www.matw.com | Nasdaq: MATW First Quarter Fiscal 2024 Earnings Teleconference February 2, 2024 Joseph C. Bartolacci President and Chief Executive Officer Steven F. Nicola Chief Financial Officer

© 2024 Matthews International Corporation. All Rights Reserved. DISCLAIMER 2 Any forward-looking statements contained in this presentation are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding the expectations, hopes, beliefs, intentions or strategies of the Company regarding the future, and may be identified by the use of words such as “expects,” “believes,” “intends,” “projects,” “anticipates,” estimates,” “plans,” “seeks,” “forecasts,” “predicts,” “objective,” “targets,” “potential,” “outlook,” “may,” “will,” “could” or the negative of these terms, other comparable terminology and variations thereof. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from management’s expectations, and no assurance can be given that such expectations will prove correct. Factors that could cause the Company's results to differ materially from the results discussed in such forward-looking statements principally include changes in domestic or international economic conditions, changes in foreign currency exchange rates, changes in interest rates, changes in the cost of materials used in the manufacture of the Company's products, any impairment of goodwill or intangible assets, environmental liability and limitations on the Company’s operations due to environmental laws and regulations, disruptions to certain services, such as telecommunications, network server maintenance, cloud computing or transaction processing services, provided to the Company by third-parties, changes in mortality and cremation rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company operates, or other factors such as supply chain disruptions, labor shortages or labor cost increases, changes in product demand or pricing as a result of domestic or international competitive pressures, ability to achieve cost-reduction objectives, unknown risks in connection with the Company's acquisitions and divestitures, cybersecurity concerns and costs arising with management of cybersecurity threats, effectiveness of the Company's internal controls, compliance with domestic and foreign laws and regulations, technological factors beyond the Company's control, impact of pandemics or similar outbreaks, or other disruptions to our industries, customers, or supply chains, the impact of global conflicts, such as the current war between Russia and Ukraine, and other factors described in the Company’s Annual Report on Form 10-K and other periodic filings with the U.S. Securities and Exchange Commission. Included in this report are measures of financial performance that are not defined by generally accepted accounting principles in the United States (“GAAP”). The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition and divestiture costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to certain commercial and operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company’s core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. The Company believes that adjusted EBITDA provides relevant and useful information, which is used by the Company’s management in assessing the performance of its business. Adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management’s evaluation of its operating results. These items include stock-based compensation, the non-service portion of pension and postretirement expense, acquisition and divestiture costs, ERP integration costs, and strategic initiatives and other charges. Adjusted EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income taxes, and the effects of certain acquisition and divestiture and ERP integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating operating performance. It is also useful as a financial measure for lenders and is used by the Company’s management to measure business performance. Adjusted EBITDA is not a measure of the Company's financial performance under GAAP and should not be considered as an alternative to net income or other performance measures derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the Company's liquidity. The Company's definition of adjusted EBITDA may not be comparable to similarly titled measures used by other companies. The Company has presented constant currency sales and constant currency adjusted EBITDA and believes these measures provide relevant and useful information, which is used by the Company's management in assessing the performance of its business on a consistent basis by removing the impact of changes due to foreign exchange translation rates. These measures allow management, as well as investors, to assess the Company’s sales and adjusted EBITDA on a constant currency basis. The Company has also presented adjusted net income and adjusted earnings per share and believes each measure provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in assessing the performance of its business. Adjusted net income and adjusted earnings per share provides the Company with an understanding of the results from the primary operations of our business by excluding the effects of certain acquisition, divestiture, and system-integration costs, and items that do not reflect the ordinary earnings of our operations. These measures provide management with insight into the earning value for shareholders excluding certain costs, not related to the Company’s primary operations. Likewise, these measures may be useful to an investor in evaluating the underlying operating performance of the Company’s business overall, as well as performance trends, on a consistent basis. Lastly, the Company has presented net debt and a net debt leverage ratio and believes each measure provides relevant and useful information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the indebtedness of the Company, net of cash and cash equivalents and relative to adjusted EBITDA. These measures allow management, as well as analysts and investors, to assess the Company’s leverage.

BUSINESS OVERVIEW

© 2024 Matthews International Corporation. All Rights Reserved. 4 SGK BRAND SOLUTIONS MEMORIALIZATION INDUSTRIAL TECHNOLOGIES • Q1 benefited from recent acquisition of Eagle Granite • Return to normalized death rates • Improved pricing and realized benefits from recent cost reduction actions • Lower retail-based sales and continued softness in European brand markets • Continued interest in energy storage solutions business • Timing of energy projects impacted current quarter sales • Hydrogen fuel cell equipment business progressing • Product identification and surfaces business growth BUSINESS UPDATE

© 2024 Matthews International Corporation. All Rights Reserved. Key Drivers • Growth in consolidated sales and adjusted EBITDA • Customer interest in the energy storage solutions business remains strong • Large longer-term projects impact quarterly predictability • Global economic conditions remain uncertain • Stronger cash flow expected in latter half of fiscal 2024 OUTLOOK FOR FISCAL 2024 5

