www.matw.com | Nasdaq: MATW © 2023 Matthews International Corporation. All Rights Reserved. CORPORATE PRESENTATION July 2023

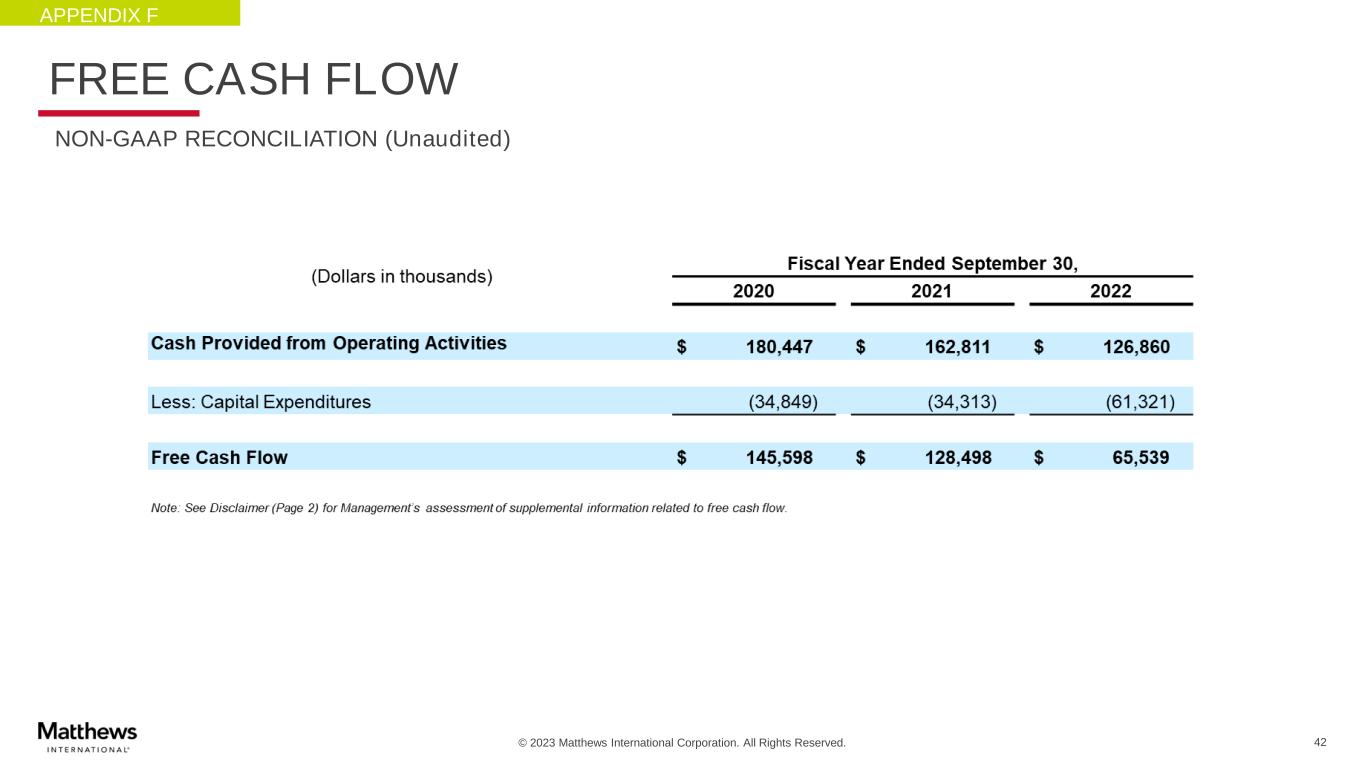

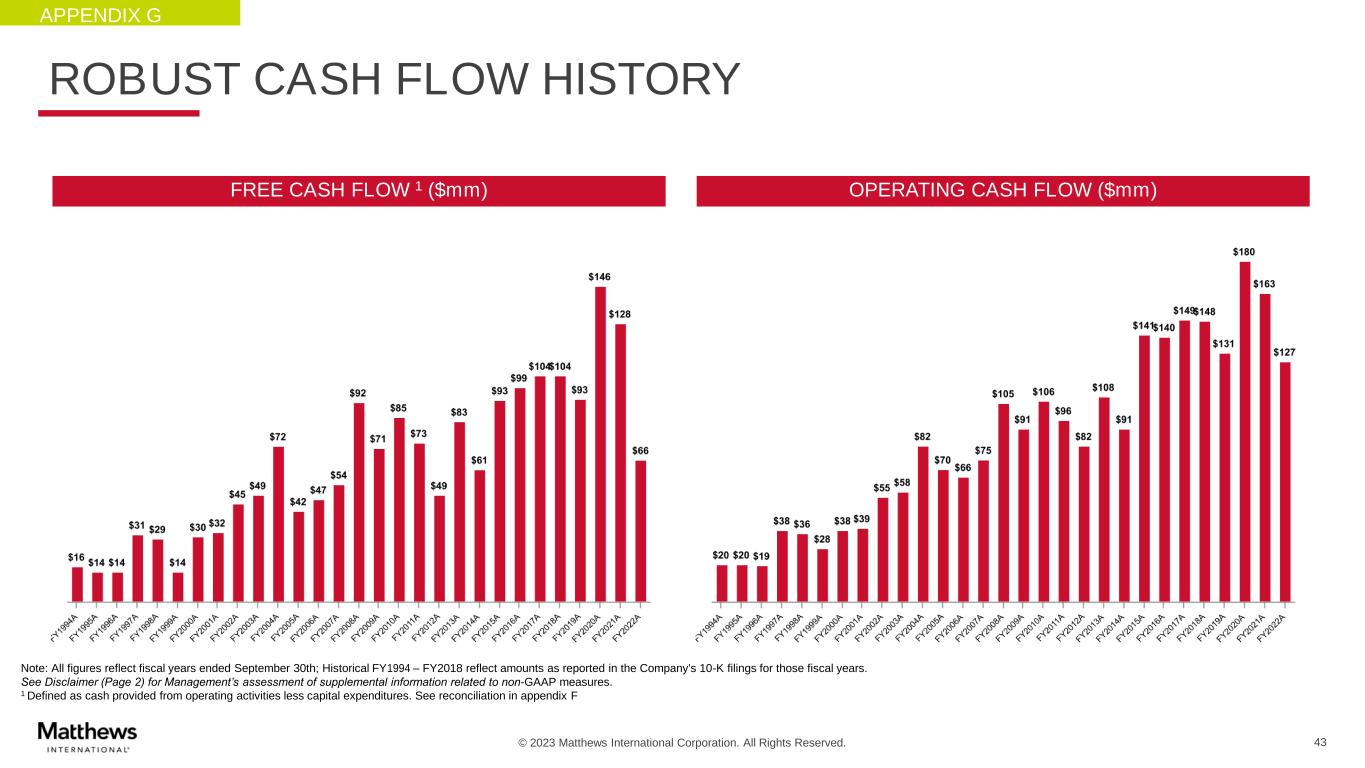

© 2023 Matthews International Corporation. All Rights Reserved. DISCLAIMER 2 Any forward-looking statements contained in this presentation are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from management’s expectations. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove correct. Factors that could cause the Company's results to differ materially from the results discussed in such forward-looking statements principally include changes in domestic or international economic conditions, changes in foreign currency exchange rates, changes in the cost of materials used in the manufacture of the Company's products, changes in mortality and cremation rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company operates, or other factors such as supply chain disruptions, labor shortages or labor cost increases, changes in product demand or pricing as a result of domestic or international competitive pressures, ability to achieve cost-reduction objectives, unknown risks in connection with the Company's acquisitions, cybersecurity concerns, effectiveness of the Company's internal controls, compliance with domestic and foreign laws and regulations, technological factors beyond the Company's control, impact of pandemics or similar outbreaks, or other disruptions to our industries, customers, or supply chains, the impact of global conflicts, such as the current war between Russia and Ukraine, and other factors described in the Company’s Annual Report on Form 10-K and other periodic filings with the U.S. Securities and Exchange Commission ("SEC"). The information contained in this presentation, including any financial data, is made as of September 30, 2022 unless otherwise noted. The Company does not, and is not obligated to, update this information after the date of such information. Included in this report are measures of financial performance that are not defined by generally accepted accounting principles in the United States (“GAAP”). The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition and divestiture costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company’s core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. The Company believes that adjusted EBITDA provides relevant and useful information, which is used by the Company’s management in assessing the performance of its business. Adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management’s evaluation of its operating results. These items include stock-based compensation, the non-service portion of pension and postretirement expense, acquisition and divestiture costs, ERP integration costs, and strategic initiatives and other charges. Adjusted EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income taxes, and the effects of certain acquisition, divestiture and ERP integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating operating performance. It is also useful as a financial measure for lenders and is used by the Company’s management to measure business performance. Adjusted EBITDA is not a measure of the Company's financial performance under GAAP and should not be considered as an alternative to net income or other performance measures derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the Company's liquidity. The Company's definition of adjusted EBITDA may not be comparable to similarly titled measures used by other companies. The Company has presented constant currency sales and constant currency adjusted EBITDA and believes these measures provide relevant and useful information, which is used by the Company's management in assessing the performance of its business on a consistent basis by removing the impact of changes due to foreign exchange translation rates. These measures allow management, as well as investors, to assess the Company’s sales and adjusted EBITDA on a constant currency basis. The Company has also presented adjusted net income and adjusted earnings per share and believes each measure provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in assessing the performance of its business. Adjusted net income and adjusted earnings per share provides the Company with an understanding of the results from the primary operations of our business by excluding the effects of certain acquisition, divestiture and system-integration costs, and items that do not reflect the ordinary earnings of our operations. These measures provide management with insight into the earning value for shareholders excluding certain costs, not related to the Company’s primary operations. Likewise, these measures may be useful to an investor in evaluating the underlying operating performance of the Company’s business overall, as well as performance trends, on a consistent basis. The Company has also presented net debt and a net debt leverage ratio and believes each measure provides relevant and useful information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the indebtedness of the Company, net of cash and cash equivalents and relative to adjusted EBITDA. These measures allow management, as well as analysts and investors, to assess the Company’s leverage.. Lastly, the Company has presented free cash flow as supplemental measures of cash flow that are not required by, or presented in accordance with, GAAP. Management believes that these measures provide relevant and useful information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the cash generated by operations, excluding capital expenditures. These measures allows management, as well as analysts and investors, to assess the Company’s ability to pursue growth and investment opportunities designed to increase Shareholder value.

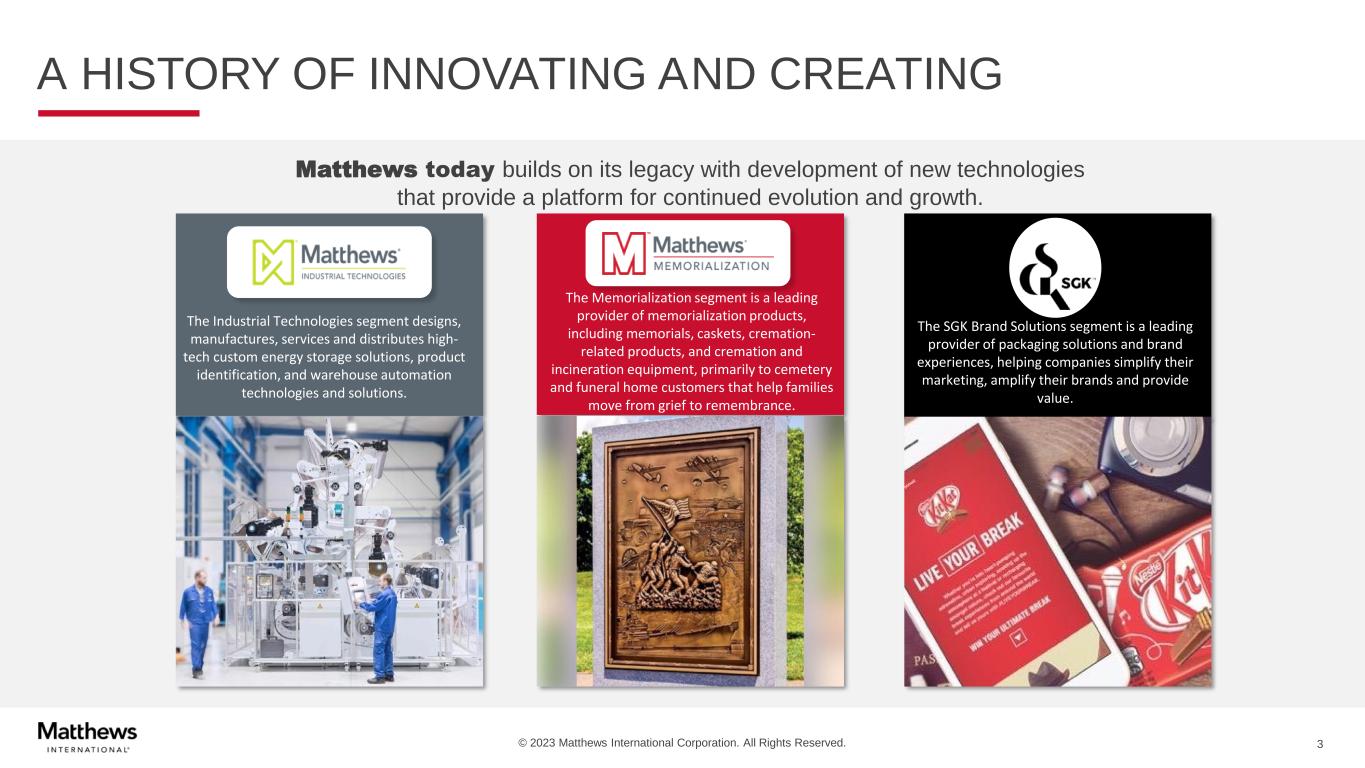

© 2023 Matthews International Corporation. All Rights Reserved. A HISTORY OF INNOVATING AND CREATING Matthews today builds on its legacy with development of new technologies that provide a platform for continued evolution and growth. 3 The SGK Brand Solutions segment is a leading provider of packaging solutions and brand experiences, helping companies simplify their marketing, amplify their brands and provide value. The Memorialization segment is a leading provider of memorialization products, including memorials, caskets, cremation- related products, and cremation and incineration equipment, primarily to cemetery and funeral home customers that help families move from grief to remembrance. The Industrial Technologies segment designs, manufactures, services and distributes high- tech custom energy storage solutions, product identification, and warehouse automation technologies and solutions.

