporate practice to request an expression of opinion from the shareholders on the appointment. Ratification of the appointment of Ernst & Young LLP requires the affirmative vote of a majority of the shares represented at the meeting and entitled to vote, a quorum being present. Abstentions and non-broker votes will have the effect of a vote cast “against” the proposal.

If the shareholders do not ratify the selection of Ernst & Young LLP, the selection of an alternative independent registered public accounting firm will be considered by the Audit Committee; provided, further, however, even if the shareholders do ratify the selection of Ernst & Young LLP, as requested in this Proxy Statement, the Audit Committee reserves the right, at any time, to re-designate and retain a different independent registered public accounting firm to audit the records of the Company for the year ending September 30, 2020.

It is not expected that any representative of Ernst & Young LLP will be present at the Annual Meeting of the Shareholders.

The Board of Directors recommends that you vote FOR Proposal 2.

15

PROPOSAL 3

ADVISORY (NON-BINDING) VOTE ON THE EXECUTIVE COMPENSATION

OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

As described in the Compensation Discussion and Analysis in this Proxy Statement, and summarized in the “Executive Summary” thereto, the Compensation Committee of the Board has developed an executive compensation program designed to pay for performance and to align the long-term interests of our named executive officers with the long-term interests of our shareholders. The Company presents a proposal for an advisory (non-binding) vote on the executive compensation of the Company’s named executive officers on an annual basis. Accordingly, the Company is presenting the following proposal, which gives our shareholders the opportunity to endorse or not endorse our pay program for named executive officers by voting for or against the resolution set forth below. This resolution is required pursuant to Section 14A of the Securities Exchange Act of 1934 (the "Exchange Act"). Approval of the compensation paid to our named executive officers, as disclosed in this Proxy Statement, will be approved (on a non-binding basis) if the proposal receives the affirmative vote of at least a majority of the shares represented, in person or by proxy, at the meeting and entitled to vote, a quorum being present. Abstentions and broker non-votes will have the effect of a vote cast “against” the proposal. Because the vote is advisory, it will not be binding on the Board. However, the Board and the Compensation Committee will review the voting results and take into account the outcome when considering future executive compensation arrangements. The Board and management are committed to our shareholders and understand that it is useful and appropriate to obtain the views of our shareholders when considering the design and implementation of executive compensation programs.

RESOLVED, that the shareholders approve the compensation of the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis, the compensation tables, and the related disclosure contained in the Proxy Statement set forth under the caption “Executive Compensation and Retirement Benefits.”

The Board of Directors recommends that you vote FOR approval of the compensation of our named executive officers as disclosed in the Compensation Discussion and Analysis, the compensation tables, and the related disclosure contained in this Proxy Statement set forth under the caption “Executive Compensation and Retirement Benefits” of this Proxy Statement. Proxies will be voted FOR approval of the proposal unless otherwise specified.

The Board of Directors recommends that you vote FOR Proposal 3.

16

STOCK OWNERSHIP

The Company's Articles of Incorporation divide its voting stock into three (3) classes: Preferred Stock, and Class A and Class B Common Stock. At the present time, no shares of Preferred Stock or Class B Common Stock are issued or outstanding. The following information is furnished with respect to persons who the Company believes, based on its records and filings made with the SEC, beneficially own five percent or more of the outstanding shares of Common Stock of the Company, and with respect to directors, officers and executive management. Those individuals with more than five percent of the Company's Common Stock could be deemed to be "control persons" of the Company.

This information presented is as of November 30, 2019, except as otherwise noted.

Name of Beneficial Owner (1) | Number of Class A Shares Beneficially Owned (1)(2) | Percent of Class | Deferred Stock Compensation Shares (11) | ||||