FINANCIAL OVERVIEW

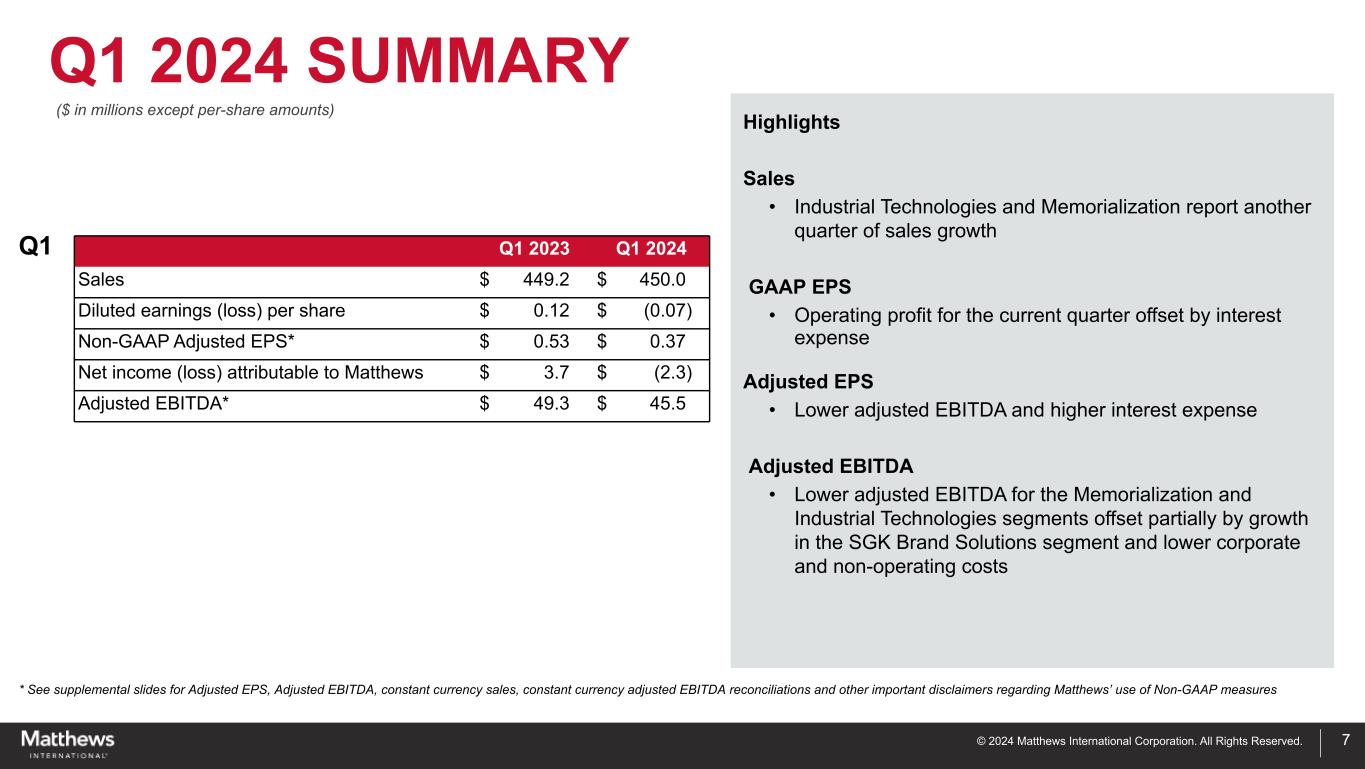

© 2024 Matthews International Corporation. All Rights Reserved. Q1 2024 SUMMARY 7 ($ in millions except per-share amounts) Q1 Q1 2023 Q1 2024 Sales $ 449.2 $ 450.0 Diluted earnings (loss) per share $ 0.12 $ (0.07) Non-GAAP Adjusted EPS* $ 0.53 $ 0.37 Net income (loss) attributable to Matthews $ 3.7 $ (2.3) Adjusted EBITDA* $ 49.3 $ 45.5 Highlights Sales • Industrial Technologies and Memorialization report another quarter of sales growth GAAP EPS • Operating profit for the current quarter offset by interest expense Adjusted EPS • Lower adjusted EBITDA and higher interest expense Adjusted EBITDA • Lower adjusted EBITDA for the Memorialization and Industrial Technologies segments offset partially by growth in the SGK Brand Solutions segment and lower corporate and non-operating costs * See supplemental slides for Adjusted EPS, Adjusted EBITDA, constant currency sales, constant currency adjusted EBITDA reconciliations and other important disclaimers regarding Matthews’ use of Non-GAAP measures

