UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2014

Commission File Number 0-09115

MATTHEWS INTERNATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

|

COMMONWEALTH OF PENNSYLVANIA

|

25-0644320

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

|

TWO NORTHSHORE CENTER, PITTSBURGH, PA

|

15212-5851

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant's telephone number, including area code

|

(412) 442-8200

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Class A Common Stock, $1.00 par value

|

NASDAQ Global Select Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405a of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes x

|

No o

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of "large accelerated filer", "accelerated filer", and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the Class A Common Stock outstanding and held by non-affiliates of the registrant, based upon the closing sale price of the Class A Common Stock on the NASDAQ Global Select Market on March 31, 2014, the last business day of the registrant's most recently completed second fiscal quarter, was approximately $1.1 billion.

As of October 31, 2014, shares of common stock outstanding were: Class A Common Stock 32,874,065 shares

Documents incorporated by reference: Specified portions of the Proxy Statement for the 2015 Annual Meeting of Shareholders are incorporated by reference into Part III of this Report.

The index to exhibits is on pages 82-84.

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION:

Any forward-looking statements contained in this Annual Report on Form 10-K (specifically those contained in Item 1, "Business", Item 1A, "Risk Factors" and Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations") are included in this report pursuant to the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the actual results of Matthews International Corporation ("Matthews" or the "Company") in future periods to be materially different from management's expectations. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove correct. Factors that could cause the Company's results to differ materially from the results discussed in such forward-looking statements principally include changes in domestic or international economic conditions, changes in foreign currency exchange rates, changes in the cost of materials used in the manufacture of the Company's products, changes in death rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company operates, changes in product demand or pricing as a result of domestic or international competitive pressures, unknown risks in connection with the Company's acquisitions, including the risks associated with the Company's recent acquisition of Schawk, Inc. ("Schawk"), and technological factors beyond the Company's control. In addition, although the Company does not have any customers that would be considered individually significant to consolidated sales, changes in the distribution of the Company's products or the potential loss of one or more of the Company's larger customers are also considered risk factors.

ITEM 1. BUSINESS.

Matthews, founded in 1850 and incorporated in Pennsylvania in 1902, is a designer, manufacturer and marketer principally of memorialization products and brand solutions. Memorialization products consist primarily of bronze and granite memorials and other memorialization products, caskets and cremation equipment for the cemetery and funeral home industries. Brand solutions include graphics imaging products and services, merchandising solutions, and marking and fulfillment systems products. The Company's products and operations are comprised of six business segments: Cemetery Products, Funeral Home Products, Cremation, Graphics Imaging, Merchandising Solutions and Marking and Fulfillment Systems. The Cemetery Products segment is a leading manufacturer of cast bronze and granite memorials and other memorialization products, cast and etched architectural products and is a leading builder of mausoleums in the United States. The Funeral Home Products segment is a leading casket manufacturer and distributor in North America and produces a wide variety of wood, metal and cremation caskets. The Cremation segment is a leading designer and manufacturer of cremation equipment in North America and Europe. The Graphics Imaging segment provides brand development, brand management, printing plates, gravure cylinders, pre-media services and imaging services. At September 30, 2014, the Graphics Imaging segment included the acquisition of Schawk, a global brand development, activation and deployment company, in July 2014 (see "Acquisitions" in Management's Discussion and Analysis). The Merchandising Solutions segment designs and manufactures merchandising displays and systems and provides creative merchandising and marketing solutions services. The Marking and Fulfillment Systems segment designs, manufactures and distributes a wide range of marking and coding equipment and consumables, industrial automation products and order fulfillment systems that are used for identifying, tracking, picking and conveying consumer and industrial products.

Beginning October 1, 2014, the Company realigned its operations into three reporting segments, SGK Brand Solutions, Memorialization, and Industrial. The SGK Brand Solutions segment is comprised of the graphics imaging business, including Schawk, and the merchandising solutions operations. The Memorialization segment is comprised of the Company's cemetery products, funeral home products and cremation operations. The Industrial segment is comprised of the Company's marking and automation products and fulfillment systems.

2

| ITEM 1. | BUSINESS, (continued) |

At October 31, 2014, the Company and its majority-owned subsidiaries had approximately 9,400 employees. The Company's principal executive offices are located at Two NorthShore Center, Pittsburgh, Pennsylvania 15212, its telephone number is

(412) 442-8200 and its internet website is www.matw.com. The Company files all required reports with the Securities and Exchange Commission ("SEC") in accordance with the Exchange Act. The Company's Annual Report on Form 10-K, Quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are available free of charge on the Company's website as soon as reasonably practicable after being filed or furnished to the SEC. The reports filed with the SEC are also available to read and copy at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or by contacting the SEC at 1-800-732-0330. All reports filed with the SEC can be found on its website at www.sec.gov.

