www.matw.com | Nasdaq: MATW Fourth Quarter Fiscal 2022 Earnings Teleconference November 18, 2022 Joseph C. Bartolacci President and Chief Executive Officer Steven F. Nicola Chief Financial Officer

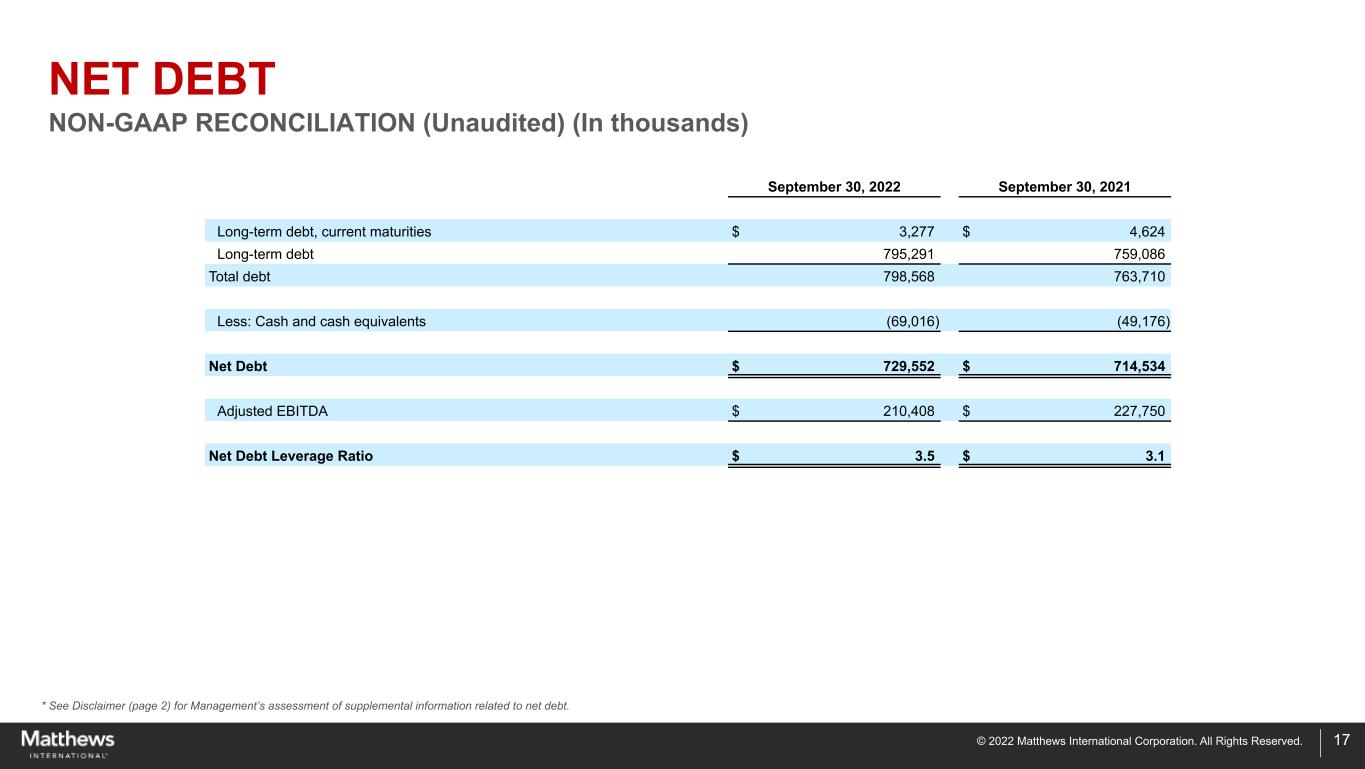

© 2022 Matthews International Corporation. All Rights Reserved. DISCLAIMER 2 Any forward-looking statements contained in this presentation are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from management’s expectations. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove correct. Factors that could cause the Company's results to differ materially from the results discussed in such forward-looking statements principally include changes in domestic or international economic conditions, changes in foreign currency exchange rates, changes in interest rates, changes in the cost of materials used in the manufacture of the Company's products, changes in mortality and cremation rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company operates, or other factors such as supply chain disruptions, labor shortages or labor cost increases, changes in product demand or pricing as a result of domestic or international competitive pressures, ability to achieve cost-reduction objectives, unknown risks in connection with the Company's acquisitions, cybersecurity concerns, effectiveness of the Company's internal controls, compliance with domestic and foreign laws and regulations, technological factors beyond the Company's control, impact of pandemics or similar outbreaks, or other disruptions to our industries, customers, or supply chains, the impact of global conflicts, such as the current war between Russia and Ukraine, and other factors described in the Company’s Annual Report on Form 10-K and other periodic filings with the U.S. Securities and Exchange Commission ("SEC"). Included in this report are measures of financial performance that are not defined by GAAP, including, without limitation, constant currency sales, adjusted EBITDA, adjusted net income and EPS, net debt and net debt leverage ratio. The Company defines net debt leverage ratio as outstanding debt (net of cash) relative to adjusted EBITDA. The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Constant currency sales removes the impact of changes due to foreign exchange. To calculate sales on a constant currency basis, sales for periods in the current fiscal year are translated into U.S. dollars using exchange rates applicable to the comparable periods of the prior fiscal year. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company's core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company's calculations of its non-GAAP financial measures, however, may not be comparable to similarly titled measures reported by other companies. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provide investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. The Company has presented constant currency sales and believes this measure provides relevant and useful information, which is used by the Company's management in assessing the performance of its business on a consistent basis by removing the impact of changes due to foreign exchange. This measure allows management, as well as investors, to assess the Company’s sales on a constant currency basis. The Company believes that adjusted EBITDA provides relevant and useful information, which is used by the Company’s management in assessing the performance of its business. Adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management’s evaluation of its operating results. These items include stock-based compensation, the non-service portion of pension and postretirement expense, acquisition costs, ERP integration costs, and strategic initiatives and other charges. Adjusted EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income taxes, and the effects of certain acquisition and ERP integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating operating performance. It is also useful as a financial measure for lenders and is used by the Company’s management to measure business performance. Adjusted EBITDA is not a measure of the Company's financial performance under GAAP and should not be considered as an alternative to net income or other performance measures derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the Company's liquidity. The Company's definition of adjusted EBITDA may not be comparable to similarly titled measures used by other companies. The Company has also presented adjusted net income and adjusted earnings per share and believes each measure provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in assessing the performance of its business. Adjusted net income and adjusted earnings per share provides the Company with an understanding of the results from the primary operations of our business by excluding the effects of certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of our operations. These measures provide management with insight into the earning value for shareholders excluding certain costs, not related to the Company’s primary operations. Likewise, these measures may be useful to an investor in evaluating the underlying operating performance of the Company’s business overall, as well as performance trends, on a consistent basis. Lastly, the Company has presented net debt and a net debt leverage ratio and believes each measure provides relevant and useful information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the indebtedness of the Company, net of cash and cash equivalents and relative to adjusted EBITDA. These measures allow management, as well as analysts and investors, to assess the Company’s leverage.