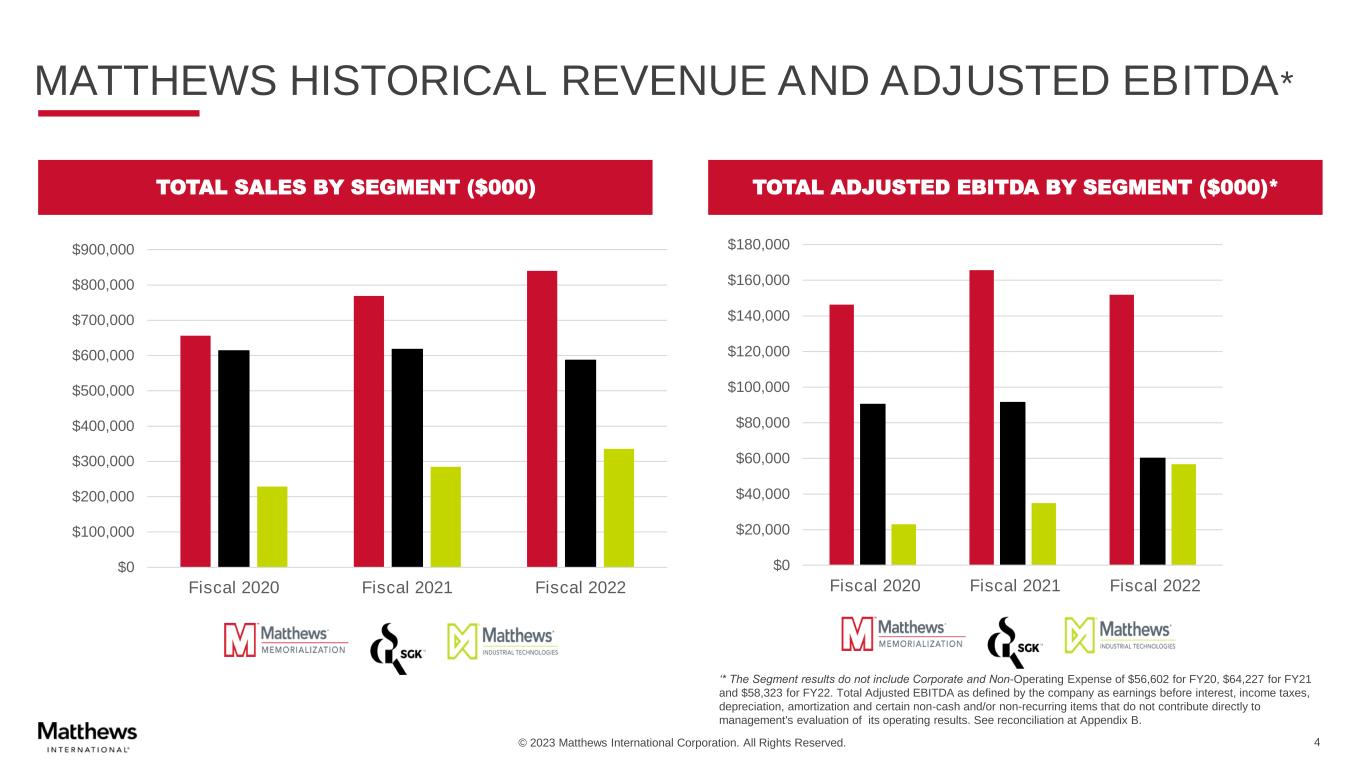

© 2023 Matthews International Corporation. All Rights Reserved. 4 ‘* The Segment results do not include Corporate and Non-Operating Expense of $56,602 for FY20, $64,227 for FY21 and $58,323 for FY22. Total Adjusted EBITDA as defined by the company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management's evaluation of its operating results. See reconciliation at Appendix B. MATTHEWS HISTORICAL REVENUE AND ADJUSTED EBITDA* TOTAL SALES BY SEGMENT ($000) TOTAL ADJUSTED EBITDA BY SEGMENT ($000)* $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $900,000 Fiscal 2020 Fiscal 2021 Fiscal 2022 $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 Fiscal 2020 Fiscal 2021 Fiscal 2022

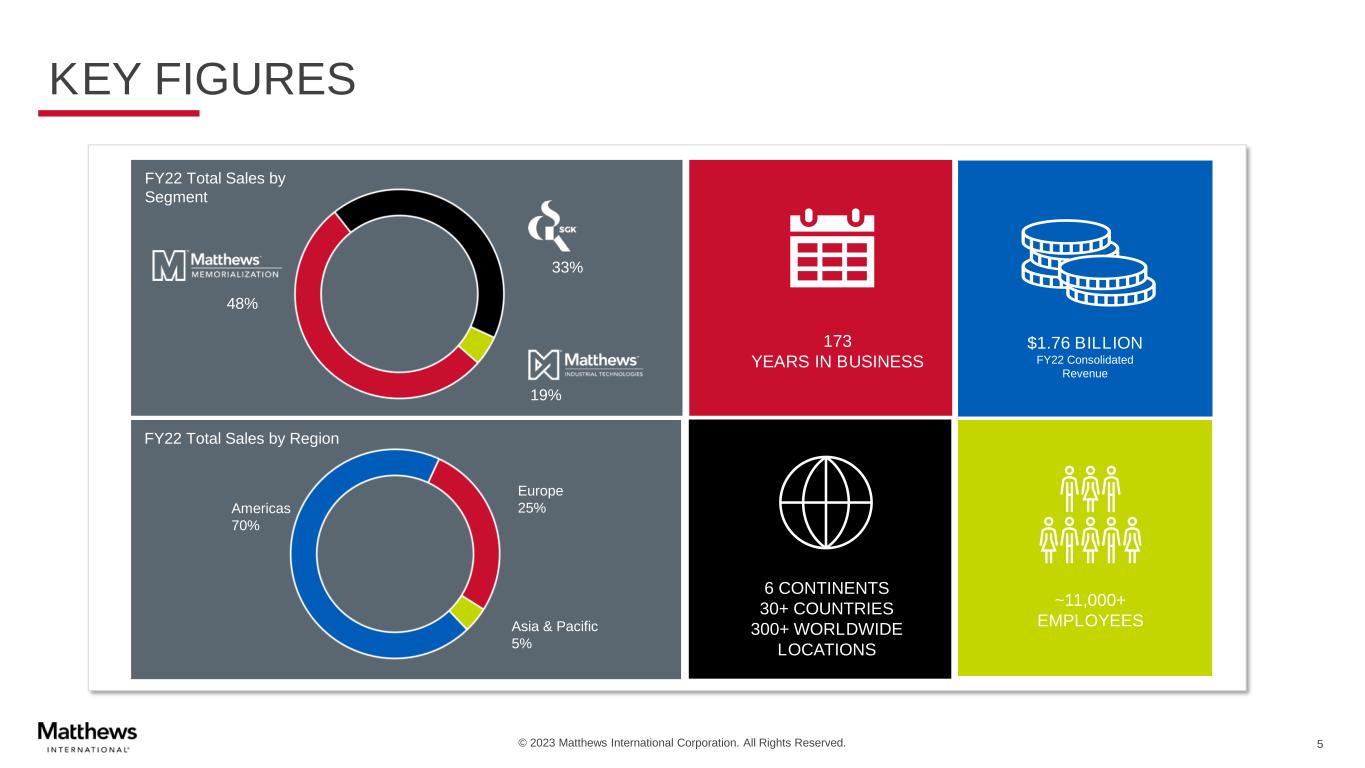

© 2023 Matthews International Corporation. All Rights Reserved. KEY FIGURES 5 $1.76 BILLION FY22 Consolidated Revenue 6 CONTINENTS 30+ COUNTRIES 300+ WORLDWIDE LOCATIONS Europe 25% Asia & Pacific 5% Americas 70% FY22 Total Sales by Region FY22 Total Sales by Segment 48% 33% 19% 300+ WORLDWIDE LOCATIONS ~11,000+ EMPLOYEES 173 YEARS IN BUSINESS

© 2023 Matthews International Corporation. All Rights Reserved. INDUSTRIAL TECHNOLOGIES

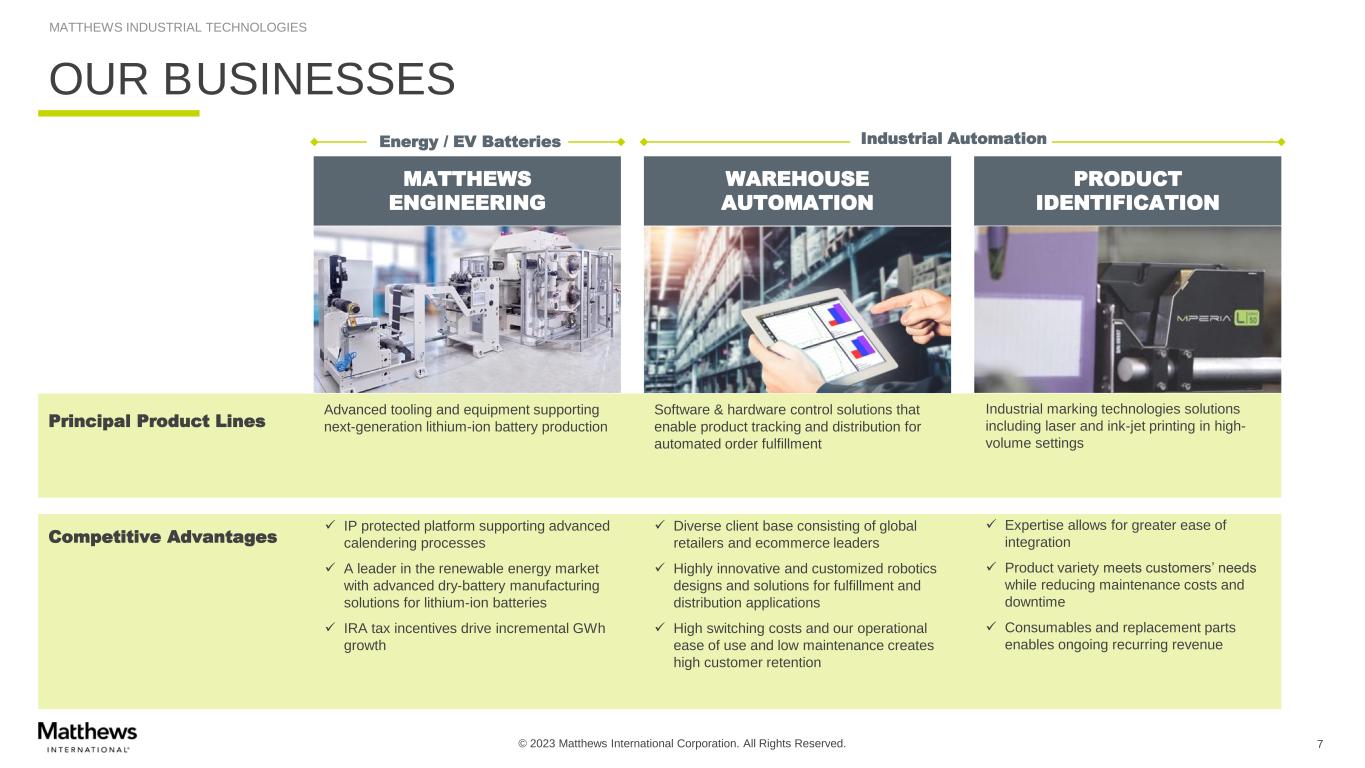

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS INDUSTRIAL TECHNOLOGIES OUR BUSINESSES 7 MATTHEWS ENGINEERING Advanced tooling and equipment supporting next-generation lithium-ion battery production WAREHOUSE AUTOMATION Software & hardware control solutions that enable product tracking and distribution for automated order fulfillment PRODUCT IDENTIFICATION Industrial marking technologies solutions including laser and ink-jet printing in high- volume settings Principal Product Lines Competitive Advantages ✓ IP protected platform supporting advanced calendering processes ✓ A leader in the renewable energy market with advanced dry-battery manufacturing solutions for lithium-ion batteries ✓ IRA tax incentives drive incremental GWh growth ✓ Diverse client base consisting of global retailers and ecommerce leaders ✓ Highly innovative and customized robotics designs and solutions for fulfillment and distribution applications ✓ High switching costs and our operational ease of use and low maintenance creates high customer retention ✓ Expertise allows for greater ease of integration ✓ Product variety meets customers’ needs while reducing maintenance costs and downtime ✓ Consumables and replacement parts enables ongoing recurring revenue Industrial AutomationEnergy / EV Batteries

