INVESTOR PRESENTATION SECOND QUARTER FISCAL YEAR 2023 www.matw.com | Nasdaq: MATW

© 2023 Matthews International Corporation. All Rights Reserved. 2 DISCLAIMER Any forward-looking statements contained in this presentation are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from management’s expectations. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove correct. Factors that could cause the Company's results to differ materially from the results discussed in such forward-looking statements principally include changes in domestic or international economic conditions, changes in foreign currency exchange rates, changes in the cost of materials used in the manufacture of the Company's products, changes in mortality and cremation rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company operates, or other factors such as supply chain disruptions, labor shortages or labor cost increases, changes in product demand or pricing as a result of domestic or international competitive pressures, ability to achieve cost-reduction objectives, unknown risks in connection with the Company's acquisitions, cybersecurity concerns, effectiveness of the Company's internal controls, compliance with domestic and foreign laws and regulations, technological factors beyond the Company's control, impact of pandemics or similar outbreaks, or other disruptions to our industries, customers, or supply chains, the impact of global conflicts, such as the current war between Russia and Ukraine, and other factors described in the Company’s Annual Report on Form 10-K and other periodic filings with the U.S. Securities and Exchange Commission ("SEC"). The information contained in this presentation, including any financial data, is made as of March 31, 2023 unless otherwise noted. The Company does not, and is not obligated to, update this information after the date of such information. Included in this report are measures of financial performance that are not defined by generally accepted accounting principles in the United States (“GAAP”). The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition and divestiture costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company’s core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. The Company believes that adjusted EBITDA provides relevant and useful information, which is used by the Company’s management in assessing the performance of its business. Adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management’s evaluation of its operating results. These items include stock-based compensation, the non-service portion of pension and postretirement expense, acquisition and divestiture costs, ERP integration costs, and strategic initiatives and other charges. Adjusted EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income taxes, and the effects of certain acquisition, divestiture and ERP integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating operating performance. It is also useful as a financial measure for lenders and is used by the Company’s management to measure business performance. Adjusted EBITDA is not a measure of the Company's financial performance under GAAP and should not be considered as an alternative to net income or other performance measures derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the Company's liquidity. The Company's definition of adjusted EBITDA may not be comparable to similarly titled measures used by other companies. The Company has presented constant currency sales and constant currency adjusted EBITDA and believes these measures provide relevant and useful information, which is used by the Company's management in assessing the performance of its business on a consistent basis by removing the impact of changes due to foreign exchange translation rates. These measures allow management, as well as investors, to assess the Company’s sales and adjusted EBITDA on a constant currency basis. The Company has also presented adjusted net income and adjusted earnings per share and believes each measure provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in assessing the performance of its business. Adjusted net income and adjusted earnings per share provides the Company with an understanding of the results from the primary operations of our business by excluding the effects of certain acquisition, divestiture and system-integration costs, and items that do not reflect the ordinary earnings of our operations. These measures provide management with insight into the earning value for shareholders excluding certain costs, not related to the Company’s primary operations. Likewise, these measures may be useful to an investor in evaluating the underlying operating performance of the Company’s business overall, as well as performance trends, on a consistent basis. The Company has also presented net debt and a net debt leverage ratio and believes each measure provides relevant and useful information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the indebtedness of the Company, net of cash and cash equivalents and relative to adjusted EBITDA. These measures allow management, as well as analysts and investors, to assess the Company’s leverage.. Lastly, the Company has presented free cash flow as supplemental measures of cash flow that are not required by, or presented in accordance with, GAAP. Management believes that these measures provide relevant and useful information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the cash generated by operations, excluding capital expenditures. These measures allows management, as well as analysts and investors, to assess the Company’s ability to pursue growth and investment opportunities designed to increase Shareholder value.

© 2023 Matthews International Corporation. All Rights Reserved. 3

© 2023 Matthews International Corporation. All Rights Reserved. 4 MATTHEWS EVOLUTION

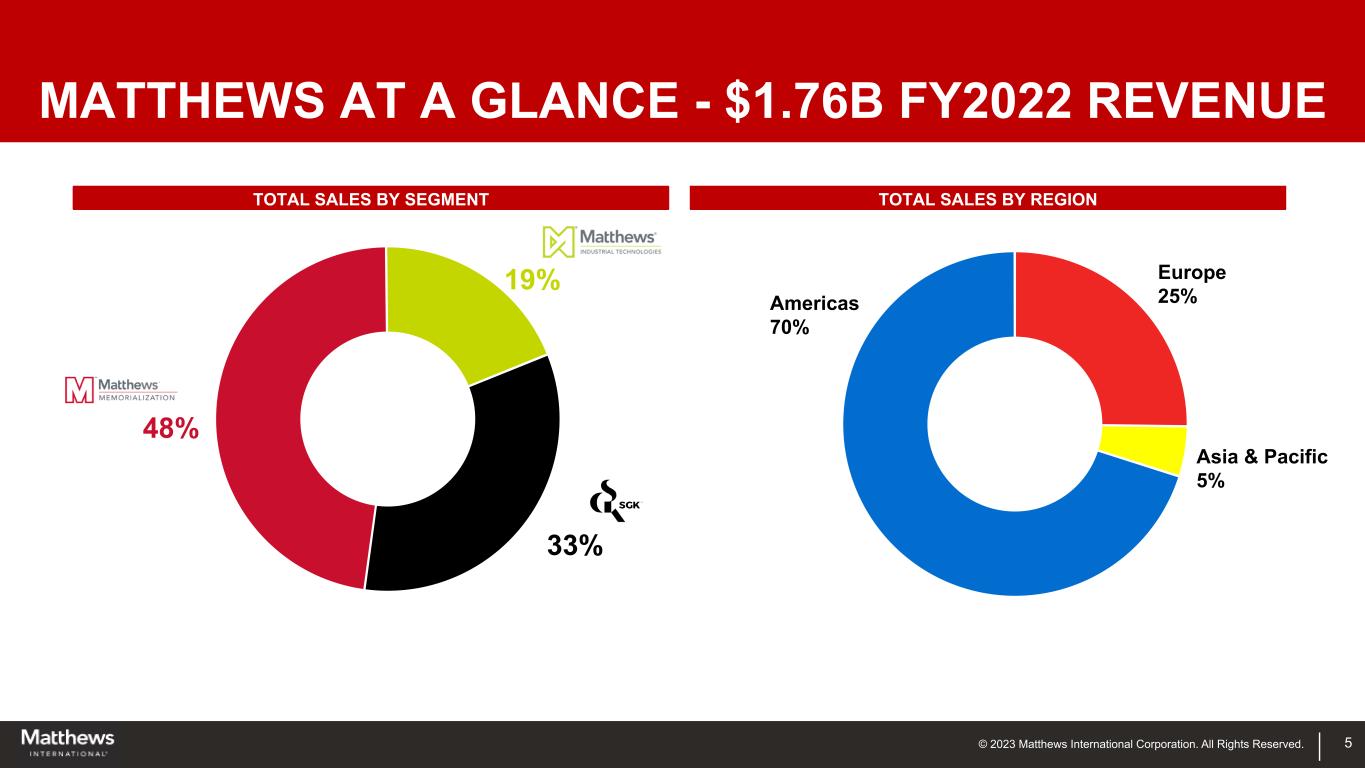

© 2023 Matthews International Corporation. All Rights Reserved. 5 MATTHEWS AT A GLANCE - $1.76B FY2022 REVENUE 33% 48% 19% Europe 25% Asia & Pacific 5% Americas 70% TOTAL SALES BY SEGMENT TOTAL SALES BY REGION

© 2023 Matthews International Corporation. All Rights Reserved.© 2023 Matthews International Corporation. All Rights Reserved. ENGINEERED SOLUTIONS PRODUCT IDENTIFICATION WAREHOUSE AUTOMATION

© 2023 Matthews International Corporation. All Rights Reserved. 7 INDUSTRIAL TECHNOLOGIES PRODUCTS AND MARKETS PRINCIPAL PRODUCT LINES COMPETITIVE ADVANTAGES

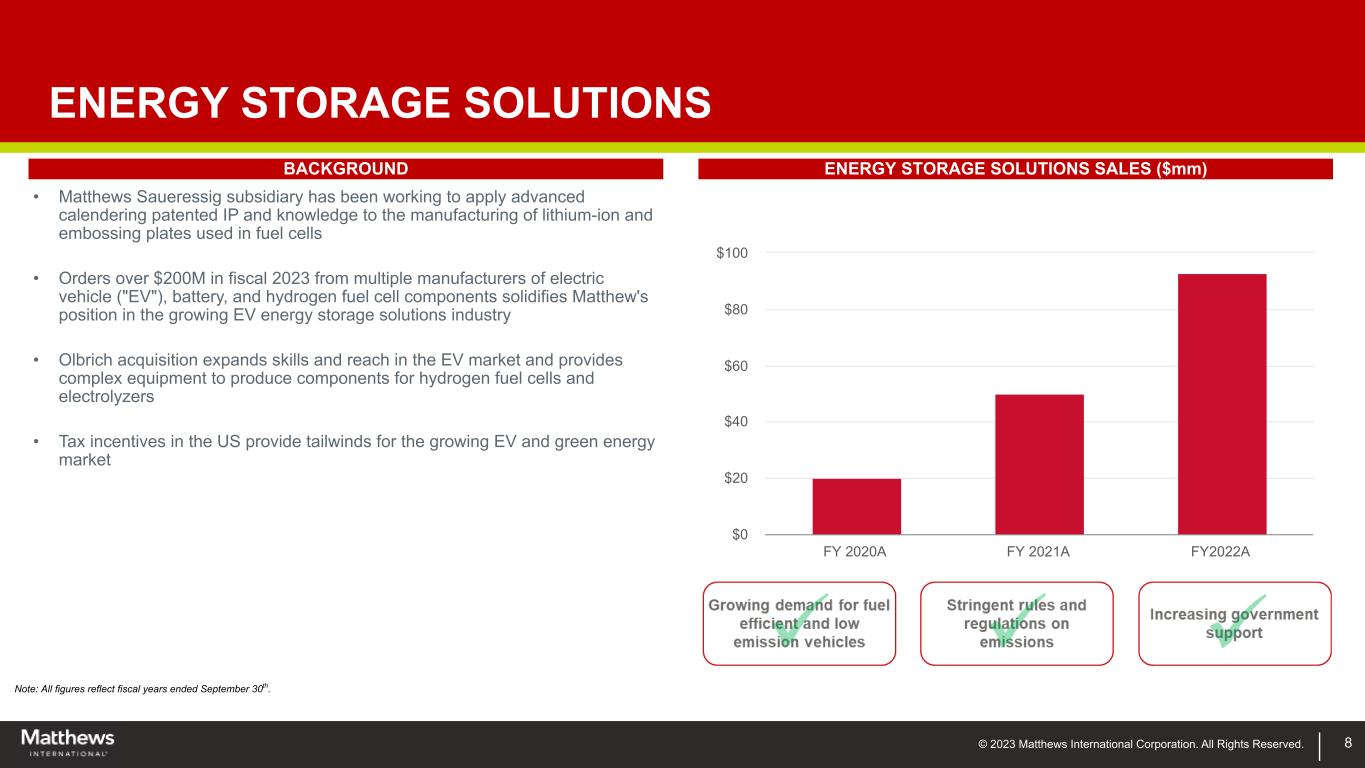

© 2023 Matthews International Corporation. All Rights Reserved. 8 ENERGY STORAGE SOLUTIONS • Matthews Saueressig subsidiary has been working to apply advanced calendering patented IP and knowledge to the manufacturing of lithium-ion and embossing plates used in fuel cells • Orders over $200M in fiscal 2023 from multiple manufacturers of electric vehicle ("EV"), battery, and hydrogen fuel cell components solidifies Matthew's position in the growing EV energy storage solutions industry • Olbrich acquisition expands skills and reach in the EV market and provides complex equipment to produce components for hydrogen fuel cells and electrolyzers • Tax incentives in the US provide tailwinds for the growing EV and green energy market BACKGROUND ENERGY STORAGE SOLUTIONS SALES ($mm) FY 2020A FY 2021A FY2022A $0 $20 $40 $60 $80 $100 Note: All figures reflect fiscal years ended September 30th.