BUSINESS OVERVIEW

© 2022 Matthews International Corporation. All Rights Reserved. 4 SGK BRAND SOLUTIONS MEMORIALIZATION INDUSTRIAL TECHNOLOGIES • Strong top line performance, particularly in cemetery and US cremation-related products • Increased pricing to mitigate the effects of inflation • Higher material costs and increased labor and freight costs • Challenged by unfavorable currency and weakened economic conditions in Europe • Continued high year-to-date growth in energy storage solutions business • Strong warehouse and product identification order rates and backlog BUSINESS UPDATE

© 2022 Matthews International Corporation. All Rights Reserved. Key Drivers • Consolidated sales growth • Growth in Industrial Technologies; strong backlogs in many of our businesses, particularly energy storage solutions • SGK Brand Solutions impacted by weakened global economic conditions, including currency rate changes • Benefits from cost reduction initiatives in fiscal 2022 • Company expects fiscal 2023 adjusted EBITDA in the range of $215 million to $235 million OUTLOOK FOR FISCAL 2023 5

FINANCIAL OVERVIEW

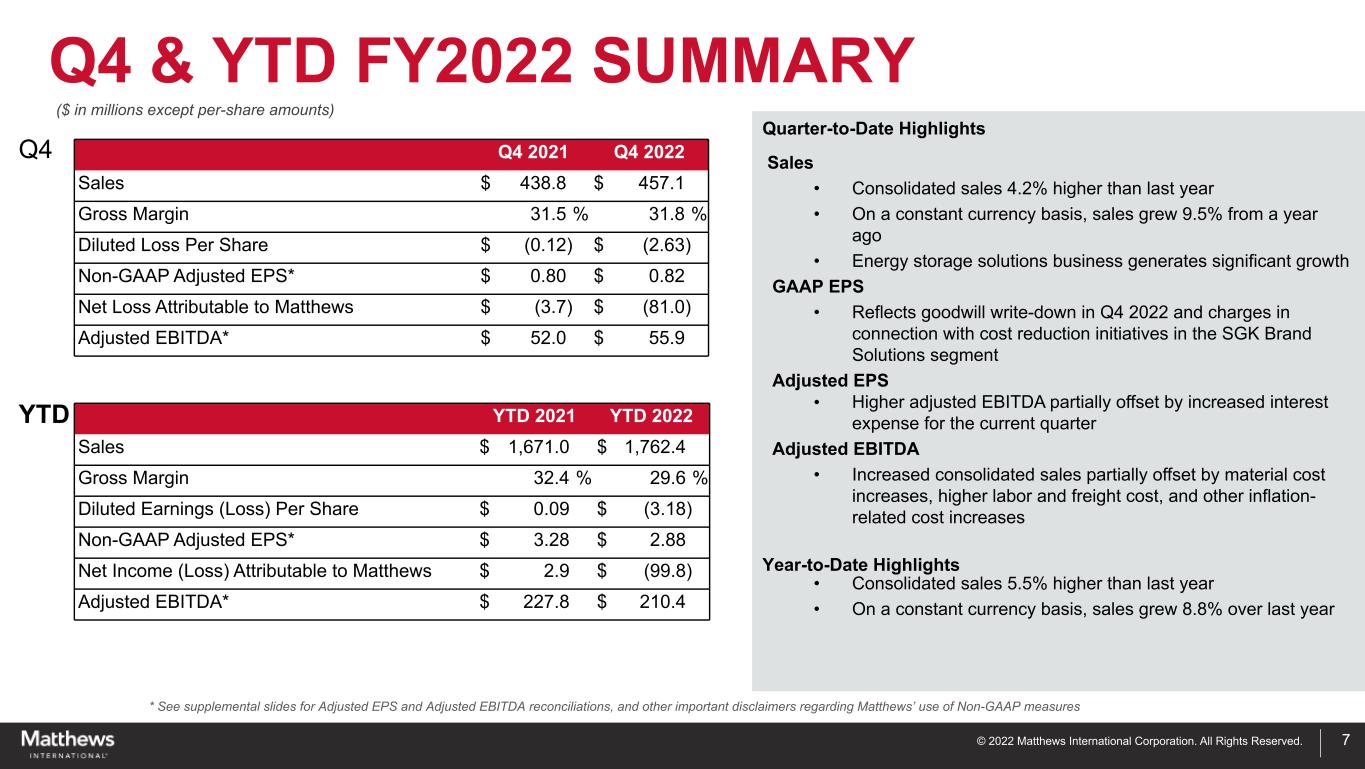

© 2022 Matthews International Corporation. All Rights Reserved. Q4 & YTD FY2022 SUMMARY * See supplemental slides for Adjusted EPS and Adjusted EBITDA reconciliations, and other important disclaimers regarding Matthews’ use of Non-GAAP measures Quarter-to-Date Highlights Sales • Consolidated sales 4.2% higher than last year • On a constant currency basis, sales grew 9.5% from a year ago • Energy storage solutions business generates significant growth GAAP EPS • Reflects goodwill write-down in Q4 2022 and charges in connection with cost reduction initiatives in the SGK Brand Solutions segment Adjusted EPS • Higher adjusted EBITDA partially offset by increased interest expense for the current quarter Adjusted EBITDA • Increased consolidated sales partially offset by material cost increases, higher labor and freight cost, and other inflation- related cost increases Year-to-Date Highlights • Consolidated sales 5.5% higher than last year • On a constant currency basis, sales grew 8.8% over last year 7 Q4 2021 Q4 2022 Sales $ 438.8 $ 457.1 Gross Margin 31.5 % 31.8 % Diluted Loss Per Share $ (0.12) $ (2.63) Non-GAAP Adjusted EPS* $ 0.80 $ 0.82 Net Loss Attributable to Matthews $ (3.7) $ (81.0) Adjusted EBITDA* $ 52.0 $ 55.9 ($ in millions except per-share amounts) Q4 YTD YTD 2021 YTD 2022 Sales $ 1,671.0 $ 1,762.4 Gross Margin 32.4 % 29.6 % Diluted Earnings (Loss) Per Share $ 0.09 $ (3.18) Non-GAAP Adjusted EPS* $ 3.28 $ 2.88 Net Income (Loss) Attributable to Matthews $ 2.9 $ (99.8) Adjusted EBITDA* $ 227.8 $ 210.4

