INVESTOR PRESENTATION THIRD QUARTER FISCAL YEAR 2020

DISCLAIMER Any forward-looking statements contained in this presentation are included pursuant to the “safe harbor” provisions of the Private The Company believes that adjusted EBITDA provides relevant and useful information, which is used by the Company’s Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks and uncertainties that management in assessing the performance of its business. Adjusted EBITDA is defined by the Company as earnings before interest, may cause the Company’s actual results in future periods to be materially different from management’s expectations. Although the income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given management’s evaluation of its operating results. These items include stock-based compensation, the non-service portion of that such expectations will prove correct. Factors that could cause the Company's results to differ materially from the results pension and postretirement expense, acquisition costs, ERP integration costs, and strategic initiatives and other charges. Adjusted discussed in such forward-looking statements principally include changes in domestic or international economic conditions, changes EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income in foreign currency exchange rates, changes in the cost of materials used in the manufacture of the Company's products, changes in taxes, and the effects of certain acquisition and ERP integration costs, and items that do not reflect the ordinary earnings of the mortality and cremation rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company’s operations. This measure may be useful to an investor in evaluating operating performance. It is also useful as a Company operates, changes in product demand or pricing as a result of domestic or international competitive pressures, ability to financial measure for lenders and is used by the Company’s management to measure business performance. Adjusted EBITDA is achieve cost reduction objectives, unknown risks in connection with the Company's acquisitions, cybersecurity concerns, not a measure of the Company's financial performance under GAAP and should not be considered as an alternative to net income or effectiveness of the Company's internal controls, compliance with domestic and foreign laws and regulations, technological factors other performance measures derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a beyond the Company's control, impact of pandemics or similar outbreaks, such as coronavirus disease 2019 ("COVID-19") or other measure of the Company's liquidity. The Company's definition of adjusted EBITDA may not be comparable to similarly titled disruptions to our industries, customers or supply chains, and other factors described in the Company’s Annual Report on Form 10-K measures used by other companies. and other periodic filings with the U.S. Securities and Exchange Commission (“SEC”). The Company has also presented adjusted net income and adjusted earnings per share and believes each measure provides The information contained in this presentation, including any financial data, is made as of June 30, 2020 unless otherwise noted. The relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in Company does not, and is not obligated to, update this information after the date of such information. Included in this report are assessing the performance of its business. Adjusted net income and adjusted earnings per share provides the Company with an measures of financial performance that are not defined by generally accepted accounting principles in the United States (“GAAP”). understanding of the results from the primary operations of our business by excluding the effects of certain acquisition and system- The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of integration costs, and items that do not reflect the ordinary earnings of our operations. These measures provide management with business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s insight into the earning value for shareholders excluding certain costs, not related to the Company’s primary operations. Likewise, core operations including acquisition costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring these measures may be useful to an investor in evaluating the underlying operating performance of the Company’s business overall, charges related to operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and as well as performance trends, on a consistent basis. postretirement expense. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that The Company has also presented net debt and believes that this measure provides relevant and useful information, which is widely management believes do not directly reflect the Company’s core operations, (ii) permits investors to view performance using the used by analysts and investors as well as by our management. This measure provide management with insight on the indebtedness same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, of the Company, net of cash and cash equivalents. This measure allows management, as well as analysts and investors, to assess and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The the Company’s leverage. Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding Lastly, the Company has presented free cash flow and free cash flow yield as supplemental measures of cash flow that are not GAAP financial measures and the reconciliations to those measures, provided herein, provides investors with an additional required by, or presented in accordance with, GAAP. Management believes that these measures provide relevant and useful understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the cash generated by operations, excluding capital expenditures. These measures allows management, as well as analysts and investors, to assess the Company’s ability to pursue growth and investment opportunities designed to increase Shareholder value. © 2020 Matthews International Corporation. All Rights Reserved. 2

BUSINESS OVERVIEW

ROOTED IN IDENTIFICATION PRODUCTS FOUNDED in 1850 TODAY • Marking Products • SGK Brand Solutions • Printing Plates • Memorialization • Bronze Plaques • Industrial Technologies © 2020 Matthews International Corporation. All Rights Reserved. 4

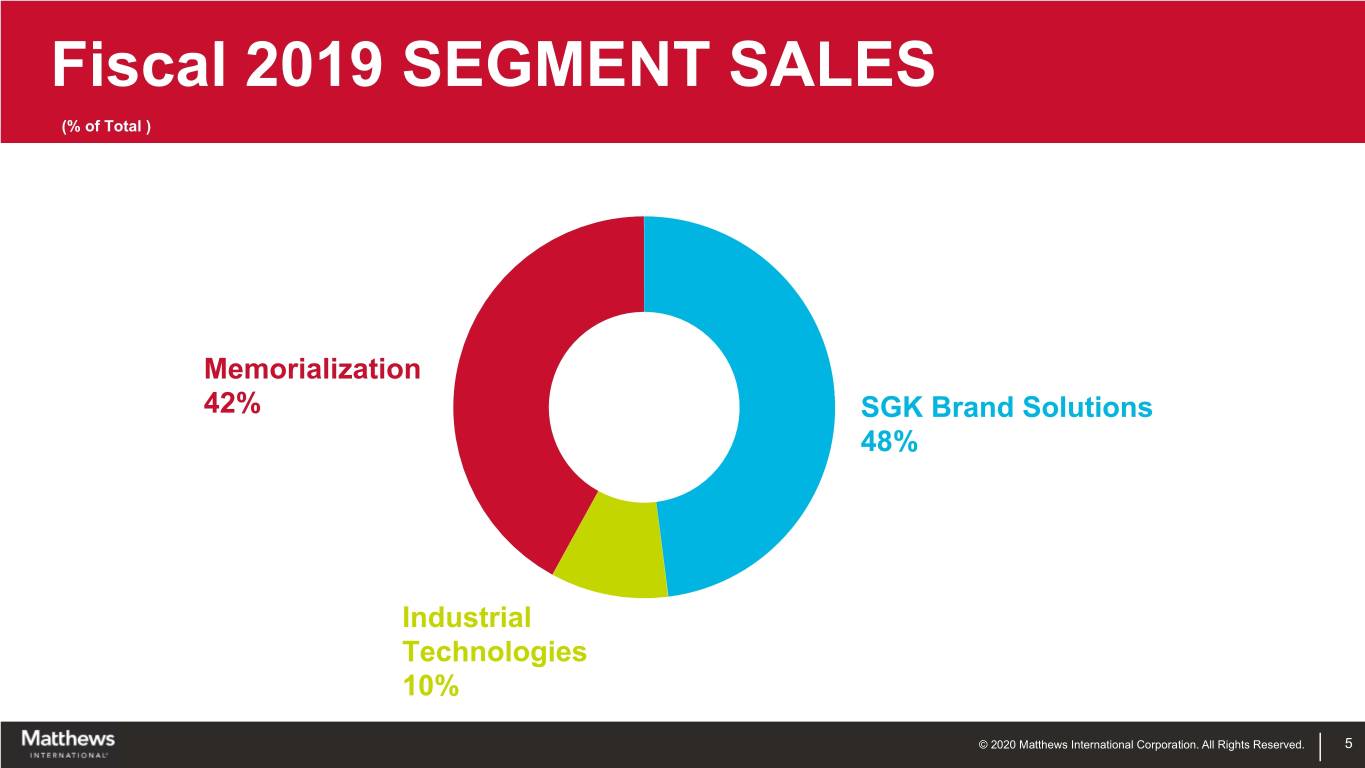

Fiscal 2019 SEGMENT SALES (% of Total ) Memorialization 42% SGK Brand Solutions 48% Industrial Technologies 10% © 2020 Matthews International Corporation. All Rights Reserved. 5

COVID-19 IMPACTS CRITICAL SUPPLIER IN MOST OF OUR BUSINESSES • Continuing operations as an essential supplier • Safeguarding our employees is top priority • Meeting demand with virtual information technology enabled environment - globally COMMERCIAL IMPACTS VARY • Memorialization – Recent higher casket volume; delayed orders for cemetery memorial products • SGK Brand Solutions – Relatively stable sales from consumer packaged goods clients; other businesses vary. • Industrial Technologies – Customer delays in warehouse automation but backlog remains strong; potential project deferrals LIQUIDITY AVAILABLE • Capacity under domestic credit facility • Strict cash management © 2020 Matthews International Corporation. All Rights Reserved. 6

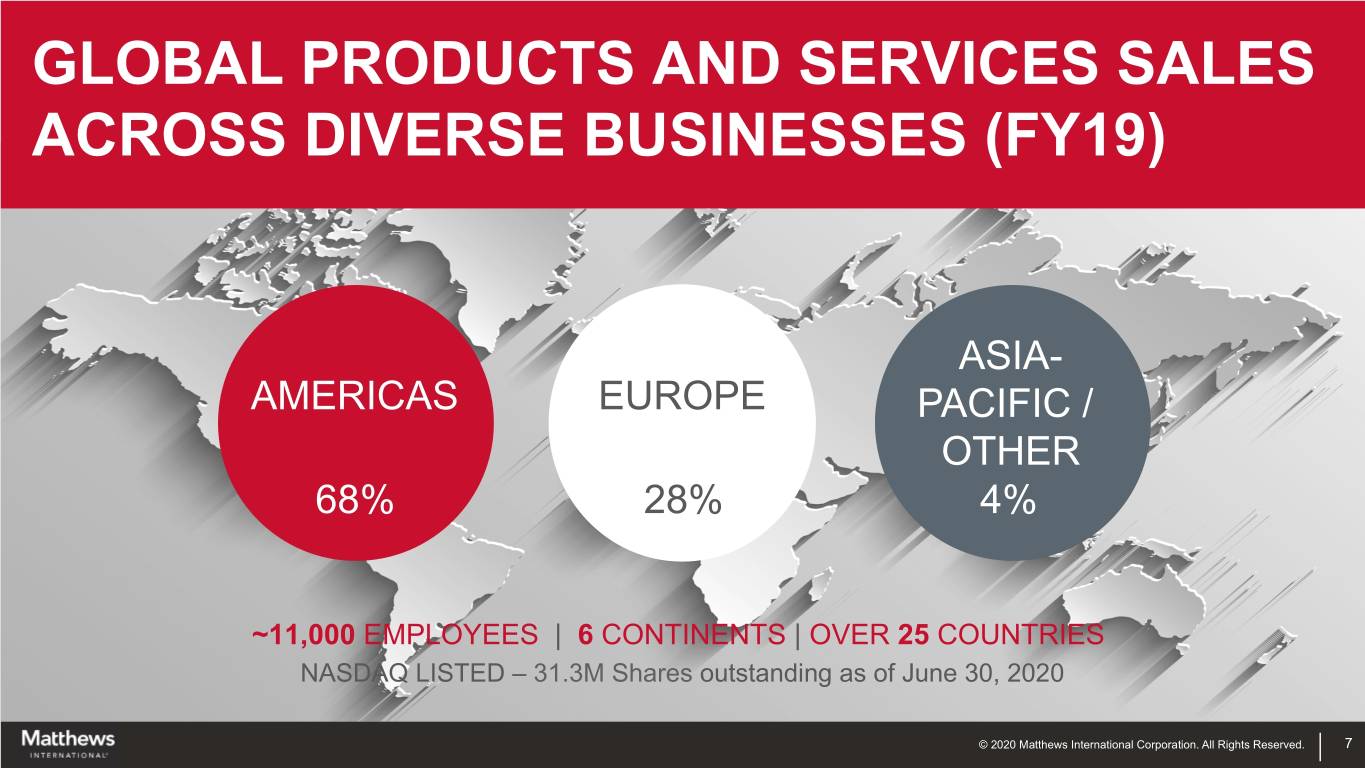

GLOBAL PRODUCTS AND SERVICES SALES ACROSS DIVERSE BUSINESSES (FY19) ASIA- AMERICAS EUROPE PACIFIC / OTHER 68% 28% 4% ~11,000 EMPLOYEES | 6 CONTINENTS | OVER 25 COUNTRIES NASDAQ LISTED – 31.3M Shares outstanding as of June 30, 2020 © 2020 Matthews International Corporation. All Rights Reserved. 7

© 2020 Matthews International Corporation. All Rights Reserved.