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS INDUSTRIAL TECHNOLOGIES MATTHEWS ENGINEERING 8 Creators of world-leading energy and converting technologies Matthews Engineering is a global team that turn ideas into powerful technologies Over 70 years of experiences as a production equipment manufacturer, offering advanced calendering and processing systems, coating lines, rotary embossing, cutting cylinders and assembly and production lines We build machines for tomorrow’s innovators

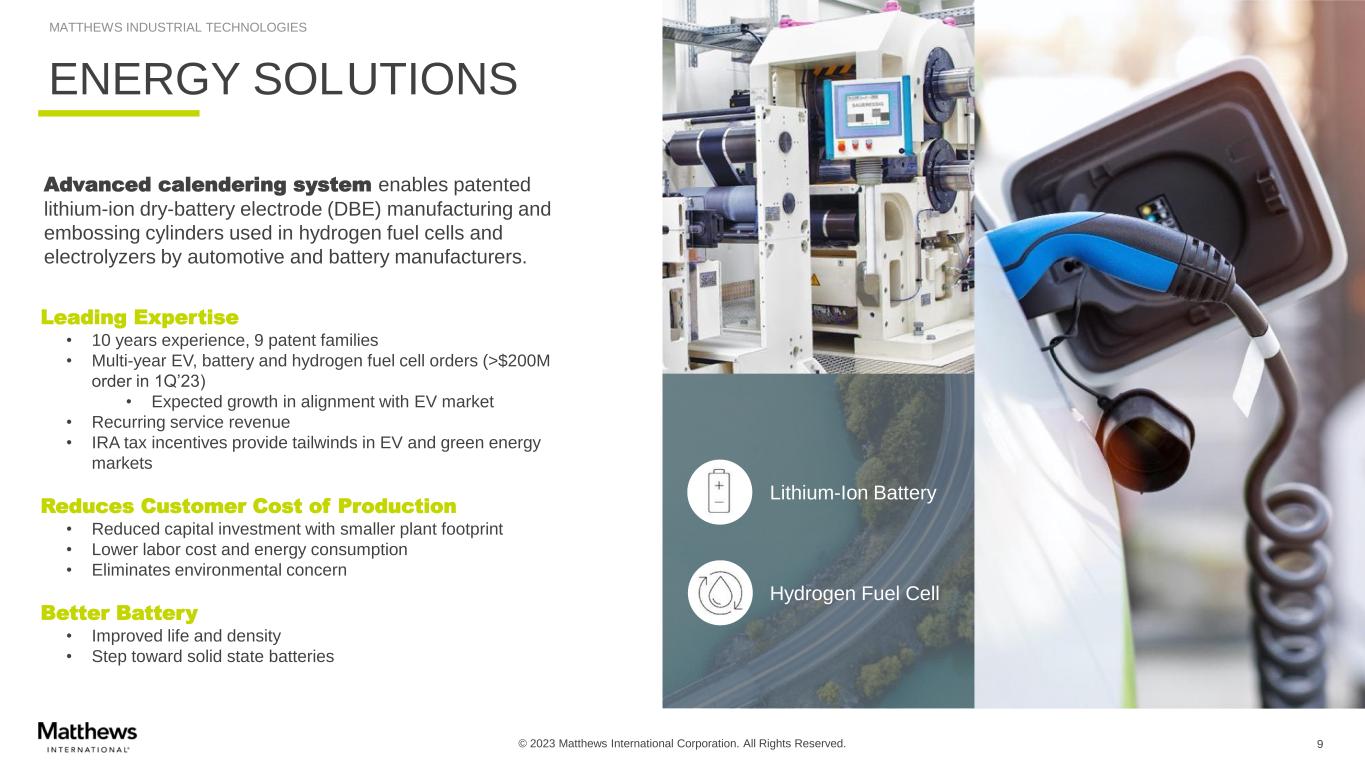

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS INDUSTRIAL TECHNOLOGIES ENERGY SOLUTIONS 9 Advanced calendering system enables patented lithium-ion dry-battery electrode (DBE) manufacturing and embossing cylinders used in hydrogen fuel cells and electrolyzers by automotive and battery manufacturers. Lithium-Ion Battery Hydrogen Fuel Cell Leading Expertise • 10 years experience, 9 patent families • Multi-year EV, battery and hydrogen fuel cell orders (>$200M order in 1Q’23) • Expected growth in alignment with EV market • Recurring service revenue • IRA tax incentives provide tailwinds in EV and green energy markets Reduces Customer Cost of Production • Reduced capital investment with smaller plant footprint • Lower labor cost and energy consumption • Eliminates environmental concern Better Battery • Improved life and density • Step toward solid state batteries

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS INDUSTRIAL TECHNOLOGIES LITHIUM-ION BATTERY STRUCTURE AND PRINCIPLE OF OPERATION 10 CYLINDRICAL POUCHPRISMATIC CELL DESIGN

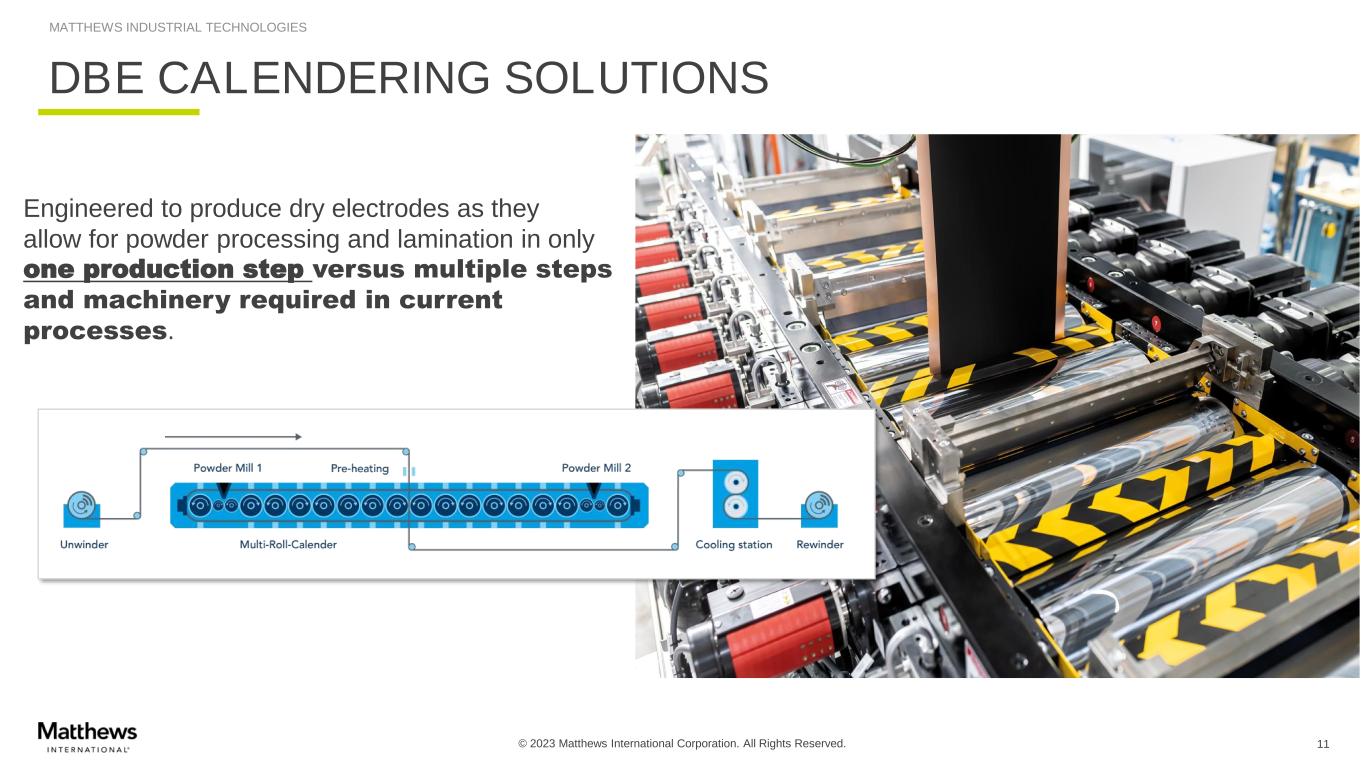

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS INDUSTRIAL TECHNOLOGIES Engineered to produce dry electrodes as they allow for powder processing and lamination in only one production step versus multiple steps and machinery required in current processes. DBE CALENDERING SOLUTIONS 11

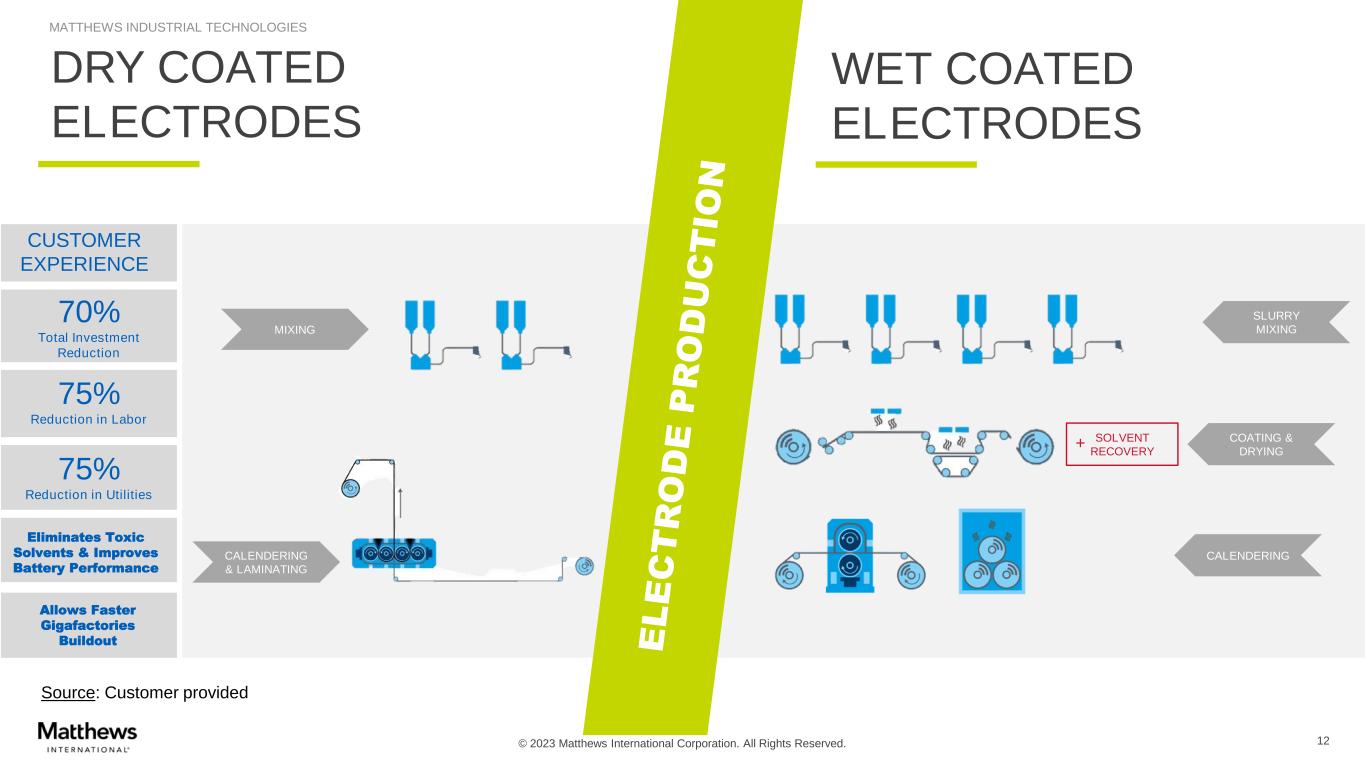

© 2023 Matthews International Corporation. All Rights Reserved. SLURRY MIXING COATING & DRYING CALENDERING SOLVENT RECOVERY + 12 MIXING CALENDERING & LAMINATING DRY COATED ELECTRODES WET COATED ELECTRODES MATTHEWS INDUSTRIAL TECHNOLOGIES 75% Reduction in Utilities Eliminates Toxic Solvents & Improves Battery Performance 75% Reduction in Labor 70% Total Investment Reduction Allows Faster Gigafactories Buildout Source: Customer provided CUSTOMER EXPERIENCE