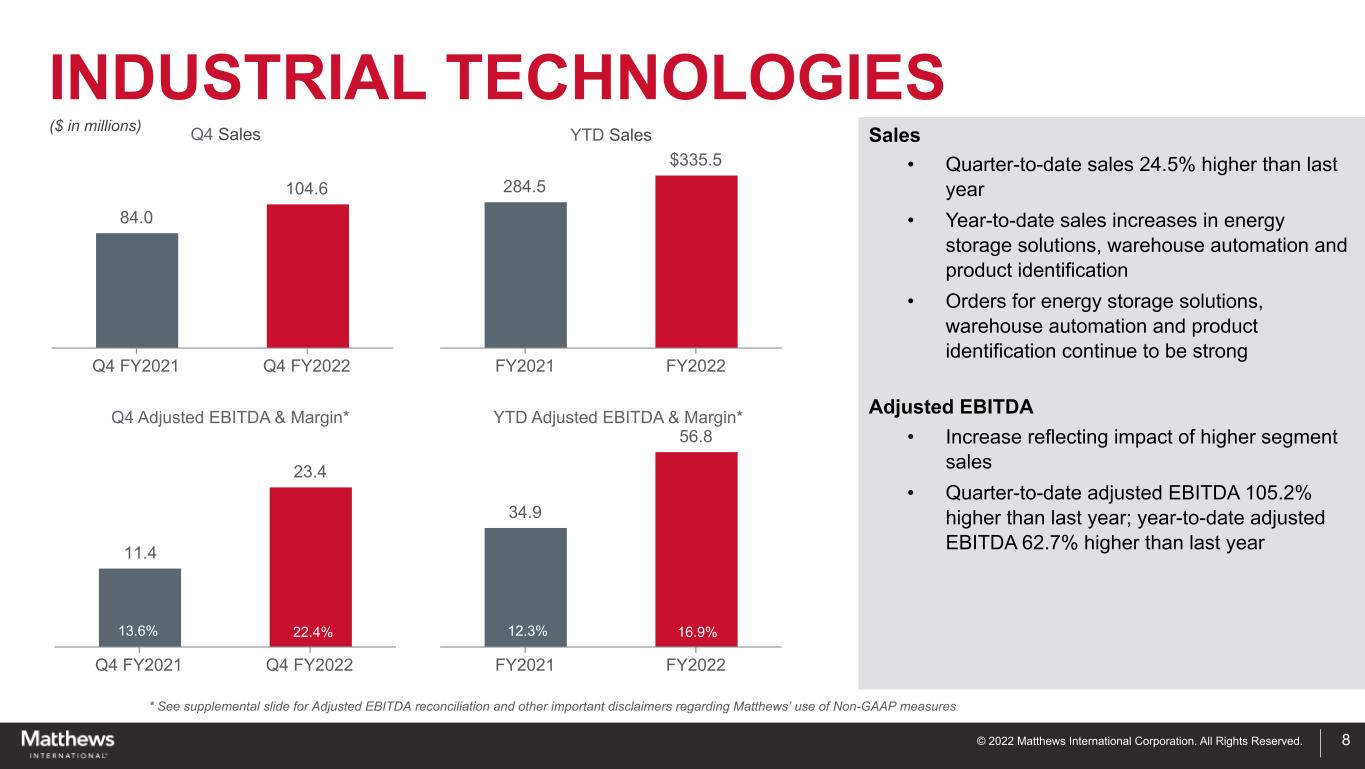

© 2022 Matthews International Corporation. All Rights Reserved. INDUSTRIAL TECHNOLOGIES * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures 8 15.5% 12.4% 15.6%10.3% Sales • Quarter-to-date sales 24.5% higher than last year • Year-to-date sales increases in energy storage solutions, warehouse automation and product identification • Orders for energy storage solutions, warehouse automation and product identification continue to be strong Adjusted EBITDA • Increase reflecting impact of higher segment sales • Quarter-to-date adjusted EBITDA 105.2% higher than last year; year-to-date adjusted EBITDA 62.7% higher than last year ($ in millions) 84.0 104.6 Q4 FY2021 Q4 FY2022 284.5 $335.5 FY2021 FY2022 11.4 23.4 Q4 FY2021 Q4 FY2022 34.9 56.8 FY2021 FY2022 13.6% 22.4% 12.3% 16.9% Q4 Sales Q4 Adjusted EBITDA & Margin* YTD Sales YTD Adjusted EBITDA & Margin*