Directors, Officers and Executive Management: | |||||||

J.C. Bartolacci | 338,326 | (3) | 1.1 | — | |||

G.S. Babe | 35,899 | (3) | 0.1 | 5,798 | |||

K.E. Dietze | 24,477 | (4) | 0.1 | — | |||

T.L. Dunlap | 8,729 | (4) | * | — | |||

B.J. Dunn | 53,093 | (3) | 0.2 | — | |||

S.D. Gackenbach | 86,939 | (3) | 0.2 | — | |||

A. Garcia-Tunon | 24,759 | (4) | 0.1 | 11,112 | |||

S.F. Nicola | 139,680 | (3) | 0.4 | — | |||

M.K. O’Brien | 16,669 | (4) | 0.1 | — | |||

D.W. Quigley, Jr. | 6,434 | (4) | * | — | |||

D.A. Schawk | 204,315 | (3)(5) | 0.7 | — | |||

J.D. Turner | 32,477 | (4) | 0.1 | 4,307 | |||

B.D. Walters | 37,248 | (3) | 0.1 | — | |||

J.R. Whitaker | 13,331 | (4) | * | 4,282 | |||

All directors, officers and executive management as a group (19 persons) | 1,065,008 | (6) | 3.4 | 25,499 | |||

Others: | |||||||

BlackRock, Inc. 55 East 52nd Street New York, NY 10005 | 4,717,879 | (7)** | 15.1 | ||||

The Vanguard Group, Inc. 100 Vanguard Boulevard Malvern, PA 19355-2331 | 3,417,468 | (8)** | 10.9 | ||||

Franklin Resources, Inc. One Franklin Parkway San Mateo, CA 94403 | 2,945,322 | (9)** | 9.4 | ||||

Dimensional Fund Advisors, L.P. 6300 Bee Cave Road Austin, TX 78746 | 1,896,880 | (10)** | 6.1 | ||||

Clarkston Capital Partners, LLC. 91 West Long Lake Road Bloomfield Hills, MI 48304 | 1,566,502 | ** | 5.0 | ||||

* Less than 0.1%. | |||||||

** Information as of September 30, 2019, derived from Schedule 13D or 13G filings filed by the beneficial owner. | |||||||

17

(1) | Any shares that may be beneficially owned within 60 days of November 30, 2019 are included in beneficial ownership. Unless otherwise noted, the mailing address of each beneficial owner is the same as that of the Company. |

(2) | To the best of the Company’s knowledge, the nature of the beneficial ownership for all shares is sole voting and investment power, except as otherwise noted in these footnotes. |

(3) | Includes restricted shares with performance and time vesting provisions as follows: Mr. Bartolacci, 68,083 shares; Mr. Dunn, 6,800 shares; Mr. Gackenbach 10,350 shares; Mr. Nicola, 18,600 shares; and Mr. Walters, 9,500 shares. |

(4) | Includes 2,301 restricted shares with time vesting provisions. |

(5) | Includes 3,581 shares held in the David and Teryl Schawk Family Foundation over which Mr. Schawk has voting and investment control but no pecuniary interest; 35,548 shares held in the Teryl Alyson Schawk 1998 Trust; 51,514 shares held in trusts for the benefit of Mr. Schawk’s children for which Mr. Schawk or his spouse serves as trustee; 107,451 shares held in the David A. Schawk 1998 Trust for which Mr. Schawk serves as trustee with voting and investment power over such shares; 77,395 shares held in trust for the benefit of Mr. Schawk’s niece for which Mr. Schawk serves as custodian with voting and investment power but no pecuniary interest; and 97 shares held as custodian. |

(6) | Includes 87,137 restricted shares with time vesting provisions and 73,959 restricted shares with performance vesting provisions. |

(7) | Pursuant to that certain Amendment No. 9 to Schedule 13G filed January 31, 2019 by BlackRock, Inc., as parent holding company or control person for certain of its subsidiaries (collectively, the “BlackRock Entities”), the BlackRock Entities have (i) sole voting power with respect to 4,613,250 shares of Class A Common Stock and (ii) sole dispositive power with respect to 4,688,448 shares of Class A Common Stock |

(8) | Pursuant to that certain Amendment No. 8 to Schedule 13G filed February 11, 2019 by The Vanguard Group, Inc., as beneficial owner and parent holding company or control person for certain of its subsidiaries (collectively, the “Vanguard Entities”), the Vanguard Entities have (i) sole voting power with respect to 30,949 shares of Class A Common Stock, (ii) shared voting power with respect to 4,746 shares of Class A Common Stock, (iii) sole dispositive power with respect to 3,412,072 shares of Class A Common Stock, and (iv) shared dispositive power with respect to 32,385 shares of Class A Common Stock. |