PACKAGING PRODUCTION: OUR CORE BUSINESS From Logo To Shelf BRAND BRAND ASSETS, PACKAGING LAYOUT, COLOR CONTROL PRINTED PACKAGING CREATIVE CLIENT & LEGAL PRODUCTION ART & & PRINT TOOLING SKU’s & DESIGN INPUTS COLOR SEPARATION © 2020 Matthews International Corporation. All Rights Reserved. 9

TOOLING EXPERTISE Taking Ideas To Finished Products. We are a leading global designer and supplier of rotary tools and services for printing, texturing and converting of packaging and other non- woven materials with new opportunities in energy storage. © 2020 Matthews International Corporation. All Rights Reserved. 10

SGK BRAND SOLUTIONS SERVICING GLOBAL AND REGIONAL CLIENTS FOOD/BEVERAGE GLOBAL PHARMA / GLOBAL OTHER • Longstanding relationships with a CLIENTS HEALTHCARE RETAILER LEADING large, blue chip customer base CLIENTS CLIENTS BRANDS consisting of many Fortune 100 and Fortune 500 companies • "Strategic" relationships rather than "vendor" relationships - more valued client engagement • Critical service provider in marketing execution of top worldwide brands, particularly where global consistency is highly valued © 2020 Matthews International Corporation. All Rights Reserved. 11

© 2020 Matthews International Corporation. All Rights Reserved.

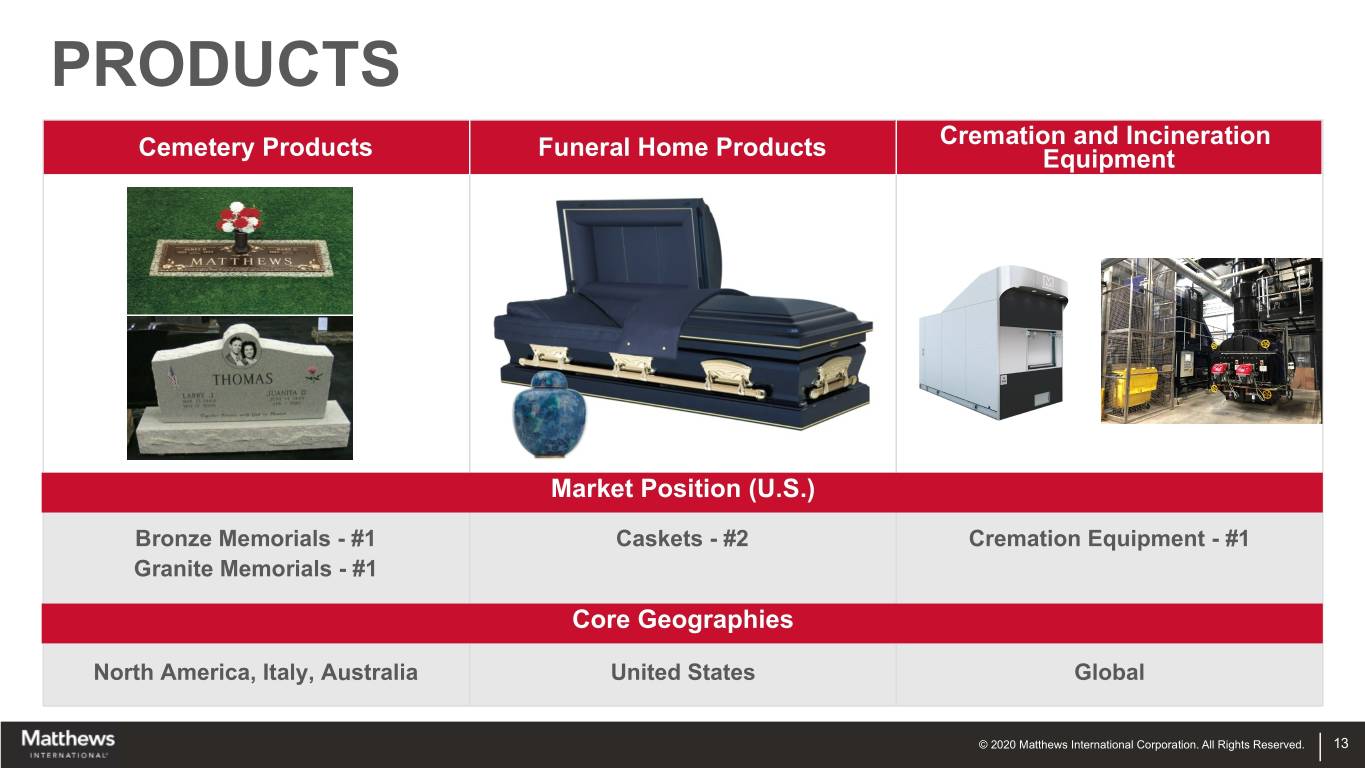

PRODUCTS Cremation and Incineration Cemetery Products Funeral Home Products Equipment Market Position (U.S.) Bronze Memorials - #1 Caskets - #2 Cremation Equipment - #1 Granite Memorials - #1 Core Geographies North America, Italy, Australia United States Global © 2020 Matthews International Corporation. All Rights Reserved. 13

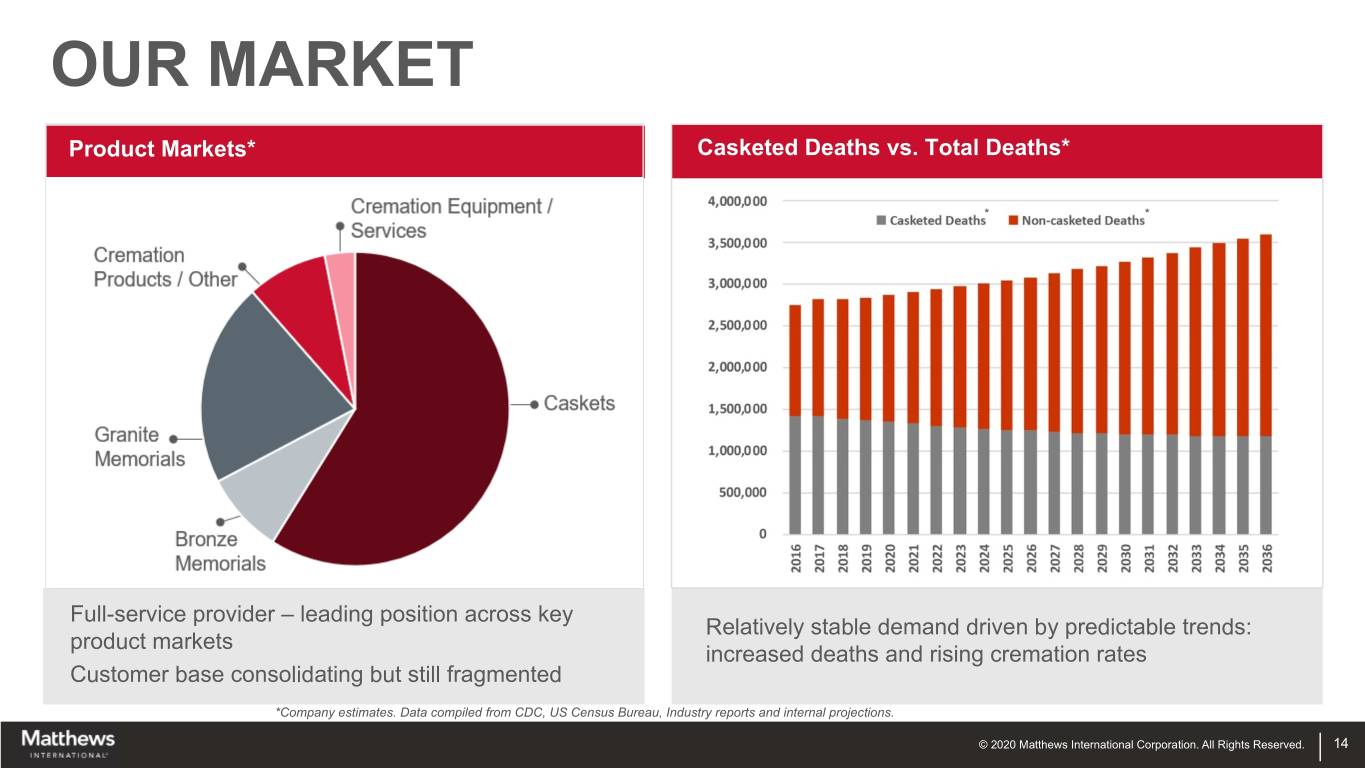

OUR MARKET Product Markets* Casketed Deaths vs. Total Deaths* * * Full-service provider – leading position across key Relatively stable demand driven by predictable trends: product markets increased deaths and rising cremation rates Customer base consolidating but still fragmented *Company estimates. Data compiled from CDC, US Census Bureau, Industry reports and internal projections. © 2020 Matthews International Corporation. All Rights Reserved. 14

© 2020 Matthews International Corporation. All Rights Reserved.