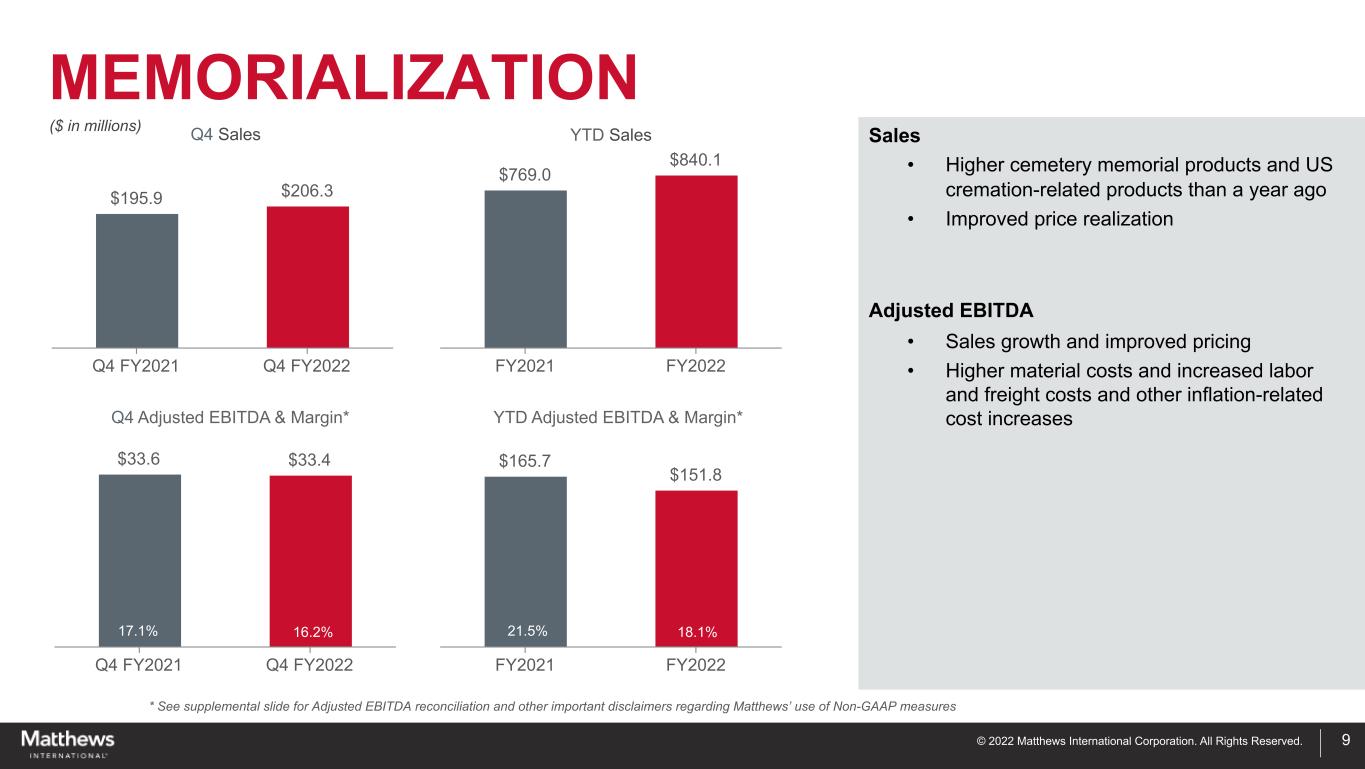

© 2022 Matthews International Corporation. All Rights Reserved. MEMORIALIZATION * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures 9 23.0% 21.1% $195.9 $206.3 Q4 FY2021 Q4 FY2022 $769.0 $840.1 FY2021 FY2022 $33.6 $33.4 Q4 FY2021 Q4 FY2022 $165.7 $151.8 FY2021 FY2022 Sales • Higher cemetery memorial products and US cremation-related products than a year ago • Improved price realization Adjusted EBITDA • Sales growth and improved pricing • Higher material costs and increased labor and freight costs and other inflation-related cost increases 17.1% 16.2% 21.5% 18.1% ($ in millions) Q4 Sales Q4 Adjusted EBITDA & Margin* YTD Sales YTD Adjusted EBITDA & Margin*

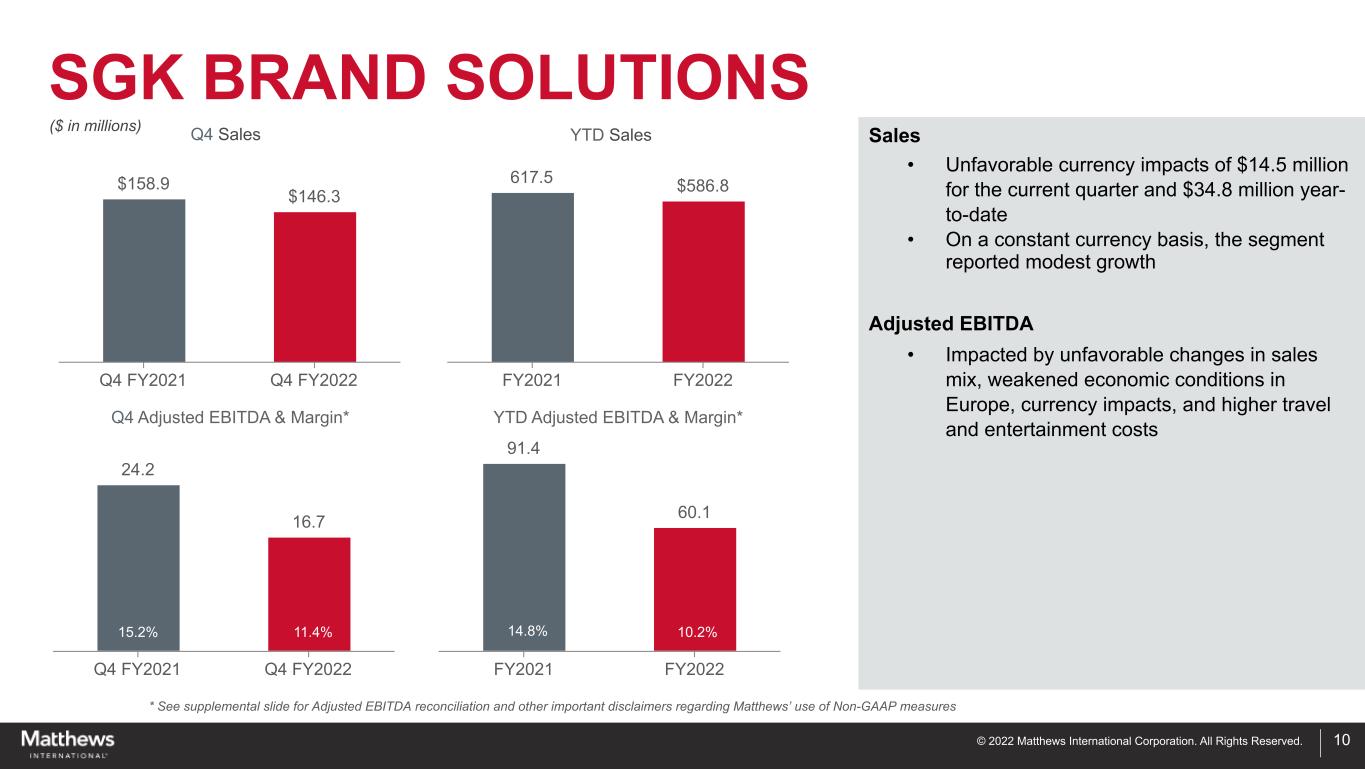

© 2022 Matthews International Corporation. All Rights Reserved. SGK BRAND SOLUTIONS Sales • Unfavorable currency impacts of $14.5 million for the current quarter and $34.8 million year- to-date • On a constant currency basis, the segment reported modest growth Adjusted EBITDA • Impacted by unfavorable changes in sales mix, weakened economic conditions in Europe, currency impacts, and higher travel and entertainment costs ($ in millions) * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures 10 15.4% 12.9% $158.9 $146.3 Q4 FY2021 Q4 FY2022 617.5 $586.8 FY2021 FY2022 24.2 16.7 Q4 FY2021 Q4 FY2022 91.4 60.1 FY2021 FY2022 11.4%15.2% 14.8% 10.2% Q4 Sales Q4 Adjusted EBITDA & Margin* YTD Sales YTD Adjusted EBITDA & Margin*