(9) | Pursuant to that certain Amendment No. 6 to Schedule 13G filed January 18, 2019 by Franklin Resources, Inc. ("Franklin Resources"), Charles B. Johnson, Rupert H. Johnson, Jr. and Franklin Advisers, Inc. ("Franklin Advisers") to the effect that (a) each (directly or indirectly) has dispositive and voting power over these shares to the extent disclosed therein and (b) these shares are held by investment companies or other managed accounts that are advised by subsidiaries of Franklin Resources pursuant to investment management contracts which grant to such subsidiaries all investment and voting power over these shares. Pursuant to the such Schedule 13G, Franklin Advisers has sole voting and dispositive power with respect to these shares of Class A Common Stock. |

(10) | Pursuant to that certain Schedule 13G filed February 8, 2019 by Dimensional Fund Advisors LP (“Dimensional”), Dimensional has (i) sole voting power with respect to 1,686,824 shares of Class A Common Stock and (ii) sole dispositive power with respect to 1,737,395 shares of Class A Common Stock. Such Schedule 13G indicates that Dimensional, acts as an investment adviser to four registered investment companies, and as investment manager to certain other commingled group trusts and separate accounts (such investment companies, trusts and accounts, collectively, the “Dimensional Funds”), and in certain cases, subsidiaries of Dimensional may act as an adviser or sub-adviser to certain Dimensional Funds. Such Schedule 13G indicates that in its role as investment advisor, sub-adviser and/or manager, neither Dimensional or its subsidiaries possess voting and/or investment power over the shares of Class A Common Stock owned by the Dimensional Funds, and may be deemed to be the beneficial owner of the shares of Class A Common Stock held by the Dimensional Funds. Such Schedule 13G indicates that all shares of Class A Common Stock reported on such Schedule 13G are owned by the Dimensional Funds. |

(11) | Represents shares of Common Stock held in a deferred stock compensation account for the benefit of the director under the Company’s Director Fee Plan. See “General Information Regarding Corporate Governance--Compensation of Directors” of this Proxy Statement. |

18

Stock Ownership Guidelines

The Company has established guidelines for stock ownership by management, which are intended to promote the alignment of the interests of management with the Company’s shareholders. As more fully described under “Compensation Discussion and Analysis” of this Proxy Statement, the guidelines provide for ownership by management of shares of the Company’s Common Stock with a minimum market value ranging up to six times base salary depending upon the individual’s position with the Company. Individuals are expected to achieve compliance with these guidelines within a reasonable period of time after appointment to their respective positions.

For purposes of these guidelines, stock ownership includes all shares directly owned (including shares held under the Employee Stock Purchase Plan and time-vesting restricted share units or shares), but does not include outstanding stock options or unvested performance-based restricted share units or shares. Immediate compliance with these guidelines is not mandatory; however, individuals are expected to undertake a program to achieve compliance within five years of their hire date or promotion to their respective position. The ownership policy mandates that at least 50% of the after-tax shares realized upon an option exercise or vesting of restricted stock or restricted share units must be retained until the ownership guideline is met. Compliance with these ownership guidelines is one of the factors considered by the Compensation Committee in determining eligibility for participation in the Company’s equity compensation programs. As of November 30, 2019, all of the Named Executive Officers had exceeded the Company’s stock ownership guidelines.

The Company has also adopted guidelines for stock ownership by non-employee directors, which require that each director maintain ownership of shares of the Company’s Common Stock (either directly, through restricted shares or restricted share units issued under the Company’s Director Fee Plan or through shares held in a deferred stock compensation account for the benefit of the director under the Company’s Director Fee Plan) with a market value approximating five times the current annual retainer ($85,000). Directors are expected to achieve compliance with these guidelines within a reasonable period of time after becoming a director. As of November 30, 2019, all of the directors had met or exceeded the Company’s stock ownership guidelines or are within the reasonable time period for compliance.

19

EXECUTIVE COMPENSATION AND RETIREMENT BENEFITS

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed the following Compensation Discussion and Analysis with the Company’s management. Based upon such review and discussion, the Compensation Committee recommends to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s 2020 Proxy Statement, and incorporated by reference in the Company’s Annual Report on Form 10-K for the year ended September 30, 2019.