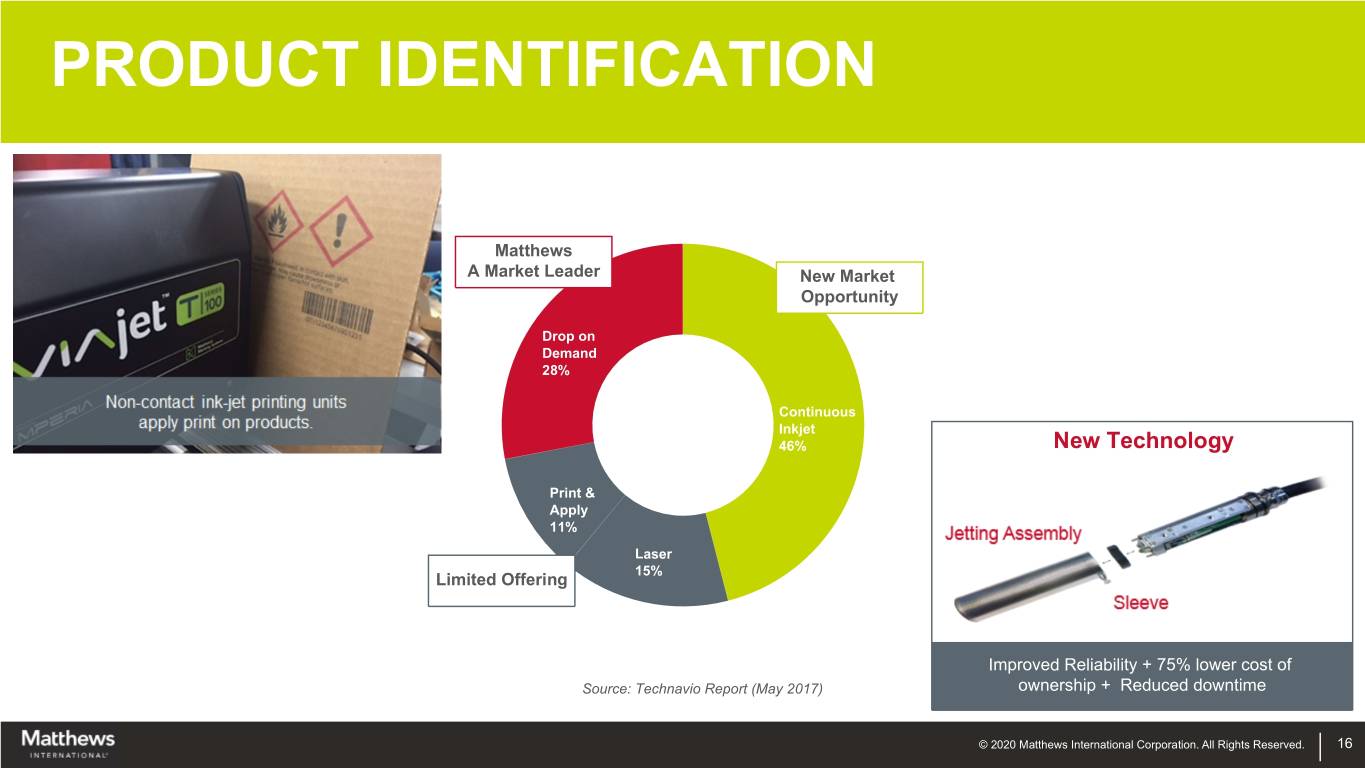

PRODUCT IDENTIFICATION Matthews A Market Leader New Market Opportunity Drop on Demand 28% Continuous Inkjet 46% New Technology Print & Apply 11% Laser 15% Limited Offering Improved Reliability + 75% lower cost of Source: Technavio Report (May 2017) ownership + Reduced downtime © 2020 Matthews International Corporation. All Rights Reserved. 16

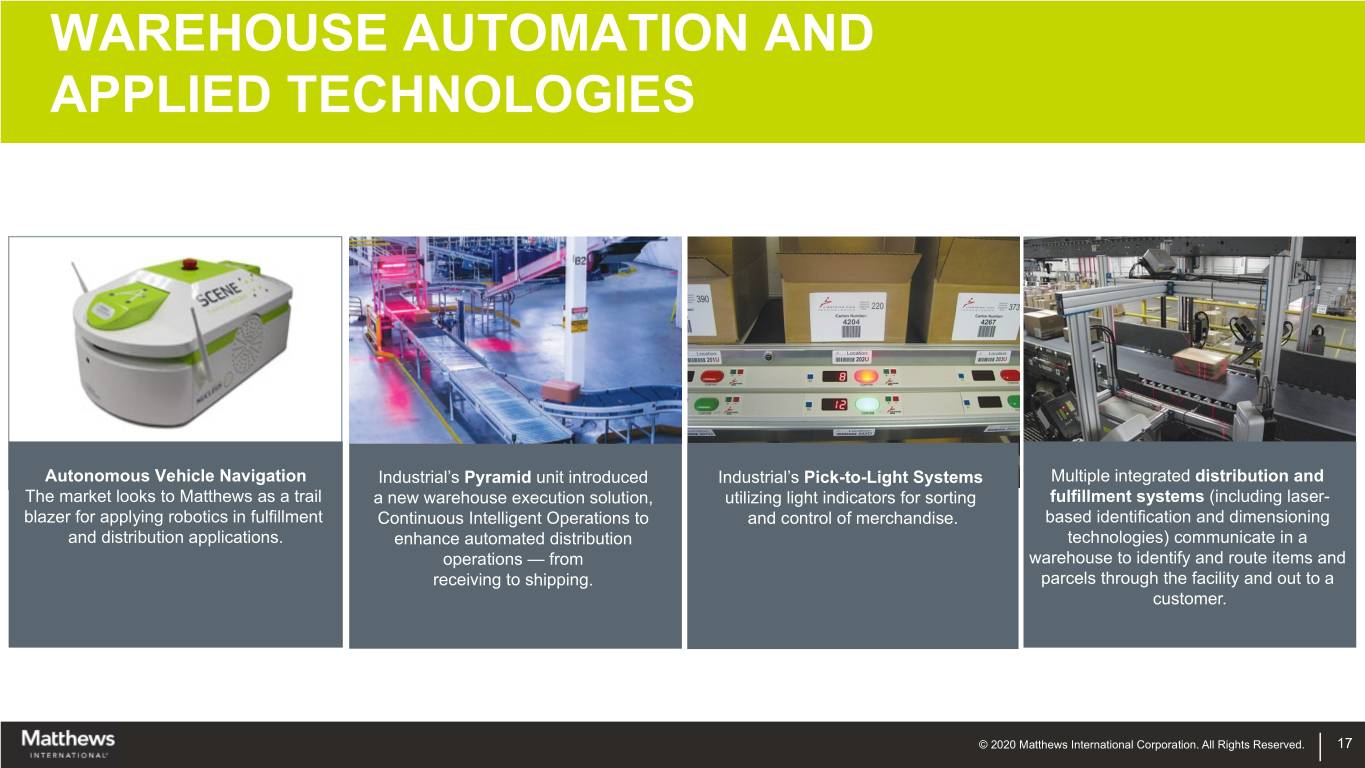

WAREHOUSE AUTOMATION AND APPLIED TECHNOLOGIES Autonomous Vehicle Navigation Industrial’s Pyramid unit introduced Industrial’s Pick-to-Light Systems Multiple integrated distribution and The market looks to Matthews as a trail a new warehouse execution solution, utilizing light indicators for sorting fulfillment systems (including laser- blazer for applying robotics in fulfillment Continuous Intelligent Operations to and control of merchandise. based identification and dimensioning and distribution applications. enhance automated distribution technologies) communicate in a operations — from warehouse to identify and route items and receiving to shipping. parcels through the facility and out to a customer. © 2020 Matthews International Corporation. All Rights Reserved. 17

© 2020 Matthews International Corporation. All Rights Reserved.

VALUE CREATION ORGANIC • Expanding market penetration with existing products • Synergies and manufacturing / cost structure improvements • New product introductions ACQUISITIONS • Support segment business plans; fill product / geographic gaps • Leverage existing operating infrastructure • Achieve long-term annual return (EBITDA) on invested capital of at least 14% SHARE REPURCHASES • Opportunistic • Repurchase in periods of excess cash flow • Current remaining authorization: 0.6 million shares © 2020 Matthews International Corporation. All Rights Reserved. 19

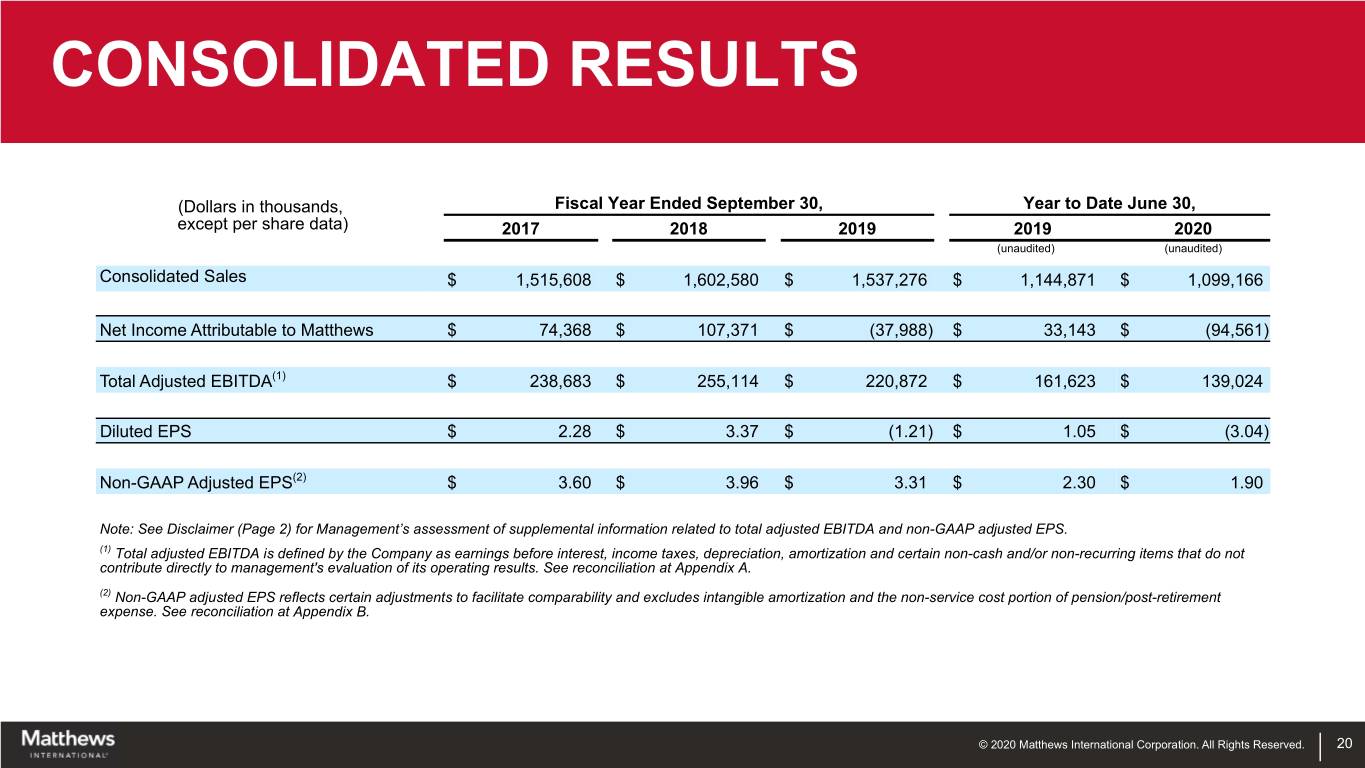

CONSOLIDATED RESULTS (Dollars in thousands, Fiscal Year Ended September 30, Year to Date June 30, except per share data) 2017 2018 2019 2019 2020 (unaudited) (unaudited) Consolidated Sales $ 1,515,608 $ 1,602,580 $ 1,537,276 $ 1,144,871 $ 1,099,166 Net Income Attributable to Matthews $ 74,368 $ 107,371 $ (37,988) $ 33,143 $ (94,561) Total Adjusted EBITDA(1) $ 238,683 $ 255,114 $ 220,872 $ 161,623 $ 139,024 Diluted EPS $ 2.28 $ 3.37 $ (1.21) $ 1.05 $ (3.04) Non-GAAP Adjusted EPS(2) $ 3.60 $ 3.96 $ 3.31 $ 2.30 $ 1.90 Note: See Disclaimer (Page 2) for Management’s assessment of supplemental information related to total adjusted EBITDA and non-GAAP adjusted EPS. (1) Total adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management's evaluation of its operating results. See reconciliation at Appendix A. (2) Non-GAAP adjusted EPS reflects certain adjustments to facilitate comparability and excludes intangible amortization and the non-service cost portion of pension/post-retirement expense. See reconciliation at Appendix B. © 2020 Matthews International Corporation. All Rights Reserved. 20