© 2023 Matthews International Corporation. All Rights Reserved. 9 POSITION STRENGTHENED WITH INFLATION REDUCTION ACT • Projections on incremental Gigawatt hour (GWh) installed for U.S. by 2030 was over 600 GWh prior to the Inflation Reduction Act • Expect this number to be significantly higher based on the tax credits and incentives available • Matthews estimates this is a $6B global market potential by 2030 TAX INCENTIVES STIMULATE DEMAND DRY BATTERY ELECTRODES BENEFITS LEADING EXPERTISE • 10 Years experience • 7 patent families REDUCED COST OF PRODUCTION • Energy consumptions • Labor Cost • Plant footprint • Lower capital investment • Eliminate environmental concern BETTER BATTERY • Improved life • Improved density • Step toward solid state

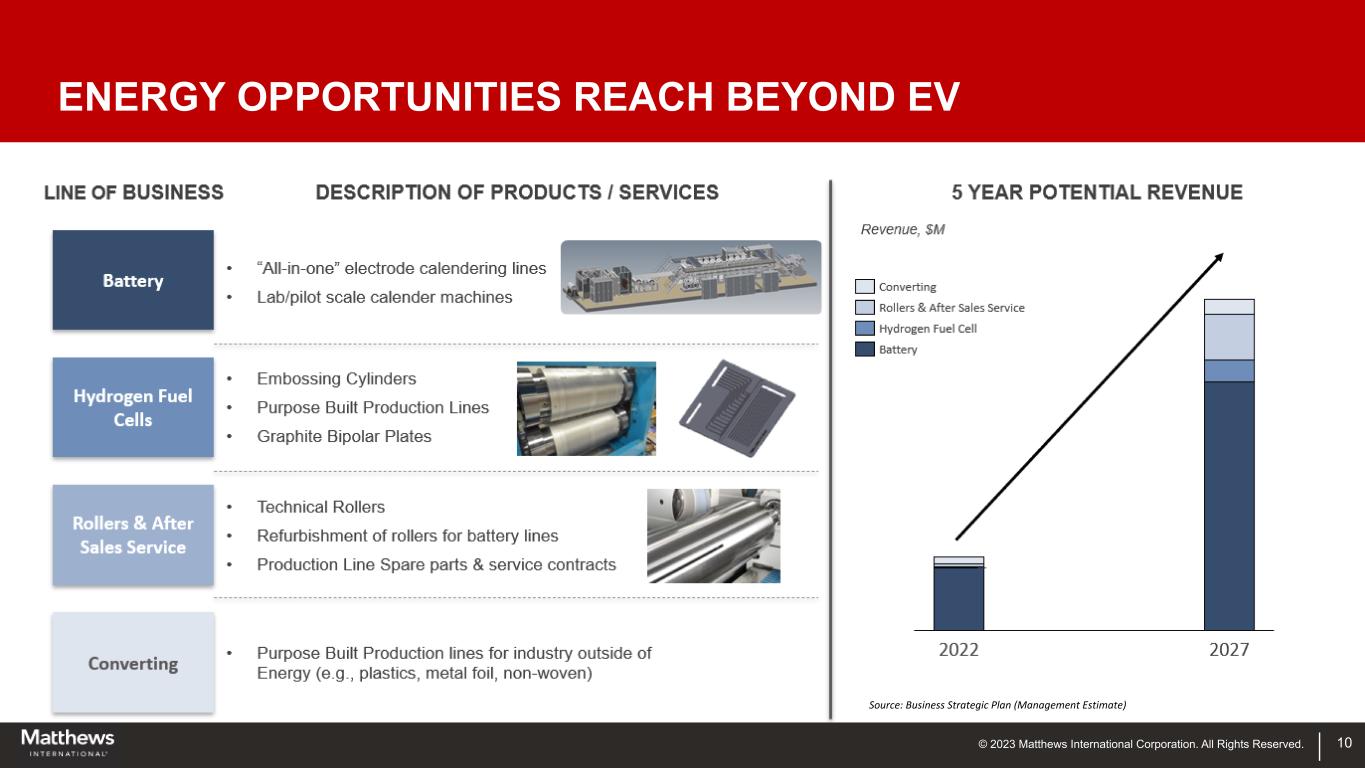

© 2023 Matthews International Corporation. All Rights Reserved. 10 ENERGY OPPORTUNITIES REACH BEYOND EV Source: Business Strategic Plan (Management Estimate)

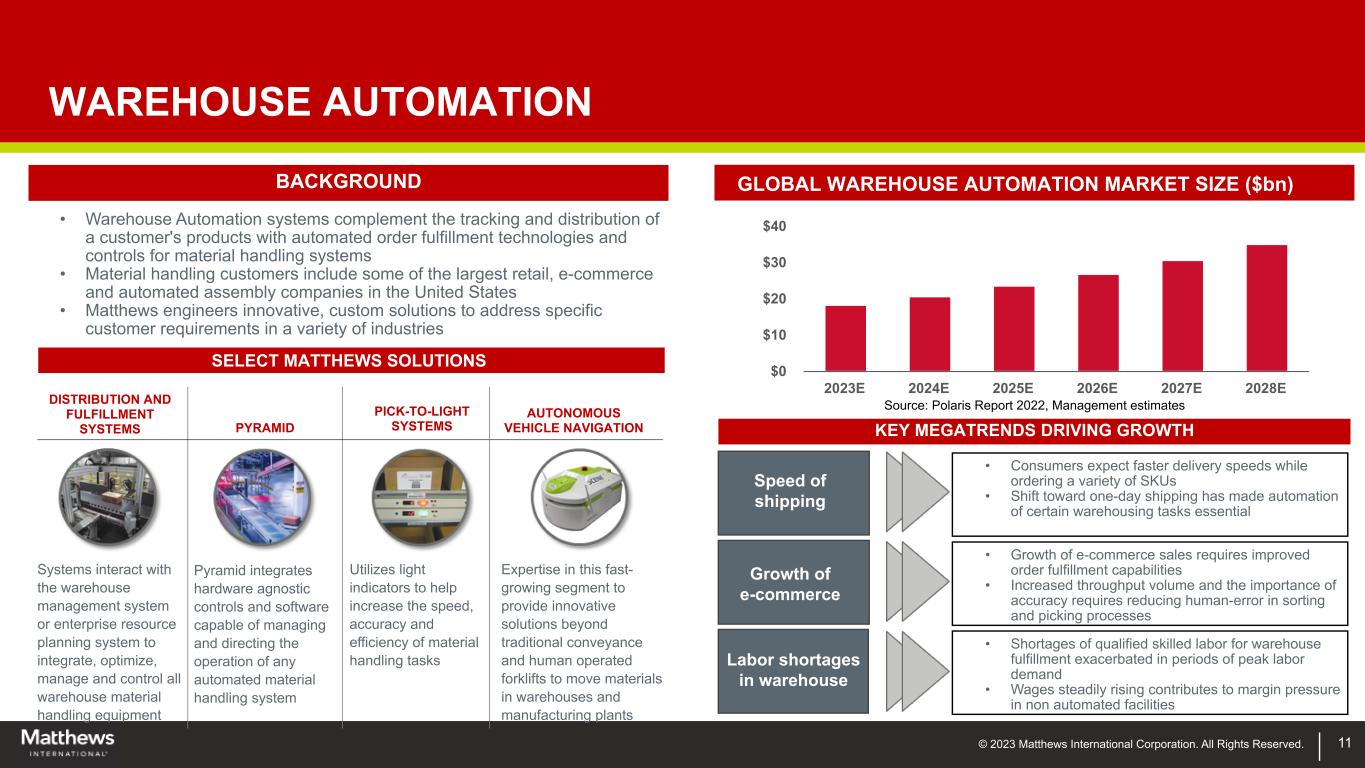

© 2023 Matthews International Corporation. All Rights Reserved. 11 WAREHOUSE AUTOMATION • Warehouse Automation systems complement the tracking and distribution of a customer's products with automated order fulfillment technologies and controls for material handling systems • Material handling customers include some of the largest retail, e-commerce and automated assembly companies in the United States • Matthews engineers innovative, custom solutions to address specific customer requirements in a variety of industries BACKGROUND 2023E 2024E 2025E 2026E 2027E 2028E $0 $10 $20 $30 $40 GLOBAL WAREHOUSE AUTOMATION MARKET SIZE ($bn) Speed of shipping Growth of e-commerce Labor shortages in warehouse KEY MEGATRENDS DRIVING GROWTH Systems interact with the warehouse management system or enterprise resource planning system to integrate, optimize, manage and control all warehouse material handling equipment DISTRIBUTION AND FULFILLMENT SYSTEMS PYRAMID PICK-TO-LIGHT SYSTEMS AUTONOMOUS VEHICLE NAVIGATION Pyramid integrates hardware agnostic controls and software capable of managing and directing the operation of any automated material handling system Utilizes light indicators to help increase the speed, accuracy and efficiency of material handling tasks Expertise in this fast- growing segment to provide innovative solutions beyond traditional conveyance and human operated forklifts to move materials in warehouses and manufacturing plants SELECT MATTHEWS SOLUTIONS • Consumers expect faster delivery speeds while ordering a variety of SKUs • Shift toward one-day shipping has made automation of certain warehousing tasks essential • Growth of e-commerce sales requires improved order fulfillment capabilities • Increased throughput volume and the importance of accuracy requires reducing human-error in sorting and picking processes • Shortages of qualified skilled labor for warehouse fulfillment exacerbated in periods of peak labor demand • Wages steadily rising contributes to margin pressure in non automated facilities Source: Polaris Report 2022, Management estimates

© 2023 Matthews International Corporation. All Rights Reserved. 12 WAREHOUSE AUTOMATION EXPANSION POTENTIAL • Expand configurability and web interface for information everywhere • Continued growth in e-commerce solutions • Warehouse automation market continues to grow in demand from both greenfield sites as well as retrofit opportunities NEXUS WAREHOUSE EXECUTION SOFTWARE DEVELOPMENT GLOBAL EXPANSION AND INDUSTRIAL AUTOMATION • European expansion from Guidance AMR platform • Expansion into Industrial Automation from the foundation of engineers acquired with R + S Automotive

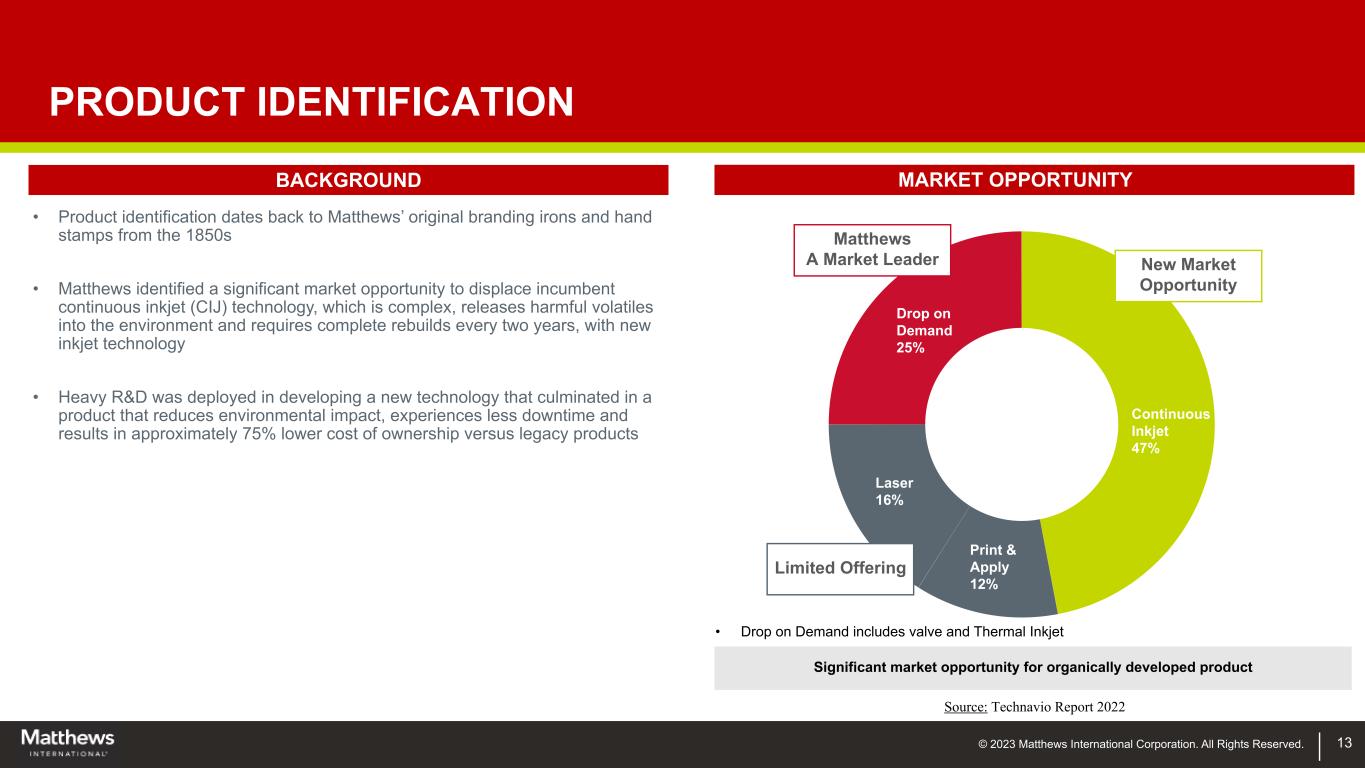

© 2023 Matthews International Corporation. All Rights Reserved. 13 PRODUCT IDENTIFICATION • Product identification dates back to Matthews’ original branding irons and hand stamps from the 1850s • Matthews identified a significant market opportunity to displace incumbent continuous inkjet (CIJ) technology, which is complex, releases harmful volatiles into the environment and requires complete rebuilds every two years, with new inkjet technology • Heavy R&D was deployed in developing a new technology that culminated in a product that reduces environmental impact, experiences less downtime and results in approximately 75% lower cost of ownership versus legacy products BACKGROUND MARKET OPPORTUNITY Continuous Inkjet 47% Print & Apply 12% Laser 16% Drop on Demand 25% New Market Opportunity Limited Offering Matthews A Market Leader Significant market opportunity for organically developed product • Drop on Demand includes valve and Thermal Inkjet Source: Technavio Report 2022

© 2023 Matthews International Corporation. All Rights Reserved. 14 NEW PRINTHEAD TECHNOLOGY DRIVES ADDITIONAL DEMAND • Technology miniaturizes valves the same way a transistor miniaturized switches • Business development evaluating additional opportunities in adjacent markets • Reduces VOC emissions in printing process PATENTED TECHNOLOGY USE BEYOND PRINTING REGULATORY • Closed system uses less chemicals and releases less volatiles into the environment versus current technologies • Better fit for new regulations requiring 2D codes GLOBAL EXPANSION • Europe’s focus on environmental concerns strengthens the value of the technology • Reduced maintenance value proposition fits very well in fast growing Asian market

© 2023 Matthews International Corporation. All Rights Reserved.© 2022 Matthews International Corporation. All Rights Reserved. CEMETERY PRODUCTS FUNERAL HOME PRODUCTS CREMATION PRODUCTS AND EQUIPMENT 3 tt s I t r ti l r r ti . ll i ts s rv .