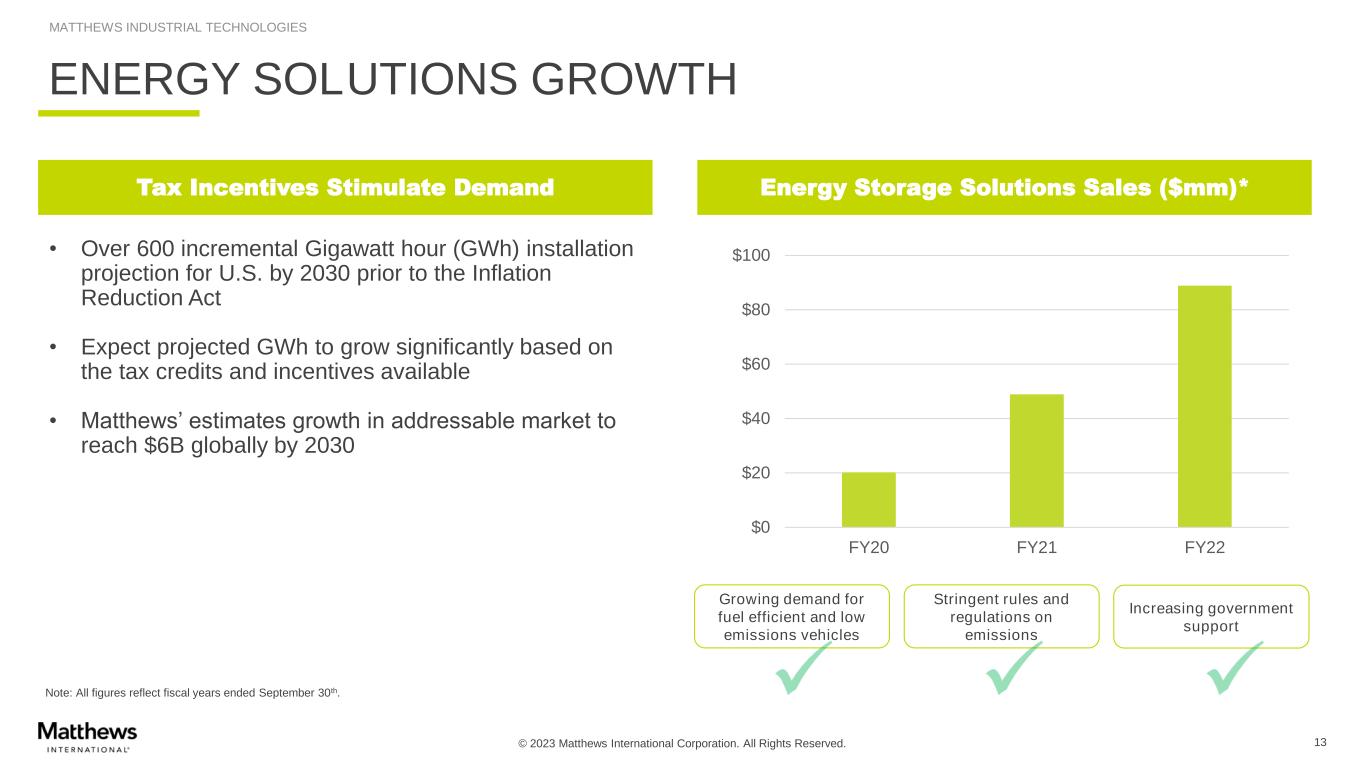

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS INDUSTRIAL TECHNOLOGIES 13 Note: All figures reflect fiscal years ended September 30th. ENERGY SOLUTIONS GROWTH Energy Storage Solutions Sales ($mm)* Growing demand for fuel efficient and low emissions vehicles Increasing government support Stringent rules and regulations on emissions $0 $20 $40 $60 $80 $100 FY20 FY21 FY22 Tax Incentives Stimulate Demand • Over 600 incremental Gigawatt hour (GWh) installation projection for U.S. by 2030 prior to the Inflation Reduction Act • Expect projected GWh to grow significantly based on the tax credits and incentives available • Matthews’ estimates growth in addressable market to reach $6B globally by 2030

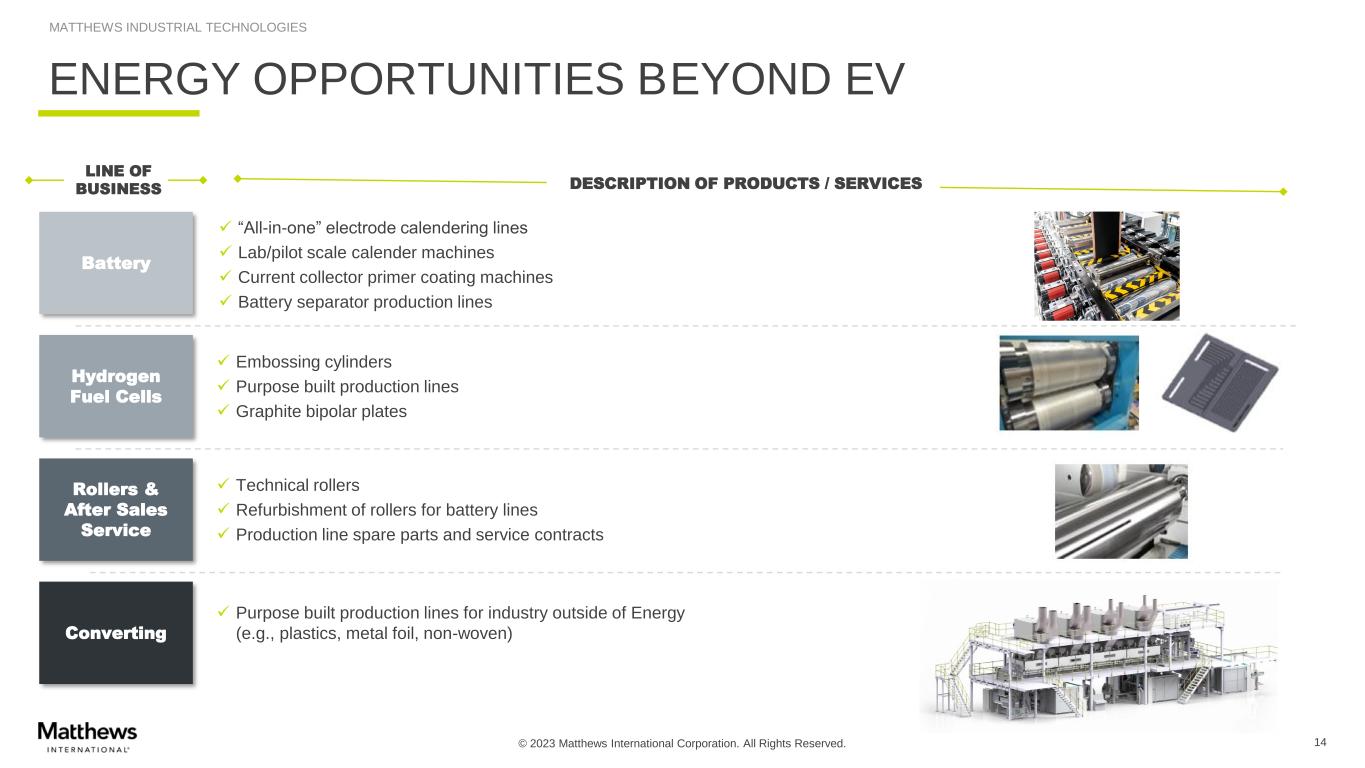

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS INDUSTRIAL TECHNOLOGIES 14 ENERGY OPPORTUNITIES BEYOND EV Battery Hydrogen Fuel Cells Rollers & After Sales Service Converting ✓ “All-in-one” electrode calendering lines ✓ Lab/pilot scale calender machines ✓ Current collector primer coating machines ✓ Battery separator production lines ✓ Embossing cylinders ✓ Purpose built production lines ✓ Graphite bipolar plates ✓ Technical rollers ✓ Refurbishment of rollers for battery lines ✓ Production line spare parts and service contracts ✓ Purpose built production lines for industry outside of Energy (e.g., plastics, metal foil, non-woven) LINE OF BUSINESS DESCRIPTION OF PRODUCTS / SERVICES

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS INDUSTRIAL TECHNOLOGIES Creators of premier industrial automation applications. Designs manufacturing technologies and solutions for industrial automation applications that mark, identify, track, control and pick products at the highest levels of accuracy Business Units • Warehouse Automation • Product Identification MATTHEWS INDUSTRIAL AUTOMATION 15

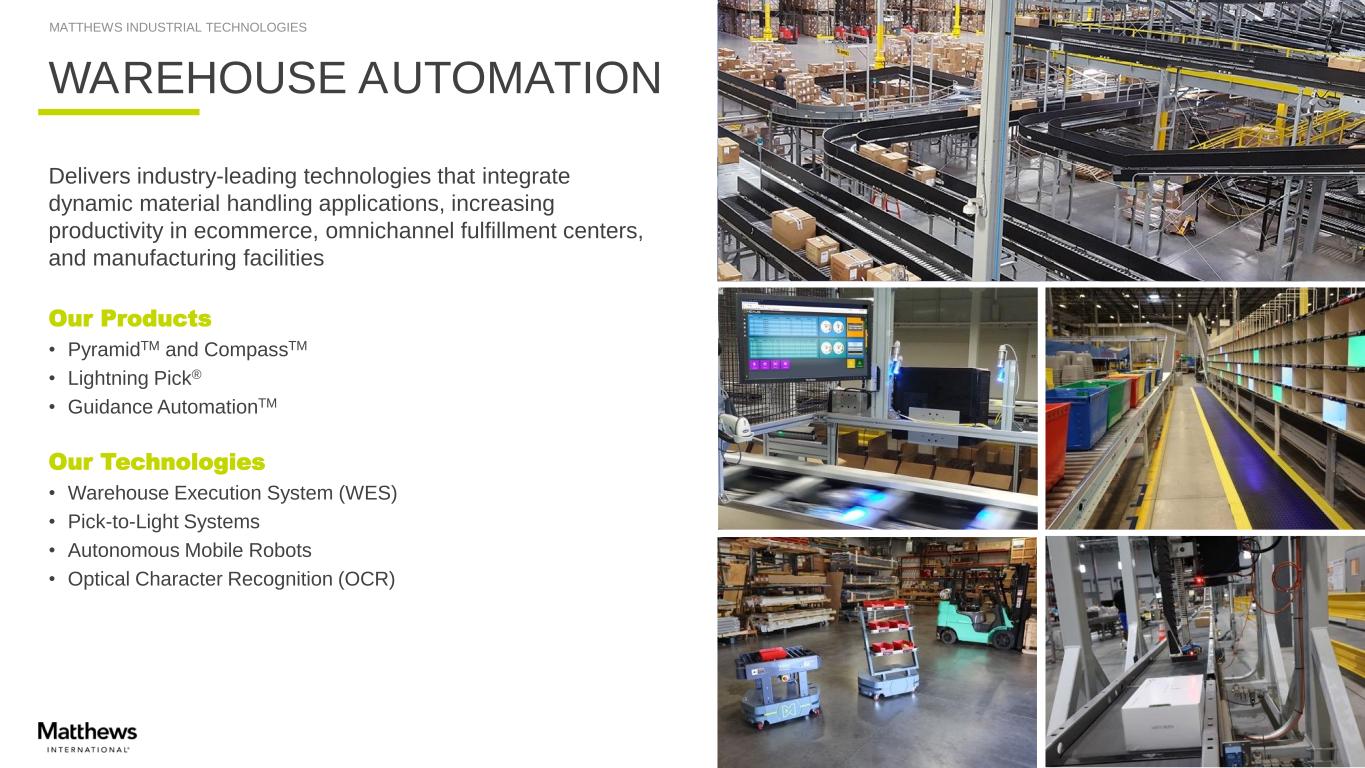

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS INDUSTRIAL TECHNOLOGIES Delivers industry-leading technologies that integrate dynamic material handling applications, increasing productivity in ecommerce, omnichannel fulfillment centers, and manufacturing facilities Our Products • PyramidTM and CompassTM • Lightning Pick® • Guidance AutomationTM Our Technologies • Warehouse Execution System (WES) • Pick-to-Light Systems • Autonomous Mobile Robots • Optical Character Recognition (OCR) WAREHOUSE AUTOMATION