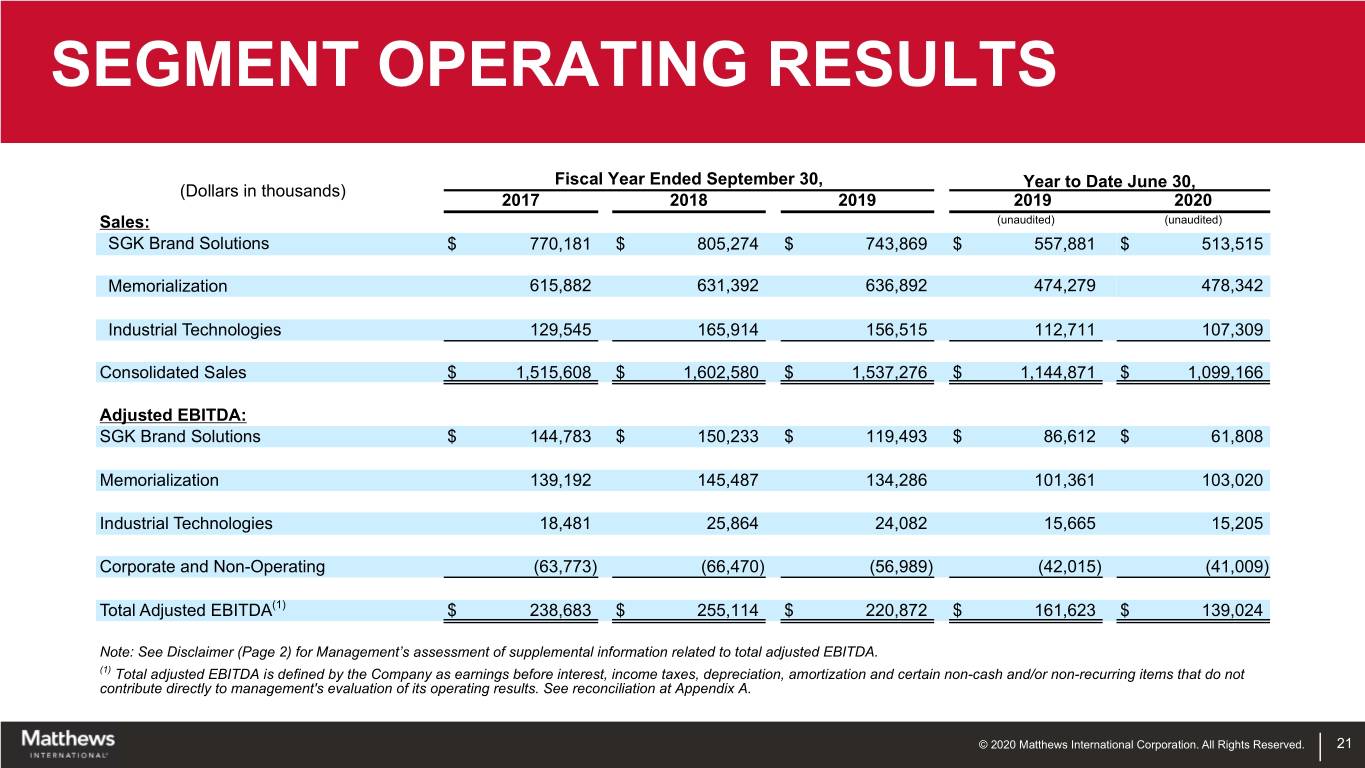

SEGMENT OPERATING RESULTS Fiscal Year Ended September 30, Year to Date June 30, (Dollars in thousands) 2017 2018 2019 2019 2020 Sales: (unaudited) (unaudited) SGK Brand Solutions $ 770,181 $ 805,274 $ 743,869 $ 557,881 $ 513,515 Memorialization 615,882 631,392 636,892 474,279 478,342 Industrial Technologies 129,545 165,914 156,515 112,711 107,309 Consolidated Sales $ 1,515,608 $ 1,602,580 $ 1,537,276 $ 1,144,871 $ 1,099,166 Adjusted EBITDA: SGK Brand Solutions $ 144,783 $ 150,233 $ 119,493 $ 86,612 $ 61,808 Memorialization 139,192 145,487 134,286 101,361 103,020 Industrial Technologies 18,481 25,864 24,082 15,665 15,205 Corporate and Non-Operating (63,773) (66,470) (56,989) (42,015) (41,009) Total Adjusted EBITDA(1) $ 238,683 $ 255,114 $ 220,872 $ 161,623 $ 139,024 Note: See Disclaimer (Page 2) for Management’s assessment of supplemental information related to total adjusted EBITDA. (1) Total adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management's evaluation of its operating results. See reconciliation at Appendix A. © 2020 Matthews International Corporation. All Rights Reserved. 21

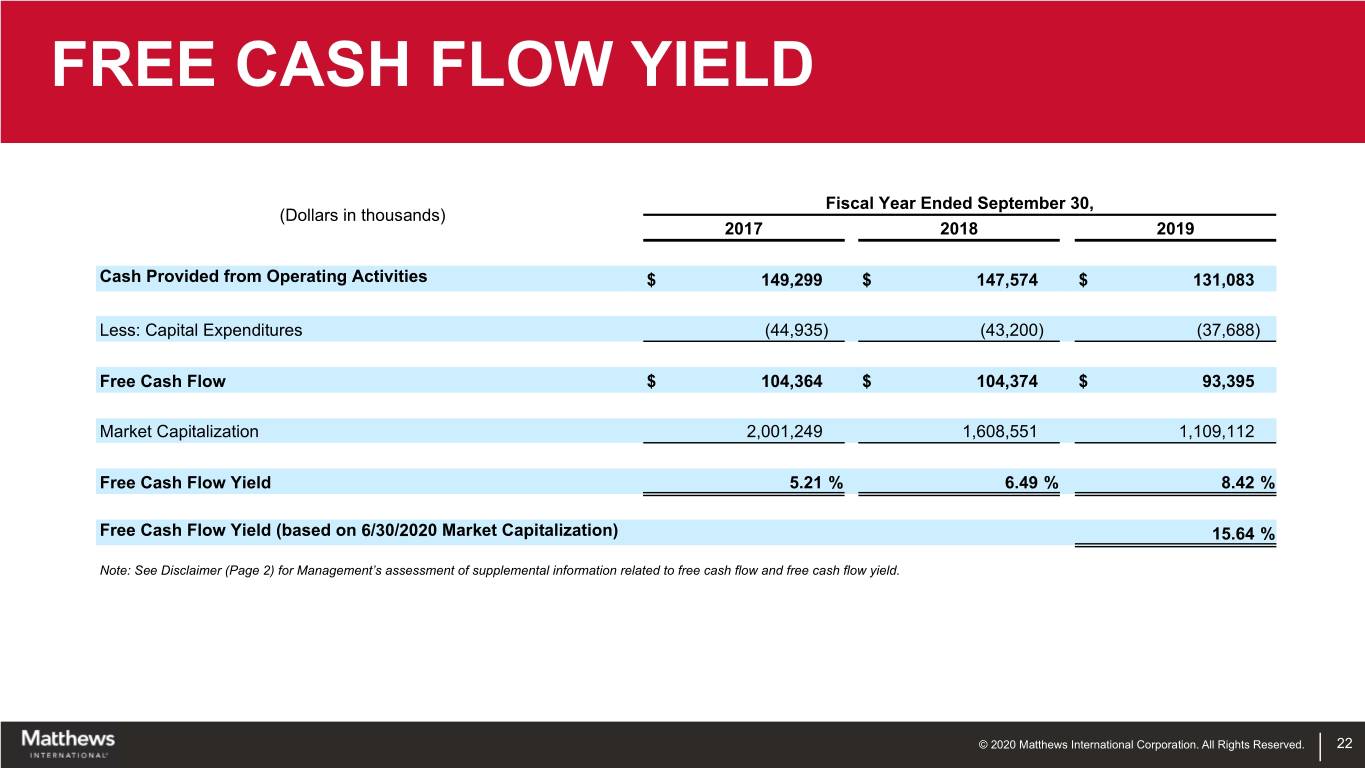

FREE CASH FLOW YIELD Fiscal Year Ended September 30, (Dollars in thousands) 2017 2018 2019 Cash Provided from Operating Activities $ 149,299 $ 147,574 $ 131,083 Less: Capital Expenditures (44,935) (43,200) (37,688) Free Cash Flow $ 104,364 $ 104,374 $ 93,395 Market Capitalization 2,001,249 1,608,551 1,109,112 Free Cash Flow Yield 5.21 % 6.49 % 8.42 % Free Cash Flow Yield (based on 6/30/2020 Market Capitalization) 15.64 % Note: See Disclaimer (Page 2) for Management’s assessment of supplemental information related to free cash flow and free cash flow yield. © 2020 Matthews International Corporation. All Rights Reserved. 22