Submitted by:

The Compensation Committee of the Board of

Directors of Matthews International Corporation

M.K. O’Brien, Chairperson

A. Garcia-Tunon

D.W. Quigley, Jr.

Compensation Discussion and Analysis

Matthews International Corporation’s Named Executive Officers in Fiscal 2019

Joseph C. Bartolacci | President & Chief Executive Officer |

Brian J. Dunn | Executive Vice President, Strategy & Corporate Development |

Steven D. Gackenbach | Group President, Memorialization |

Steven F. Nicola | Chief Financial Officer & Secretary |

Brian D. Walters | Senior Vice President and General Counsel |

The Company's executive compensation policies are administered by the Compensation Committee of the Board of Directors. The Compensation Committee consists of three independent directors: Mr. O’Brien (Chairperson), Mr. Garcia-Tunon, and Mr. Quigley. Compensation for the Company's CEO, Chief Financial Officer, and the three other most highly compensated executives is presented in the Summary Compensation Table.

Executive Summary

Compensation Philosophy and Objectives |

Continuous improvement in operating results and the creation of shareholder value are key elements of the compensation philosophy of Matthews. This philosophy serves as the framework for the Company’s executive compensation program. Our program is designed to provide incentive arrangements that reward executives for improvement in the Company’s operating results and appreciation in our stock value.

20

To underscore the importance of “pay-for-performance” in our compensation philosophy and our Company’s culture, our Compensation Committee (referred to throughout this section as the Committee) has developed incentive arrangements based on rigorous performance standards. Our annual incentive compensation plan rewards executives for the adjusted EBITDA (earnings before interest, income taxes, depreciation and amortization ("EBITDA") and economic value added targets. For purposes of our annual incentive plan, “economic value added” is the measure of adjusted EBITDA compared to the cost of the capital utilized to generate this adjusted EBITDA. Our long-term incentive plan rewards for the achievement of earnings per share targets and return on invested capital (ROIC).

The principal objectives of the Company’s executive compensation program for the Company’s named executive officers ("NEOs") and other executive officers, are to:

• | Attract, retain and motivate highly-qualified executives; |

• | Reward continuous improvement in operating results and the creation of shareholder value; and |

• | Align the interests of the Company’s executives with our shareholders. |

The Company seeks to accomplish these objectives by maintaining a compensation philosophy that emphasizes rigorous performance-based programs. The foundation of its philosophy is to:

• | Emphasize rigorous performance-based compensation elements in our pay mix while providing total compensation opportunities commensurate with market levels; |

• | Provide retirement and health benefits that are competitive with market levels; and |

• | De-emphasize the use of perquisites except for business purposes. |

Fiscal year 2019 reflected the first year of our new compensation philosophy that targets the market median for all elements of compensation.

Response to 2019 Say on Pay Vote and Investor Engagement Efforts |

In response to lower shareholder support (approximately 69%) at our 2018 annual meeting, the Committee adopted significant changes (outlined in the table below) to our executive compensation program design effective beginning in fiscal 2019. As a result, at the annual meeting held in February 2019, approximately 90% of votes cast were in support of the compensation of our NEOs. Given this increased level of support, the Committee is satisfied that the changes made more appropriately link our executive compensation to the performance of the Company and better reflect contemporary practices.

In addition, our shareholder outreach efforts continued in 2019 as we contacted the Company's largest shareholders representing in aggregate over 60% of the Company's outstanding shares. The Committee evaluated the responses from these efforts and deemed that the current executive compensation design aligns with the expectations of our shareholders. Therefore, based on the results of our latest Say-on-Pay vote and feedback from investors, the Committee maintained its newly-adopted changes to the core executive compensation design. A summary of the program changes that became effective for fiscal 2019 are included in the table below.