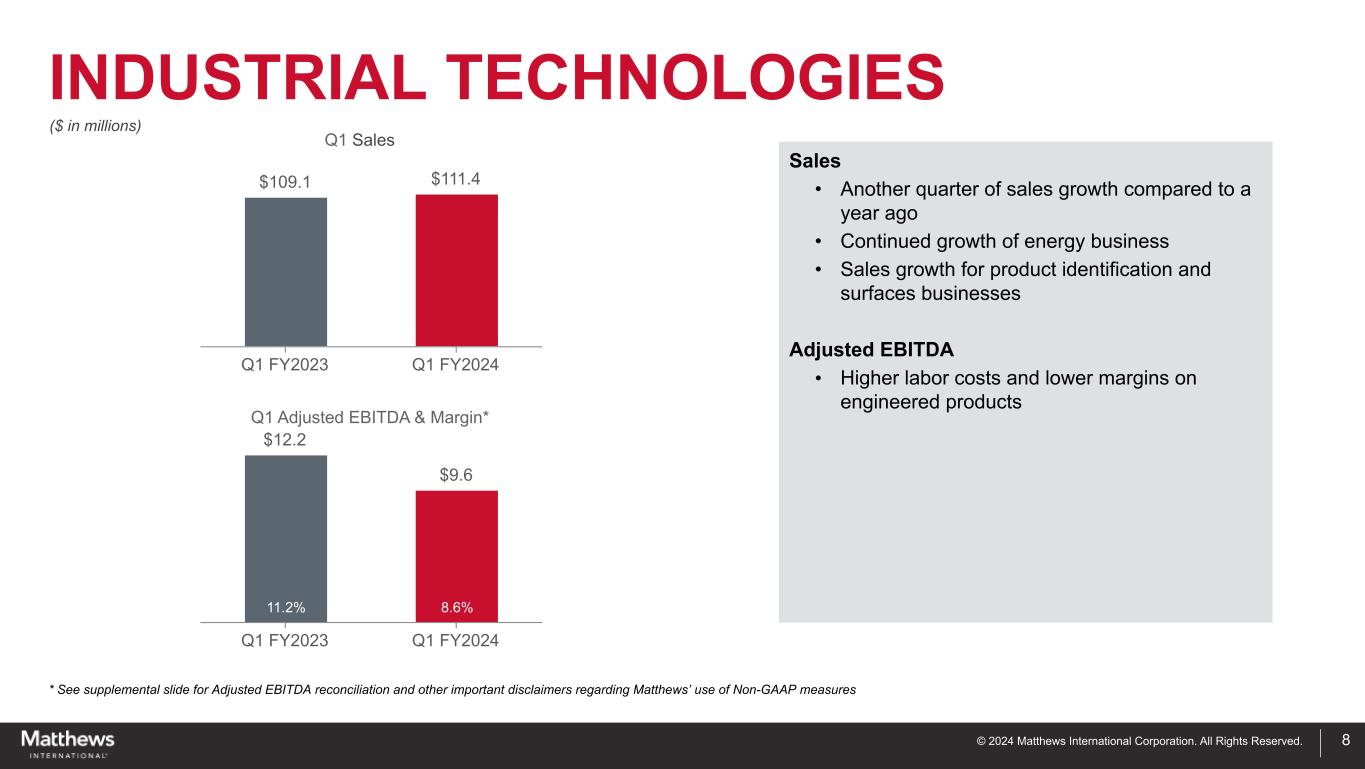

© 2024 Matthews International Corporation. All Rights Reserved. INDUSTRIAL TECHNOLOGIES 8 15.5% 12.4% 15.6%10.3% ($ in millions) $109.1 $111.4 Q1 FY2023 Q1 FY2024 $12.2 $9.6 Q1 FY2023 Q1 FY2024 11.2% 8.6% Q1 Sales Q1 Adjusted EBITDA & Margin* Sales • Another quarter of sales growth compared to a year ago • Continued growth of energy business • Sales growth for product identification and surfaces businesses Adjusted EBITDA • Higher labor costs and lower margins on engineered products * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures

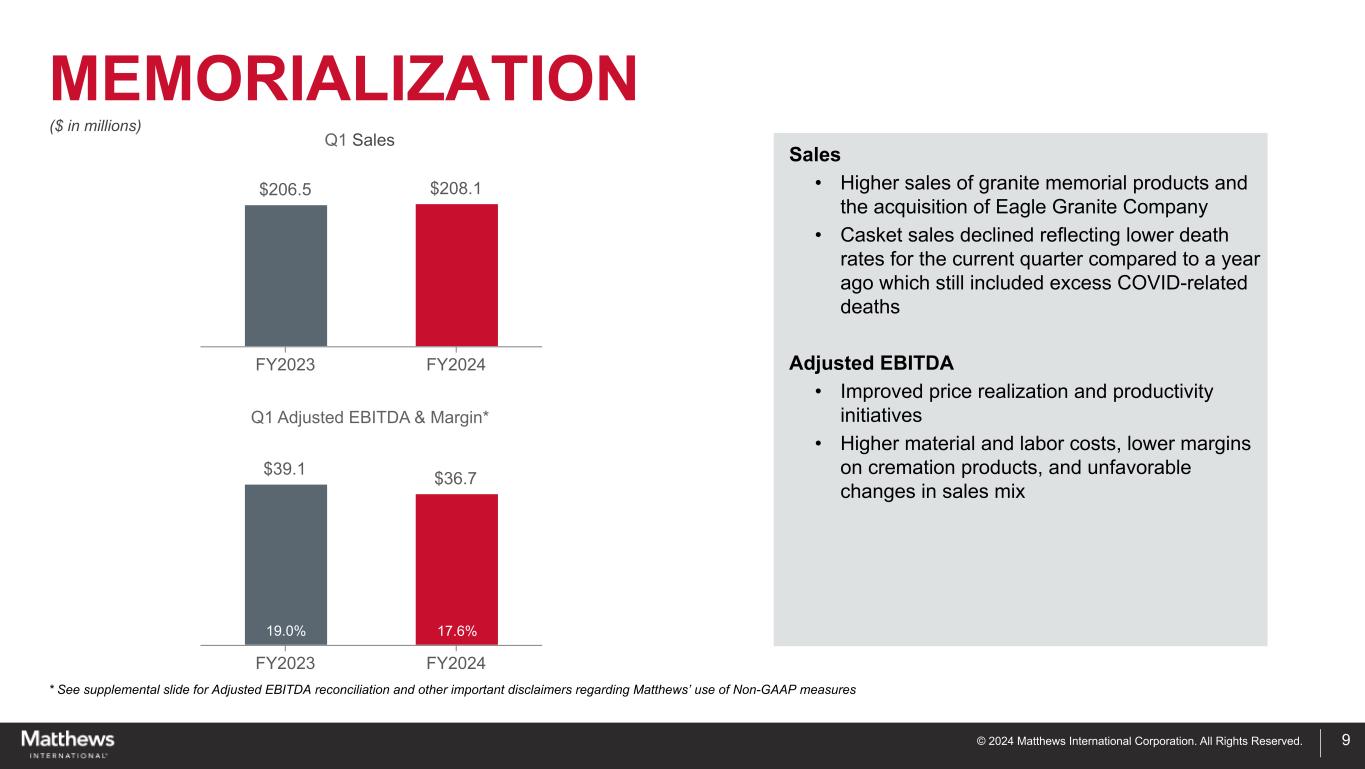

© 2024 Matthews International Corporation. All Rights Reserved. MEMORIALIZATION 9 23.0% 21.1% $206.5 $208.1 FY2023 FY2024 $39.1 $36.7 FY2023 FY2024 19.0% 17.6% ($ in millions) Q1 Sales Q1 Adjusted EBITDA & Margin* Sales • Higher sales of granite memorial products and the acquisition of Eagle Granite Company • Casket sales declined reflecting lower death rates for the current quarter compared to a year ago which still included excess COVID-related deaths Adjusted EBITDA • Improved price realization and productivity initiatives • Higher material and labor costs, lower margins on cremation products, and unfavorable changes in sales mix * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures