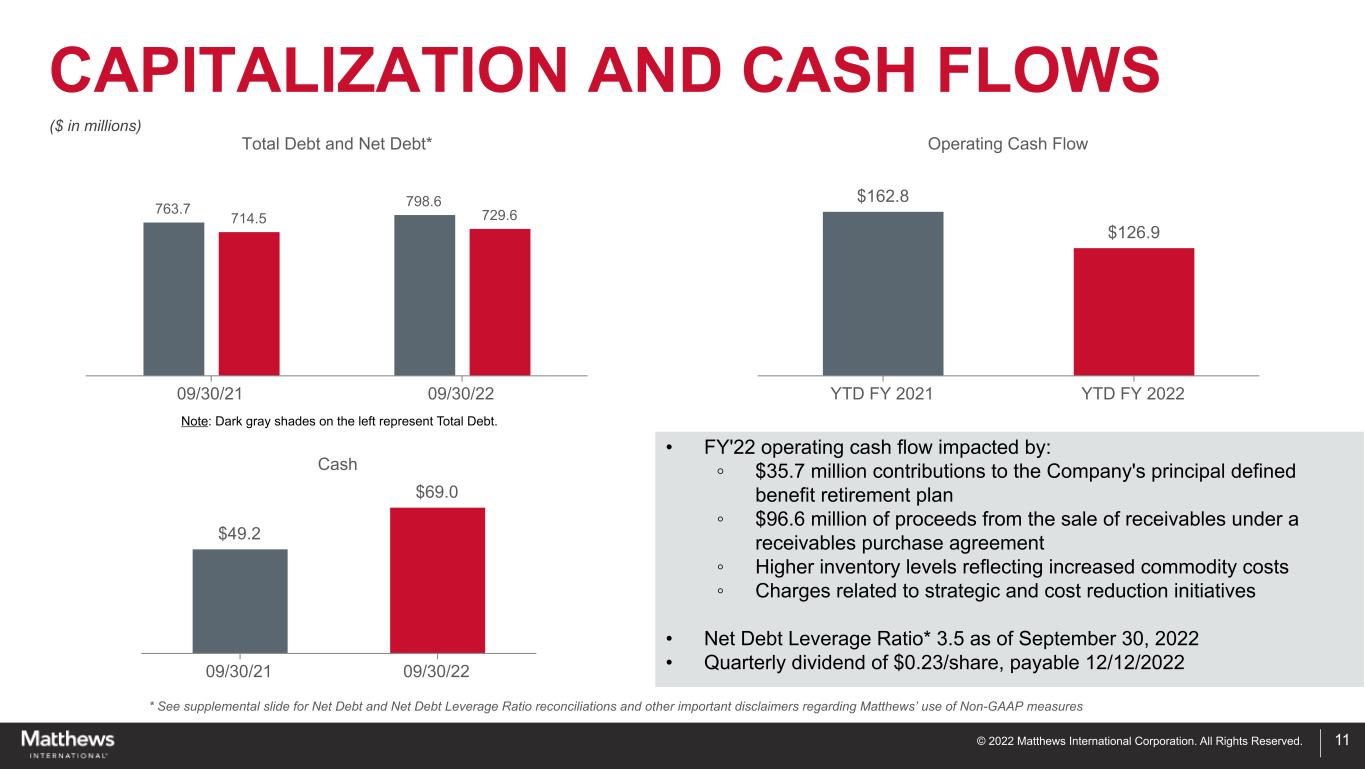

© 2022 Matthews International Corporation. All Rights Reserved. • FY'22 operating cash flow impacted by: ◦ $35.7 million contributions to the Company's principal defined benefit retirement plan ◦ $96.6 million of proceeds from the sale of receivables under a receivables purchase agreement ◦ Higher inventory levels reflecting increased commodity costs ◦ Charges related to strategic and cost reduction initiatives • Net Debt Leverage Ratio* 3.5 as of September 30, 2022 • Quarterly dividend of $0.23/share, payable 12/12/2022 CAPITALIZATION AND CASH FLOWS 11 * See supplemental slide for Net Debt and Net Debt Leverage Ratio reconciliations and other important disclaimers regarding Matthews’ use of Non-GAAP measures Note: Dark gray shades on the left represent Total Debt. Total Debt and Net Debt* 763.7 798.6 714.5 729.6 09/30/21 09/30/22 ($ in millions) Operating Cash Flow $162.8 $126.9 YTD FY 2021 YTD FY 2022 Cash $49.2 $69.0 09/30/21 09/30/22

