of directors appointed to the Board since October 2020 to four new directors and J. Michael Nauman was elected at the 2025 Annual Meeting, bringing the total new directors to five since October 2020.

Prior to the 2025 Annual Meeting, I also announced that I would retire from the Board upon the certification of the vote at the 2026 Annual Meeting. As I close out this chapter of my tenure with Matthews, I want to relay that it has been a distinct honor to serve as Chairperson and as a member of the Board of the Company and a privilege to work and serve alongside my fellow directors, Mr. Bartolacci, the entire management team and our over 5,000 employees in representing your interests and driving value for our shareholders. At Matthews, as we celebrate our 175 years as a company, we are very proud of our legacy and culture—but are always looking forward to using our strong history and culture to propel us to additional innovations across the Company, strengthen performance and grow our profitability. Given the opportunities that lay ahead and our strong foundation, I am also pleased that J. Michael Nauman will lead the Board of Directors through the next phase of Matthews’ enduring story as its Chairperson and, I am sure, to continued and greater success for the Company and our shareholders.

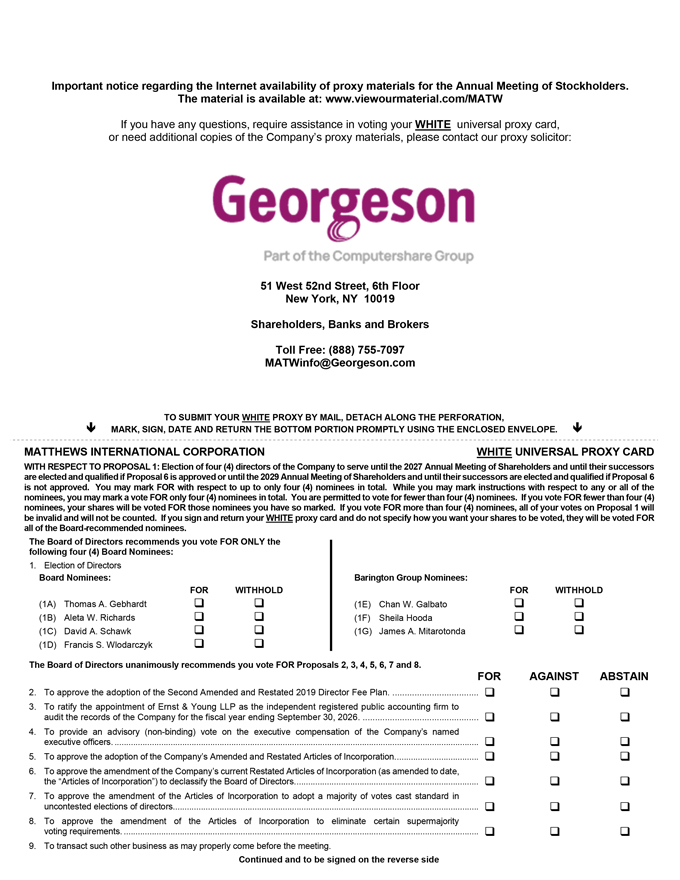

As you consider how to vote your shares at the 2026 Annual Meeting, I again encourage you to reflect on how serious this Board has taken its commitment to you and considering your best interests, rather than the interests of a select few. Please join me in voting your shares “FOR” the election of our four nominees: Thomas A. Gebhardt, Aleta W. Richards, David A. Schawk, and Francis S. Wlodarczyk using the WHITE proxy card.

Your Vote is Important

The accompanying Notice of Annual Meeting of Shareholders and Proxy Statement describe the business to be conducted at the Annual Meeting. You will also find a WHITE proxy card and postage-paid return envelope. WHITE proxy cards are being solicited on behalf of the Board of Directors of Matthews. This year, your WHITE proxy card looks different than the proxy card we send to our shareholders most years as proxy rules require that we list the nominees of Barington (as defined below) in addition to the Board’s nominees.

Your vote is important, and we ask that you please vote “FOR” the election of our four nominees: Thomas A. Gebhardt, Aleta W. Richards, David A. Schawk, and Francis S. Wlodarczyk using the WHITE proxy card.

You may receive solicitation materials from Barington, including proxy statements, mailings and proxy cards, asking for your support in favor of their three nominees, including two nominees who were previously defeated by our shareholders at last year’s annual meeting. The Board of Directors urges you to disregard any such materials and does not endorse any of Barington’s nominees.

If you have any questions or require any assistance with voting your shares, please call the Company’s proxy solicitor, Georgeson LLC, at:

51 West 52nd Street, 6th Floor

New York, NY 10019

Shareholders, Banks and Brokers

Toll Free: (888) 755-7097

MATWinfo@Georgeson.com

We appreciate your ongoing support and investment in Matthews International.

Thank you,

Alvaro Garcia-Tunon

Chairperson of the Board