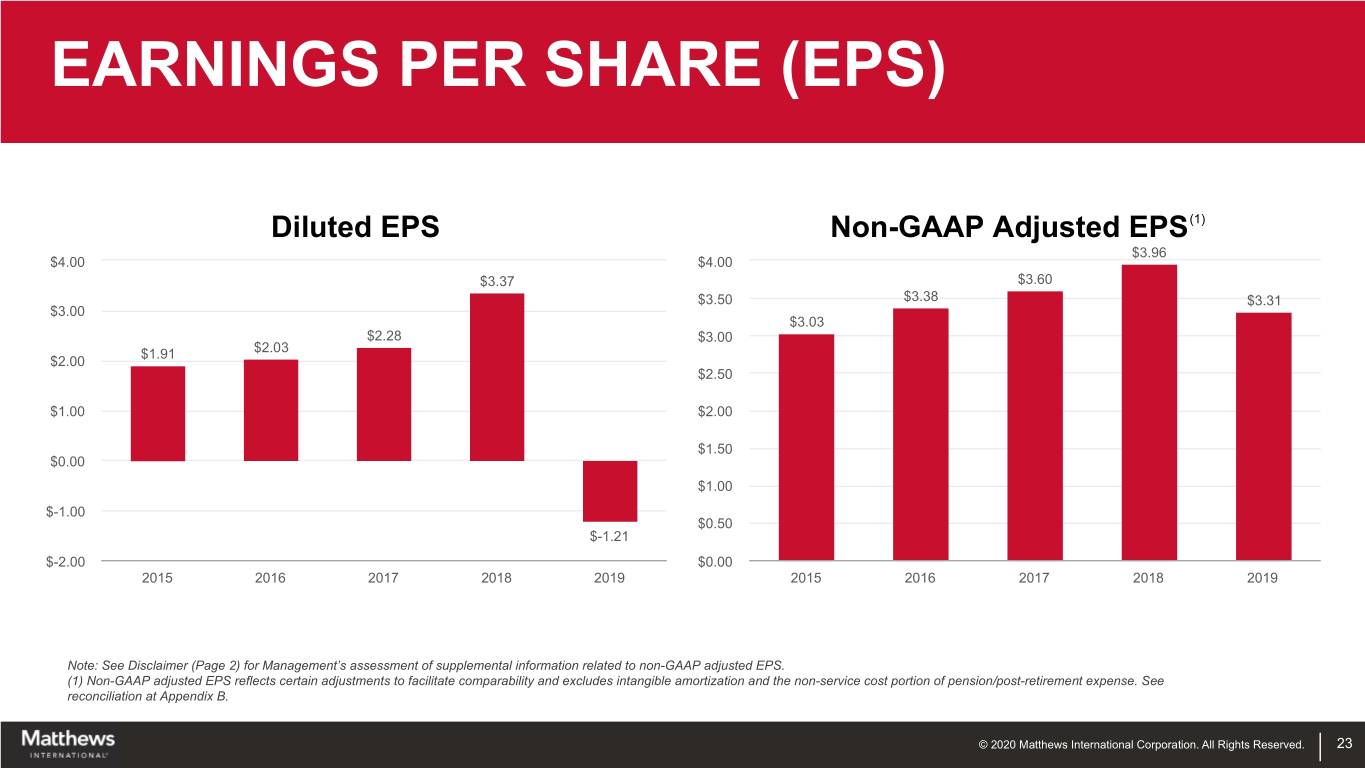

EARNINGS PER SHARE (EPS) Diluted EPS Non-GAAP Adjusted EPS(1) $3.96 $4.00 $4.00 $3.37 $3.60 $3.50 $3.38 $3.31 $3.00 $3.03 $2.28 $3.00 $1.91 $2.03 $2.00 $2.50 $1.00 $2.00 $1.50 $0.00 $1.00 $-1.00 $0.50 $-1.21 $-2.00 $0.00 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 Note: See Disclaimer (Page 2) for Management’s assessment of supplemental information related to non-GAAP adjusted EPS. (1) Non-GAAP adjusted EPS reflects certain adjustments to facilitate comparability and excludes intangible amortization and the non-service cost portion of pension/post-retirement expense. See reconciliation at Appendix B. © 2020 Matthews International Corporation. All Rights Reserved. 23

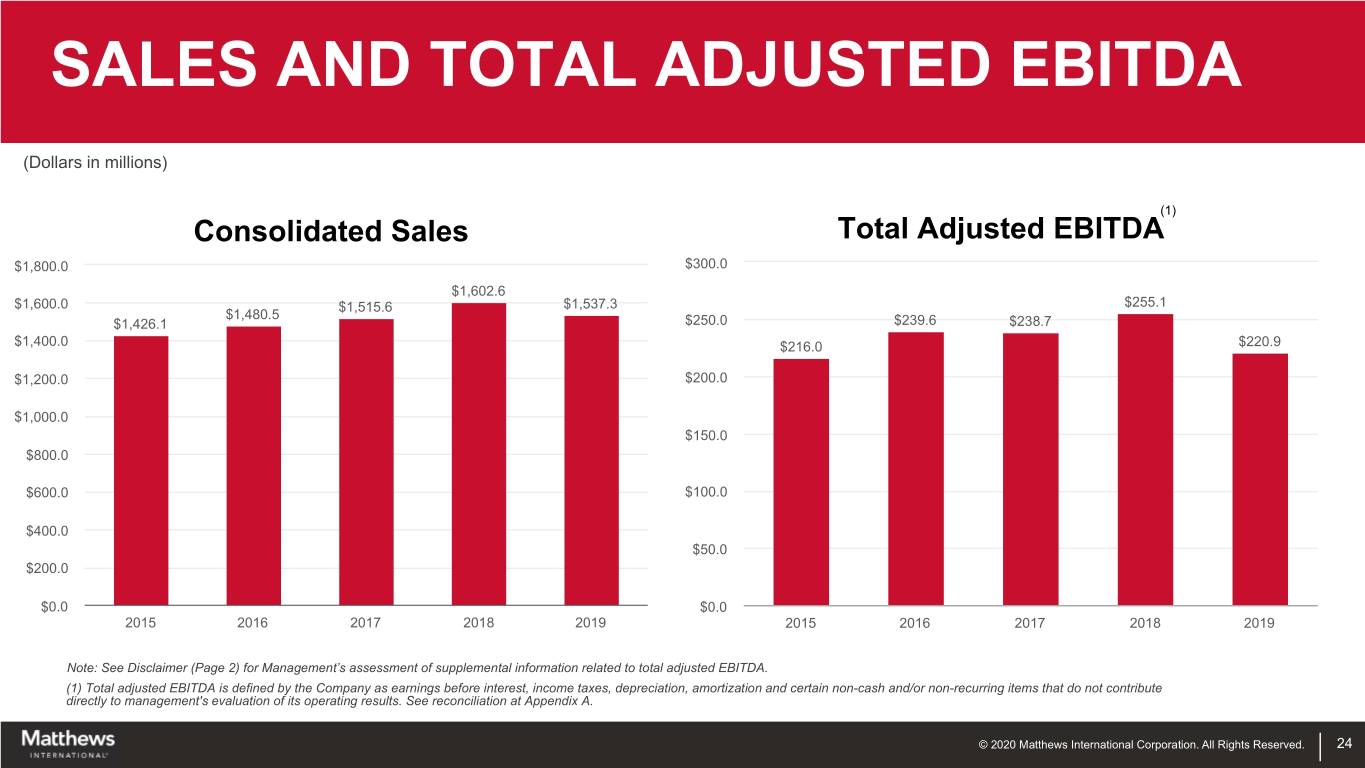

SALES AND TOTAL ADJUSTED EBITDA (Dollars in millions) (1) Consolidated Sales Total Adjusted EBITDA $1,800.0 $300.0 $1,602.6 $1,600.0 $1,515.6 $1,537.3 $255.1 $1,480.5 $1,426.1 $250.0 $239.6 $238.7 $1,400.0 $216.0 $220.9 $1,200.0 $200.0 $1,000.0 $150.0 $800.0 $600.0 $100.0 $400.0 $50.0 $200.0 $0.0 $0.0 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 Note: See Disclaimer (Page 2) for Management’s assessment of supplemental information related to total adjusted EBITDA. (1) Total adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management's evaluation of its operating results. See reconciliation at Appendix A. © 2020 Matthews International Corporation. All Rights Reserved. 24

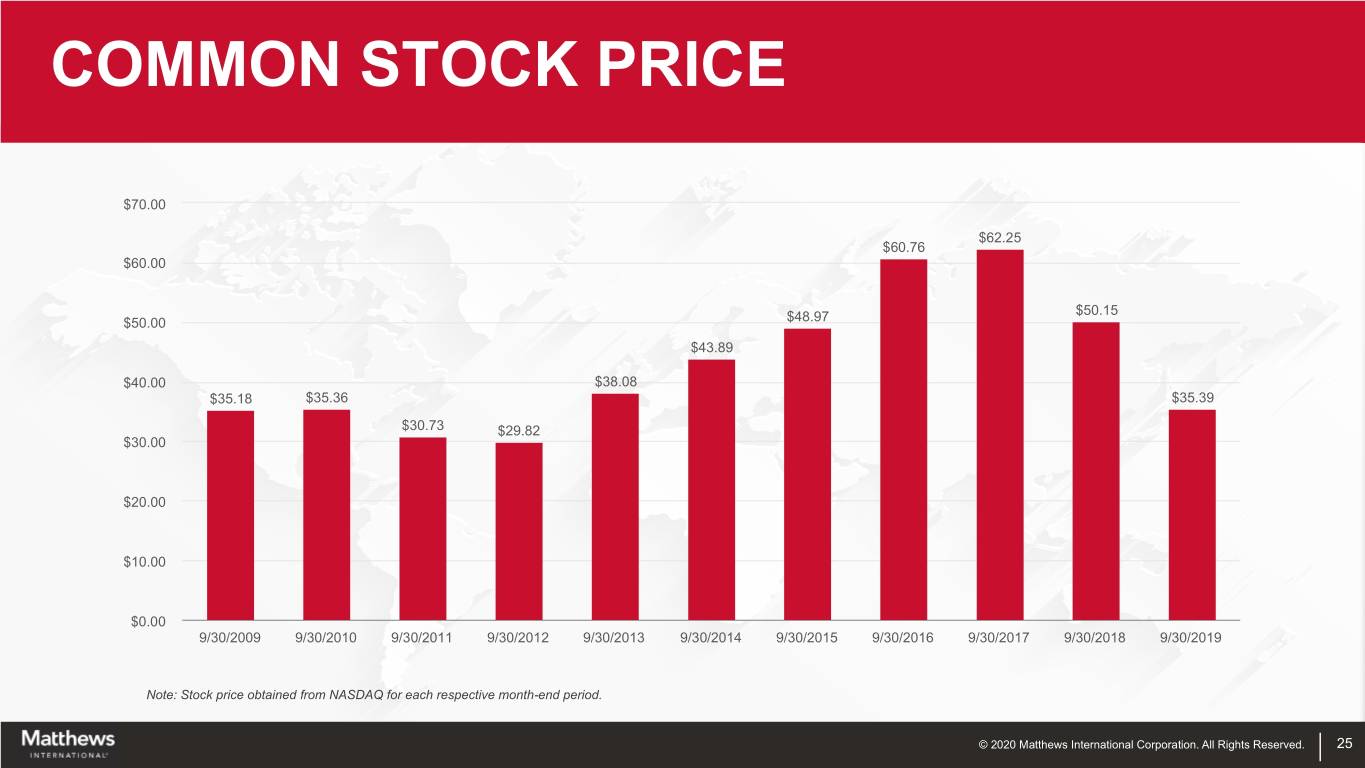

COMMON STOCK PRICE $70.00 $62.25 $60.76 $60.00 $50.15 $50.00 $48.97 $43.89 $40.00 $38.08 $35.18 $35.36 $35.39 $30.73 $29.82 $30.00 $20.00 $10.00 $0.00 9/30/2009 9/30/2010 9/30/2011 9/30/2012 9/30/2013 9/30/2014 9/30/2015 9/30/2016 9/30/2017 9/30/2018 9/30/2019 Note: Stock price obtained from NASDAQ for each respective month-end period. © 2020 Matthews International Corporation. All Rights Reserved. 25