SUPPLEMENTAL INFORMATION

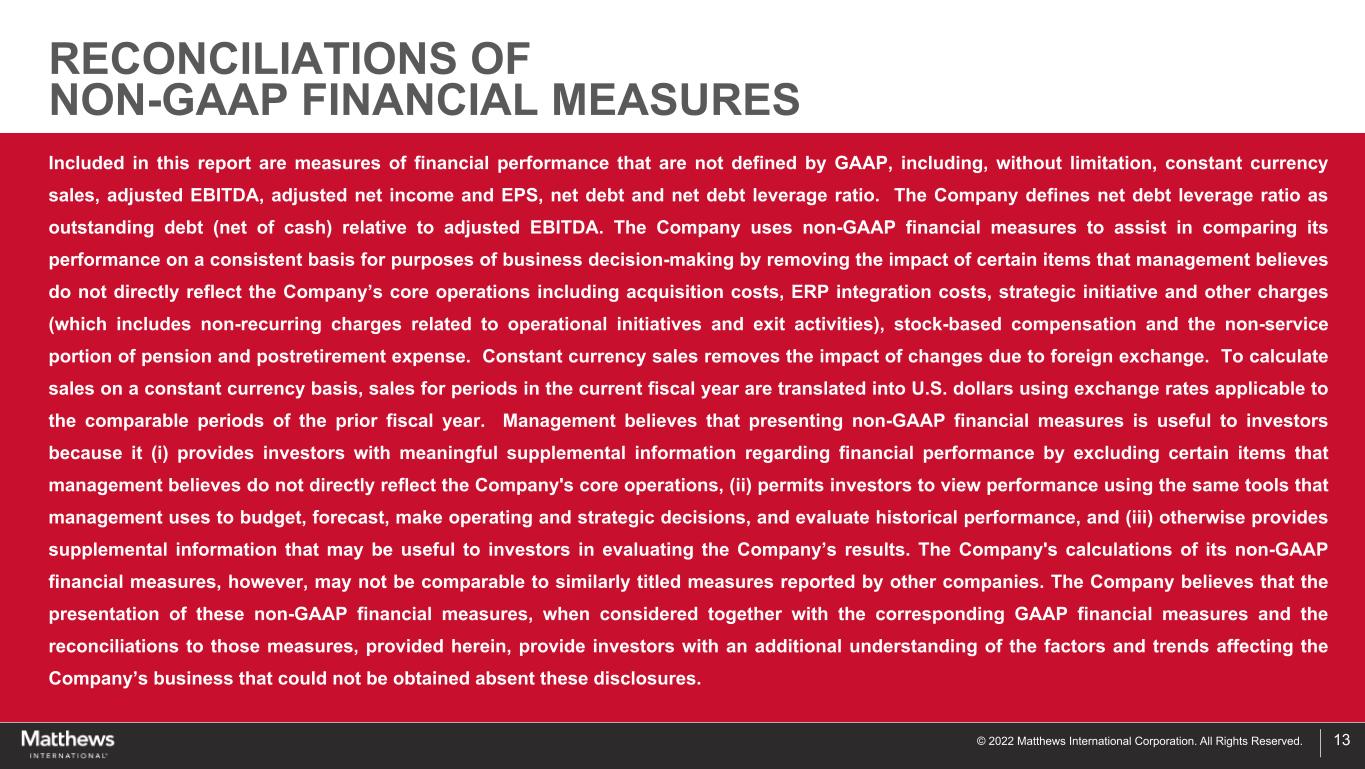

© 2022 Matthews International Corporation. All Rights Reserved. 13 Included in this report are measures of financial performance that are not defined by GAAP, including, without limitation, constant currency sales, adjusted EBITDA, adjusted net income and EPS, net debt and net debt leverage ratio. The Company defines net debt leverage ratio as outstanding debt (net of cash) relative to adjusted EBITDA. The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Constant currency sales removes the impact of changes due to foreign exchange. To calculate sales on a constant currency basis, sales for periods in the current fiscal year are translated into U.S. dollars using exchange rates applicable to the comparable periods of the prior fiscal year. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company's core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company's calculations of its non-GAAP financial measures, however, may not be comparable to similarly titled measures reported by other companies. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provide investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

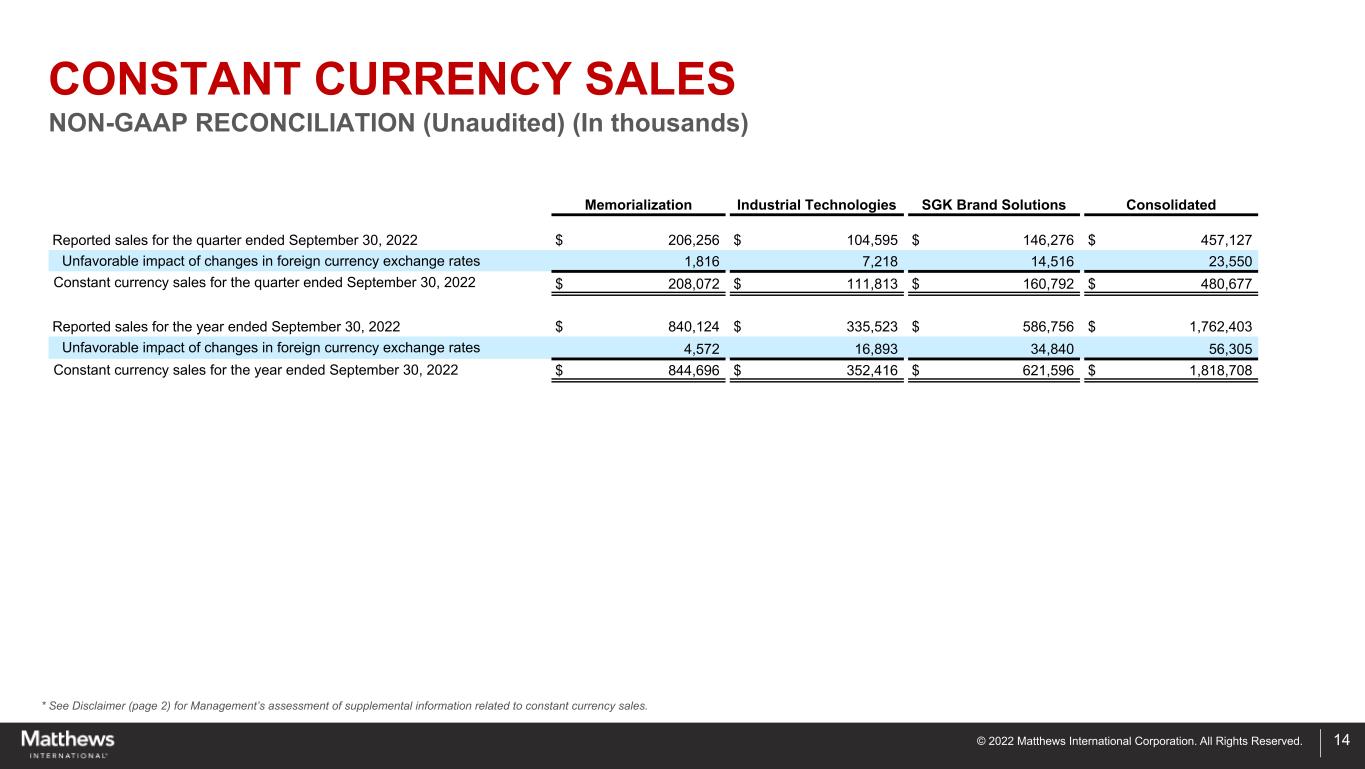

© 2022 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to constant currency sales. 14 CONSTANT CURRENCY SALES NON-GAAP RECONCILIATION (Unaudited) (In thousands) Memorialization Industrial Technologies SGK Brand Solutions Consolidated Reported sales for the quarter ended September 30, 2022 $ 206,256 $ 104,595 $ 146,276 $ 457,127 Unfavorable impact of changes in foreign currency exchange rates 1,816 7,218 14,516 23,550 Constant currency sales for the quarter ended September 30, 2022 $ 208,072 $ 111,813 $ 160,792 $ 480,677 Reported sales for the year ended September 30, 2022 $ 840,124 $ 335,523 $ 586,756 $ 1,762,403 Unfavorable impact of changes in foreign currency exchange rates 4,572 16,893 34,840 56,305 Constant currency sales for the year ended September 30, 2022 $ 844,696 $ 352,416 $ 621,596 $ 1,818,708