21

Compensation Program Changes Approved Beginning Fiscal Year 2019 | ||

Changed from… | Changed to… | Rationale for Change |

Compensation Philosophy that targets long-term incentive (LTI) compensation at levels modestly above the market median | Compensation Philosophy that targets the market median for all elements of pay, including awards under our LTI plan | - Aligns with competitive market - Supports transition to new LTI plan |

Long-term incentives consisting of restricted stock with 50% vesting based on achieving performance targets and 50% vesting on continued employment | For November 2019 awards, long-term incentives with a 65% weighting assigned to performance share units (PSUs) and 35% assigned to time vesting restricted share units | - Heavier weighting assigned to PSUs provides a stronger incentive to achieve long-term strategic goals |

Performance-based restricted stock vesting based on achieving annual performance goals over three years | PSUs earned based on achieving performance goals at the end of a cumulative three-year performance period | - Strengthens the long-term orientation of the incentive |

Performance-based restricted stock based on annual EPS goals and stock price hurdles | PSUs earned based on EPS and Return on Invested Capital (ROIC) metrics | -EPS remains a key indicator of profitability and driver of shareholder value - ROIC ensures the appropriate use of investors’ capital |

Performance-based restricted stock payout limited to number of shares granted - one-third vests upon achieving annual EPS goals or three levels of stock price hurdles | PSUs vest in a range of 50% of target for achieving threshold performance to 200% of target for achieving performance at the high end of the range determined by the Committee | - Adopt contemporary PSU performance/payout design - High-end level goals represent stretch performance |

Upon a Change in Control, unvested equity awards accelerate (“single trigger”) | Upon a Change in Control, unvested or unearned equity awards accelerate upon involuntary or good reason termination (“double trigger”) | - Adopt a contemporary approach to equity acceleration - Prevent windfall in the event executive is not terminated |

Beginning in fiscal 2019, the minimum vesting period, in general, for all restricted share units (time and performance) is three years. Previously, the minimum vesting period for performance-based restricted shares was one year. In addition, as noted in the above table, the Company adopted during fiscal 2019 a contemporary change-in-control policy which requires a “double trigger” for vesting acceleration. The change-in-control agreements provide for cash severance equal to two times the executive’s base salary and target bonus in the event of a change in control of the Company and involuntary termination of the executive.

Executive Compensation Governance Practices |

The following executive compensation practices and policies have been adopted by the Compensation Committee to ensure sound corporate governance and alignment of the interests of executives and the Company’s shareholders. Many of these policies and practices have been adopted to discourage excessive risk-taking by our executive team.

22

What We Do:

ü | Designate a non-executive board chair to provide effective independent board leadership and oversight of management |

ü | Review risks associated with our compensation arrangements and adopt mitigating features, practices, and policies |

ü | Engage in a rigorous CEO performance evaluation process |

ü | Employ shareholder-value creating metrics and challenging targets such as adjusted EBITDA and economic value added in our annual incentive plan, and earnings per share and, return on invested capital within our long-term incentive plan |

ü | Cap annual and long-term incentive payouts |

ü | Maintain significant stock ownership guidelines for both executives and directors |

ü | Require both a qualified change in control and termination of employment (“Double Trigger”) in order to receive cash severance benefits and for unvested equity awards to accelerate |

ü | Maintain a “clawback” policy that provides for the recoupment of incentive awards under certain conditions in the event of a financial restatement |

ü | Retain an independent compensation consultant who regularly provides advise to the compensation committee on matters pertaining to executive compensation |

What We Don’t Do:

û | Enter into individual employment contracts with our executives, except in an instance where an agreement is assumed as part of an acquisition |

û | Allow hedging or pledging of the Company's common stock |

û | Provide excise tax gross-ups related to change in control terminations |

û | Allow repricing or exchanging of stock options or other equity awards without shareholder approval |

û | Provide excessive perquisites and tax gross-up perquisites |

23

Executive Compensation Elements for Fiscal 2019 |

Our executive compensation program is comprised of the following three key elements. Each is designed to meet the objectives of our executive compensation program as established by the Committee:

Compensation Element | Form and Key Characteristics | Description and Performance Metrics |

Base Salary | - Fixed cash component - Reviewed annually and adjusted as appropriate | - Positioned competitively to attract and retain executive talent - Considers scope and complexity of the role as well as individual performance and experience |