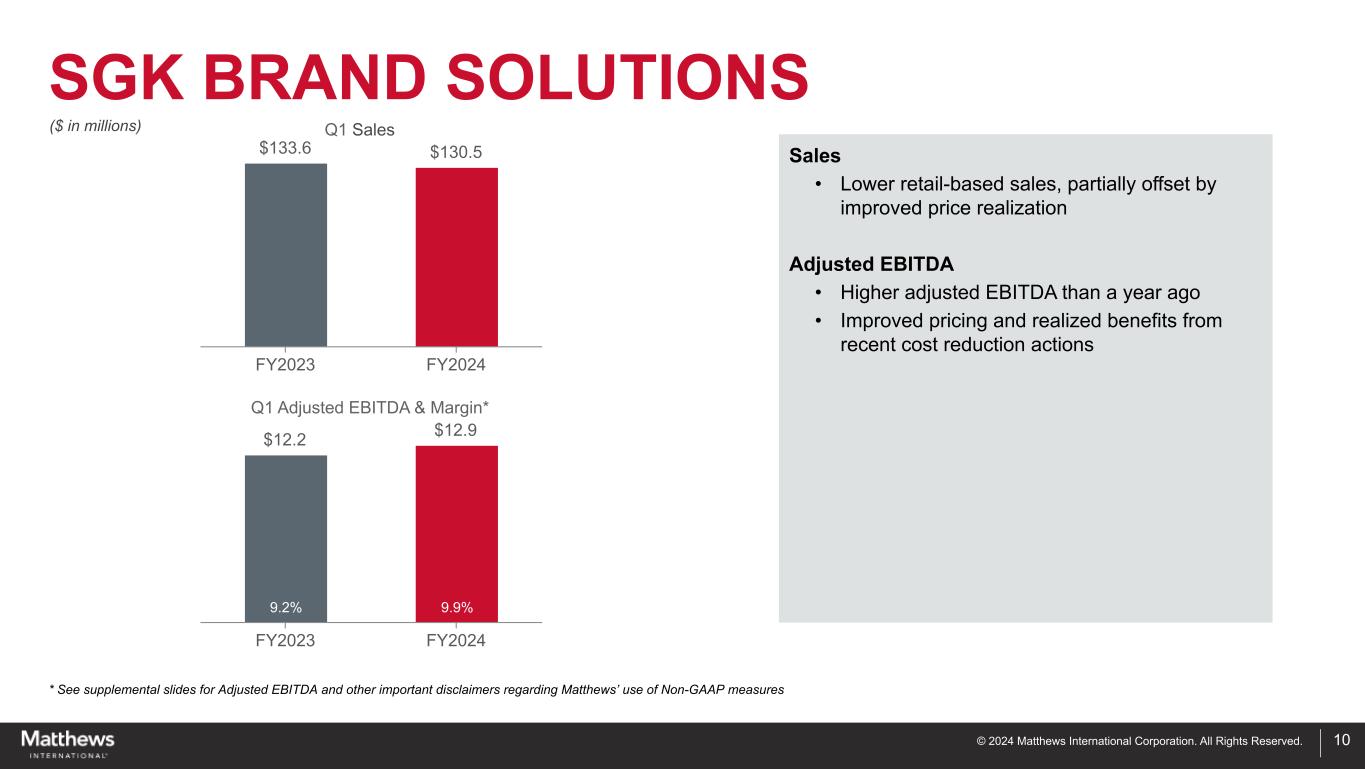

© 2024 Matthews International Corporation. All Rights Reserved. SGK BRAND SOLUTIONS ($ in millions) * See supplemental slides for Adjusted EBITDA and other important disclaimers regarding Matthews’ use of Non-GAAP measures 10 15.4% 12.9% $133.6 $130.5 FY2023 FY2024 $12.2 $12.9 FY2023 FY2024 9.2% 9.9% Q1 Sales Q1 Adjusted EBITDA & Margin* Sales • Lower retail-based sales, partially offset by improved price realization Adjusted EBITDA • Higher adjusted EBITDA than a year ago • Improved pricing and realized benefits from recent cost reduction actions