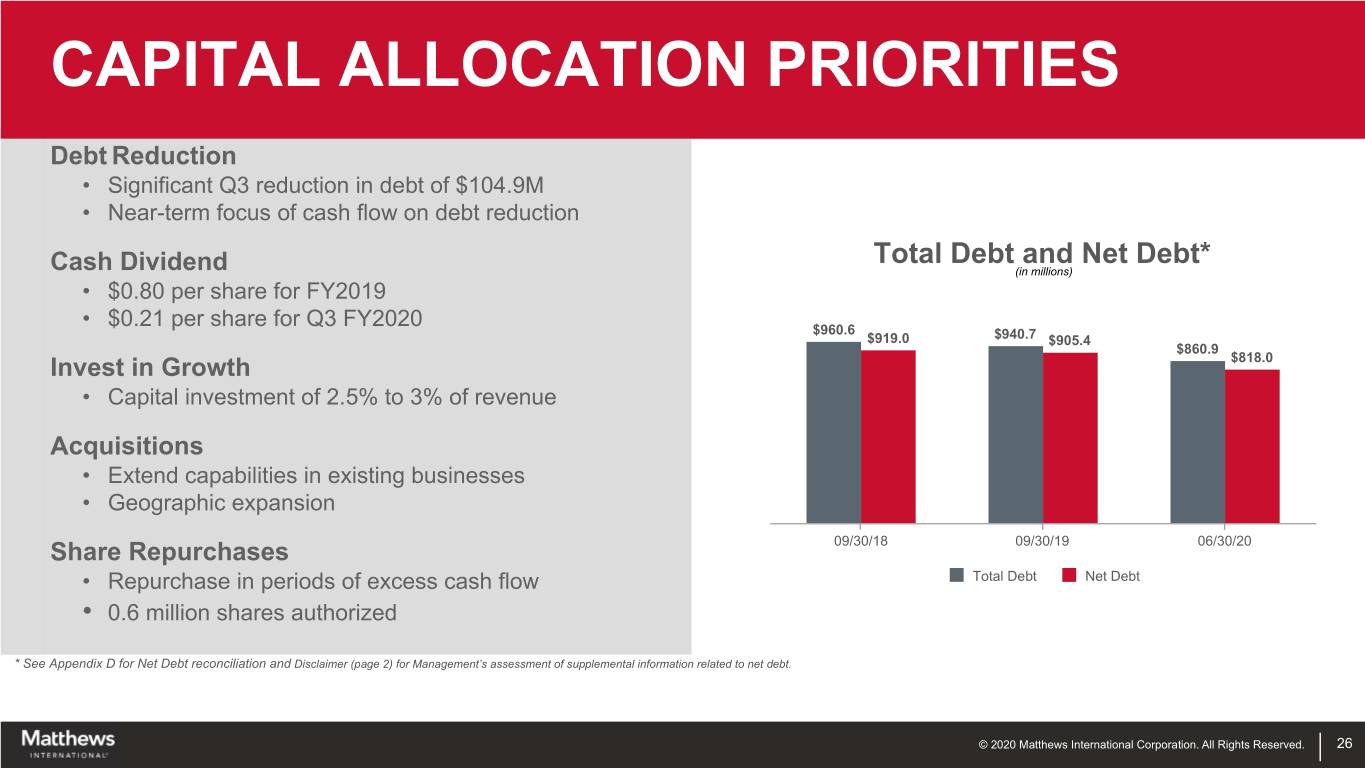

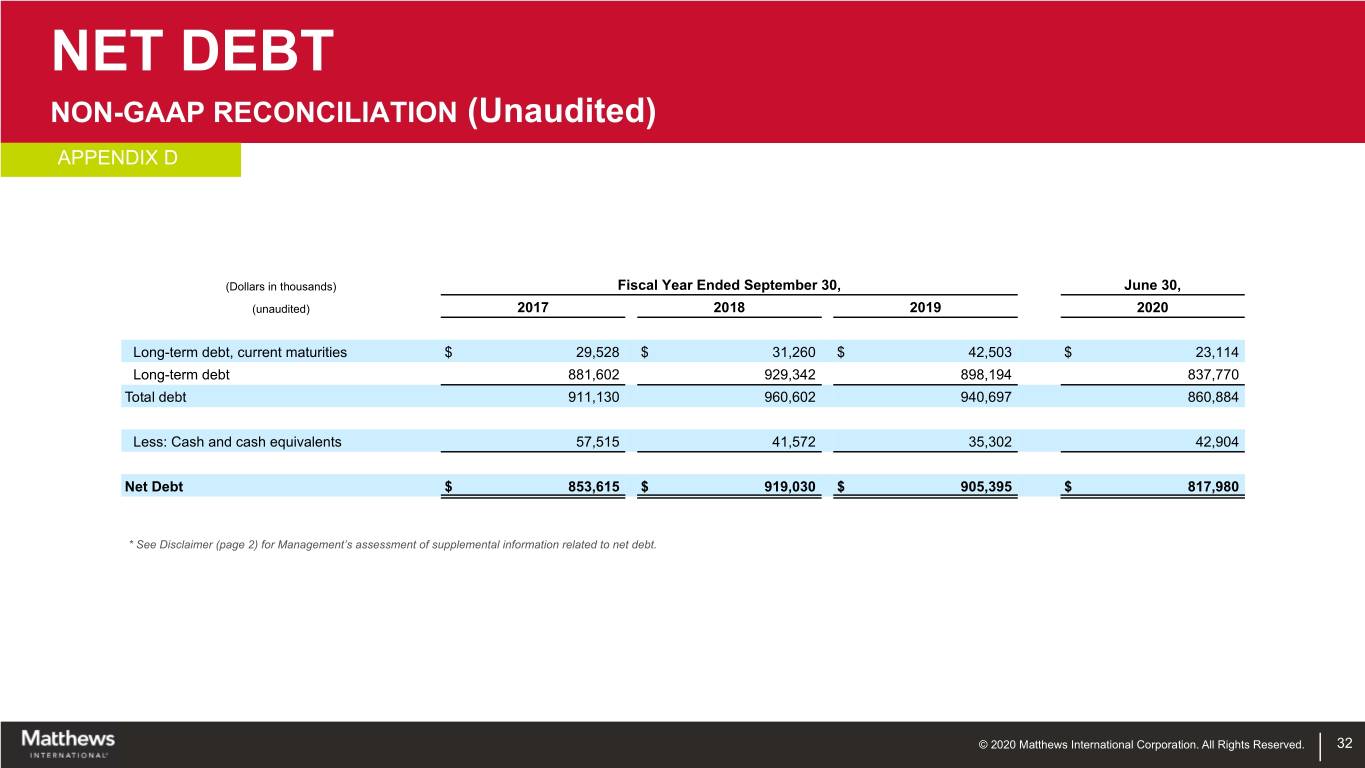

CAPITAL ALLOCATION PRIORITIES Debt Reduction • Significant Q3 reduction in debt of $104.9M • Near-term focus of cash flow on debt reduction Total Debt and Net Debt* Cash Dividend (in millions) • $0.80 per share for FY2019 • $0.21 per share for Q3 FY2020 $960.6 $919.0 $940.7 $905.4 $860.9 Invest in Growth $818.0 • Capital investment of 2.5% to 3% of revenue Acquisitions • Extend capabilities in existing businesses • Geographic expansion Share Repurchases 09/30/18 09/30/19 06/30/20 • Repurchase in periods of excess cash flow Total Debt Net Debt • 0.6 million shares authorized * See Appendix D for Net Debt reconciliation and Disclaimer (page 2) for Management’s assessment of supplemental information related to net debt. © 2020 Matthews International Corporation. All Rights Reserved. 26

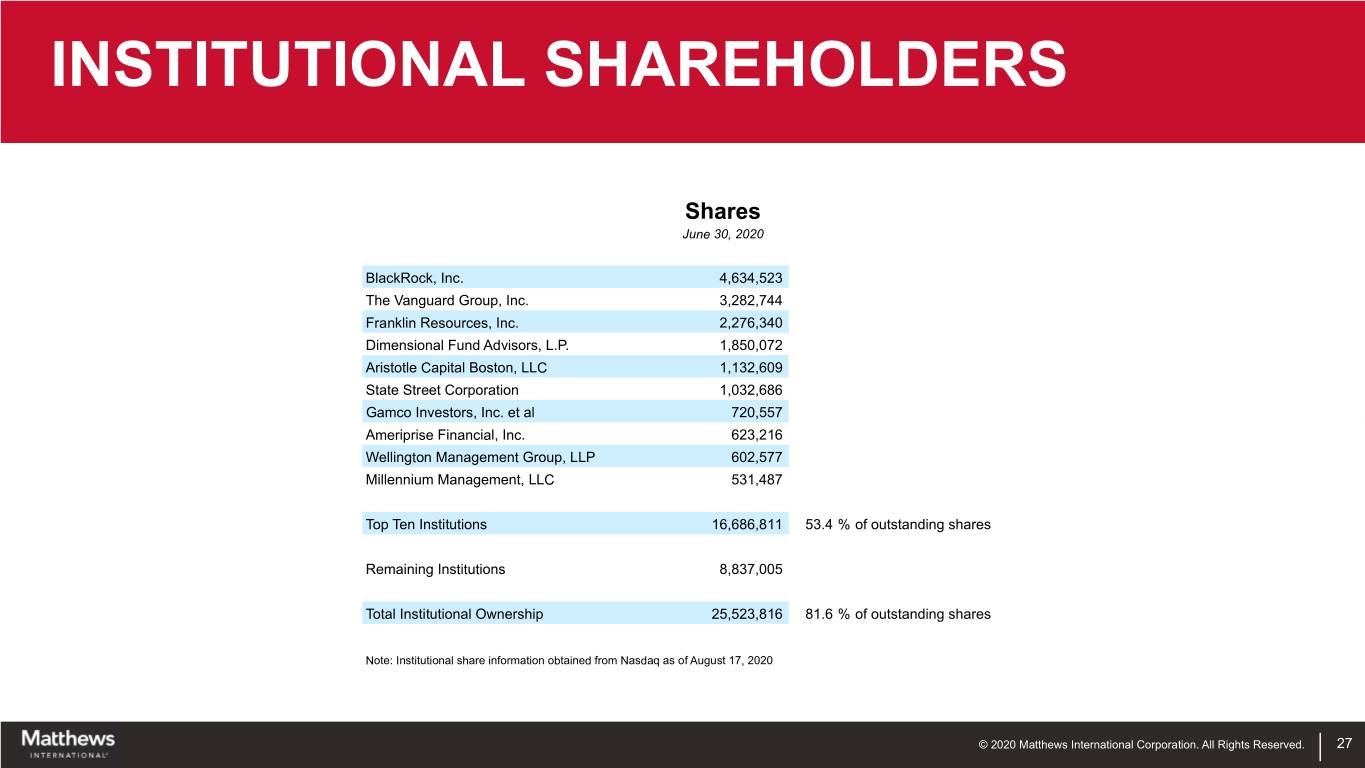

INSTITUTIONAL SHAREHOLDERS Shares June 30, 2020 BlackRock, Inc. 4,634,523 The Vanguard Group, Inc. 3,282,744 Franklin Resources, Inc. 2,276,340 Dimensional Fund Advisors, L.P. 1,850,072 Aristotle Capital Boston, LLC 1,132,609 State Street Corporation 1,032,686 Gamco Investors, Inc. et al 720,557 Ameriprise Financial, Inc. 623,216 Wellington Management Group, LLP 602,577 Millennium Management, LLC 531,487 Top Ten Institutions 16,686,811 53.4 % of outstanding shares Remaining Institutions 8,837,005 Total Institutional Ownership 25,523,816 81.6 % of outstanding shares Note: Institutional share information obtained from Nasdaq as of August 17, 2020 © 2020 Matthews International Corporation. All Rights Reserved. 27