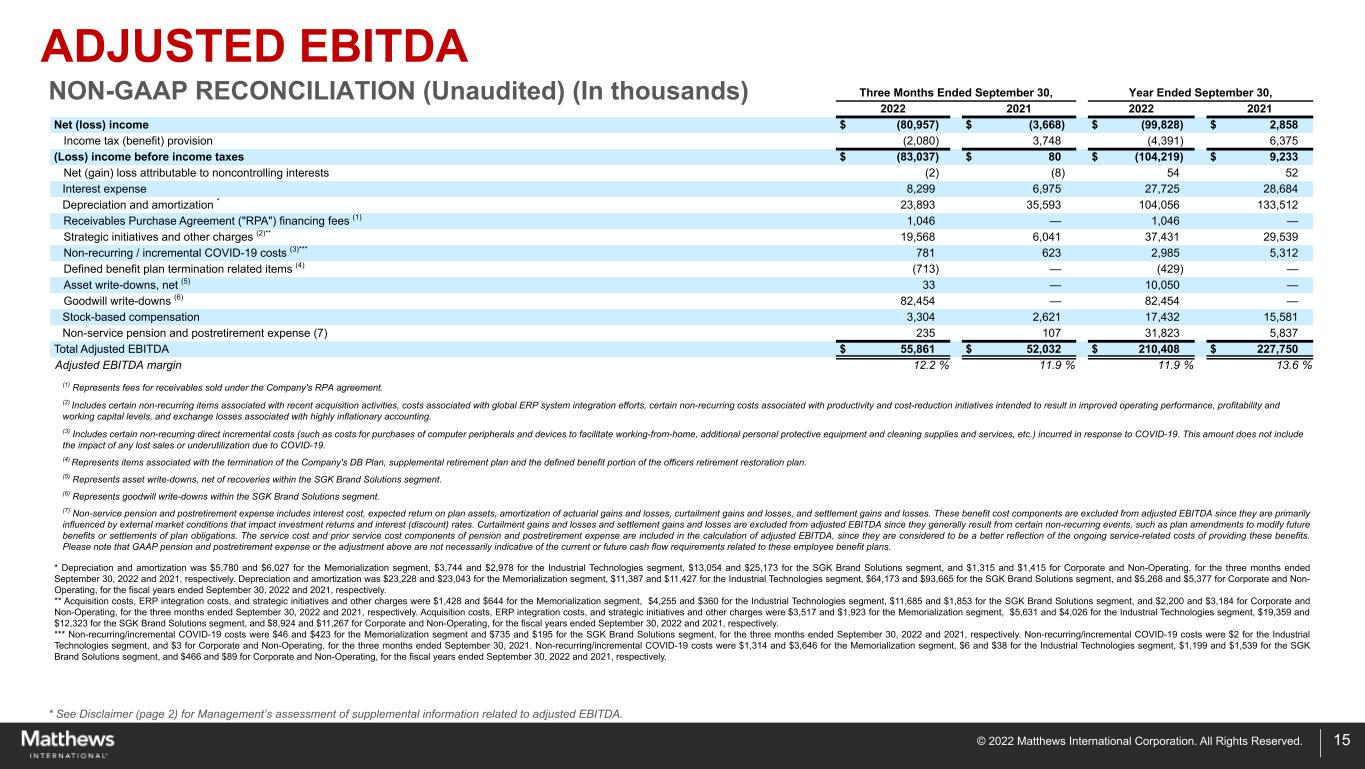

© 2022 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted EBITDA. 15 Three Months Ended September 30, Year Ended September 30, 2022 2021 2022 2021 Net (loss) income $ (80,957) $ (3,668) $ (99,828) $ 2,858 Income tax (benefit) provision (2,080) 3,748 (4,391) 6,375 (Loss) income before income taxes $ (83,037) $ 80 $ (104,219) $ 9,233 Net (gain) loss attributable to noncontrolling interests (2) (8) 54 52 Interest expense 8,299 6,975 27,725 28,684 Depreciation and amortization * 23,893 35,593 104,056 133,512 Receivables Purchase Agreement ("RPA") financing fees (1) 1,046 — 1,046 — Strategic initiatives and other charges (2)** 19,568 6,041 37,431 29,539 Non-recurring / incremental COVID-19 costs (3)*** 781 623 2,985 5,312 Defined benefit plan termination related items (4) (713) — (429) — Asset write-downs, net (5) 33 — 10,050 — Goodwill write-downs (6) 82,454 — 82,454 — Stock-based compensation 3,304 2,621 17,432 15,581 Non-service pension and postretirement expense (7) 235 107 31,823 5,837 Total Adjusted EBITDA $ 55,861 $ 52,032 $ 210,408 $ 227,750 Adjusted EBITDA margin 12.2 % 11.9 % 11.9 % 13.6 % (1) Represents fees for receivables sold under the Company's RPA agreement. (2) Includes certain non-recurring items associated with recent acquisition activities, costs associated with global ERP system integration efforts, certain non-recurring costs associated with productivity and cost-reduction initiatives intended to result in improved operating performance, profitability and working capital levels, and exchange losses associated with highly inflationary accounting. (3) Includes certain non-recurring direct incremental costs (such as costs for purchases of computer peripherals and devices to facilitate working-from-home, additional personal protective equipment and cleaning supplies and services, etc.) incurred in response to COVID-19. This amount does not include the impact of any lost sales or underutilization due to COVID-19. (4) Represents items associated with the termination of the Company's DB Plan, supplemental retirement plan and the defined benefit portion of the officers retirement restoration plan. (5) Represents asset write-downs, net of recoveries within the SGK Brand Solutions segment. (6) Represents goodwill write-downs within the SGK Brand Solutions segment. (7) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. * Depreciation and amortization was $5,780 and $6,027 for the Memorialization segment, $3,744 and $2,978 for the Industrial Technologies segment, $13,054 and $25,173 for the SGK Brand Solutions segment, and $1,315 and $1,415 for Corporate and Non-Operating, for the three months ended September 30, 2022 and 2021, respectively. Depreciation and amortization was $23,228 and $23,043 for the Memorialization segment, $11,387 and $11,427 for the Industrial Technologies segment, $64,173 and $93,665 for the SGK Brand Solutions segment, and $5,268 and $5,377 for Corporate and Non- Operating, for the fiscal years ended September 30, 2022 and 2021, respectively. ** Acquisition costs, ERP integration costs, and strategic initiatives and other charges were $1,428 and $644 for the Memorialization segment, $4,255 and $360 for the Industrial Technologies segment, $11,685 and $1,853 for the SGK Brand Solutions segment, and $2,200 and $3,184 for Corporate and Non-Operating, for the three months ended September 30, 2022 and 2021, respectively. Acquisition costs, ERP integration costs, and strategic initiatives and other charges were $3,517 and $1,923 for the Memorialization segment, $5,631 and $4,026 for the Industrial Technologies segment, $19,359 and $12,323 for the SGK Brand Solutions segment, and $8,924 and $11,267 for Corporate and Non-Operating, for the fiscal years ended September 30, 2022 and 2021, respectively. *** Non-recurring/incremental COVID-19 costs were $46 and $423 for the Memorialization segment and $735 and $195 for the SGK Brand Solutions segment, for the three months ended September 30, 2022 and 2021, respectively. Non-recurring/incremental COVID-19 costs were $2 for the Industrial Technologies segment, and $3 for Corporate and Non-Operating, for the three months ended September 30, 2021. Non-recurring/incremental COVID-19 costs were $1,314 and $3,646 for the Memorialization segment, $6 and $38 for the Industrial Technologies segment, $1,199 and $1,539 for the SGK Brand Solutions segment, and $466 and $89 for Corporate and Non-Operating, for the fiscal years ended September 30, 2022 and 2021, respectively. ADJUSTED EBITDA NON-GAAP RECONCILIATION (Unaudited) (In thousands)