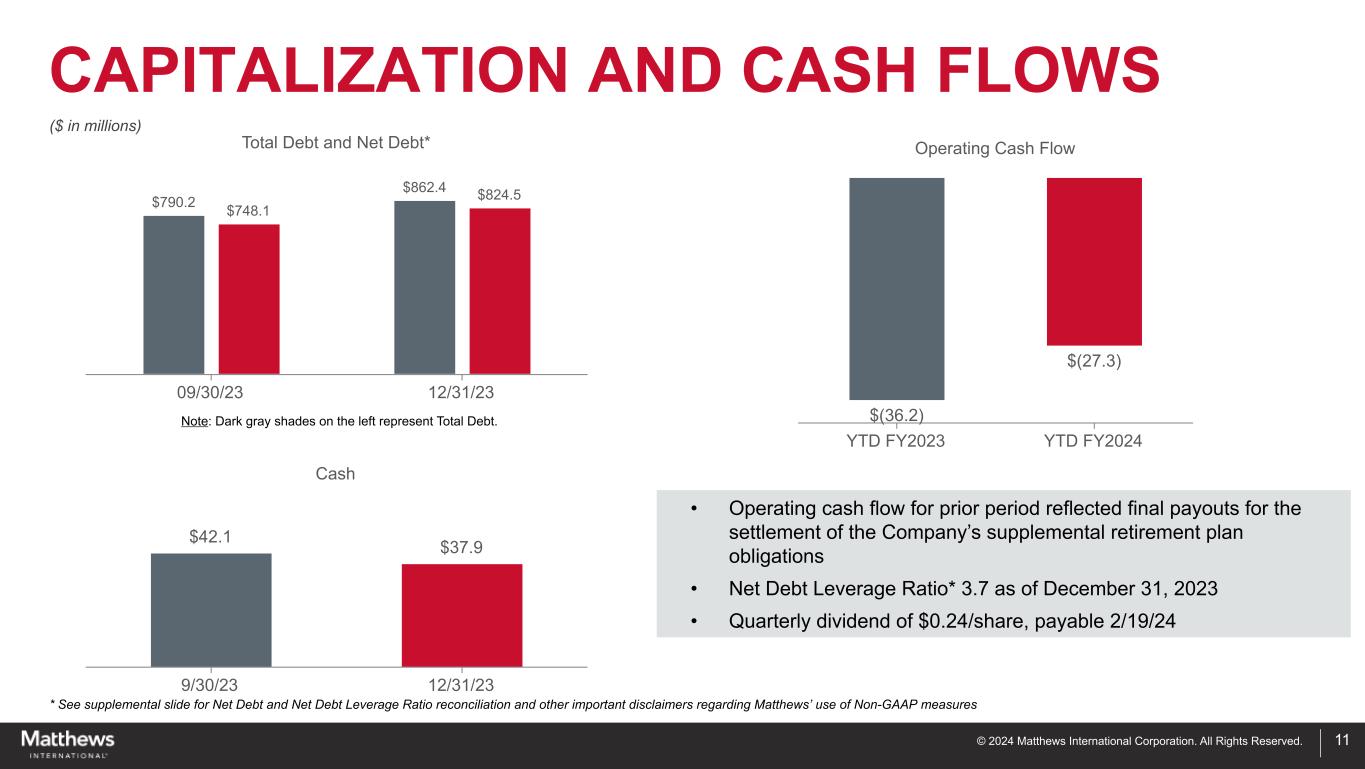

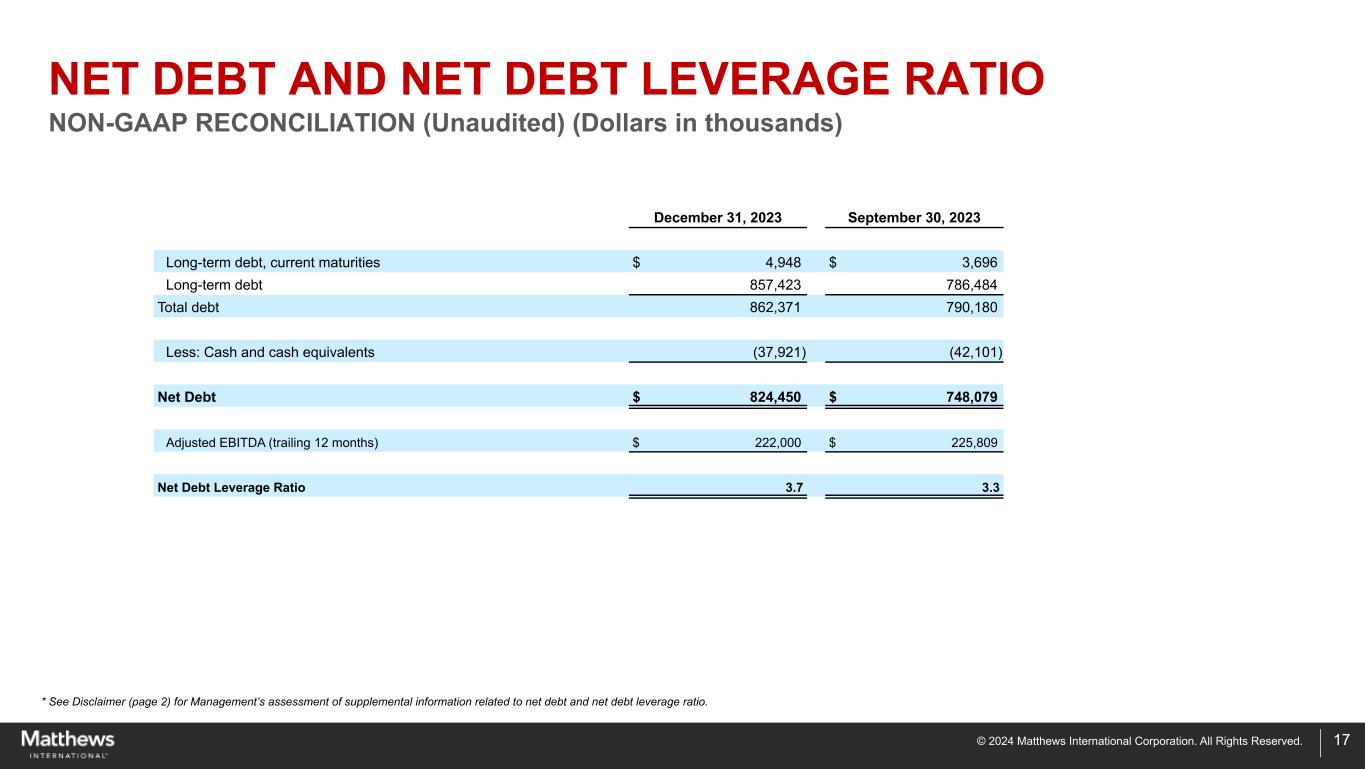

© 2024 Matthews International Corporation. All Rights Reserved. • Operating cash flow for prior period reflected final payouts for the settlement of the Company’s supplemental retirement plan obligations • Net Debt Leverage Ratio* 3.7 as of December 31, 2023 • Quarterly dividend of $0.24/share, payable 2/19/24 CAPITALIZATION AND CASH FLOWS 11 * See supplemental slide for Net Debt and Net Debt Leverage Ratio reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures Note: Dark gray shades on the left represent Total Debt. Total Debt and Net Debt* $790.2 $862.4 $748.1 $824.5 09/30/23 12/31/23 ($ in millions) Cash $42.1 $37.9 9/30/23 12/31/23 Operating Cash Flow $(36.2) $(27.3) YTD FY2023 YTD FY2024