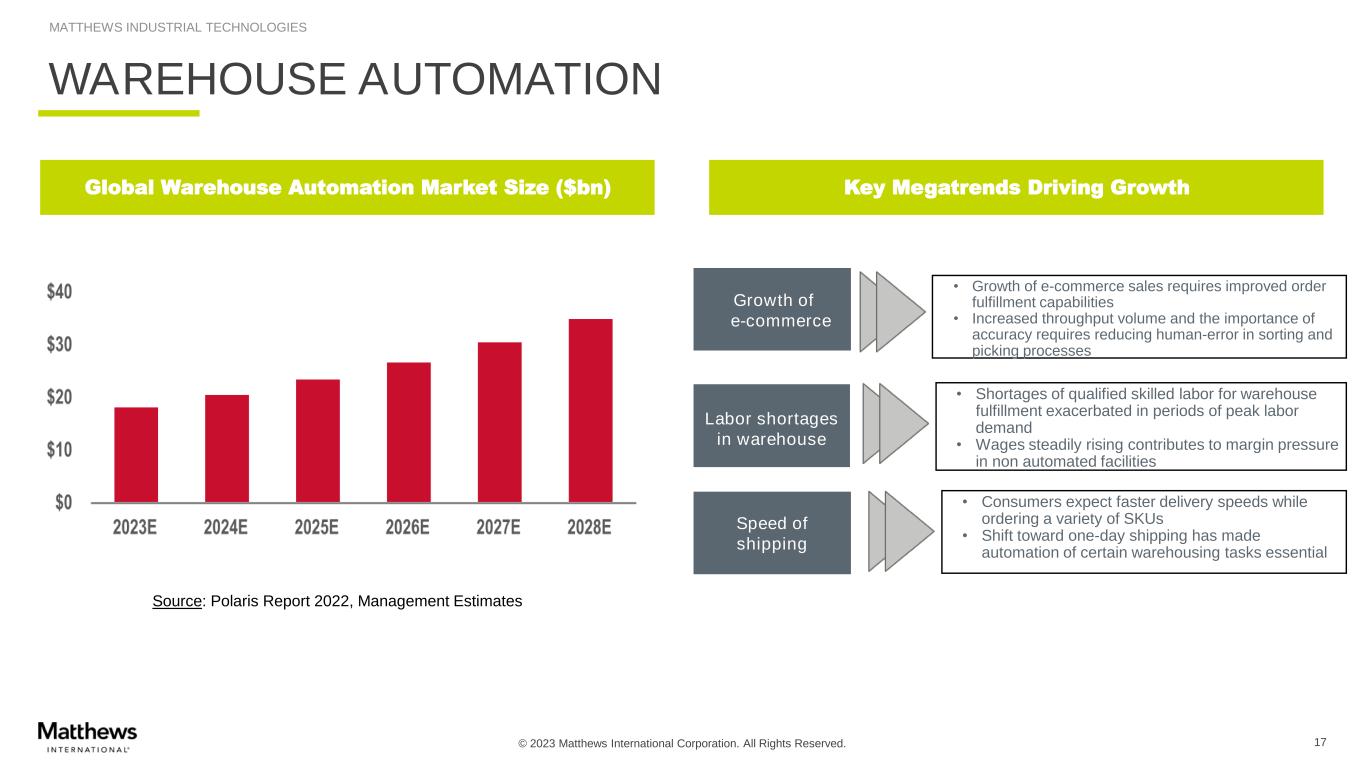

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS INDUSTRIAL TECHNOLOGIES 17 WAREHOUSE AUTOMATION Global Warehouse Automation Market Size ($bn) Key Megatrends Driving Growth Speed of shipping Growth of e-commerce Labor shortages in warehouse • Consumers expect faster delivery speeds while ordering a variety of SKUs • Shift toward one-day shipping has made automation of certain warehousing tasks essential • Growth of e-commerce sales requires improved order fulfillment capabilities • Increased throughput volume and the importance of accuracy requires reducing human-error in sorting and picking processes • Shortages of qualified skilled labor for warehouse fulfillment exacerbated in periods of peak labor demand • Wages steadily rising contributes to margin pressure in non automated facilities Source: Polaris Report 2022, Management Estimates

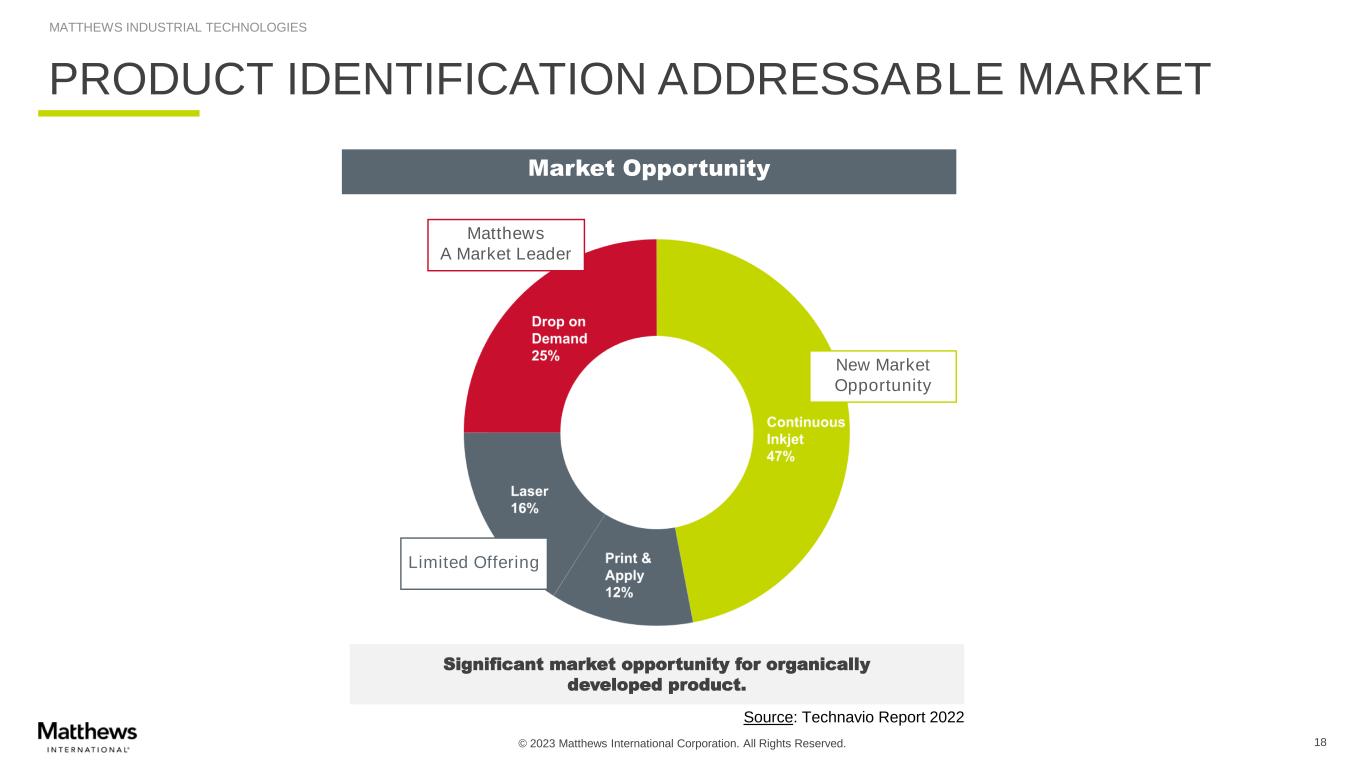

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS INDUSTRIAL TECHNOLOGIES 18 MARKET OPPORTUNITY PRODUCT IDENTIFICATION ADDRESSABLE MARKET Significant market opportunity for organically developed product. Market Opportunity New Market Opportunity Limited Offering Matthews A Market Leader Source: Technavio Report 2022

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS MEMORIALIZATION

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS MEMORIALIZATION Helping families move from grieving to remembrance for nearly 100 years Leading provider of products, business solutions and technology services to cemeteries, funeral homes, and monument dealers MATTHEWS MEMORIALIZATION 20

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS MEMORIALIZATION 21 PRODUCTS & SOLUTIONS CEMETERY PRODUCTS FUNERAL HOME SOLUTIONS CREMATION & INCINERATION EQUIPMENT MARKET POSITION CORE GEOGRAPHIES North America, Italy, Australia United States Global Bronze Memorials - #1 Granite Memorials - #1 Caskets - #2 Cremation Equipment - #1

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS MEMORIALIZATION 22 MEMORIALIZATION COMPETITIVE ADVANTAGE OPERATOR OF SCALE • Leadership position and barriers to entry create strong margins and stable cash flow generation STRONG BRAND & REPUTATION • Respected and growing market leader within the death care services industry DEEP CUSTOMER RELATIONSHIPS • Provides innovative, value-added services to help clients grow their businesses BREADTH OF PRODUCT OFFERING • Superior product quality and service LEAN OPERATING MODEL & NATIONAL DELIVERY NETWORK • Maintains a strong supply chain that maximizes efficiency and reliability INNOVATION • Complimentary new products (Jewelry, 3D casting and others)

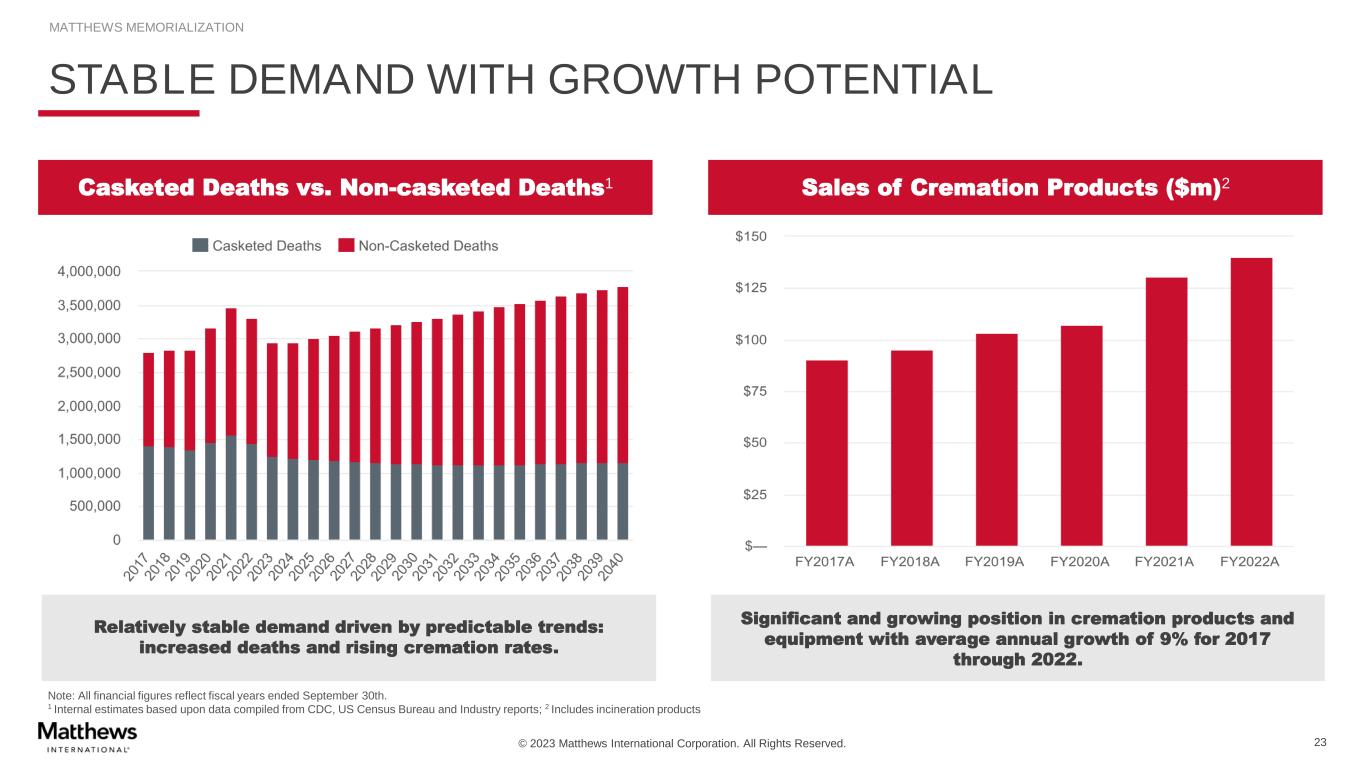

© 2023 Matthews International Corporation. All Rights Reserved. MATTHEWS MEMORIALIZATION 23 STABLE DEMAND WITH GROWTH POTENTIAL Casketed Deaths vs. Non-casketed Deaths1 Sales of Cremation Products ($m)2 Relatively stable demand driven by predictable trends: increased deaths and rising cremation rates. Significant and growing position in cremation products and equipment with average annual growth of 9% for 2017 through 2022. Note: All financial figures reflect fiscal years ended September 30th. 1 Internal estimates based upon data compiled from CDC, US Census Bureau and Industry reports; 2 Includes incineration products

© 2023 Matthews International Corporation. All Rights Reserved. SGK BRAND SOLUTIONS