APPENDICES

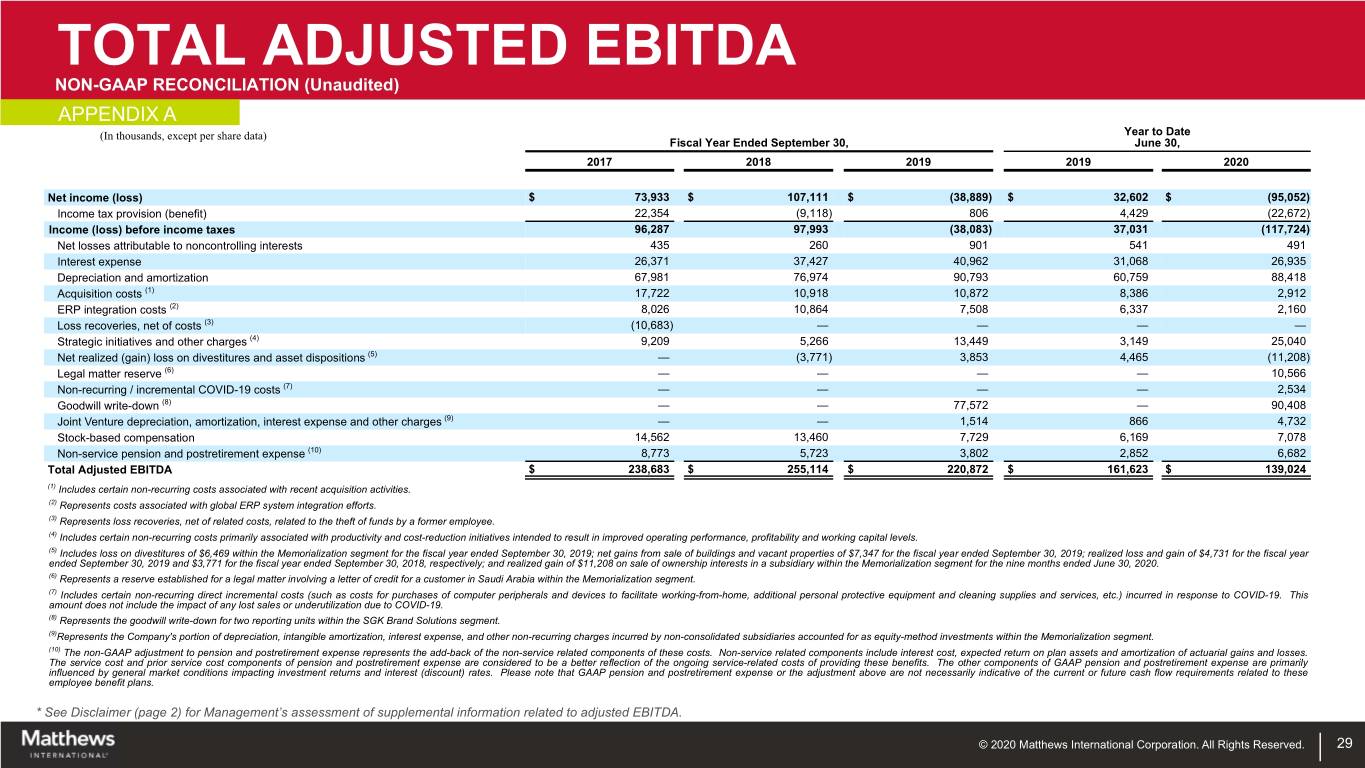

TOTAL ADJUSTED EBITDA NON-GAAP RECONCILIATION (Unaudited) APPENDIX A (In thousands, except per share data) Year to Date Fiscal Year Ended September 30, June 30, 2017 2018 2019 2019 2020 Net income (loss) $ 73,933 $ 107,111 $ (38,889) $ 32,602 $ (95,052) Income tax provision (benefit) 22,354 (9,118) 806 4,429 (22,672) Income (loss) before income taxes 96,287 97,993 (38,083) 37,031 (117,724) Net losses attributable to noncontrolling interests 435 260 901 541 491 Interest expense 26,371 37,427 40,962 31,068 26,935 Depreciation and amortization 67,981 76,974 90,793 60,759 88,418 Acquisition costs (1) 17,722 10,918 10,872 8,386 2,912 ERP integration costs (2) 8,026 10,864 7,508 6,337 2,160 Loss recoveries, net of costs (3) (10,683) — — — — Strategic initiatives and other charges (4) 9,209 5,266 13,449 3,149 25,040 Net realized (gain) loss on divestitures and asset dispositions (5) — (3,771) 3,853 4,465 (11,208) Legal matter reserve (6) — — — — 10,566 Non-recurring / incremental COVID-19 costs (7) — — — — 2,534 Goodwill write-down (8) — — 77,572 — 90,408 Joint Venture depreciation, amortization, interest expense and other charges (9) — — 1,514 866 4,732 Stock-based compensation 14,562 13,460 7,729 6,169 7,078 Non-service pension and postretirement expense (10) 8,773 5,723 3,802 2,852 6,682 Total Adjusted EBITDA $ 238,683 $ 255,114 $ 220,872 $ 161,623 $ 139,024 (1) Includes certain non-recurring costs associated with recent acquisition activities. (2) Represents costs associated with global ERP system integration efforts. (3) Represents loss recoveries, net of related costs, related to the theft of funds by a former employee. (4) Includes certain non-recurring costs primarily associated with productivity and cost-reduction initiatives intended to result in improved operating performance, profitability and working capital levels. (5) Includes loss on divestitures of $6,469 within the Memorialization segment for the fiscal year ended September 30, 2019; net gains from sale of buildings and vacant properties of $7,347 for the fiscal year ended September 30, 2019; realized loss and gain of $4,731 for the fiscal year ended September 30, 2019 and $3,771 for the fiscal year ended September 30, 2018, respectively; and realized gain of $11,208 on sale of ownership interests in a subsidiary within the Memorialization segment for the nine months ended June 30, 2020. (6) Represents a reserve established for a legal matter involving a letter of credit for a customer in Saudi Arabia within the Memorialization segment. (7) Includes certain non-recurring direct incremental costs (such as costs for purchases of computer peripherals and devices to facilitate working-from-home, additional personal protective equipment and cleaning supplies and services, etc.) incurred in response to COVID-19. This amount does not include the impact of any lost sales or underutilization due to COVID-19. (8) Represents the goodwill write-down for two reporting units within the SGK Brand Solutions segment. (9)Represents the Company's portion of depreciation, intangible amortization, interest expense, and other non-recurring charges incurred by non-consolidated subsidiaries accounted for as equity-method investments within the Memorialization segment. (10) The non-GAAP adjustment to pension and postretirement expense represents the add-back of the non-service related components of these costs. Non-service related components include interest cost, expected return on plan assets and amortization of actuarial gains and losses. The service cost and prior service cost components of pension and postretirement expense are considered to be a better reflection of the ongoing service-related costs of providing these benefits. The other components of GAAP pension and postretirement expense are primarily influenced by general market conditions impacting investment returns and interest (discount) rates. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted EBITDA. © 2020 Matthews International Corporation. All Rights Reserved. 29