SUPPLEMENTAL INFORMATION

© 2024 Matthews International Corporation. All Rights Reserved. 13 Included in this report are measures of financial performance that are not defined by GAAP, including, without limitation, adjusted EBITDA, adjusted net income and EPS, constant currency sales, constant currency adjusted EBITDA, and net debt and net debt leverage ratio. The Company defines net debt leverage ratio as outstanding debt (net of cash) relative to adjusted EBITDA. The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition and divestiture costs, ERP integration costs, strategic initiative and other charges (which includes non-recurring charges related to certain commercial and operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Constant currency sales and constant currency adjusted EBITDA removes the impact of changes due to foreign exchange translation rates. To calculate sales and adjusted EBITDA on a constant currency basis, amounts for periods in the current fiscal year are translated into U.S. dollars using exchange rates applicable to the comparable periods of the prior fiscal year. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company's core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company's calculations of its non-GAAP financial measures, however, may not be comparable to similarly titled measures reported by other companies. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provide investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

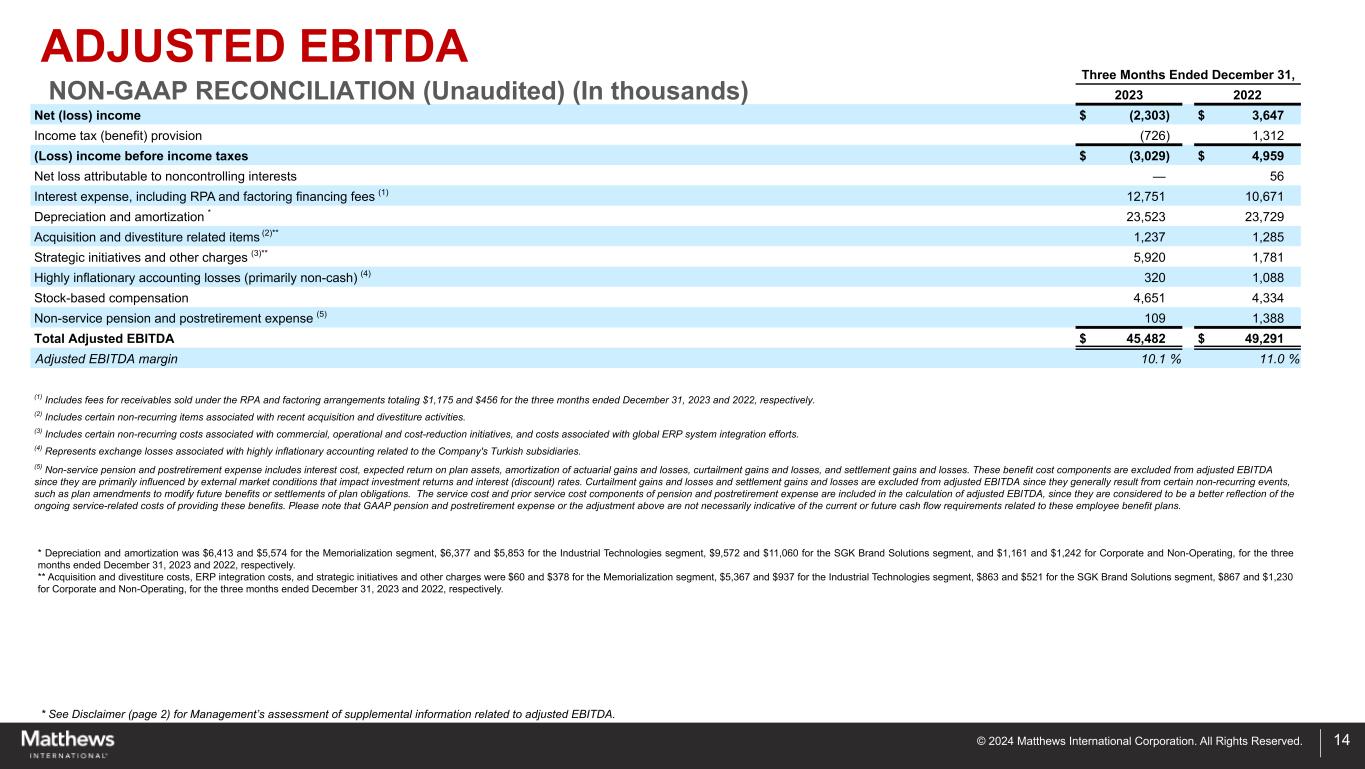

© 2024 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted EBITDA. 14 Three Months Ended December 31, 2023 2022 Net (loss) income $ (2,303) $ 3,647 Income tax (benefit) provision (726) 1,312 (Loss) income before income taxes $ (3,029) $ 4,959 Net loss attributable to noncontrolling interests — 56 Interest expense, including RPA and factoring financing fees (1) 12,751 10,671 Depreciation and amortization * 23,523 23,729 Acquisition and divestiture related items (2)** 1,237 1,285 Strategic initiatives and other charges (3)** 5,920 1,781 Highly inflationary accounting losses (primarily non-cash) (4) 320 1,088 Stock-based compensation 4,651 4,334 Non-service pension and postretirement expense (5) 109 1,388 Total Adjusted EBITDA $ 45,482 $ 49,291 Adjusted EBITDA margin 10.1 % 11.0 % (1) Includes fees for receivables sold under the RPA and factoring arrangements totaling $1,175 and $456 for the three months ended December 31, 2023 and 2022, respectively. (2) Includes certain non-recurring items associated with recent acquisition and divestiture activities. (3) Includes