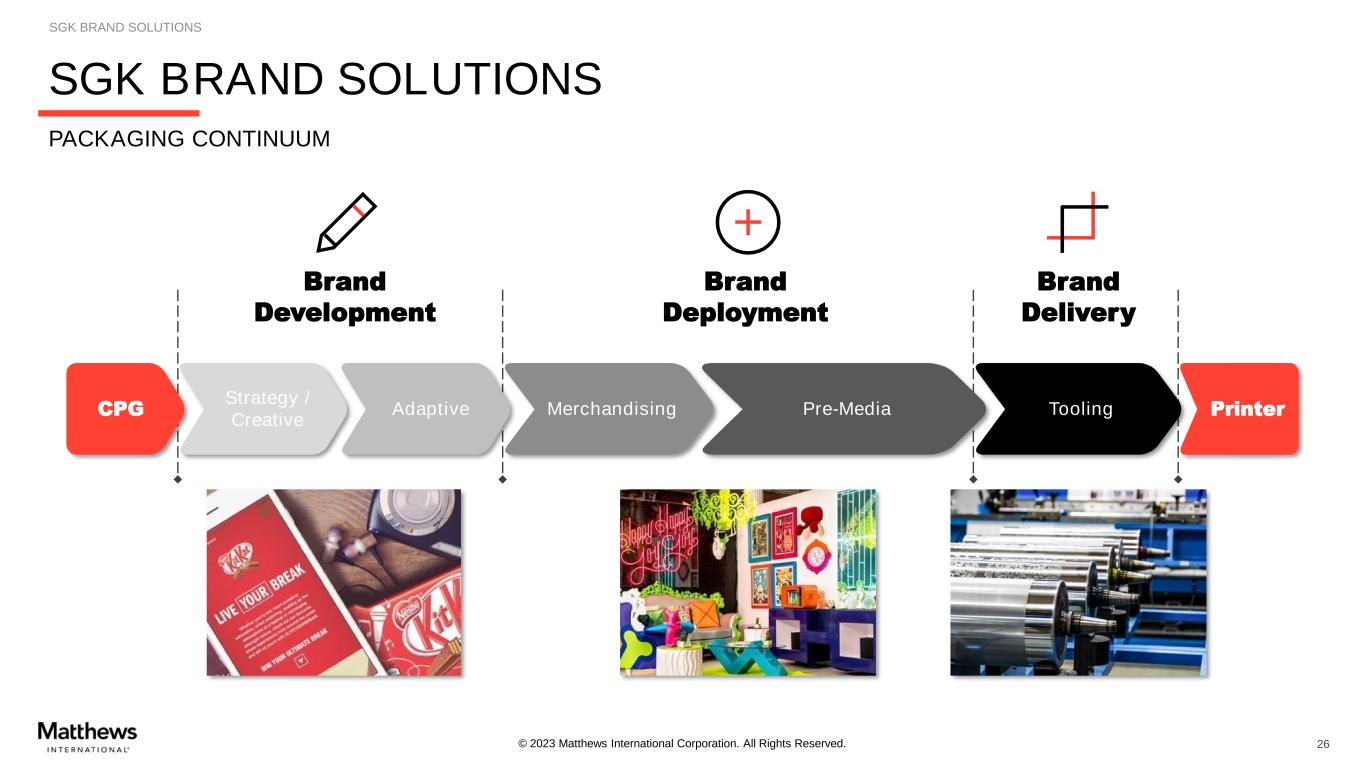

© 2023 Matthews International Corporation. All Rights Reserved. SGK BRAND SOLUTIONS Creators of experiences and solutions, we simplify marketing and amplify brands SGK Brand Solutions connects many of the largest global consumer products companies through every step of the packaging continuum – from brand development and creative stages to the adaptation necessary for deployment and bringing a range of products to market Our marketing and technological capabilities have created a sustainable competitive advantage for major brands across the CPG, health, retail, and lifestyle sectors built on differentiation. SGK BRAND SOLUTIONS 25

© 2023 Matthews International Corporation. All Rights Reserved. SGK BRAND SOLUTIONS SGK BRAND SOLUTIONS PACKAGING CONTINUUM 26 Brand Development Assem ble Team Strategy / Creative Adaptive Merchandising Pre-Media Tooling PrinterCPG Brand Deployment Brand Delivery

© 2023 Matthews International Corporation. All Rights Reserved. SGK BRAND SOLUTIONS SGK BRAND SOLUTIONS 27 CORE PACKAGING

© 2023 Matthews International Corporation. All Rights Reserved. SGK BRAND SOLUTIONS SGK BRAND SOLUTIONS 28 CORE PACKAGING SERVICES GK BRAND SOLUTIONS DIVERSE CLIENT BASE FOOD/ BEVERAGE CLIENTS GLOBAL PHARMA/ HEALTHCARE CLIENTS GLOBAL RETAILER CLIENTS OTHER LEADING BRANDS

© 2023 Matthews International Corporation. All Rights Reserved. 29 INVESTMENT HIGHLIGHTS AND FINANCIAL OVERVIEW

© 2023 Matthews International Corporation. All Rights Reserved. 30 GROWTH OPPORTUNITIES SUPPORTED BY STABLE CORE BUSINESSES 1 FAVORABLE COMPETITIVE POSITIONS IN ATTRACTIVE ADDRESSABLE MARKETS 2 DISCIPLINED TRACK RECORD OF ACQUISITIONS AND INTEGRATION 4 STRONG AND EXPERIENCED MANAGEMENT TEAM 5 3 KEY INVESTMENT HIGHLIGHTS ROBUST CASH FLOW HISTORY

© 2023 Matthews International Corporation. All Rights Reserved. 31 Financial Overview

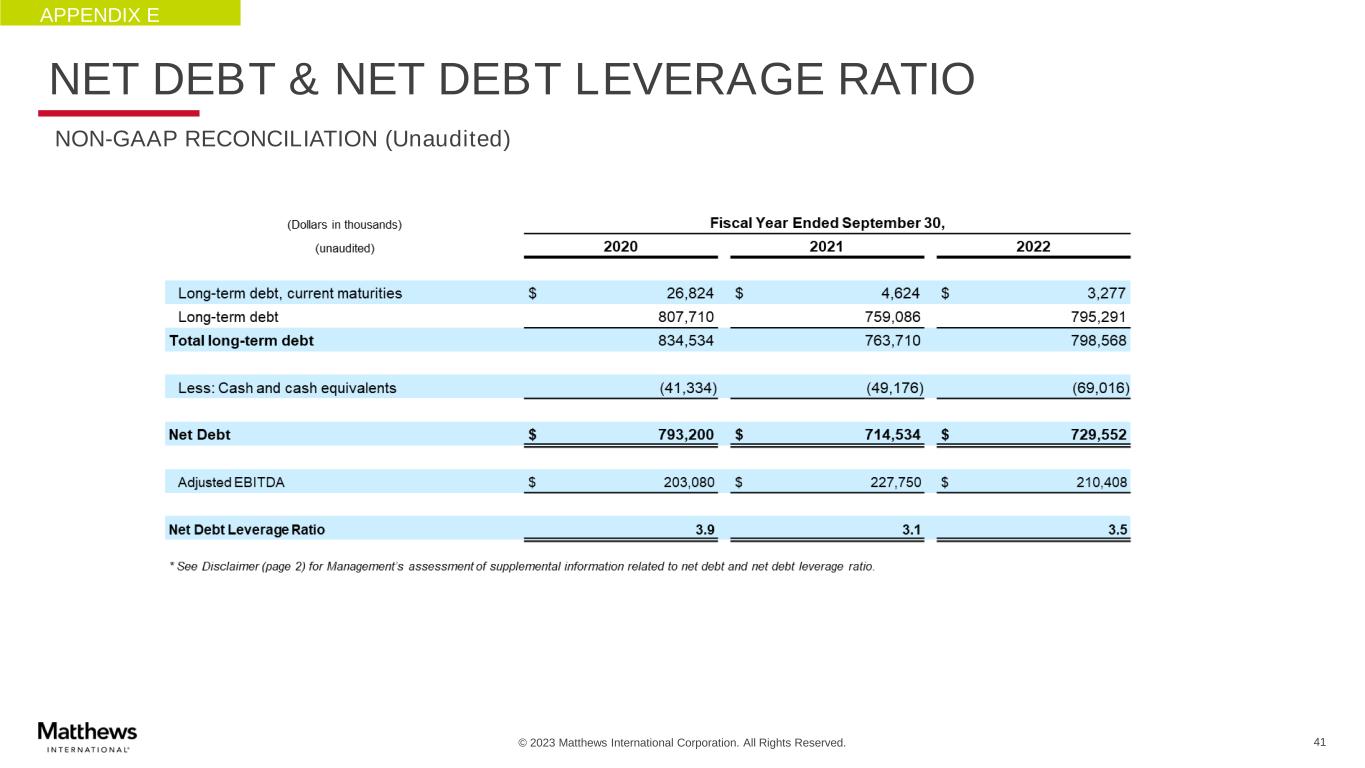

© 2023 Matthews International Corporation. All Rights Reserved. 32 Debt Reduction • Historically maintained a modest leverage profile • Publicly stated Net Debt Leverage Ratio (1) target of 3.0x or less • Continued emphasis on leverage, balanced growth and share repurchase • Settled the principal U.S. defined benefit plan and SERP plan- reduced the Company’s accrued pension liabilities over $100 million from September 30, 2020 • New receivables purchased agreement entered into during Q2 of FY2022 (reduced debt $97 million as of September 30, 2022) Growth – Organic & Acquisitions • Organic: Leverage existing capability in new markets and geographic regions, cost structure improvements, new product development • Recent growth initiatives include (i) Saueressig engineered machines used in electric vehicle battery production, and (ii) new technology in industrial product identification business • Acquisitions: Identify and integrate complementary businesses with prudent capital deployment (achieve long-term annual return on invested capital of at least 12%) Share Repurchases & Dividends • Opportunistically repurchase in periods of excess cash flow • Authorization of 1.3 million shares at September 30, 2022 • Quarterly dividend of $0.23 per share for FY2023 vs. $0.22 per share for FY2022 Note: See Disclaimer (Page 2) for Management’s assessment of supplemental information related to non-GAAP net debt leverage ratio. (1) Non-GAAP net debt leverage ratio is defined as outstanding debt (net of cash) relative to adjusted EBITDA. See reconciliation at Appendix E. FINANCIAL POLICY & CAPITAL ALLOCATION STRATEGY

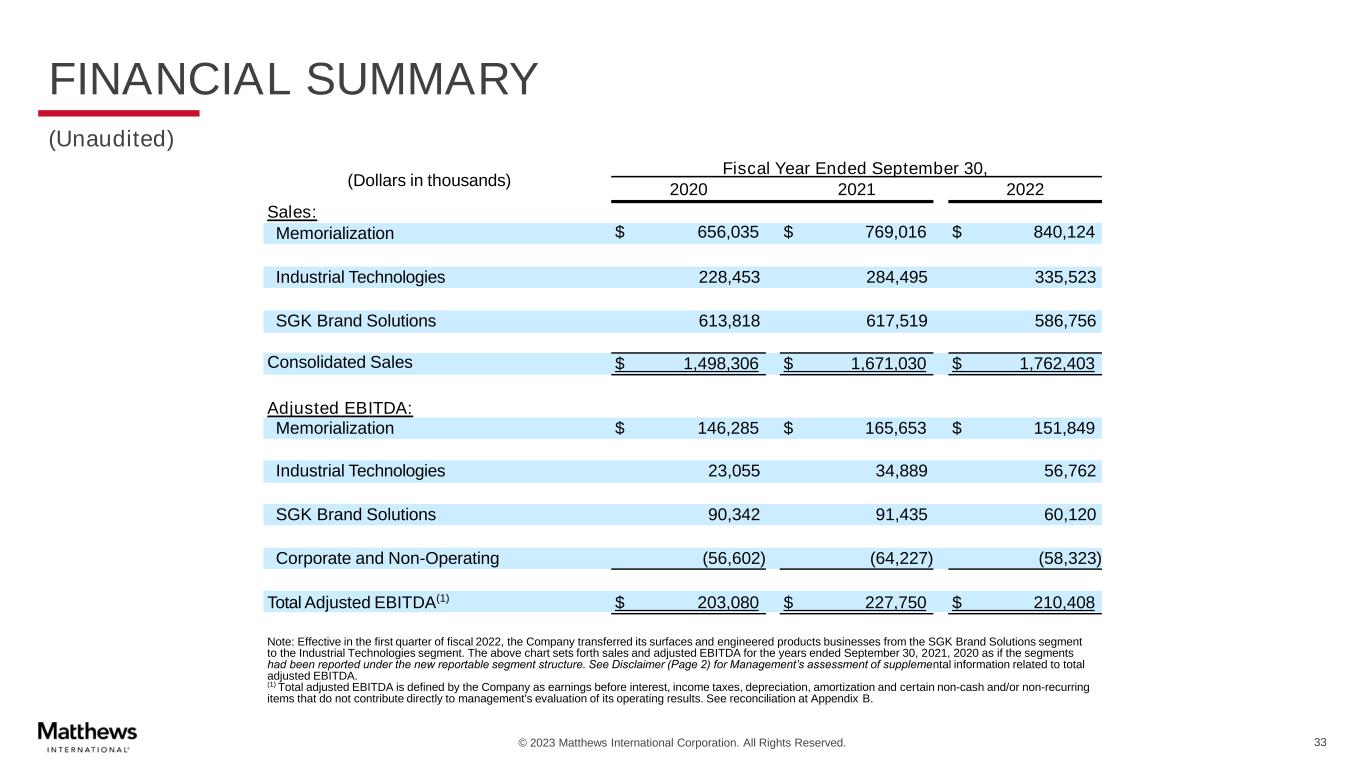

© 2023 Matthews International Corporation. All Rights Reserved. 33 FINANCIAL SUMMARY (Unaudited) 2020 2021 2022 Sales: Memorialization $ 656,035 $ 769,016 $ 840,124 Industrial Technologies 228,453 284,495 335,523 SGK Brand Solutions 613,818 617,519 586,756 Consolidated Sales $ 1,498,306 $ 1,671,030 $ 1,762,403 Adjusted EBITDA: Memorialization $ 146,285 $ 165,653 $ 151,849 Industrial Technologies 23,055 34,889 56,762 SGK Brand Solutions 90,342 91,435 60,120 Corporate and Non-Operating (56,602) (64,227) (58,323) Total Adjusted EBITDA(1) $ 203,080 $ 227,750 $ 210,408 (Dollars in thousands) Fiscal Year Ended September 30, Note: Effective in the first quarter of fiscal 2022, the Company transferred its surfaces and engineered products businesses from the SGK Brand Solutions segment to the Industrial Technologies segment. The above chart sets forth sales and adjusted EBITDA for the years ended September 30, 2021, 2020 as if the segments had been reported under the new reportable segment structure. See Disclaimer (Page 2) for Management’s assessment of supplemental information related to total adjusted EBITDA. (1) Total adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management's evaluation of its operating results. See reconciliation at Appendix B.