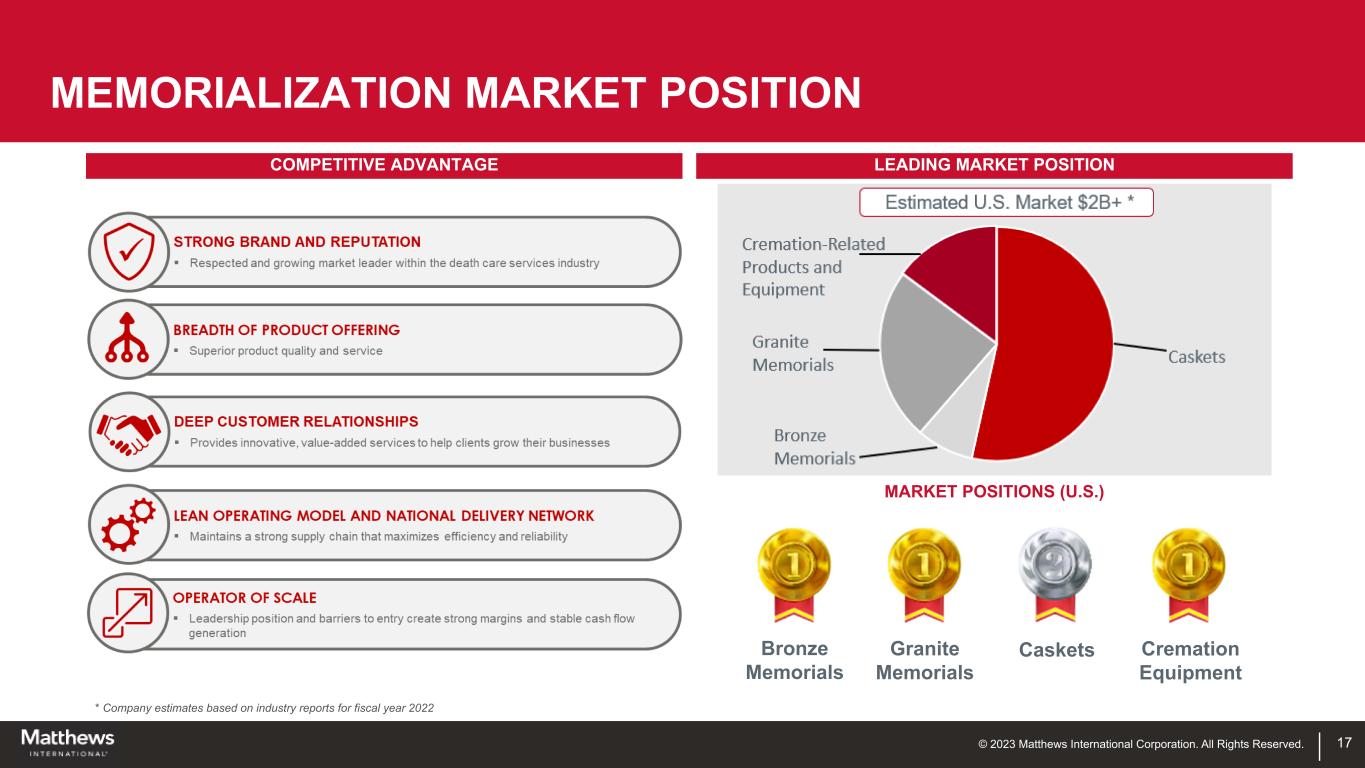

© 2023 Matthews International Corporation. All Rights Reserved. Cemetery Products Bronze Memorials - #1 Granite Memorials - #1 North America, Italy, Australia 16 Funeral Home Products Caskets - #2 United States Cremation and Incineration Equipment Cremation Equipment - #1 United States and Europe Market Position (U.S.) Core Geographies MARKET LEADERSHIP

© 2023 Matthews International Corporation. All Rights Reserved. LEADING MARKET POSITION 17 MEMORIALIZATION MARKET POSITION * Company estimates based on industry reports for fiscal year 2022 MARKET POSITIONS (U.S.) Bronze Memorials Granite Memorials Caskets Cremation Equipment COMPETITIVE ADVANTAGE

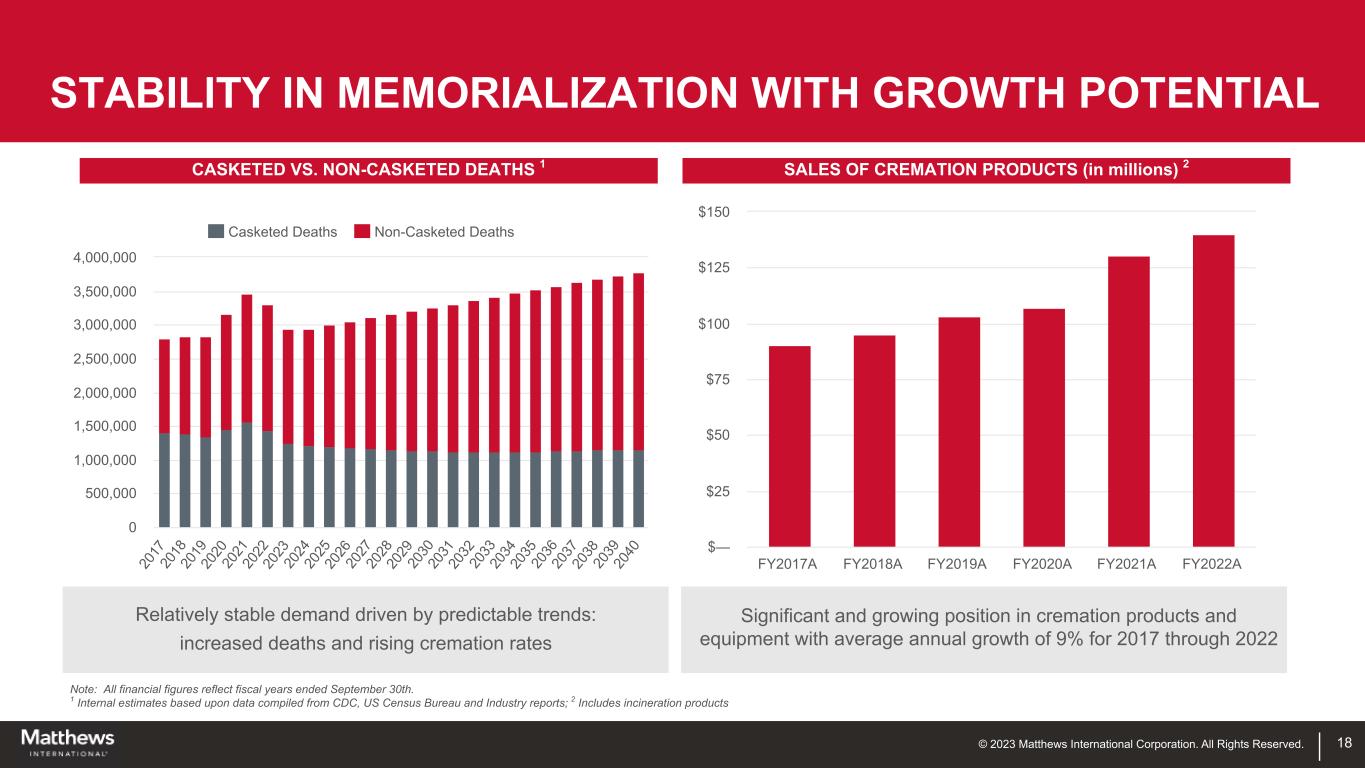

© 2023 Matthews International Corporation. All Rights Reserved. 18 Note: All financial figures reflect fiscal years ended September 30th. 1 Internal estimates based upon data compiled from CDC, US Census Bureau and Industry reports; 2 Includes incineration products CASKETED VS. NON-CASKETED DEATHS 1 Relatively stable demand driven by predictable trends: increased deaths and rising cremation rates Casketed Deaths Non-Casketed Deaths 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 20 26 20 27 20 28 20 29 20 30 20 31 20 32 20 33 20 34 20 35 20 36 20 37 20 38 20 39 20 40 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 STABILITY IN MEMORIALIZATION WITH GROWTH POTENTIAL SALES OF CREMATION PRODUCTS (in millions) 2 Significant and growing position in cremation products and equipment with average annual growth of 9% for 2017 through 2022 FY2017A FY2018A FY2019A FY2020A FY2021A FY2022A $— $25 $50 $75 $100 $125 $150

© 2023 Matthews International Corporation. All Rights Reserved. 19 STABILITY IN MEMORIALIZATION WITH GROWTH POTENTIAL STRATEGIC GROWTH OPPORTUNITIES • Cremation products • Online solutions • Technology services – software as a service • Complimentary new products to funeral homes / cemeteries • 3D printing proprietary capabilities to enter new markets

© 2023 Matthews International Corporation. All Rights Reserved.© 2023 Matthews International Corporation. All Rights Reserved.

© 2023 Matthews International Corporation. All Rights Reserved. 21 CORE PACKAGING SERVICES CORE PACKAGING SERVICES SGK’s packaging solutions can be purchased as an integrated, end to end solution or as stand-alone services.

© 2023 Matthews International Corporation. All Rights Reserved. 22 CORE PACKAGING SERVICES BRAND EXPERIENCE SOLUTIONS Tailored solutions for brand commerce and brand activation that deliver more connected and enriching experiences between brand and consumer

© 2023 Matthews International Corporation. All Rights Reserved. SGK BRAND SOLUTIONS FOOD/BEVERAGE CLIENTS GLOBAL PHARMA / HEALTHCARE CLIENTS GLOBAL RETAILER CLIENTS OTHER LEADING BRANDS 23 • Longstanding relationships with a large, blue chip customer base consisting of many Fortune 100 and Fortune 500 companies • "Strategic" relationships rather than "vendor" relationships – more valued client engagement • Critical service provider in marketing execution of top worldwide brands, particularly where global consistency is highly valued • Global ERP platform provides improvements for the segment operations CORE PACKAGING SERVICES BRAND SOLUTIONS SERVICING GLOBAL AND REGIONAL CLIENTS