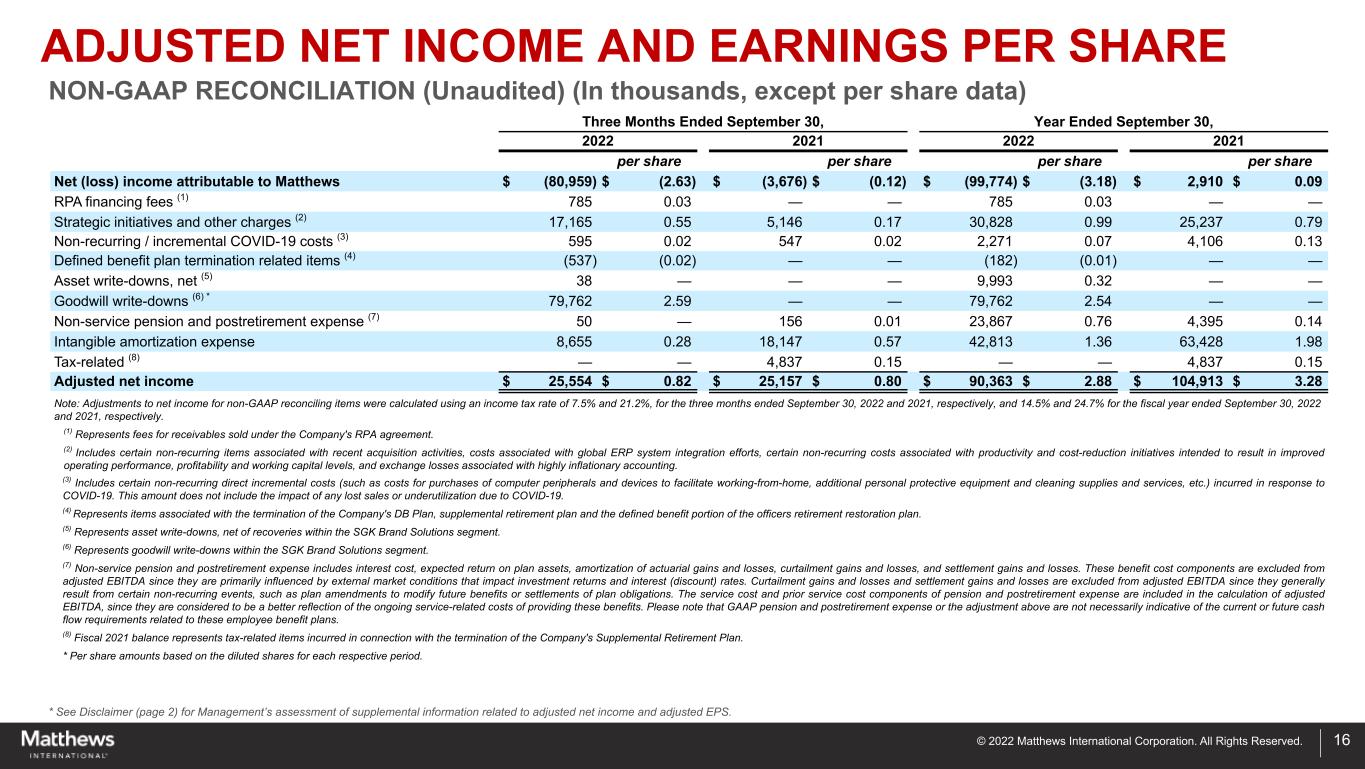

© 2022 Matthews International Corporation. All Rights Reserved. ADJUSTED NET INCOME AND EARNINGS PER SHARE NON-GAAP RECONCILIATION (Unaudited) (In thousands, except per share data) * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted net income and adjusted EPS. 16 Three Months Ended September 30, Year Ended September 30, 2022 2021 2022 2021 per share per share per share per share Net (loss) income attributable to Matthews $ (80,959) $ (2.63) $ (3,676) $ (0.12) $ (99,774) $ (3.18) $ 2,910 $ 0.09 RPA financing fees (1) 785 0.03 — — 785 0.03 — — Strategic initiatives and other charges (2) 17,165 0.55 5,146 0.17 30,828 0.99 25,237 0.79 Non-recurring / incremental COVID-19 costs (3) 595 0.02 547 0.02 2,271 0.07 4,106 0.13 Defined benefit plan termination related items (4) (537) (0.02) — — (182) (0.01) — — Asset write-downs, net (5) 38 — — — 9,993 0.32 — — Goodwill write-downs (6) * 79,762 2.59 — — 79,762 2.54 — — Non-service pension and postretirement expense (7) 50 — 156 0.01 23,867 0.76 4,395 0.14 Intangible amortization expense 8,655 0.28 18,147 0.57 42,813 1.36 63,428 1.98 Tax-related (8) — — 4,837 0.15 — — 4,837 0.15 Adjusted net income $ 25,554 $ 0.82 $ 25,157 $ 0.80 $ 90,363 $ 2.88 $ 104,913 $ 3.28 Note: Adjustments to net income for non-GAAP reconciling items were calculated using an income tax rate of 7.5% and 21.2%, for the three months ended September 30, 2022 and 2021, respectively, and 14.5% and 24.7% for the fiscal year ended September 30, 2022 and 2021, respectively. (1) Represents fees for receivables sold under the Company's RPA agreement. (2) Includes certain non-recurring items associated with recent acquisition activities, costs associated with global ERP system integration efforts, certain non-recurring costs associated with productivity and cost-reduction initiatives intended to result in improved operating performance, profitability and working capital levels, and exchange losses associated with highly inflationary accounting. (3) Includes certain non-recurring direct incremental costs (such as costs for purchases of computer peripherals and devices to facilitate working-from-home, additional personal protective equipment and cleaning supplies and services, etc.) incurred in response to COVID-19. This amount does not include the impact of any lost sales or underutilization due to COVID-19. (4) Represents items associated with the termination of the Company's DB Plan, supplemental retirement plan and the defined benefit portion of the officers retirement restoration plan. (5) Represents asset write-downs, net of recoveries within the SGK Brand Solutions segment. (6) Represents goodwill write-downs within the SGK Brand Solutions segment. (7) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. (8) Fiscal 2021 balance represents tax-related items incurred in connection with the termination of the Company's Supplemental Retirement Plan. * Per share amounts based on the diluted shares for each respective period.

© 2022 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to net debt. 17 September 30, 2022 September 30, 2021 Long-term debt, current maturities $ 3,277 $ 4,624 Long-term debt 795,291 759,086 Total debt 798,568 763,710 Less: Cash and cash equivalents (69,016) (49,176) Net Debt $ 729,552 $ 714,534 Adjusted EBITDA $ 210,408 $ 227,750 Net Debt Leverage Ratio $ 3.5 $ 3.1 NET DEBT NON-GAAP RECONCILIATION (Unaudited) (In thousands)