© 2023 Matthews International Corporation. All Rights Reserved. 34 ESG Overview

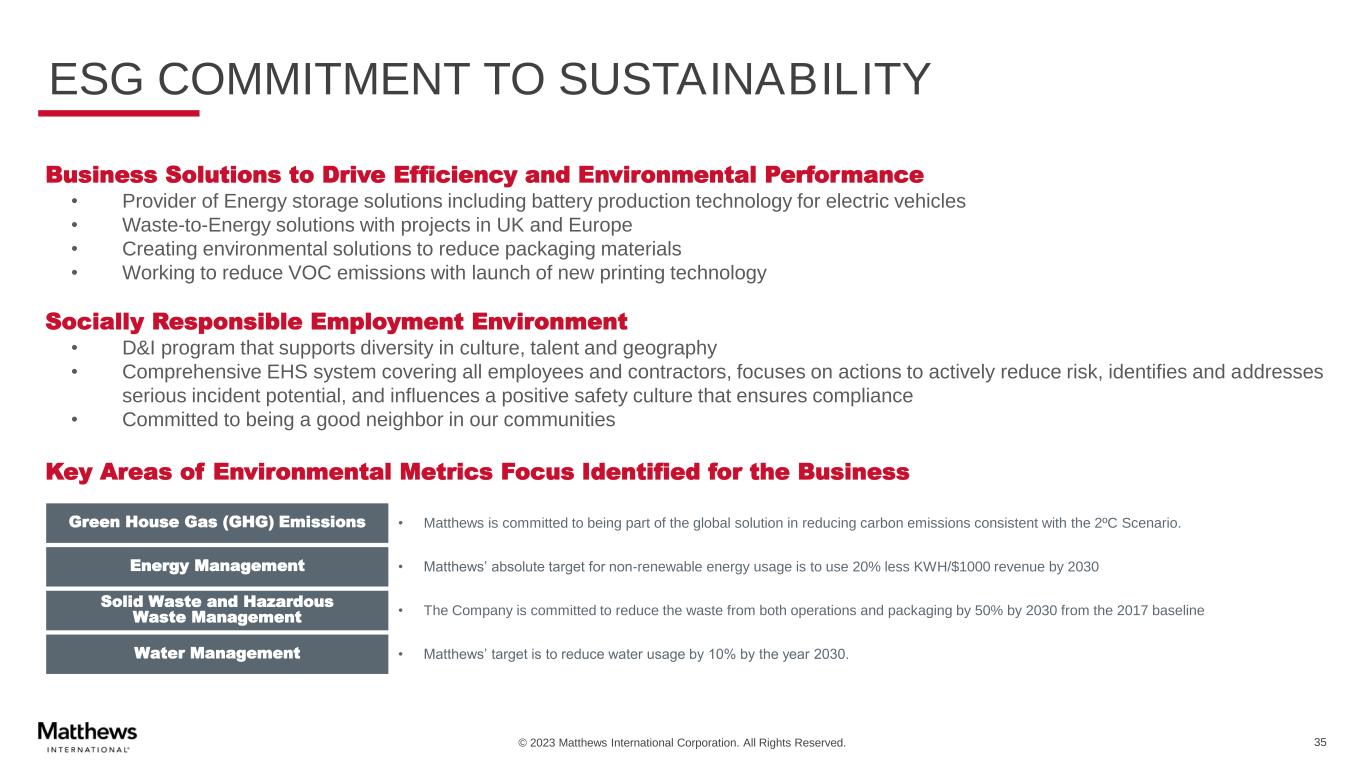

© 2023 Matthews International Corporation. All Rights Reserved. 35 Business Solutions to Drive Efficiency and Environmental Performance • Provider of Energy storage solutions including battery production technology for electric vehicles • Waste-to-Energy solutions with projects in UK and Europe • Creating environmental solutions to reduce packaging materials • Working to reduce VOC emissions with launch of new printing technology Socially Responsible Employment Environment • D&I program that supports diversity in culture, talent and geography • Comprehensive EHS system covering all employees and contractors, focuses on actions to actively reduce risk, identifies and addresses serious incident potential, and influences a positive safety culture that ensures compliance • Committed to being a good neighbor in our communities Key Areas of Environmental Metrics Focus Identified for the Business Green House Gas (GHG) Emissions • Matthews is committed to being part of the global solution in reducing carbon emissions consistent with the 2ºC Scenario. Energy Management • Matthews’ absolute target for non-renewable energy usage is to use 20% less KWH/$1000 revenue by 2030 Solid Waste and Hazardous Waste Management • The Company is committed to reduce the waste from both operations and packaging by 50% by 2030 from the 2017 baseline Water Management • Matthews’ target is to reduce water usage by 10% by the year 2030. ESG COMMITMENT TO SUSTAINABILITY

© 2023 Matthews International Corporation. All Rights Reserved. 36 Appendix

© 2023 Matthews International Corporation. All Rights Reserved. Steven F. Nicola Chief Financial Officer & Secretary • 2003: Named Chief Financial Officer • 2001: Vice President, Accounting and Finance • 1995: Corporate Controller • 1992: Joined Matthews • Prior to Matthews: Steve worked at Coopers & Lybrand (now PricewaterhouseCoopers LLP) 37 Joseph C. Bartolacci Chief Executive Officer & President • 2006: Named Chief Executive Officer and President • 2005-2006: Chief Operating Officer • 2004-2005: President of York Casket division and EVP of Matthews • 1999-2004: President of Caggiati and Matthews, Europe • 1997: Joined Matthews OUR EXECUTIVE TEAM Steven D. Gackenbach Group President, Memorialization • 2011: Named Group President, Memorialization • 2011: Joined Matthews Chief Commercial Officer, Memorialization • Prior to Matthews: Spent 18 years in marketing, general management and strategy assignments with Kraft Foods Gary R. Kohl Group President, SGK Brand Solutions • 2017: Named SGK Group President • 2015: Served as Executive Vice President, Global Development at SGK • Prior to SGK: Group senior vice president of the digital solutions, global packaging and printed electronics team at RR Donnelley Lee Lane Group President, Industrial Automation & Environmental Solutions • 2022: Joined Matthews • Prior to Matthews: Lee led the Safety, Sensing and Industrial Components business unit of Rockwell Automation, Inc. • During his career at Rockwell, Lee held roles in engineering, marketing product management and product security Gregory S. Babe CTO & Group President, Industrial Technologies • 2015: Named Chief Technology Officer • 2014: Served as interim Chief Information Officer / Chief Technology Officer • 2008-2012: Served as President and Chief Executive Officer of Bayer Corporation North America before retiring from role APPENDIX A

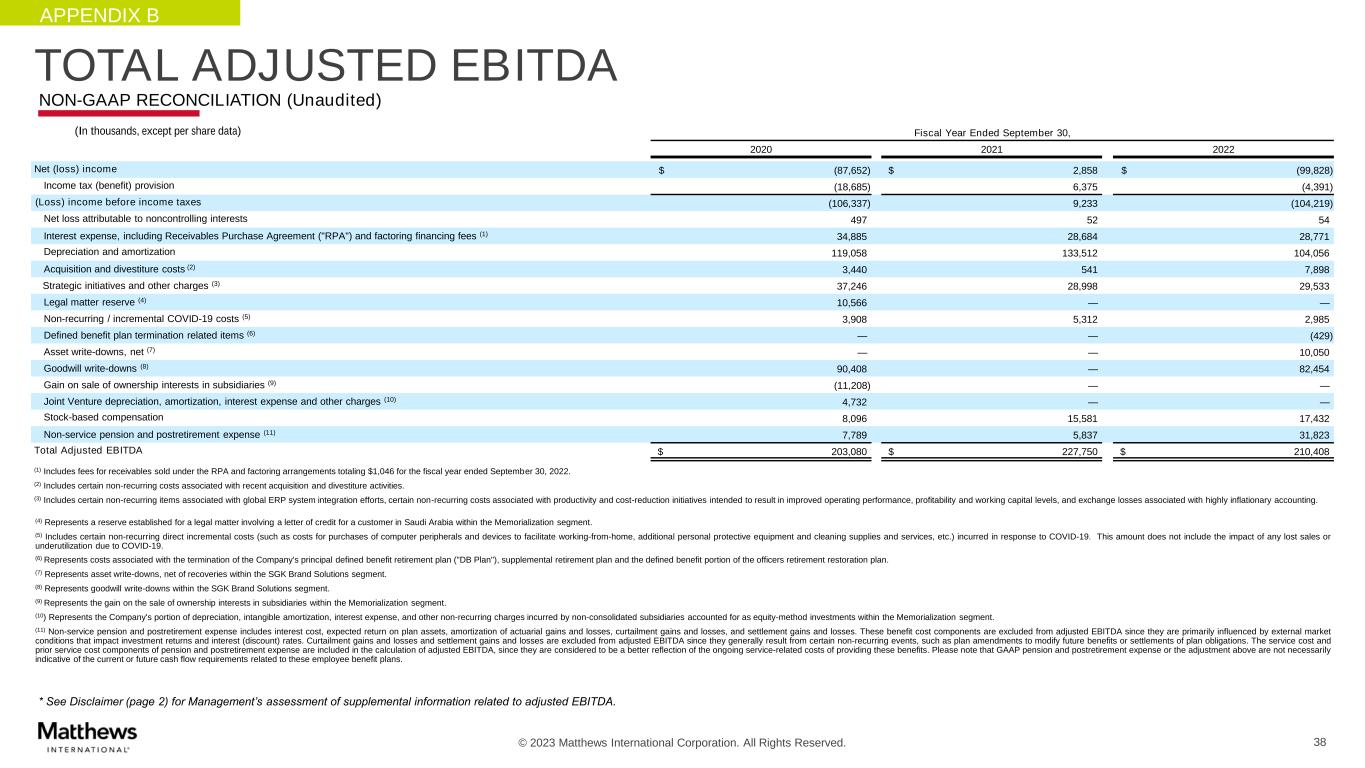

© 2023 Matthews International Corporation. All Rights Reserved. NON-GAAP RECONCILIATION (Unaudited) 38 APPENDIX B T T L ADJUSTED EBITDA Fiscal Year Ended September 30, 2020 2021 2022 Net (loss) income $ (87,652) $ 2,858 $ (99,828) Income tax (benefit) provision (18,685) 6,375 (4,391) (Loss) income before income taxes (106,337) 9,233 (104,219) Net loss attributable to noncontrolling interests 497 52 54 Interest expense, including Receivables Purchase Agreement ("RPA") and factoring financing fees (1) 34,885 28,684 28,771 Depreciation and amortization 119,058 133,512 104,056 Acquisition and divestiture costs (2) 3,440 541 7,898 Strategic initiatives and other charges (3) 37,246 28,998 29,533 Legal matter reserve (4) 10,566 — — Non-recurring / incremental COVID-19 costs (5) 3,908 5,312 2,985 Defined benefit plan termination related items (6) — — (429) Asset write-downs, net (7) — — 10,050 Goodwill write-downs (8) 90,408 — 82,454 Gain on sale of ownership interests in subsidiaries (9) (11,208) — — Joint Venture depreciation, amortization, interest expense and other charges (10) 4,732 — — Stock-based compensation 8,096 15,581 17,432 Non-service pension and postretirement expense (11) 7,789 5,837 31,823 Total Adjusted EBITDA $ 203,080 $ 227,750 $ 210,408 (1) Includes fees for receivables sold under the RPA and factoring arrangements totaling $1,046 for the fiscal year ended September 30, 2022. (2) Includes certain non-recurring costs associated with recent acquisition and divestiture activities. (3) Includes certain non-recurring items associated with global ERP system integration efforts, certain non-recurring costs associated with productivity and cost-reduction initiatives intended to result in improved operating performance, profitability and working capital levels, and exchange losses associated with highly inflationary accounting. (4) Represents a reserve established for a legal matter involving a letter of credit for a customer in Saudi Arabia within the Memorialization segment. (5) Includes certain non-recurring direct incremental costs (such as costs for purchases of computer peripherals and devices to facilitate working-from-home, additional personal protective equipment and cleaning supplies and services, etc.) incurred in response to COVID-19. This amount does not include the impact of any lost sales or underutilization due to COVID-19. (6) Represents costs associated with the termination of the Company's principal defined benefit retirement plan ("DB Plan"), supplemental retirement plan and the defined benefit portion of the officers retirement restoration plan. (7) Represents asset write-downs, net of recoveries within the SGK Brand Solutions segment. (8) Represents goodwill write-downs within the SGK Brand Solutions segment. (9) Represents the gain on the sale of ownership interests in subsidiaries within the Memorialization segment. (10) Represents the Company's portion of depreciation, intangible amortization, interest expense, and other non-recurring charges incurred by non-consolidated subsidiaries accounted for as equity-method investments within the Memorialization segment. (11) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted EBITDA. NON-GAAP RECONCILIATION (Unaudited) (In thousands, except per share data)