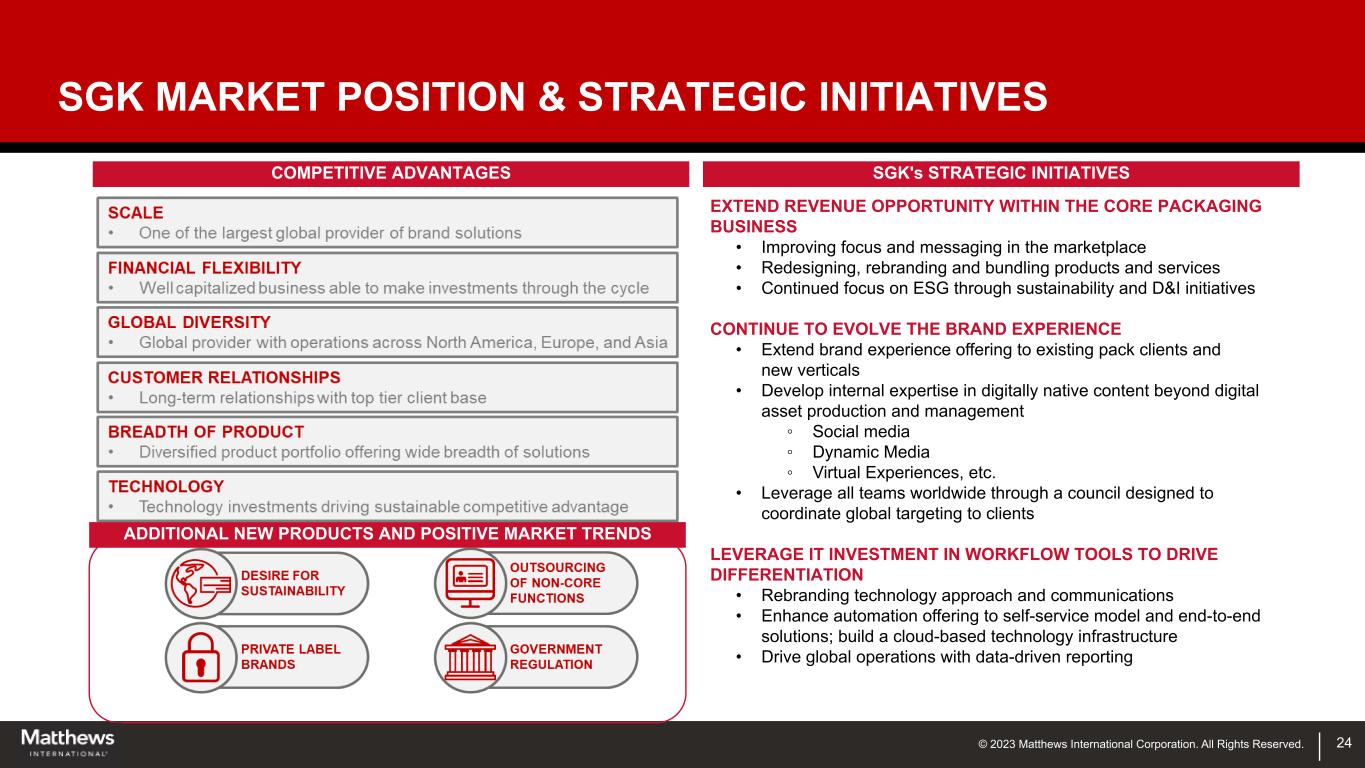

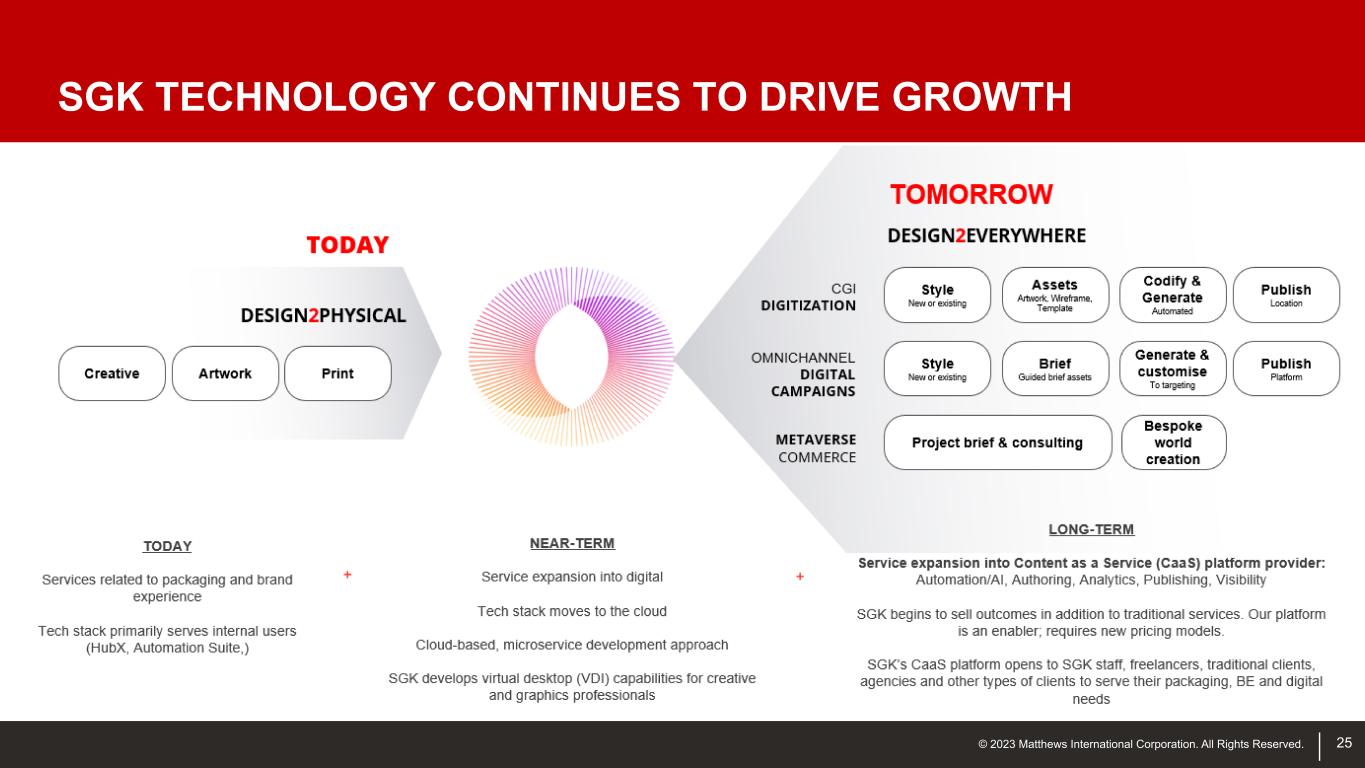

© 2023 Matthews International Corporation. All Rights Reserved. SGK's STRATEGIC INITIATIVES 24 EXTEND REVENUE OPPORTUNITY WITHIN THE CORE PACKAGING BUSINESS • Improving focus and messaging in the marketplace • Redesigning, rebranding and bundling products and services • Continued focus on ESG through sustainability and D&I initiatives CONTINUE TO EVOLVE THE BRAND EXPERIENCE • Extend brand experience offering to existing pack clients and new verticals • Develop internal expertise in digitally native content beyond digital asset production and management ◦ Social media ◦ Dynamic Media ◦ Virtual Experiences, etc. • Leverage all teams worldwide through a council designed to coordinate global targeting to clients LEVERAGE IT INVESTMENT IN WORKFLOW TOOLS TO DRIVE DIFFERENTIATION • Rebranding technology approach and communications • Enhance automation offering to self-service model and end-to-end solutions; build a cloud-based technology infrastructure • Drive global operations with data-driven reporting COMPETITIVE ADVANTAGES CORE PACKAGING SERVICES SGK MARKET POSITION & STRATEGIC INITIATIVES ADDITIONAL NEW PRODUCTS AND POSITIVE MARKET TRENDS

© 2023 Matthews International Corporation. All Rights Reserved. SGK TECHNOLOGY CONTINUES TO DRIVE GROWTH 25

© 2023 Matthews International Corporation. All Rights Reserved. 26 INVESTMENT THESIS

© 2023 Matthews International Corporation. All Rights Reserved. 27 GROWTH OPPORTUNITIES SUPPORTED BY STABLE CORE BUSINESSES DISCIPLINED TRACK RECORD OF ACQUISITIONS AND INTEGRATION ROBUST CASH FLOW HISTORY FAVORABLE COMPETITIVE POSITIONS IN ATTRACTIVE ADDRESSABLE MARKETS STRONG AND EXPERIENCED MANAGEMENT TEAM 1 2 4 5 3 KEY HIGHLIGHTS

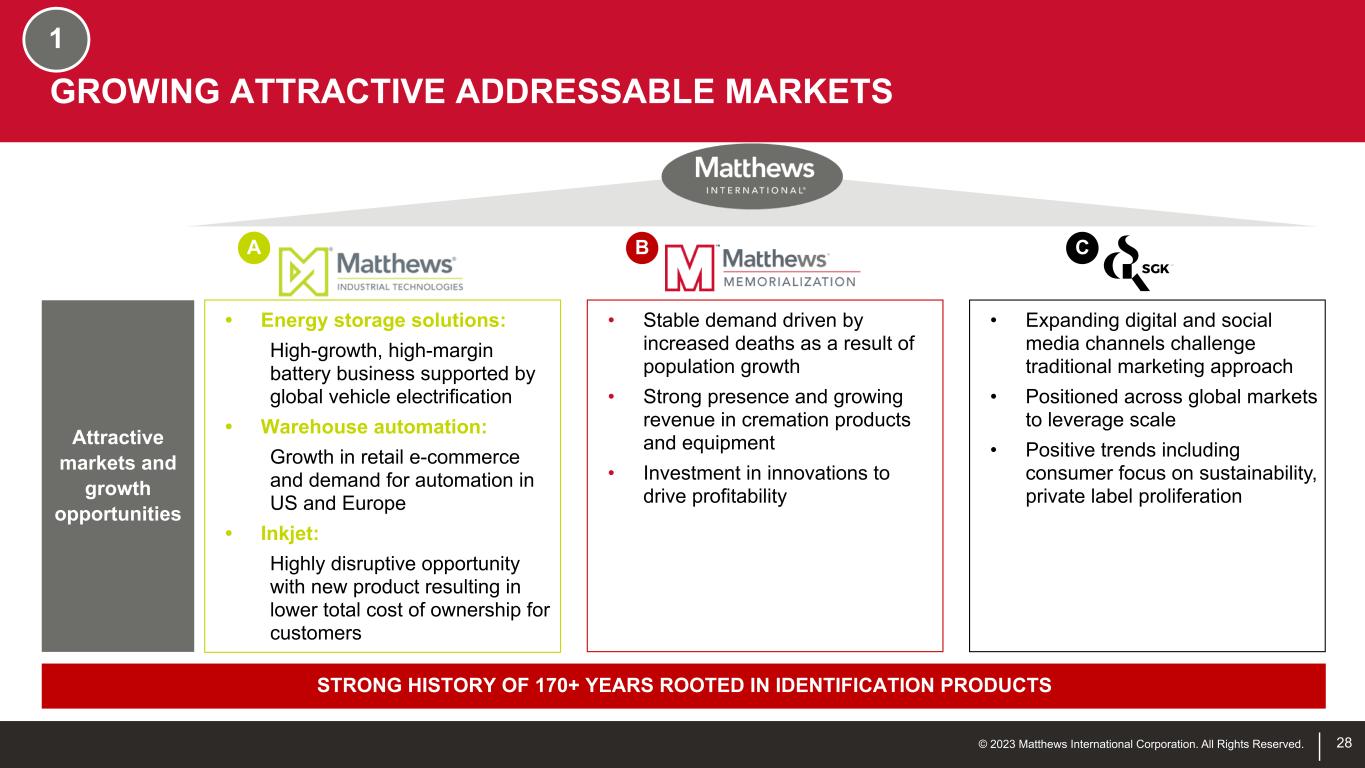

© 2023 Matthews International Corporation. All Rights Reserved. B CA Attractive markets and growth opportunities • Stable demand driven by increased deaths as a result of population growth • Strong presence and growing revenue in cremation products and equipment • Investment in innovations to drive profitability • Expanding digital and social media channels challenge traditional marketing approach • Positioned across global markets to leverage scale • Positive trends including consumer focus on sustainability, private label proliferation • Energy storage solutions: High-growth, high-margin battery business supported by global vehicle electrification • Warehouse automation: Growth in retail e-commerce and demand for automation in US and Europe • Inkjet: Highly disruptive opportunity with new product resulting in lower total cost of ownership for customers 28 1 GROWING ATTRACTIVE ADDRESSABLE MARKETS STRONG HISTORY OF 170+ YEARS ROOTED IN IDENTIFICATION PRODUCTS

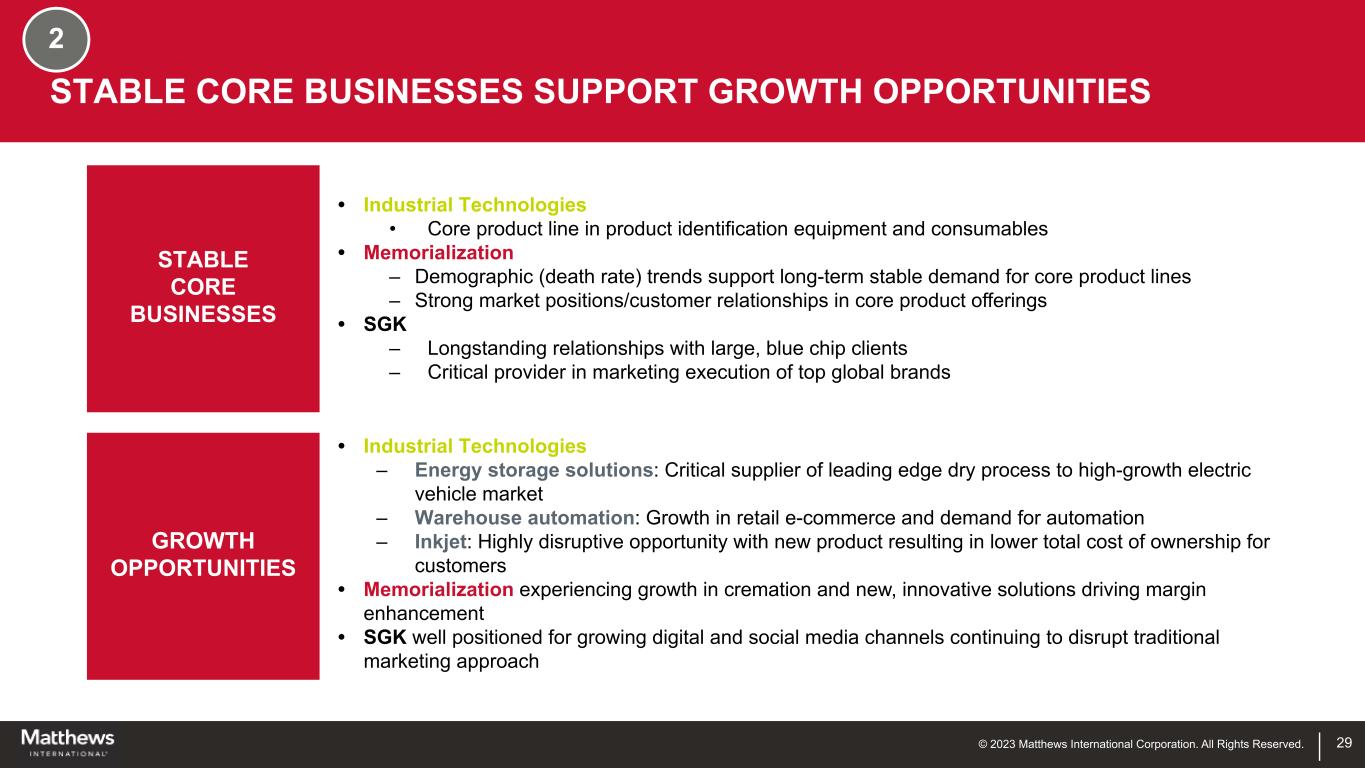

© 2023 Matthews International Corporation. All Rights Reserved. 29 STABLE CORE BUSINESSES SUPPORT GROWTH OPPORTUNITIES STABLE CORE BUSINESSES GROWTH OPPORTUNITIES • Industrial Technologies • Core product line in product identification equipment and consumables • Memorialization – Demographic (death rate) trends support long-term stable demand for core product lines – Strong market positions/customer relationships in core product offerings • SGK – Longstanding relationships with large, blue chip clients – Critical provider in marketing execution of top global brands • Industrial Technologies – Energy storage solutions: Critical supplier of leading edge dry process to high-growth electric vehicle market – Warehouse automation: Growth in retail e-commerce and demand for automation – Inkjet: Highly disruptive opportunity with new product resulting in lower total cost of ownership for customers • Memorialization experiencing growth in cremation and new, innovative solutions driving margin enhancement • SGK well positioned for growing digital and social media channels continuing to disrupt traditional marketing approach 2