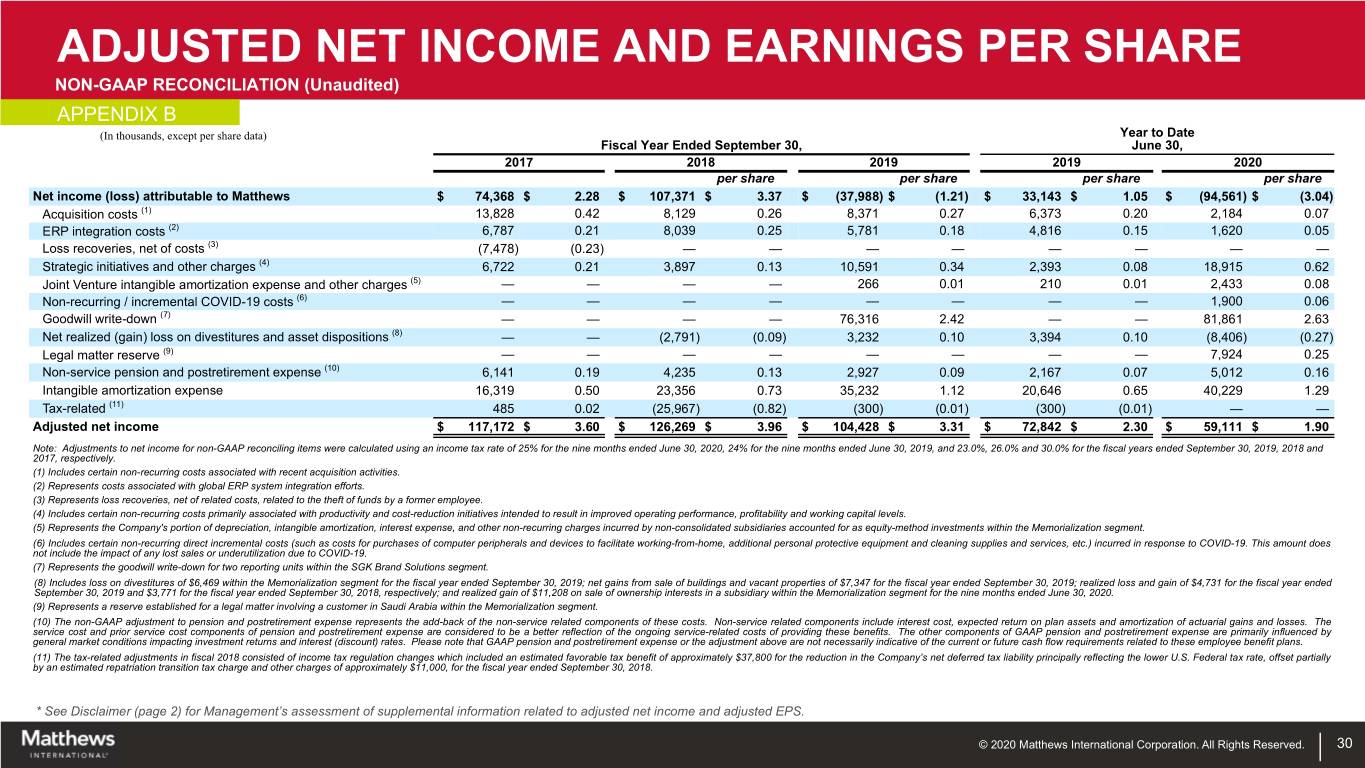

ADJUSTED NET INCOME AND EARNINGS PER SHARE NON-GAAP RECONCILIATION (Unaudited) APPENDIX B (In thousands, except per share data) Year to Date Fiscal Year Ended September 30, June 30, 2017 2018 2019 2019 2020 per share per share per share per share Net income (loss) attributable to Matthews $ 74,368 $ 2.28 $ 107,371 $ 3.37 $ (37,988) $ (1.21) $ 33,143 $ 1.05 $ (94,561) $ (3.04) Acquisition costs (1) 13,828 0.42 8,129 0.26 8,371 0.27 6,373 0.20 2,184 0.07 ERP integration costs (2) 6,787 0.21 8,039 0.25 5,781 0.18 4,816 0.15 1,620 0.05 Loss recoveries, net of costs (3) (7,478) (0.23) — — — — — — — — Strategic initiatives and other charges (4) 6,722 0.21 3,897 0.13 10,591 0.34 2,393 0.08 18,915 0.62 Joint Venture intangible amortization expense and other charges (5) — — — — 266 0.01 210 0.01 2,433 0.08 Non-recurring / incremental COVID-19 costs (6) — — — — — — — — 1,900 0.06 Goodwill write-down (7) — — — — 76,316 2.42 — — 81,861 2.63 Net realized (gain) loss on divestitures and asset dispositions (8) — — (2,791) (0.09) 3,232 0.10 3,394 0.10 (8,406) (0.27) Legal matter reserve (9) — — — — — — — — 7,924 0.25 Non-service pension and postretirement expense (10) 6,141 0.19 4,235 0.13 2,927 0.09 2,167 0.07 5,012 0.16 Intangible amortization expense 16,319 0.50 23,356 0.73 35,232 1.12 20,646 0.65 40,229 1.29 Tax-related (11) 485 0.02 (25,967) (0.82) (300) (0.01) (300) (0.01) — — Adjusted net income $ 117,172 $ 3.60 $ 126,269 $ 3.96 $ 104,428 $ 3.31 $ 72,842 $ 2.30 $ 59,111 $ 1.90 Note: Adjustments to net income for non-GAAP reconciling items were calculated using an income tax rate of 25% for the nine months ended June 30, 2020, 24% for the nine months ended June 30, 2019, and 23.0%, 26.0% and 30.0% for the fiscal years ended September 30, 2019, 2018 and 2017, respectively. (1) Includes certain non-recurring costs associated with recent acquisition activities. (2) Represents costs associated with global ERP system integration efforts. (3) Represents loss recoveries, net of related costs, related to the theft of funds by a former employee. (4) Includes certain non-recurring costs primarily associated with productivity and cost-reduction initiatives intended to result in improved operating performance, profitability and working capital levels. (5) Represents the Company's portion of depreciation, intangible amortization, interest expense, and other non-recurring charges incurred by non-consolidated subsidiaries accounted for as equity-method investments within the Memorialization segment. (6) Includes certain non-recurring direct incremental costs (such as costs for purchases of computer peripherals and devices to facilitate working-from-home, additional personal protective equipment and cleaning supplies and services, etc.) incurred in response to COVID-19. This amount does not include the impact of any lost sales or underutilization due to COVID-19. (7) Represents the goodwill write-down for two reporting units within the SGK Brand Solutions segment. (8) Includes loss on divestitures of $6,469 within the Memorialization segment for the fiscal year ended September 30, 2019; net gains from sale of buildings and vacant properties of $7,347 for the fiscal year ended September 30, 2019; realized loss and gain of $4,731 for the fiscal year ended September 30, 2019 and $3,771 for the fiscal year ended September 30, 2018, respectively; and realized gain of $11,208 on sale of ownership interests in a subsidiary within the Memorialization segment for the nine months ended June 30, 2020. (9) Represents a reserve established for a legal matter involving a customer in Saudi Arabia within the Memorialization segment. (10) The non-GAAP adjustment to pension and postretirement expense represents the add-back of the non-service related components of these costs. Non-service related components include interest cost, expected return on plan assets and amortization of actuarial gains and losses. The service cost and prior service cost components of pension and postretirement expense are considered to be a better reflection of the ongoing service-related costs of providing these benefits. The other components of GAAP pension and postretirement expense are primarily influenced by general market conditions impacting investment returns and interest (discount) rates. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. (11) The tax-related adjustments in fiscal 2018 consisted of income tax regulation changes which included an estimated favorable tax benefit of approximately $37,800 for the reduction in the Company’s net deferred tax liability principally reflecting the lower U.S. Federal tax rate, offset partially by an estimated repatriation transition tax charge and other charges of approximately $11,000, for the fiscal year ended September 30, 2018. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted net income and adjusted EPS. © 2020 Matthews International Corporation. All Rights Reserved. 30

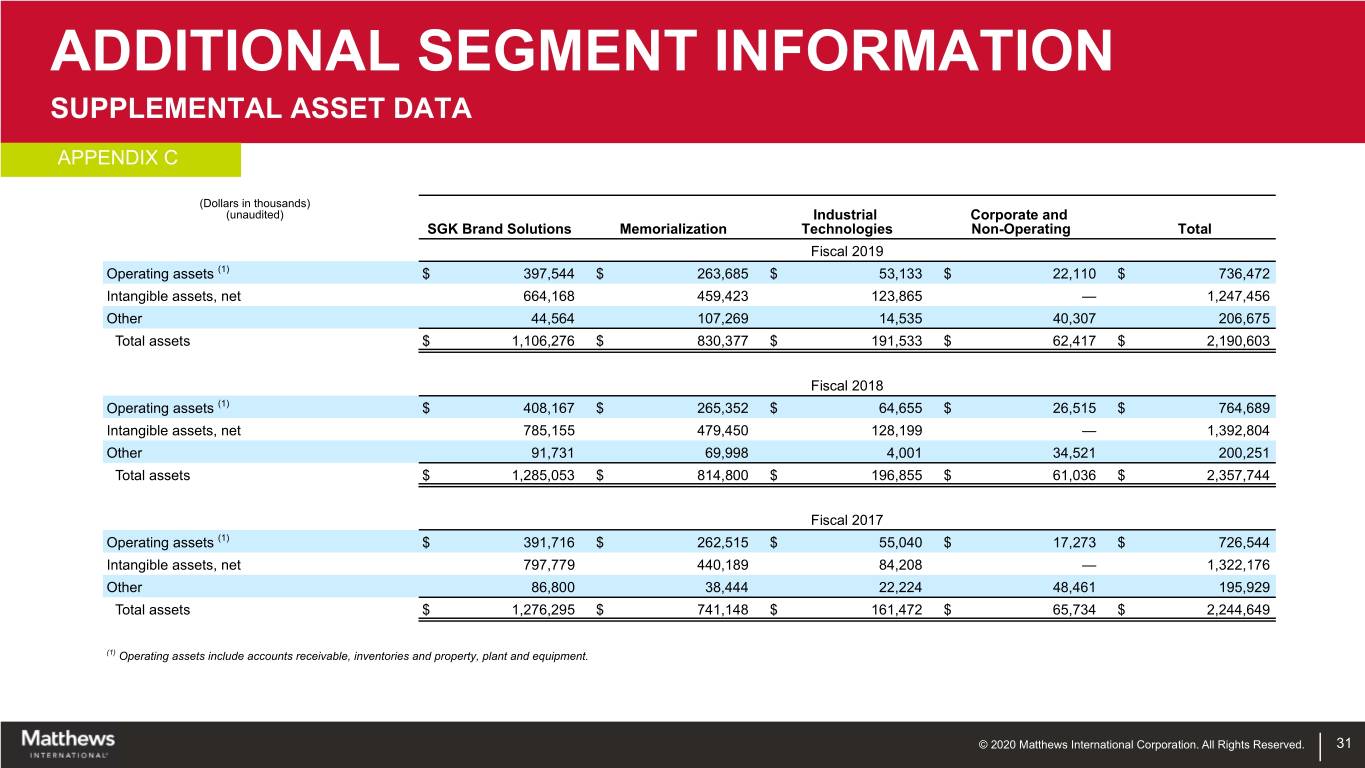

ADDITIONAL SEGMENT INFORMATION SUPPLEMENTAL ASSET DATA APPENDIX C (Dollars in thousands) (unaudited) Industrial Corporate and SGK Brand Solutions Memorialization Technologies Non-Operating Total Fiscal 2019 Operating assets (1) $ 397,544 $ 263,685 $ 53,133 $ 22,110 $ 736,472 Intangible assets, net 664,168 459,423 123,865 — 1,247,456 Other 44,564 107,269 14,535 40,307 206,675 Total assets $ 1,106,276 $ 830,377 $ 191,533 $ 62,417 $ 2,190,603 Fiscal 2018 Operating assets (1) $ 408,167 $ 265,352 $ 64,655 $ 26,515 $ 764,689 Intangible assets, net 785,155 479,450 128,199 — 1,392,804 Other 91,731 69,998 4,001 34,521 200,251 Total assets $ 1,285,053 $ 814,800 $ 196,855 $ 61,036 $ 2,357,744 Fiscal 2017 Operating assets (1) $ 391,716 $ 262,515 $ 55,040 $ 17,273 $ 726,544 Intangible assets, net 797,779 440,189 84,208 — 1,322,176 Other 86,800 38,444 22,224 48,461 195,929 Total assets $ 1,276,295 $ 741,148 $ 161,472 $ 65,734 $ 2,244,649 (1) Operating assets include accounts receivable, inventories and property, plant and equipment. © 2020 Matthews International Corporation. All Rights Reserved. 31

NET DEBT NON-GAAP RECONCILIATION (Unaudited) APPENDIX D (Dollars in thousands) Fiscal Year Ended September 30, June 30, (unaudited) 2017 2018 2019 2020 Long-term debt, current maturities $ 29,528 $ 31,260 $ 42,503 $ 23,114 Long-term debt 881,602 929,342 898,194 837,770 Total debt 911,130 960,602 940,697 860,884 Less: Cash and cash equivalents 57,515 41,572 35,302 42,904 Net Debt $ 853,615 $ 919,030 $ 905,395 $ 817,980 * See Disclaimer (page 2) for Management’s assessment of supplemental information related to net debt. © 2020 Matthews International Corporation. All Rights Reserved. 32

Proprietary and confidential. © 2020 Matthews International Corporation. All rights reserved. No part of this document may be reproduced or utilized in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage or retrieval systems, without permission in writing from Matthews International Corporation. This document is intended only for the use of the individual or entity to whom it is addressed and contains information that is privileged, confidential or otherwise exempt from disclosure under applicable law. All recipients of this document are notified that the information contained herein includes proprietary and confidential information of Matthews International Corporation and recipient may not make use of, disseminate, or in any way disclose this document or any of the enclosed information to any person other than employees of addressee to the extent necessary for consultations with authorized personnel of Matthews International Corporation.