(412) 442-8200 and its internet website is www.matw.com. The Company files all required reports with the Securities and Exchange Commission ("SEC") in accordance with the Exchange Act. The Company's Annual Report on Form 10-K, Quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are available free of charge on the Company's website as soon as reasonably practicable after being filed or furnished to the SEC. The reports filed with the SEC are also available to read and copy at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or by contacting the SEC at 1-800-732-0330. All reports filed with the SEC can be found on its website at www.sec.gov.

The following table sets forth reported sales and operating profit for the Company's business segments for the past three fiscal years. Detailed financial information relating to business segments and to domestic and international operations is presented in Note 17 ("Segment Information") to the Consolidated Financial Statements included in Part II of this Annual Report on Form 10-K.

|

Years Ended September 30,

|

||||||||||||||||||||||||

|

2014

|

2013

|

2012

|

||||||||||||||||||||||

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

|||||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||||||

|

Sales to unaffiliated customers:

|

||||||||||||||||||||||||

|

Memorialization:

|

||||||||||||||||||||||||

|

Cemetery Products

|

$

|

221,992

|

20.0

|

%

|

$

|

226,586

|

23.0

|

%

|

$

|

215,943

|

24.0

|

%

|

||||||||||||

|

Funeral Home Products

|

234,583

|

21.2

|

242,803

|

24.6

|

230,943

|

25.6

|

||||||||||||||||||

|

Cremation

|

51,845

|

4.7

|

48,522

|

4.9

|

45,981

|

5.1

|

||||||||||||||||||

|

508,420

|

45.9

|

517,911

|

52.5

|

492,867

|

54.7

|

|||||||||||||||||||

|

Brand Solutions:

|

||||||||||||||||||||||||

|

Graphics Imaging

|

398,223

|

36.0

|

294,571

|

29.9

|

259,865

|

28.9

|

||||||||||||||||||

|

Merchandising Solutions

|

99,105

|

9.0

|

79,370

|

8.1

|

72,964

|

8.1

|

||||||||||||||||||

|

Marking and Fulfillment Systems

|

100,849

|

9.1

|

93,505

|

9.5

|

74,621

|

8.3

|

||||||||||||||||||

|

598,177

|

54.1

|

467,446

|

47.5

|

407,450

|

45.3

|

|||||||||||||||||||

|

Total

|

$

|

1,106,597

|

100.0

|

%

|

$

|

985,357

|

100.0

|

%

|

$

|

900,317

|

100.0

|

%

|

||||||||||||

|

Operating profit:

|

||||||||||||||||||||||||

|

Memorialization:

|

||||||||||||||||||||||||

|

Cemetery Products

|

$

|

36,165

|

43.6

|

%

|

$

|

32,571

|

34.0

|

%

|

$

|

33,195

|

35.5

|

%

|

||||||||||||

|

Funeral Home Products

|

28,025

|

33.8

|

37,263

|

38.9

|

26,525

|

28.3

|

||||||||||||||||||

|

Cremation

|

5,116

|

6.2

|

3,097

|

3.2

|

3,869

|

4.1

|

||||||||||||||||||

|

69,306

|

83.6

|

72,931

|

76.1

|

63,589

|

67.9

|

|||||||||||||||||||

|

Brand Solutions:

|

||||||||||||||||||||||||

|

Graphics Imaging

|

(4,617

|

)

|

(5.5

|

)

|

9,724

|

10.2

|

14,843

|

15.9

|

||||||||||||||||

|

Merchandising Solutions

|

7,153

|

8.6

|

4,275

|

4.5

|

5,084

|

5.4

|

||||||||||||||||||

|

Marking and Fulfillment Systems

|

11,049

|

13.3

|

8,862

|

9.2

|

10,061

|

10.8

|

||||||||||||||||||

|

13,585

|

16.4

|

22,861

|

23.9

|

29,988

|

32.1

|

|||||||||||||||||||

|

Total

|

$

|

82,891

|

100.0

|

%

|

$

|

95,792

|

100.0

|

%

|

$

|

93,577

|

100.0

|

%

|

||||||||||||

3

| ITEM 1. | BUSINESS, (continued) |

In fiscal 2014, approximately 61% of the Company's sales were made from the United States, and 35%, 2%, 1% and 1% were made from Europe, Asia, Australia and Canada, respectively. For further information on segments, see Note 17 ("Segment Information") in Item 8 "Financial Statements and Supplementary Data" on pages 65-67 of this report. Cemetery Products segment products are sold throughout the world with the segment's principal operations located in the United States, Europe, Canada, and Australia. Funeral Home Products segment products are primarily sold in North America. Cremation segment products and services are sold primarily in North America, Europe, Asia, and Australia. Products and services of the Graphics Imaging segment are sold primarily in Europe, the United States and Asia. Merchandising Solutions segment products and services are sold principally in the United States. The Marking and Fulfillment Systems segment sells equipment and consumables directly to industrial consumers and distributors in the United States and internationally through the Company's subsidiaries in Canada, Sweden and China, and through other foreign distributors. Matthews owns a minority interest in Marking and Fulfillment Systems distributors in Asia, Australia and Europe.