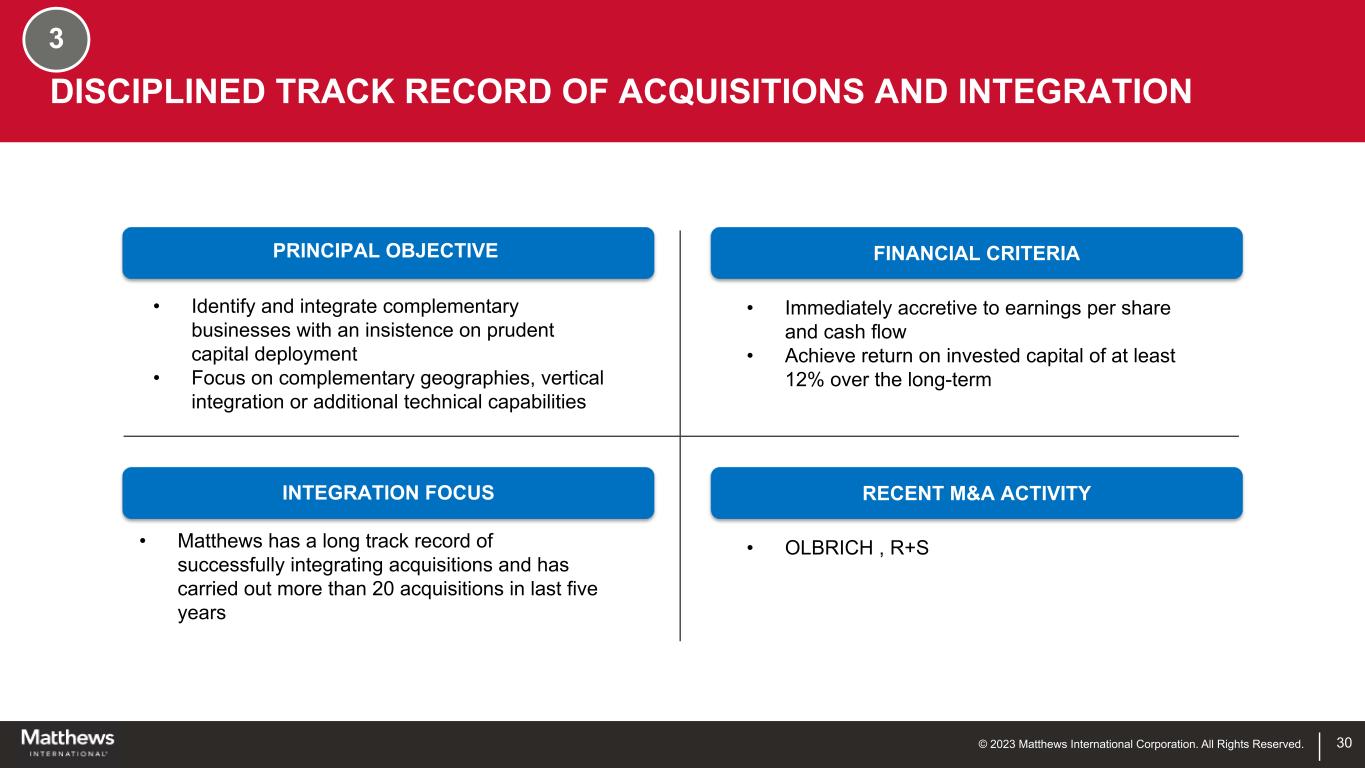

© 2023 Matthews International Corporation. All Rights Reserved. 30 3 DISCIPLINED TRACK RECORD OF ACQUISITIONS AND INTEGRATION • Identify and integrate complementary businesses with an insistence on prudent capital deployment • Focus on complementary geographies, vertical integration or additional technical capabilities • Immediately accretive to earnings per share and cash flow • Achieve return on invested capital of at least 12% over the long-term • Matthews has a long track record of successfully integrating acquisitions and has carried out more than 20 acquisitions in last five years • OLBRICH , R+S PRINCIPAL OBJECTIVE FINANCIAL CRITERIA INTEGRATION FOCUS RECENT M&A ACTIVITY

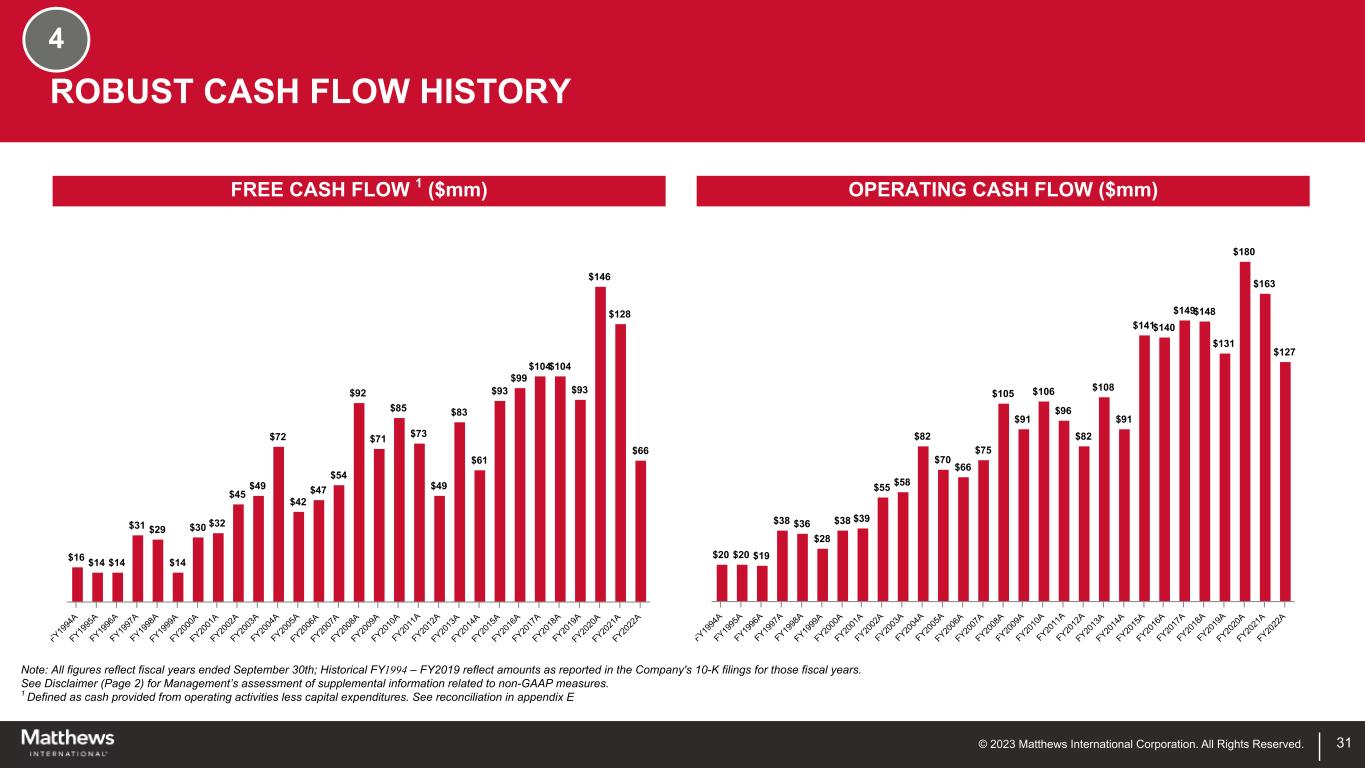

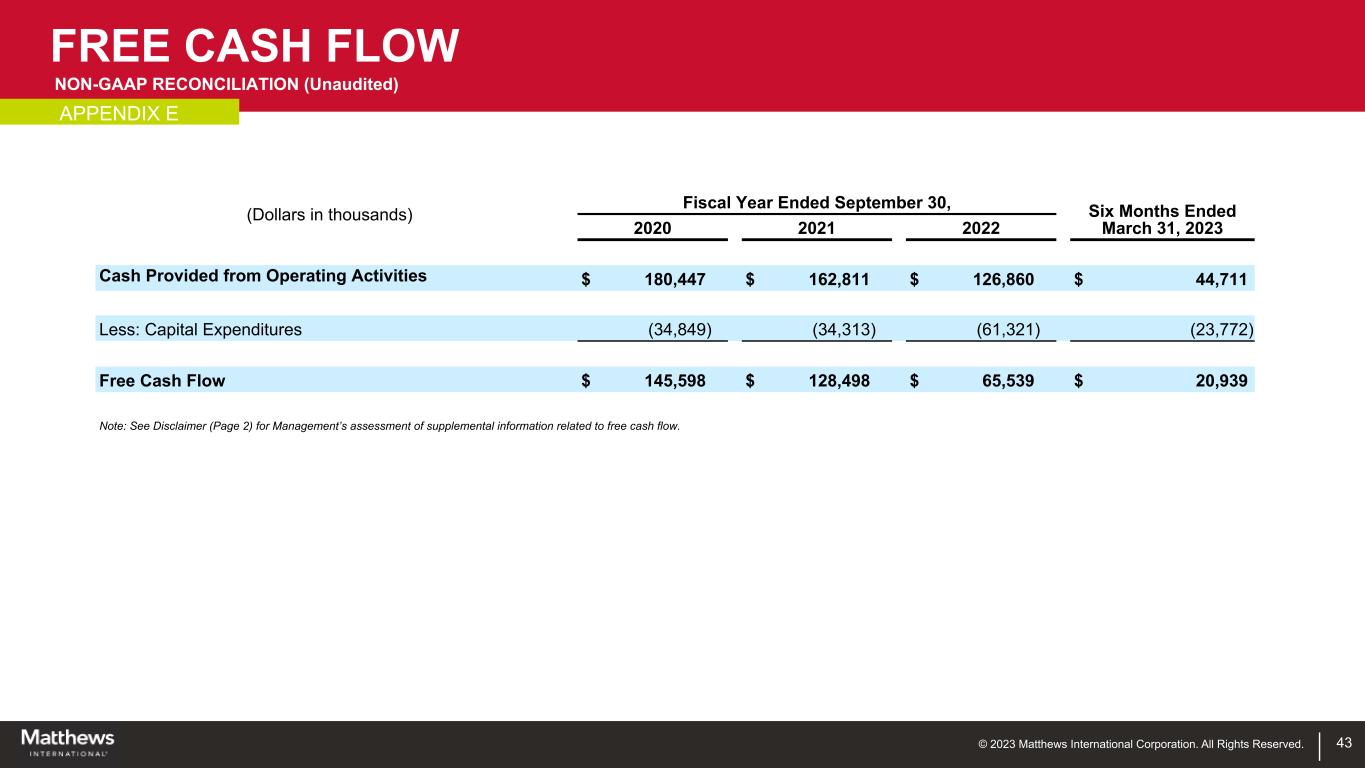

© 2023 Matthews International Corporation. All Rights Reserved. 31 Note: All figures reflect fiscal years ended September 30th; Historical FY1994 – FY2019 reflect amounts as reported in the Company's 10-K filings for those fiscal years. See Disclaimer (Page 2) for Management’s assessment of supplemental information related to non-GAAP measures. 1 Defined as cash provided from operating activities less capital expenditures. See reconciliation in appendix E $16 $14 $14 $31 $29 $14 $30 $32 $45 $49 $72 $42 $47 $54 $92 $71 $85 $73 $49 $83 $61 $93 $99 $104$104 $93 $146 $128 $66 FY19 94 A FY19 95 A FY19 96 A FY19 97 A FY19 98 A FY19 99 A FY20 00 A FY20 01 A FY20 02 A FY20 03 A FY20 04 A FY20 05 A FY20 06 A FY20 07 A FY20 08 A FY20 09 A FY20 10 A FY20 11 A FY20 12 A FY20 13 A FY20 14 A FY20 15 A FY20 16 A FY20 17 A FY20 18 A FY20 19 A FY20 20 A FY20 21 A FY20 22 A ROBUST CASH FLOW HISTORY 4 OPERATING CASH FLOW ($mm) $20 $20 $19 $38 $36 $28 $38 $39 $55 $58 $82 $70 $66 $75 $105 $91 $106 $96 $82 $108 $91 $141$140 $149$148 $131 $180 $163 $127 FY19 94 A FY19 95 A FY19 96 A FY19 97 A FY19 98 A FY19 99 A FY20 00 A FY20 01 A FY20 02 A FY20 03 A FY20 04 A FY20 05 A FY20 06 A FY20 07 A FY20 08 A FY20 09 A FY20 10 A FY20 11 A FY20 12 A FY20 13 A FY20 14 A FY20 15 A FY20 16 A FY20 17 A FY20 18 A FY20 19 A FY20 20 A FY20 21 A FY20 22 A FREE CASH FLOW 1 ($mm)