certain non-recurring costs associated with commercial, operational and cost-reduction initiatives, and costs associated with global ERP system integration efforts. (4) Represents exchange losses associated with highly inflationary accounting related to the Company's Turkish subsidiaries. (5) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. * Depreciation and amortization was $6,413 and $5,574 for the Memorialization segment, $6,377 and $5,853 for the Industrial Technologies segment, $9,572 and $11,060 for the SGK Brand Solutions segment, and $1,161 and $1,242 for Corporate and Non-Operating, for the three months ended December 31, 2023 and 2022, respectively. ** Acquisition and divestiture costs, ERP integration costs, and strategic initiatives and other charges were $60 and $378 for the Memorialization segment, $5,367 and $937 for the Industrial Technologies segment, $863 and $521 for the SGK Brand Solutions segment, $867 and $1,230 for Corporate and Non-Operating, for the three months ended December 31, 2023 and 2022, respectively. ADJUSTED EBITDA NON-GAAP RECONCILIATION (Unaudited) (In thousands)

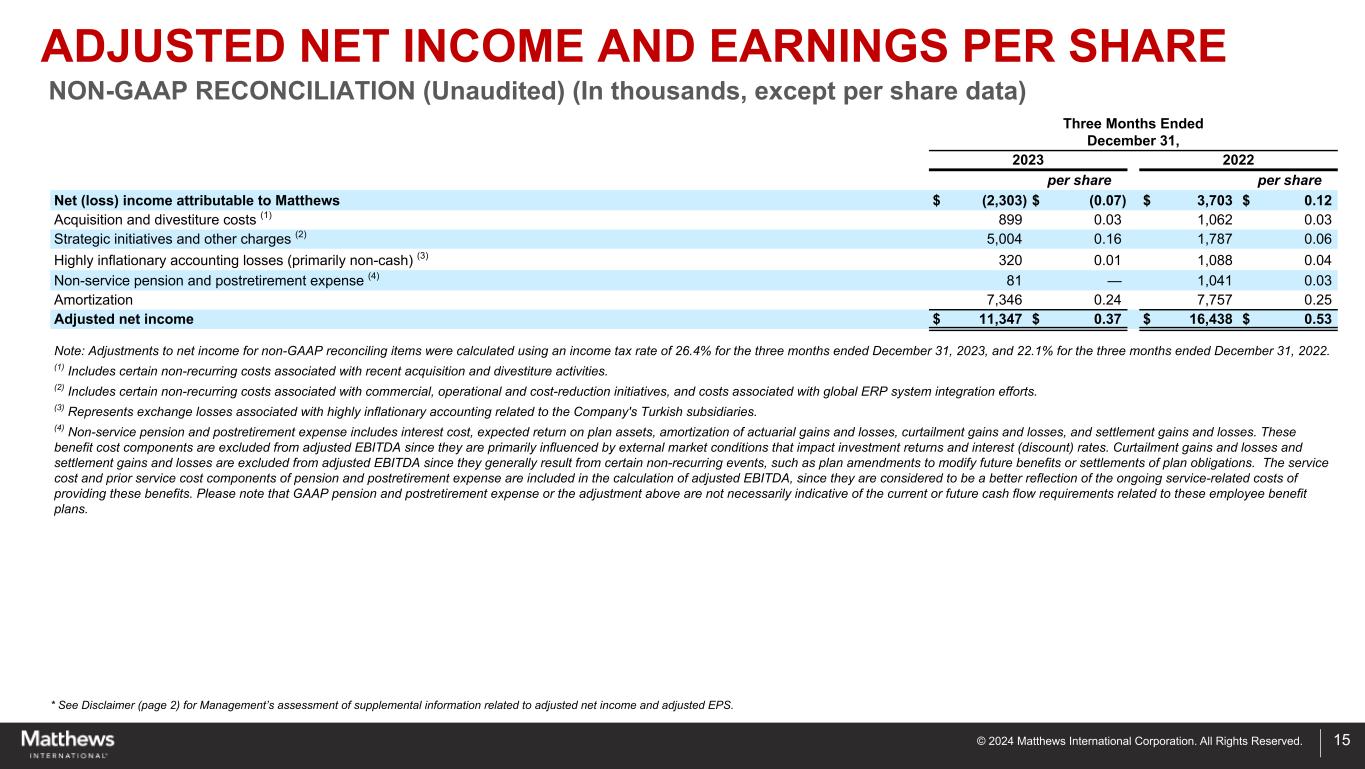

© 2024 Matthews International Corporation. All Rights Reserved. ADJUSTED NET INCOME AND EARNINGS PER SHARE NON-GAAP RECONCILIATION (Unaudited) (In thousands, except per share data) * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted net income and adjusted EPS. 15 Three Months Ended December 31, 2023 2022 per share per share Net (loss) income attributable to Matthews $ (2,303) $ (0.07) $ 3,703 $ 0.12 Acquisition and divestiture costs (1) 899 0.03 1,062 0.03 Strategic initiatives and other charges (2) 5,004 0.16 1,787 0.06 Highly inflationary accounting losses (primarily non-cash) (3) 320 0.01 1,088 0.04 Non-service pension and postretirement expense (4) 81 — 1,041 0.03 Amortization 7,346 0.24 7,757 0.25 Adjusted net income $ 11,347 $ 0.37 $ 16,438 $ 0.53 Note: Adjustments to net income for non-GAAP reconciling items were calculated using an income tax rate of 26.4% for the three months ended December 31, 2023, and 22.1% for the three months ended December 31, 2022. (1) Includes certain non-recurring costs associated with recent acquisition and divestiture activities. (2) Includes certain non-recurring costs associated with commercial, operational and cost-reduction initiatives, and costs associated with global ERP system integration efforts. (3) Represents exchange losses associated with highly inflationary accounting related to the Company's Turkish subsidiaries. (4) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans.