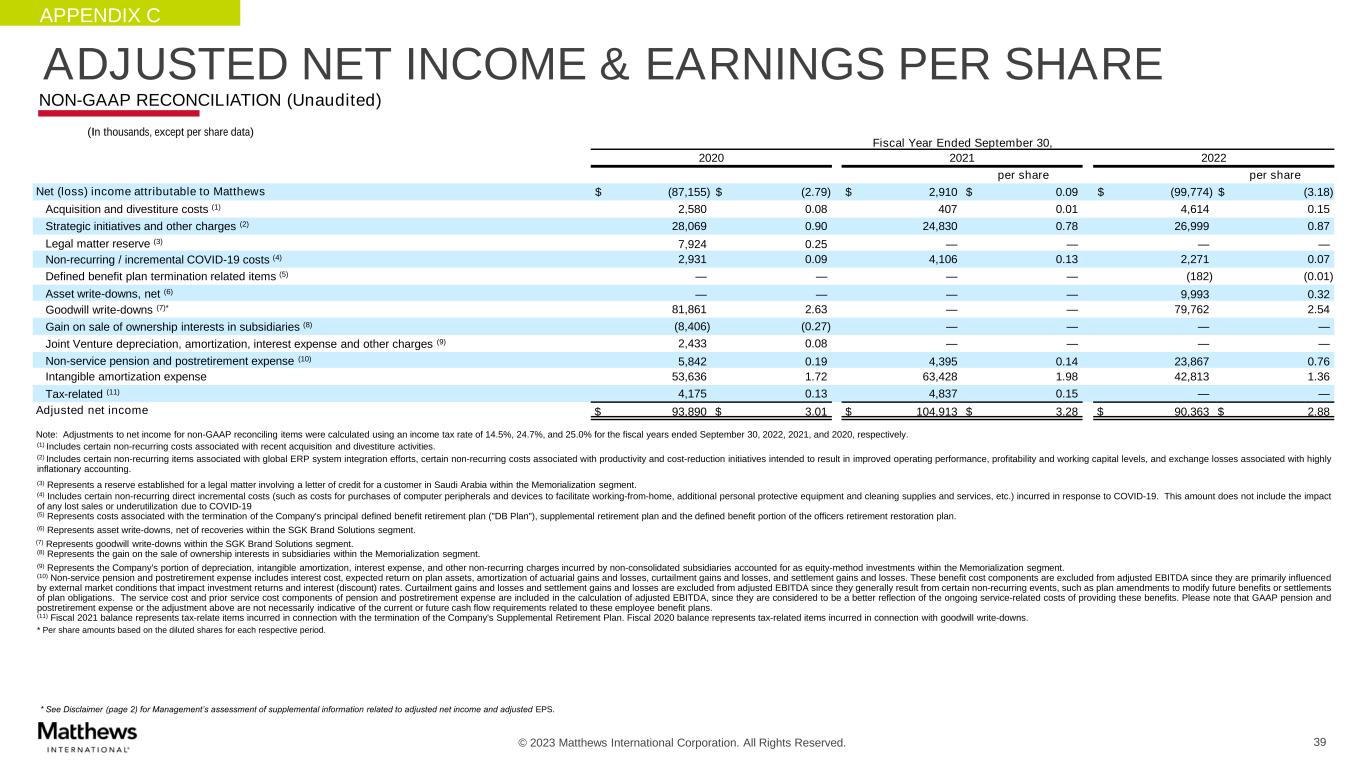

© 2023 Matthews International Corporation. All Rights Reserved. 39 APPENDIX C ADJUSTED NET INCOME & EARNINGS PER SHARE NON-GAAP RECONCILIATION (Unaudited) Fiscal Year Ended September 30, 2020 2021 2022 per share per share Net (loss) income attributable to Matthews $ (87,155) $ (2.79) $ 2,910 $ 0.09 $ (99,774) $ (3.18) Acquisition and divestiture costs (1) 2,580 0.08 407 0.01 4,614 0.15 Strategic initiatives and other charges (2) 28,069 0.90 24,830 0.78 26,999 0.87 Legal matter reserve (3) 7,924 0.25 — — — — Non-recurring / incremental COVID-19 costs (4) 2,931 0.09 4,106 0.13 2,271 0.07 Defined benefit plan termination related items (5) — — — — (182) (0.01) Asset write-downs, net (6) — — — — 9,993 0.32 Goodwill write-downs (7)* 81,861 2.63 — — 79,762 2.54 Gain on sale of ownership interests in subsidiaries (8) (8,406) (0.27) — — — — Joint Venture depreciation, amortization, interest expense and other charges (9) 2,433 0.08 — — — — Non-service pension and postretirement expense (10) 5,842 0.19 4,395 0.14 23,867 0.76 Intangible amortization expense 53,636 1.72 63,428 1.98 42,813 1.36 Tax-related (11) 4,175 0.13 4,837 0.15 — — Adjusted net income $ 93,890 $ 3.01 $ 104,913 $ 3.28 $ 90,363 $ 2.88 Note: Adjustments to net income for non-GAAP reconciling items were calculated using an income tax rate of 14.5%, 24.7%, and 25.0% for the fiscal years ended September 30, 2022, 2021, and 2020, respectively. (1) Includes certain non-recurring costs associated with recent acquisition and divestiture activities. (2) Includes certain non-recurring items associated with global ERP system integration efforts, certain non-recurring costs associated with productivity and cost-reduction initiatives intended to result in improved operating performance, profitability and working capital levels, and exchange losses associated with highly inflationary accounting. (3) Represents a reserve established for a legal matter involving a letter of credit for a customer in Saudi Arabia within the Memorialization segment. (4) Includes certain non-recurring direct incremental costs (such as costs for purchases of computer peripherals and devices to facilitate working-from-home, additional personal protective equipment and cleaning supplies and services, etc.) incurred in response to COVID-19. This amount does not include the impact of any lost sales or underutilization due to COVID-19 (5) Represents costs associated with the termination of the Company's principal defined benefit retirement plan ("DB Plan"), supplemental retirement plan and the defined benefit portion of the officers retirement restoration plan. (6) Represents asset write-downs, net of recoveries within the SGK Brand Solutions segment. (7) Represents goodwill write-downs within the SGK Brand Solutions segment. (8) Represents the gain on the sale of ownership interests in subsidiaries within the Memorialization segment. (9) Represents the Company's portion of depreciation, intangible amortization, interest expense, and other non-recurring charges incurred by non-consolidated subsidiaries accounted for as equity-method investments within the Memorialization segment. (10) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. (11) Fiscal 2021 balance represents tax-relate items incurred in connection with the termination of the Company's Supplemental Retirement Plan. Fiscal 2020 balance represents tax-related items incurred in connection with goodwill write-downs. * Per share amounts based on the diluted shares for each respective period. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted net income and adjusted EPS. (In thousands, except per share data)

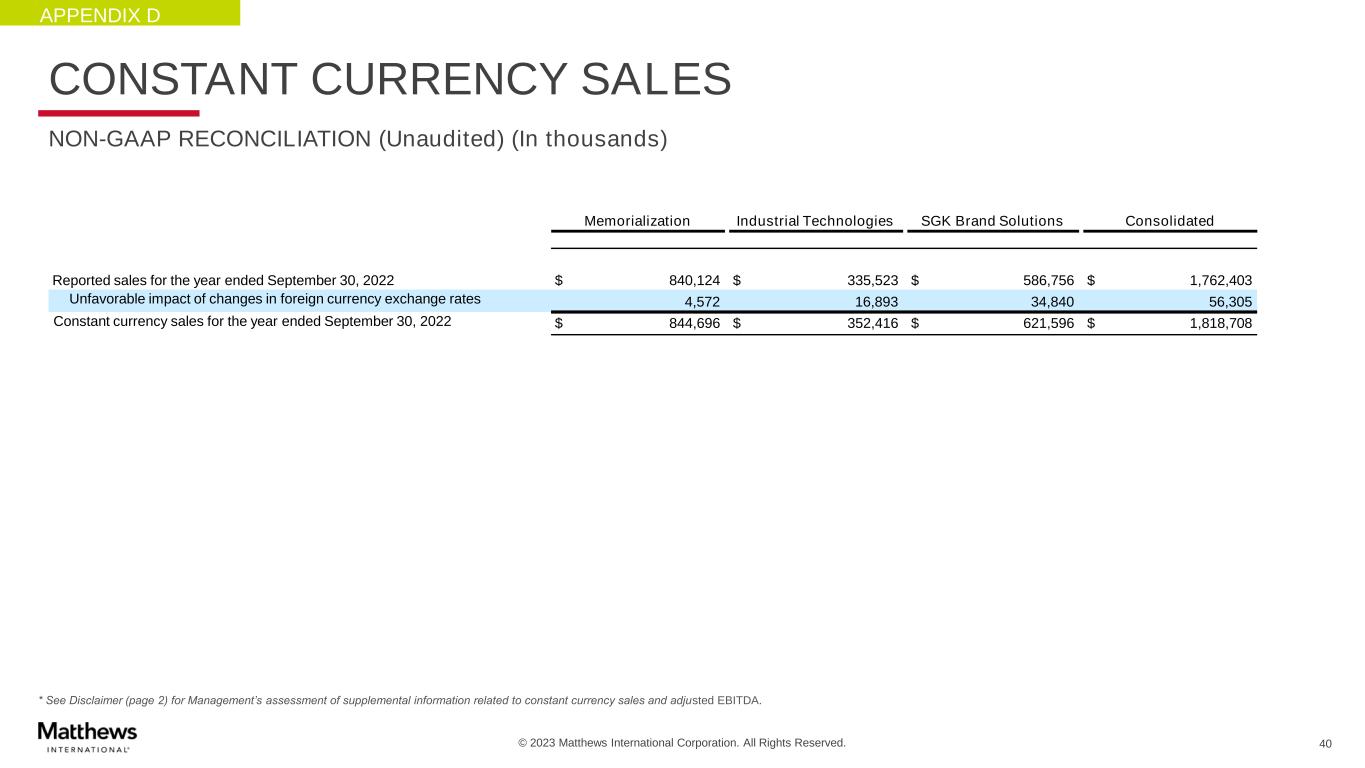

© 2023 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to constant currency sales and adjusted EBITDA. 40 APPENDIX D CONSTANT CURRENCY SALES NON-GAAP RECONCILIATION (Unaudited) (In thousands) Memorialization Industrial Technologies SGK Brand Solutions Consolidated Reported sales for the year ended September 30, 2022 $ 840,124 $ 335,523 $ 586,756 $ 1,762,403 Unfavorable impact of changes in foreign currency exchange rates 4,572 16,893 34,840 56,305 Constant currency sales for the year ended September 30, 2022 $ 844,696 $ 352,416 $ 621,596 $ 1,818,708

© 2023 Matthews International Corporation. All Rights Reserved. 41 APPENDIX E NET DEBT & NET DEBT LEVERAGE RATIO NON-GAAP RECONCILIATION (Unaudited)

© 2023 Matthews International Corporation. All Rights Reserved. 42 APPENDIX F FREE CASH FLOW NON-GAAP RECONCILIATION (Unaudited)

© 2023 Matthews International Corporation. All Rights Reserved. 43 Note: All figures reflect fiscal years ended September 30th; Historical FY1994 – FY2018 reflect amounts as reported in the Company's 10-K filings for those fiscal years. See Disclaimer (Page 2) for Management’s assessment of supplemental information related to non-GAAP measures. 1 Defined as cash provided from operating activities less capital expenditures. See reconciliation in appendix F OPERATING CASH FLOW ($mm)FREE CASH FLOW 1 ($mm) ROBUST CASH FLOW HISTORY APPENDIX G