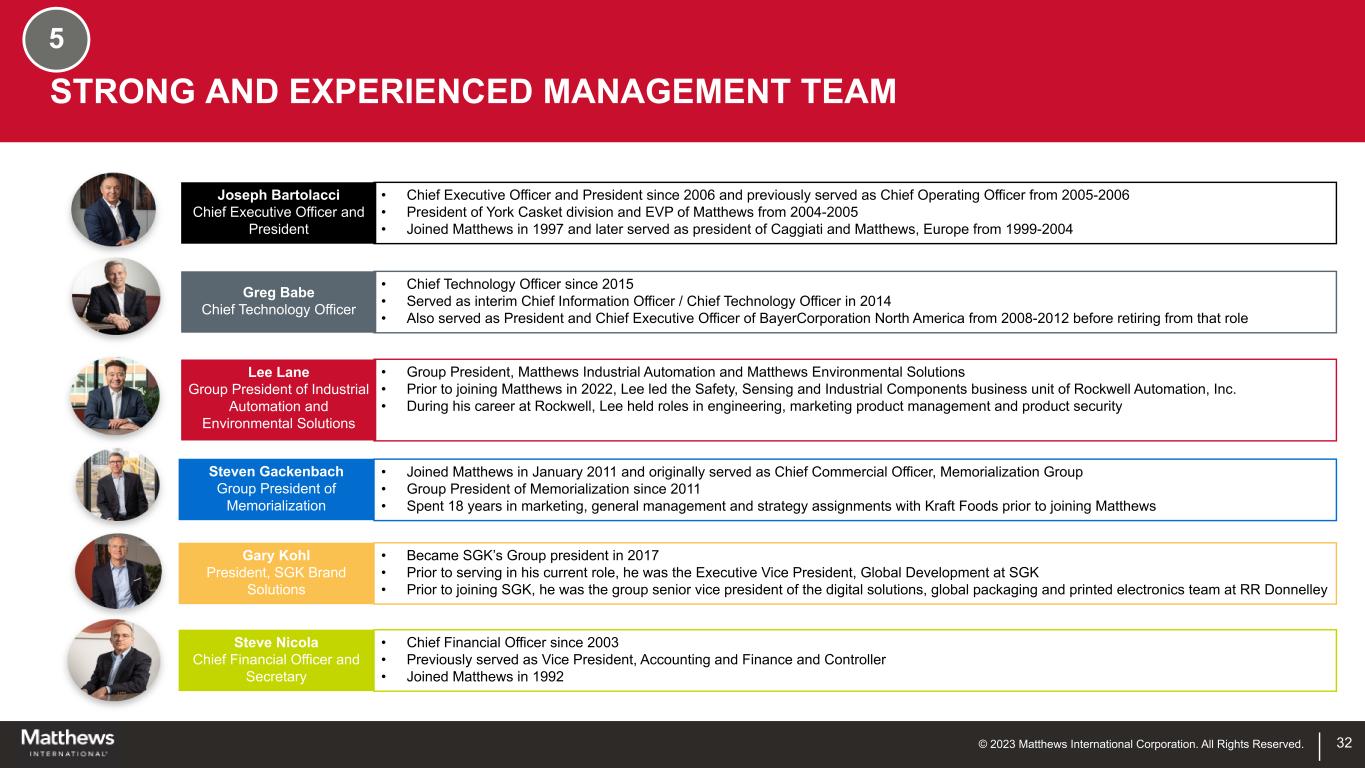

© 2023 Matthews International Corporation. All Rights Reserved. 32 5 STRONG AND EXPERIENCED MANAGEMENT TEAM Joseph Bartolacci Chief Executive Officer and President Greg Babe Chief Technology Officer Lee Lane Group President of Industrial Automation and Environmental Solutions Steven Gackenbach Group President of Memorialization Gary Kohl President, SGK Brand Solutions Steve Nicola Chief Financial Officer and Secretary • Chief Executive Officer and President since 2006 and previously served as Chief Operating Officer from 2005-2006 • President of York Casket division and EVP of Matthews from 2004-2005 • Joined Matthews in 1997 and later served as president of Caggiati and Matthews, Europe from 1999-2004 • Chief Technology Officer since 2015 • Served as interim Chief Information Officer / Chief Technology Officer in 2014 • Also served as President and Chief Executive Officer of BayerCorporation North America from 2008-2012 before retiring from that role • Group President, Matthews Industrial Automation and Matthews Environmental Solutions • Prior to joining Matthews in 2022, Lee led the Safety, Sensing and Industrial Components business unit of Rockwell Automation, Inc. • During his career at Rockwell, Lee held roles in engineering, marketing product management and product security • Joined Matthews in January 2011 and originally served as Chief Commercial Officer, Memorialization Group • Group President of Memorialization since 2011 • Spent 18 years in marketing, general management and strategy assignments with Kraft Foods prior to joining Matthews • Became SGK’s Group president in 2017 • Prior to serving in his current role, he was the Executive Vice President, Global Development at SGK • Prior to joining SGK, he was the group senior vice president of the digital solutions, global packaging and printed electronics team at RR Donnelley • Chief Financial Officer since 2003 • Previously served as Vice President, Accounting and Finance and Controller • Joined Matthews in 1992

© 2023 Matthews International Corporation. All Rights Reserved. 33 FINANCIAL OVERVIEW

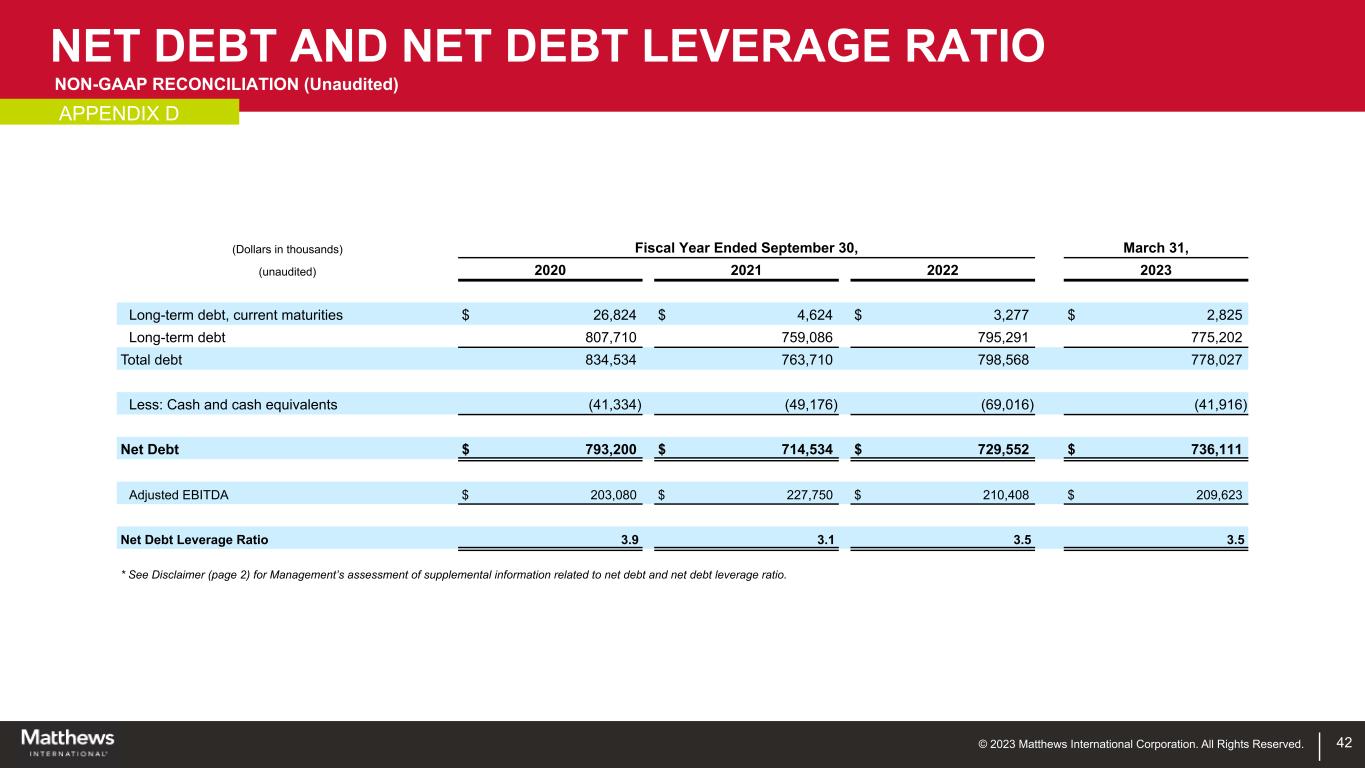

© 2023 Matthews International Corporation. All Rights Reserved. 34 DEBT REDUCTION • Historically maintained a modest leverage profile • Publicly stated Net Debt Leverage Ratio (1) target of 3.0x or less • Continued emphasis on leverage, balanced growth and share repurchase • Settled the principal U.S. defined benefit plan and SERP plan, reducing the Company’s accrued pension liabilities over $135 million from September 30, 2020 • New receivables purchased agreement entered into during Q2 of FY2022 (reduced debt $109 million as of March 31, 2023) GROWTH – ORGANIC & ACQUISITIONS • Organic: Leverage existing capability in new markets and geographic regions, cost structure improvements, new product development • Recent growth initiatives include (i) Saueressig engineered machines used in electric vehicle battery production, and (ii) new technology in industrial product identification business • Acquisitions: Identify and integrate complementary businesses with prudent capital deployment (achieve long-term annual return on invested capital of at least 12%) SHARE REPURCHASES & DIVIDENDS • Opportunistically repurchase in periods of excess cash flow • Authorization of 1.2 million shares at March 31, 2023 • Quarterly dividend of $0.23 per share for FY2023 vs. $0.22 per share for FY2022 FINANCIAL POLICY AND CAPITAL ALLOCATION STRATEGY Note: See Disclaimer (Page 2) for Management’s assessment of supplemental information related to non-GAAP net debt leverage ratio. (1) Non-GAAP net debt leverage ratio is defined as outstanding debt (net of cash) relative to adjusted EBITDA. See reconciliation at Appendix D.

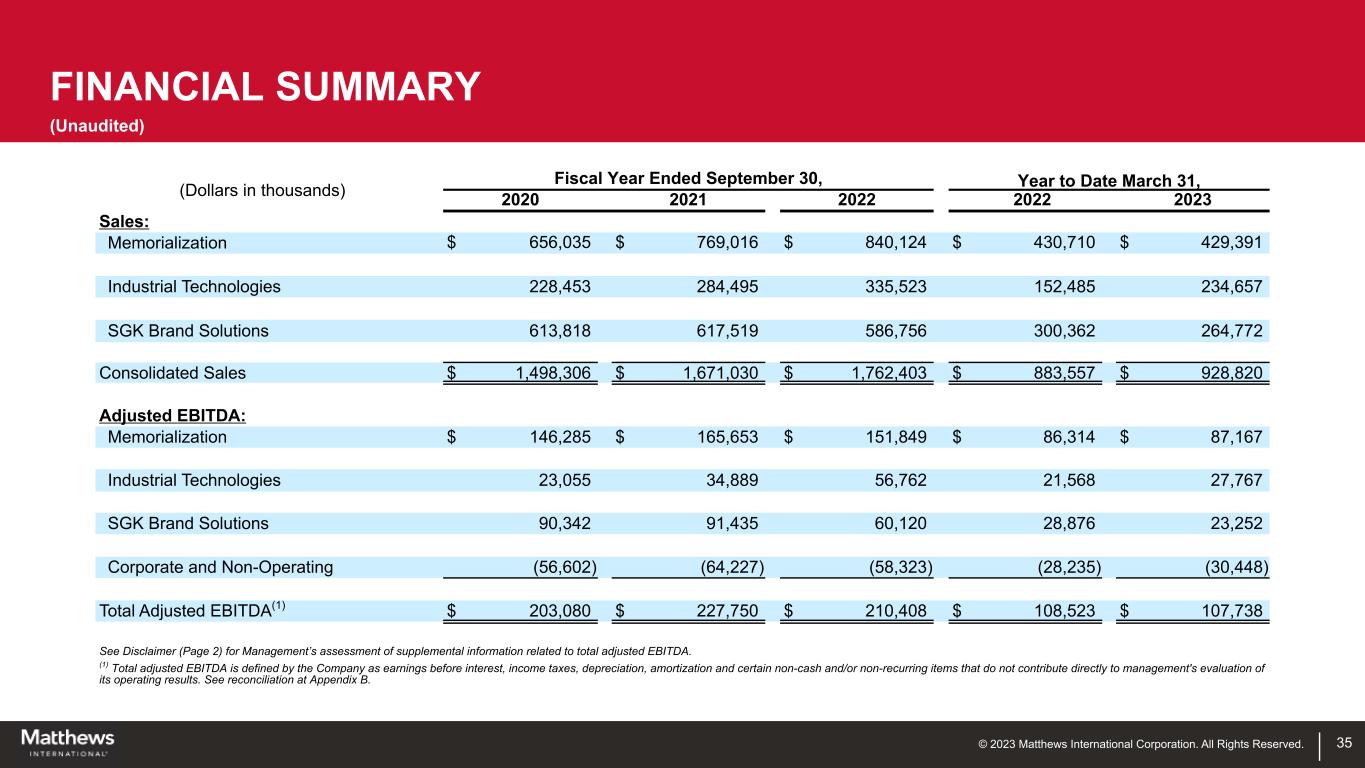

© 2023 Matthews International Corporation. All Rights Reserved. 35 (Dollars in thousands) Fiscal Year Ended September 30, Year to Date March 31, 2020 2021 2022 2022 2023 Sales: Memorialization $ 656,035 $ 769,016 $ 840,124 $ 430,710 $ 429,391 Industrial Technologies 228,453 284,495 335,523 152,485 234,657 SGK Brand Solutions 613,818 617,519 586,756 300,362 264,772 Consolidated Sales $ 1,498,306 $ 1,671,030 $ 1,762,403 $ 883,557 $ 928,820 Adjusted EBITDA: Memorialization $ 146,285 $ 165,653 $ 151,849 $ 86,314 $ 87,167 Industrial Technologies 23,055 34,889 56,762 21,568 27,767 SGK Brand Solutions 90,342 91,435 60,120 28,876 23,252 Corporate and Non-Operating (56,602) (64,227) (58,323) (28,235) (30,448) Total Adjusted EBITDA(1) $ 203,080 $ 227,750 $ 210,408 $ 108,523 $ 107,738 See Disclaimer (Page 2) for Management’s assessment of supplemental information related to total adjusted EBITDA. (1) Total adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management's evaluation of its operating results. See reconciliation at Appendix B. FINANCIAL SUMMARY (Unaudited)

© 2023 Matthews International Corporation. All Rights Reserved. 36 ESG OVERVIEW

© 2023 Matthews International Corporation. All Rights Reserved. 37 BUSINESS SOLUTIONS TO DRIVE EFFICIENCY AND ENVIRONMENTAL PERFORMANCE • Provider of Energy storage solutions including battery production technology for electric vehicles • Waste-to-Energy solutions with projects in UK and Europe • Creating environmental solutions to reduce packaging materials • Working to reduce VOC emissions with launch of new printing technology SOCIALLY RESPONSIBLE EMPLOYMENT ENVIRONMENT • D&I program that supports diversity in culture, talent and geography • Comprehensive EHS system covering all employees and contractors, focuses on actions to actively reduce risk, identifies and addresses serious incident potential, and influences a positive safety culture that ensures compliance • Committed to being a good neighbor in our communities KEY AREAS OF ENVIRONMENTAL METRICS FOCUS IDENTIFIED FOR THE BUSINESS COMMITMENT TO SUSTAINABILITY Green House Gas (GHG) Emissions • Matthews is committed to being part of the global solution in reducing carbon emissions consistent with the 2ºC Scenario. Energy Management • Matthews’ absolute target for non-renewable energy usage is to use 20% less KWH/$1000 revenue by 2030 Solid Waste and Hazardous Waste Management • The Company is committed to reduce the waste from both operations and packaging by 50% by 2030 from the 2017 baseline Water Management • Matthews’ target is to reduce water usage by 10% by the year 2030.