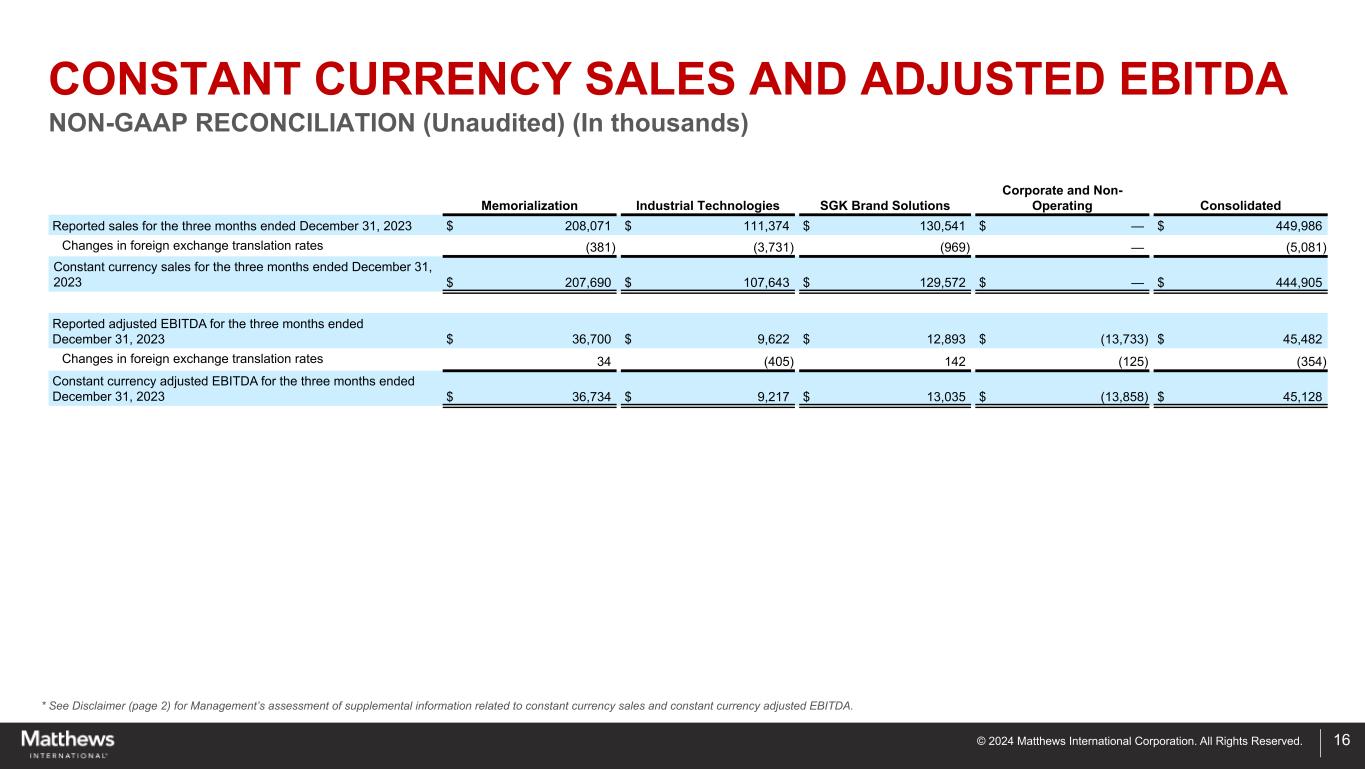

© 2024 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to constant currency sales and constant currency adjusted EBITDA. 16 CONSTANT CURRENCY SALES AND ADJUSTED EBITDA NON-GAAP RECONCILIATION (Unaudited) (In thousands) Memorialization Industrial Technologies SGK Brand Solutions Corporate and Non- Operating Consolidated Reported sales for the three months ended December 31, 2023 $ 208,071 $ 111,374 $ 130,541 $ — $ 449,986 Changes in foreign exchange translation rates (381) (3,731) (969) — (5,081) Constant currency sales for the three months ended December 31, 2023 $ 207,690 $ 107,643 $ 129,572 $ — $ 444,905 Reported adjusted EBITDA for the three months ended December 31, 2023 $ 36,700 $ 9,622 $ 12,893 $ (13,733) $ 45,482 Changes in foreign exchange translation rates 34 (405) 142 (125) (354) Constant currency adjusted EBITDA for the three months ended December 31, 2023 $ 36,734 $ 9,217 $ 13,035 $ (13,858) $ 45,128

© 2024 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to net debt and net debt leverage ratio. 17 December 31, 2023 September 30, 2023 Long-term debt, current maturities $ 4,948 $ 3,696 Long-term debt 857,423 786,484 Total debt 862,371 790,180 Less: Cash and cash equivalents (37,921) (42,101) Net Debt $ 824,450 $ 748,079 Adjusted EBITDA (trailing 12 months) $ 222,000 $ 225,809 Net Debt Leverage Ratio 3.7 3.3 NET DEBT AND NET DEBT LEVERAGE RATIO NON-GAAP RECONCILIATION (Unaudited) (Dollars in thousands)