Annual Incentive Compensation | - Variable cash compensation component - Performance-based opportunity | - Executives other than SGK Brand Solutions: - 50% weighting assigned to Net Income (corporate executives) or adjusted EBITDA (business unit executives) - 50% weighting assigned to economic value added (improvement in adjusted EBITDA greater than the cost of the capital utilized to generate this adjusted EBITDA) - SGK Brand Solutions executives: 100% weighting assigned to adjusted EBITDA |

Long-Term Incentive Compensation | - Variable equity-based compensation component - 60% performance share units (increased to 65% for fiscal 2020 awards) - 40% time vesting restricted stock units (reduced to 35% for fiscal 2020 awards) | - Performance shares earned at the end of the three-year performance period: - Upon the attainment of non-GAAP annual earnings per share - Upon the attainment of ROIC Goals - Time vesting shares vest 100% on the third anniversary of the grant |

CEO Compensation Decisions for Fiscal 2019 |

The Compensation Committee approved the following compensation changes based on an evaluation of factors including: overall company and business unit performance, performance against pre-established personal objectives and goals, execution of business strategy, and consideration of the competitive market.

• | Base Salary: Mr. Bartolacci’s base salary for 2019 was increased 2% to approximate the market median. The Committee rated his fiscal 2018 performance as Commendable. |

• | Annual Incentive Compensation Our fiscal 2019 actual performance fell below the threshold performance goals for both consolidated net income and economic value added. Therefore, Mr. Bartolacci did not earn a cash bonus for fiscal 2019. |

• | Long-Term Incentive Compensation: Mr. Bartolacci received an annual equity award for fiscal year 2019 equal to $2,874,161, a decrease of $604,761 or 17.4% when compared to his grant of $3,478,922 the previous year. |

24

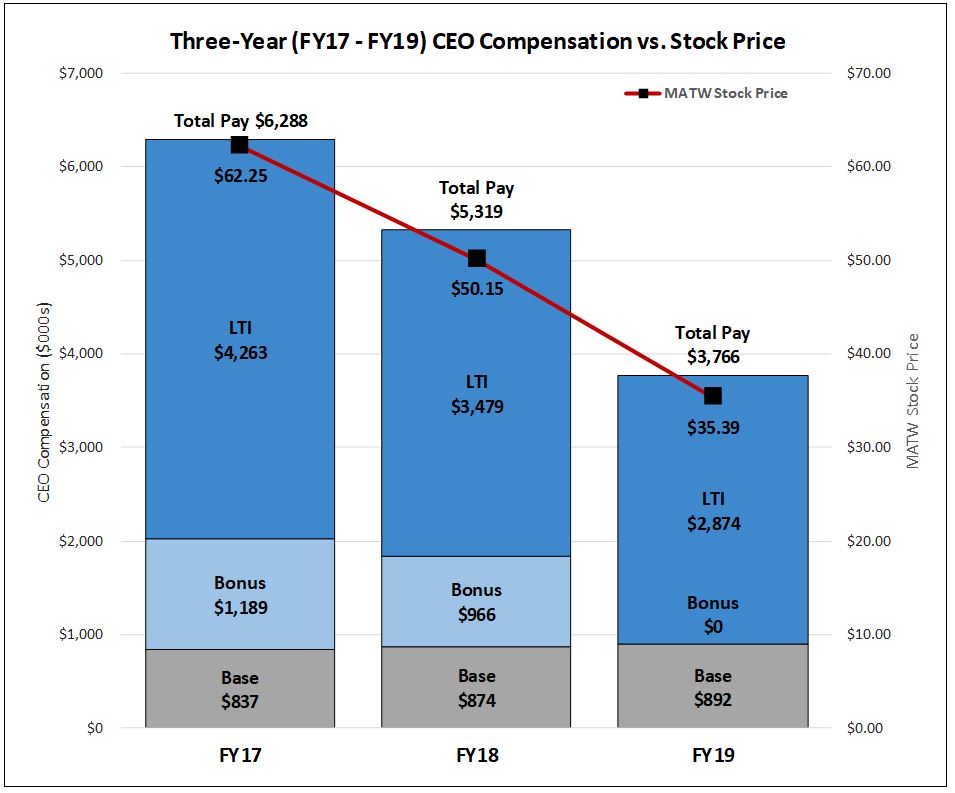

The table below illustrates Mr. Bartolacci’s compensation over the past three fiscal years as defined by base salary, actual annual incentive earned, and the grant value of long-term incentives. These amount as presented are equal to those contained in the Summary Compensation Table of this proxy statement. The decrease in our CEO’s compensation aligns with the decreases in both our financial and stock performance.