© 2023 Matthews International Corporation. All Rights Reserved. 38 APPENDIX

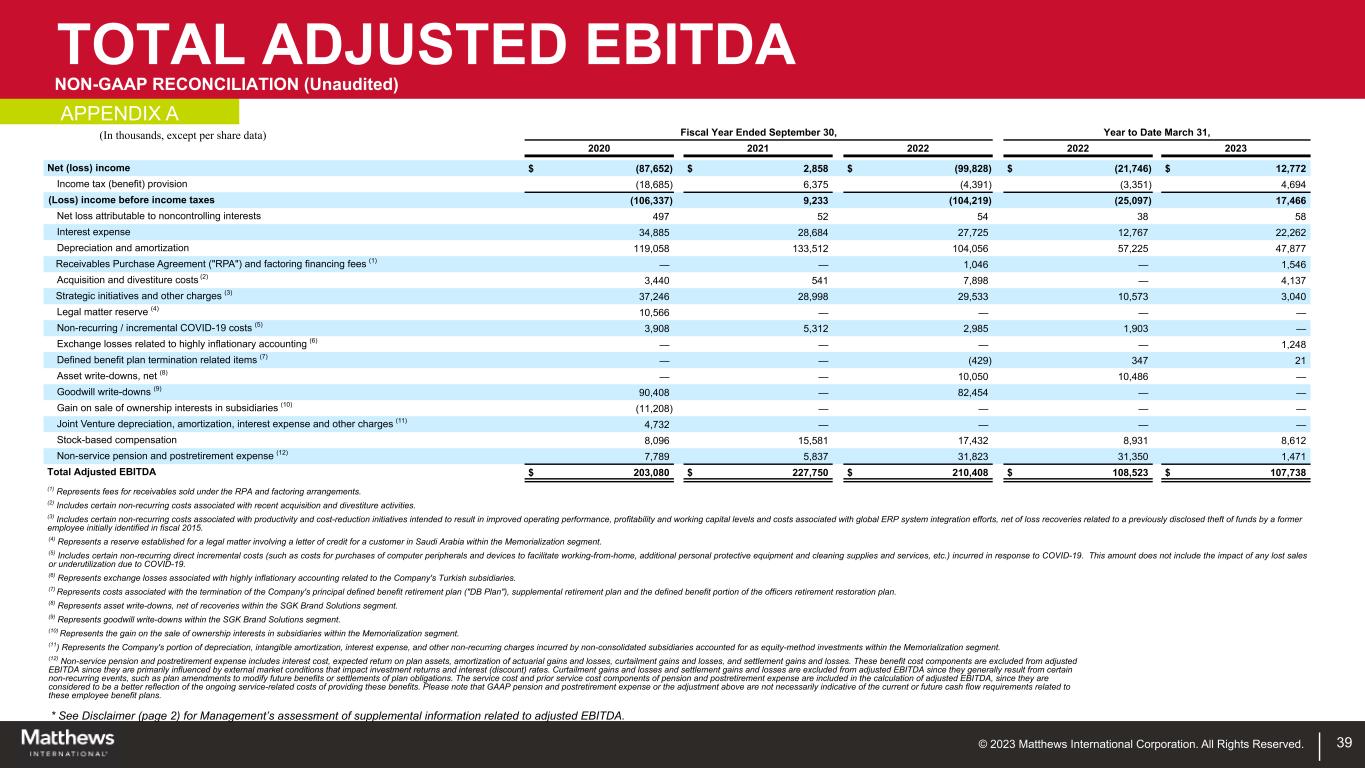

© 2023 Matthews International Corporation. All Rights Reserved. TOTAL ADJUSTED EBITDA NON-GAAP RECONCILIATION (Unaudited) * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted EBITDA. 39 (In thousands, except per share data) Fiscal Year Ended September 30, Year to Date March 31, 2020 2021 2022 2022 2023 Net (loss) income $ (87,652) $ 2,858 $ (99,828) $ (21,746) $ 12,772 Income tax (benefit) provision (18,685) 6,375 (4,391) (3,351) 4,694 (Loss) income before income taxes (106,337) 9,233 (104,219) (25,097) 17,466 Net loss attributable to noncontrolling interests 497 52 54 38 58 Interest expense 34,885 28,684 27,725 12,767 22,262 Depreciation and amortization 119,058 133,512 104,056 57,225 47,877 Receivables Purchase Agreement ("RPA") and factoring financing fees (1) — — 1,046 — 1,546 Acquisition and divestiture costs (2) 3,440 541 7,898 — 4,137 Strategic initiatives and other charges (3) 37,246 28,998 29,533 10,573 3,040 Legal matter reserve (4) 10,566 — — — — Non-recurring / incremental COVID-19 costs (5) 3,908 5,312 2,985 1,903 — Exchange losses related to highly inflationary accounting (6) — — — — 1,248 Defined benefit plan termination related items (7) — — (429) 347 21 Asset write-downs, net (8) — — 10,050 10,486 — Goodwill write-downs (9) 90,408 — 82,454 — — Gain on sale of ownership interests in subsidiaries (10) (11,208) — — — — Joint Venture depreciation, amortization, interest expense and other charges (11) 4,732 — — — — Stock-based compensation 8,096 15,581 17,432 8,931 8,612 Non-service pension and postretirement expense (12) 7,789 5,837 31,823 31,350 1,471 Total Adjusted EBITDA $ 203,080 $ 227,750 $ 210,408 $ 108,523 $ 107,738 (1) Represents fees for receivables sold under the RPA and factoring arrangements. (2) Includes certain non-recurring costs associated with recent acquisition and divestiture activities. (3) Includes certain non-recurring costs associated with productivity and cost-reduction initiatives intended to result in improved operating performance, profitability and working capital levels and costs associated with global ERP system integration efforts, net of loss recoveries related to a previously disclosed theft of funds by a former employee initially identified in fiscal 2015. (4) Represents a reserve established for a legal matter involving a letter of credit for a customer in Saudi Arabia within the Memorialization segment. (5) Includes certain non-recurring direct incremental costs (such as costs for purchases of computer peripherals and devices to facilitate working-from-home, additional personal protective equipment and cleaning supplies and services, etc.) incurred in response to COVID-19. This amount does not include the impact of any lost sales or underutilization due to COVID-19. (6) Represents exchange losses associated with highly inflationary accounting related to the Company's Turkish subsidiaries. (7) Represents costs associated with the termination of the Company's principal defined benefit retirement plan ("DB Plan"), supplemental retirement plan and the defined benefit portion of the officers retirement restoration plan. (8) Represents asset write-downs, net of recoveries within the SGK Brand Solutions segment. (9) Represents goodwill write-downs within the SGK Brand Solutions segment. (10) Represents the gain on the sale of ownership interests in subsidiaries within the Memorialization segment. (11) Represents the Company's portion of depreciation, intangible amortization, interest expense, and other non-recurring charges incurred by non-consolidated subsidiaries accounted for as equity-method investments within the Memorialization segment. (12) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. APPENDIX A

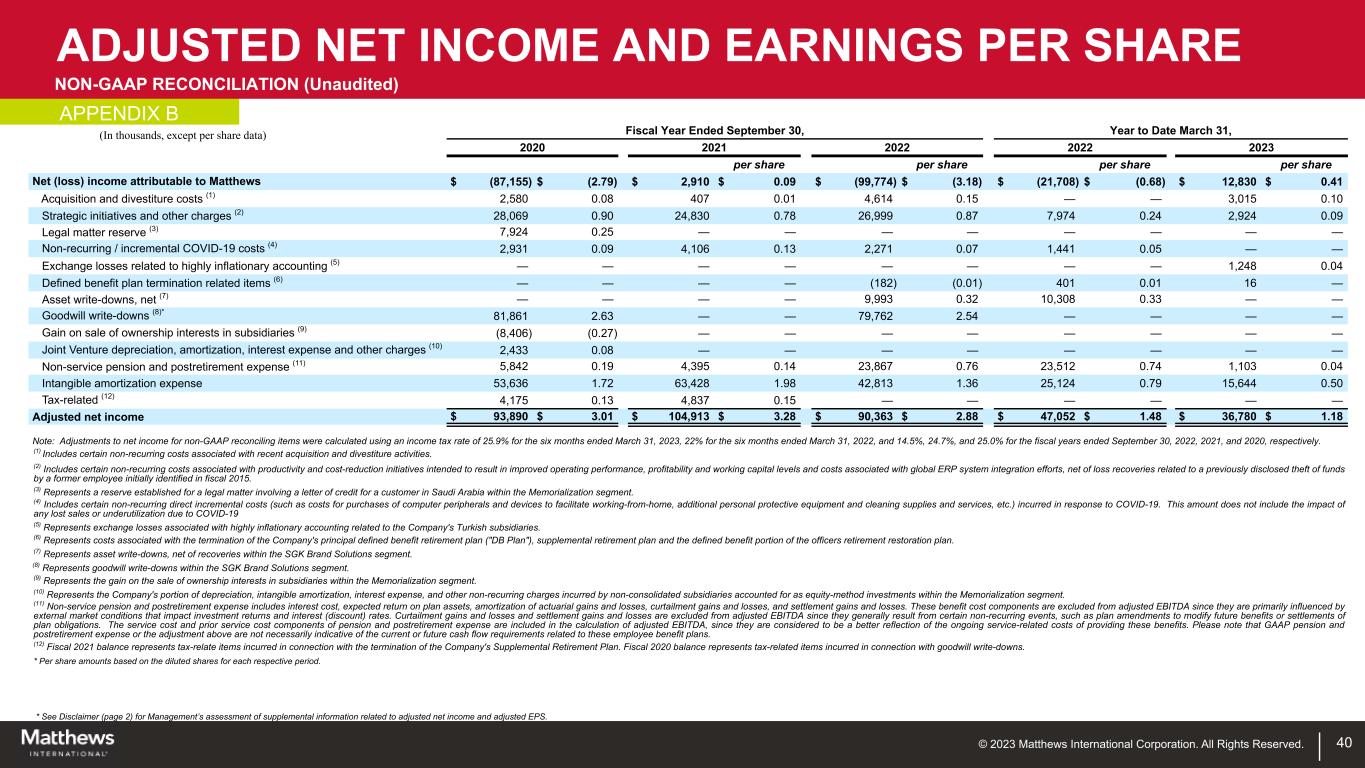

© 2023 Matthews International Corporation. All Rights Reserved. ADJUSTED NET INCOME AND EARNINGS PER SHARE NON-GAAP RECONCILIATION (Unaudited) * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted net income and adjusted EPS. 40 (In thousands, except per share data) Fiscal Year Ended September 30, Year to Date March 31, 2020 2021 2022 2022 2023 per share per share per share per share Net (loss) income attributable to Matthews $ (87,155) $ (2.79) $ 2,910 $ 0.09 $ (99,774) $ (3.18) $ (21,708) $ (0.68) $ 12,830 $ 0.41 Acquisition and divestiture costs (1) 2,580 0.08 407 0.01 4,614 0.15 — — 3,015 0.10 Strategic initiatives and other charges (2) 28,069 0.90 24,830 0.78 26,999 0.87 7,974 0.24 2,924 0.09 Legal matter reserve (3) 7,924 0.25 — — — — — — — — Non-recurring / incremental COVID-19 costs (4) 2,931 0.09 4,106 0.13 2,271 0.07 1,441 0.05 — — Exchange losses related to highly inflationary accounting (5) — — — — — — — — 1,248 0.04 Defined benefit plan termination related items (6) — — — — (182) (0.01) 401 0.01 16 — Asset write-downs, net (7) — — — — 9,993 0.32 10,308 0.33 — — Goodwill write-downs (8)* 81,861 2.63 — — 79,762 2.54 — — — — Gain on sale of ownership interests in subsidiaries (9) (8,406) (0.27) — — — — — — — — Joint Venture depreciation, amortization, interest expense and other charges (10) 2,433 0.08 — — — — — — — — Non-service pension and postretirement expense (11) 5,842 0.19 4,395 0.14 23,867 0.76 23,512 0.74 1,103 0.04 Intangible amortization expense 53,636 1.72 63,428 1.98 42,813 1.36 25,124 0.79 15,644 0.50 Tax-related (12) 4,175 0.13 4,837 0.15 — — — — — — Adjusted net income $ 93,890 $ 3.01 $ 104,913 $ 3.28 $ 90,363 $ 2.88 $ 47,052 $ 1.48 $ 36,780 $ 1.18 Note: Adjustments to net income for non-GAAP reconciling items were calculated using an income tax rate of 25.9% for the six months ended March 31, 2023, 22% for the six months ended March 31, 2022, and 14.5%, 24.7%, and 25.0% for the fiscal years ended September 30, 2022, 2021, and 2020, respectively. (1) Includes certain non-recurring costs associated with recent acquisition and divestiture activities. (2) Includes certain non-recurring costs associated with productivity and cost-reduction initiatives intended to result in improved operating performance, profitability and working capital levels and costs associated with global ERP system integration efforts, net of loss recoveries related to a previously disclosed theft of funds by a former employee initially identified in fiscal 2015. (3) Represents a reserve established for a legal matter involving a letter of credit for a customer in Saudi Arabia within the Memorialization segment. (4) Includes certain non-recurring direct incremental costs (such as costs for purchases of computer peripherals and devices to facilitate working-from-home, additional personal protective equipment and cleaning supplies and services, etc.) incurred in response to COVID-19. This amount does not include the impact of any lost sales or underutilization due to COVID-19 (5) Represents exchange losses associated with highly inflationary accounting related to the Company's Turkish subsidiaries. (6) Represents costs associated with the termination of the Company's principal defined benefit retirement plan ("DB Plan"), supplemental retirement plan and the defined benefit portion of the officers retirement restoration plan. (7) Represents asset write-downs, net of recoveries within the SGK Brand Solutions segment. (8) Represents goodwill write-downs within the SGK Brand Solutions segment. (9) Represents the gain on the sale of ownership interests in subsidiaries within the Memorialization segment. (10) Represents the Company's portion of depreciation, intangible amortization, interest expense, and other non-recurring charges incurred by non-consolidated subsidiaries accounted for as equity-method investments within the Memorialization segment. (11) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. (12) Fiscal 2021 balance represents tax-relate items incurred in connection with the termination of the Company's Supplemental Retirement Plan. Fiscal 2020 balance represents tax-related items incurred in connection with goodwill write-downs. * Per share amounts based on the diluted shares for each respective period. APPENDIX B

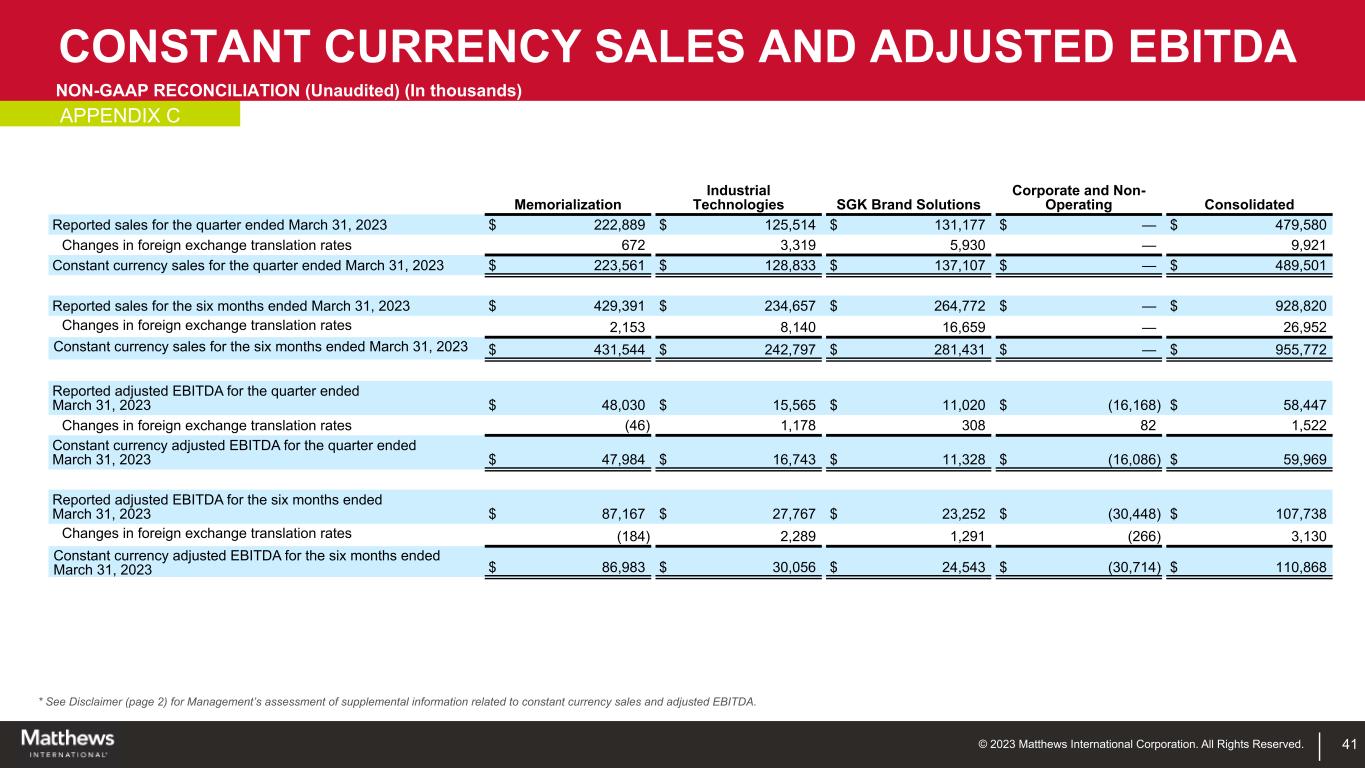

© 2023 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to constant currency sales and adjusted EBITDA. 41 CONSTANT CURRENCY SALES AND ADJUSTED EBITDA NON-GAAP RECONCILIATION (Unaudited) (In thousands) Memorialization Industrial Technologies SGK Brand Solutions Corporate and Non- Operating Consolidated Reported sales for the quarter ended March 31, 2023 $ 222,889 $ 125,514 $ 131,177 $ — $ 479,580 Changes in foreign exchange translation rates 672 3,319 5,930 — 9,921 Constant currency sales for the quarter ended March 31, 2023 $ 223,561 $ 128,833 $ 137,107 $ — $ 489,501 Reported sales for the six months ended March 31, 2023 $ 429,391 $ 234,657 $ 264,772 $ — $ 928,820 Changes in foreign exchange translation rates 2,153 8,140 16,659 — 26,952 Constant currency sales for the six months ended March 31, 2023 $ 431,544 $ 242,797 $ 281,431 $ — $ 955,772 Reported adjusted EBITDA for the quarter ended March 31, 2023 $ 48,030 $ 15,565 $ 11,020 $ (16,168) $ 58,447 Changes in foreign exchange translation rates (46) 1,178 308 82 1,522 Constant currency adjusted EBITDA for the quarter ended March 31, 2023 $ 47,984 $ 16,743 $ 11,328 $ (16,086) $ 59,969 Reported adjusted EBITDA for the six months ended March 31, 2023 $ 87,167 $ 27,767 $ 23,252 $ (30,448) $ 107,738 Changes in foreign exchange translation rates (184) 2,289 1,291 (266) 3,130 Constant currency adjusted EBITDA for the six months ended March 31, 2023 $ 86,983 $ 30,056 $ 24,543 $ (30,714) $ 110,868 APPENDIX C

© 2023 Matthews International Corporation. All Rights Reserved. 42 (Dollars in thousands) Fiscal Year Ended September 30, March 31, (unaudited) 2020 2021 2022 2023 Long-term debt, current maturities $ 26,824 $ 4,624 $ 3,277 $ 2,825 Long-term debt 807,710 759,086 795,291 775,202 Total debt 834,534 763,710 798,568 778,027 Less: Cash and cash equivalents (41,334) (49,176) (69,016) (41,916) Net Debt $ 793,200 $ 714,534 $ 729,552 $ 736,111 Adjusted EBITDA $ 203,080 $ 227,750 $ 210,408 $ 209,623 Net Debt Leverage Ratio 3.9 3.1 3.5 3.5 * See Disclaimer (page 2) for Management’s assessment of supplemental information related to net debt and net debt leverage ratio. NET DEBT AND NET DEBT LEVERAGE RATIO APPENDIX D NON-GAAP RECONCILIATION (Unaudited)

© 2023 Matthews International Corporation. All Rights Reserved. 43 (Dollars in thousands) Fiscal Year Ended September 30, Six Months Ended March 31, 20232020 2021 2022 Cash Provided from Operating Activities $ 180,447 $ 162,811 $ 126,860 $ 44,711 Less: Capital Expenditures (34,849) (34,313) (61,321) (23,772) Free Cash Flow $ 145,598 $ 128,498 $ 65,539 $ 20,939 Note: See Disclaimer (Page 2) for Management’s assessment of supplemental information related to free cash flow. FREE CASH FLOW APPENDIX E NON-GAAP RECONCILIATION (Unaudited)

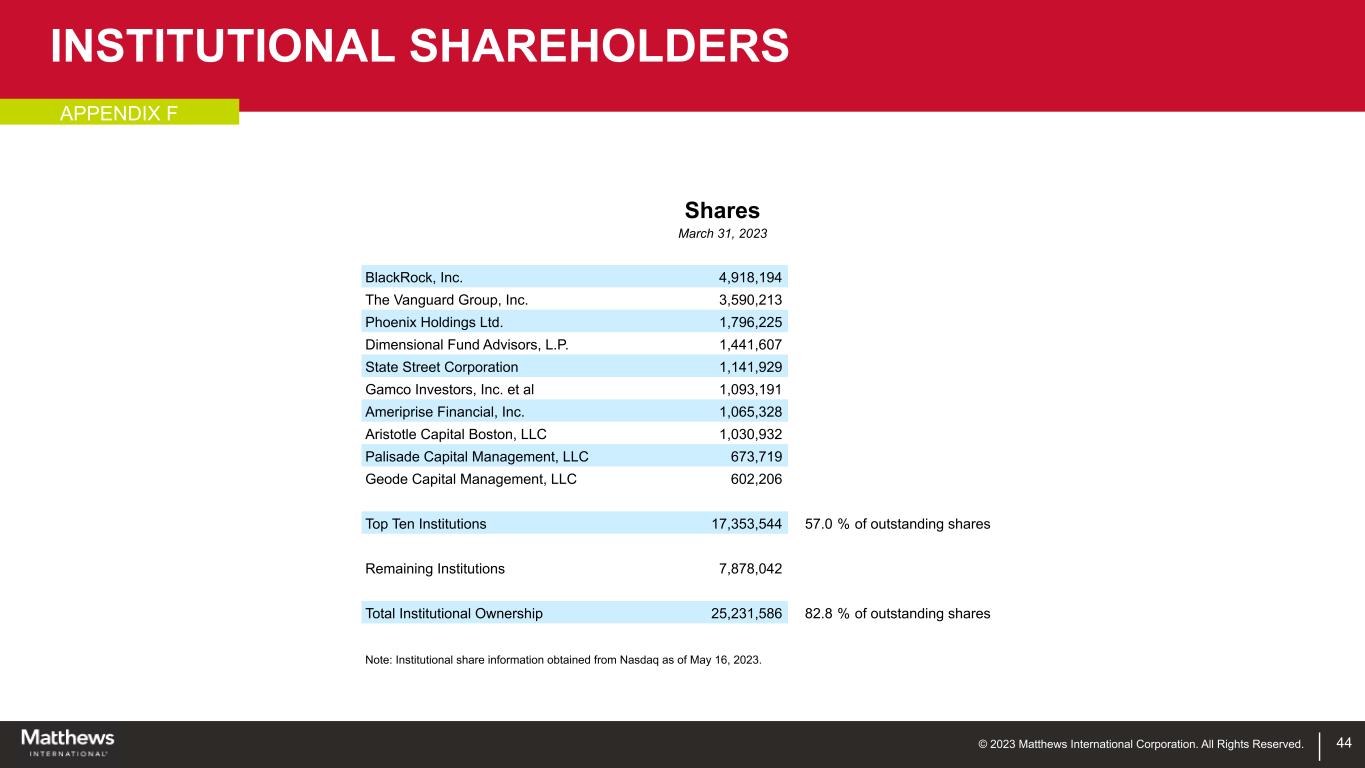

© 2023 Matthews International Corporation. All Rights Reserved. 44 Shares March 31, 2023 BlackRock, Inc. 4,918,194 The Vanguard Group, Inc. 3,590,213 Phoenix Holdings Ltd. 1,796,225 Dimensional Fund Advisors, L.P. 1,441,607 State Street Corporation 1,141,929 Gamco Investors, Inc. et al 1,093,191 Ameriprise Financial, Inc. 1,065,328 Aristotle Capital Boston, LLC 1,030,932 Palisade Capital Management, LLC 673,719 Geode Capital Management, LLC 602,206 Top Ten Institutions 17,353,544 57.0 % of outstanding shares Remaining Institutions 7,878,042 Total Institutional Ownership 25,231,586 82.8 % of outstanding shares Note: Institutional share information obtained from Nasdaq as of May 16, 2023. INSTITUTIONAL SHAREHOLDERS APPENDIX F

© 2022 Matthews International Corporation. All Rights Reserved.