While Mr. Bartolacci’s Change in Pension Value shown in the Summary Compensation Table increased from $1,129,826 for fiscal 2018 to $3,008,481 in fiscal 2019, the increase was primarily due to a reduction in the discount rate assumption from 4.18% to 3.06%.

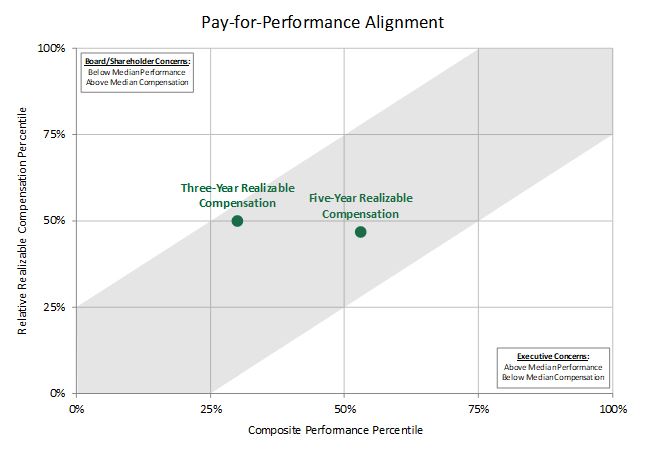

As further emphasis on the Committee’s philosophy to align long-term incentive compensation with the Company’s performance, the actual realized portion of the performance-based long-term incentive compensation awards that were granted over the past five years for the Company's CEO was 57.1% (see table on page 29).

Further, the annual equity awards to the Company’s executive management (including Mr. Bartolacci) were reduced by approximately 15% compared to the previous year as a result of the implementation of our new compensation philosophy of targeting the market median.

25

Fiscal 2019 Target Compensation Mix |

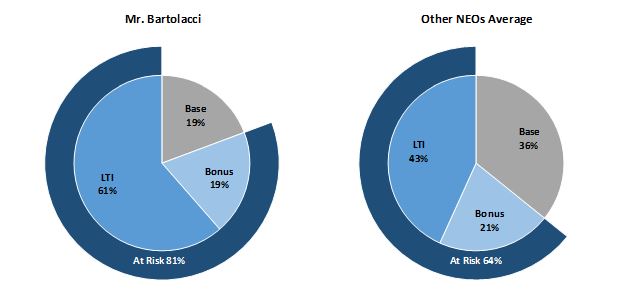

The pie charts below show the mix of target compensation provided to our CEO and other NEOs in fiscal 2019. Variable, at-risk compensation accounted for 81% of our CEO’s target compensation and 64% of our other NEOs compensation on average.

Compensation Committee Administration

The principal function of the Compensation Committee is to review the Company’s compensation and benefit programs, including executive compensation and benefits, to ensure that total compensation is appropriate, competitive and consistent with the Company’s compensation philosophy. In performing its duties, the Compensation Committee consults with the Company’s CEO, the Company’s Senior Vice President, Human Resources and various independent external advisors. In fiscal 2019, the Compensation Committee consulted principally with Pay Governance, LLC, an independent executive compensation consulting firm. Pay Governance, LLC does not perform any other services for the Company and reports directly to the Compensation Committee. The Compensation Committee has full authority to retain external advisors, consultants and agents, as necessary, in the fulfillment of its responsibilities. The Compensation Committee reviews the performance and the fees of the independent consultant each year and determines whether to retain such consultant for the upcoming year.

Among its other duties, the Compensation Committee has responsibility for setting executive base salary levels and administering the terms and policies of the following key executive benefit plans:

• | 2015 Incentive Compensation Plan; |

• | 2017 Equity Incentive Plan; |

• | Supplemental Retirement Plan ("SERP"); and |

• | Officers Retirement Restoration Plan ("ORRP"). |

26