MEMORIALIZATION PRODUCTS AND MARKETS:

Cemetery Products:

The Cemetery Products segment manufactures and markets a full line of memorialization products used primarily in cemeteries. The segment's products, which are sold principally in the United States, Europe, Canada and Australia, include cast bronze memorials, granite memorials and other memorialization products. The segment also manufactures and markets architectural products that are produced from bronze, aluminum and other metals, which are used to identify or commemorate people, places, events and accomplishments.

Memorial products, which comprise the majority of the Cemetery Products segment's sales, include flush bronze and granite memorials, upright granite memorials and monuments, cremation memorialization products, granite benches, flower vases, crypt plates and letters, cremation urns, niche units, cemetery features and statues, along with other related products and services. Flush memorials are bronze plaques or granite memorials which contain personal information about a deceased individual (such as name, birth date, and death date), photos and emblems. Flush bronze and granite memorials are even or "flush" with the ground and therefore are preferred by many cemeteries for easier mowing and general maintenance. The segment's memorial products also include community and family mausoleums within North America. In addition, the segment's other memorial products include bronze plaques, letters, emblems, vases, lights and photo ceramics that can be affixed to granite monuments, mausoleums, crypts and flush memorials. Principal customers for memorial products are cemeteries and memorial parks, which in turn sell the Company's products to the consumer.

Customers of the Cemetery Products segment can also purchase memorials and vases on a "pre-need" basis. The "pre-need" concept permits families to arrange for these purchases in advance of their actual need. Upon request, the Company will manufacture the memorial to the customer's specifications (e.g., name and birth date) and place it in storage for future delivery. Memorials in storage have been paid in full with title conveyed to each pre-need purchaser.

The Cemetery Products segment manufactures a full line of memorial products for cremation, including urns in a variety of sizes, styles and shapes as well as standard and custom designed granite cremation pedestals and benches. The segment also manufactures bronze and granite niche units, which are comprised of numerous compartments used to display cremation urns in mausoleums and churches. In addition, the Company also markets turnkey cremation gardens, which include the design and all related products for a cremation memorial garden. As part of the Memorialization group, the segment works with the Funeral Home Products and Cremation segments to provide a total solution to customers that own and operate businesses in both the cemetery and funeral home markets.

Architectural products include cast bronze and aluminum plaques, etchings and letters that are used to recognize, commemorate and identify people, places, events and accomplishments. The Company's plaques are frequently used to identify the name of a building or the names of companies or individuals located within a building. Such products are also used to commemorate events or accomplishments, such as military service or financial donations. The principal markets for the segment's architectural products are corporations, fraternal organizations, contractors, churches, hospitals, schools and government agencies. These products are sold to and distributed through a network of independent dealers including sign suppliers, awards and recognition companies, and trophy dealers.

4

| ITEM 1. | BUSINESS, (continued) |

Raw materials used by the Cemetery Products segment consist principally of bronze and aluminum ingot, granite, sheet metal, coating materials, photopolymers and construction materials and are generally available in adequate supply. Ingot is obtained from various North American, European and Australian smelters.

Competition from other cemetery product manufacturers is on the basis of reputation, product quality, delivery, price, and design availability. The Company believes that its superior quality, broad product lines, innovative designs, delivery capability, customer responsiveness, experienced personnel and consumer-oriented merchandising systems are competitive advantages in its markets. Competition in the mausoleum construction industry includes various construction companies throughout North America and is on the basis of design, quality and price. Competitors in the architectural market are numerous and include companies that manufacture cast and painted signs, plastic materials, sand-blasted wood and other fabricated products.

Funeral Home Products:

The Funeral Home Products segment is a leading manufacturer and distributor of caskets and other funeral home products in North America. The segment produces and markets metal, wood and cremation caskets. Caskets are offered in a variety of colors, interior designs, handles and trim in order to accommodate specific religious, ethnic or other personal preferences. The segment also markets other funeral home products such as urns, jewelry, stationery and other funeral home products. The segment offers individually personalized caskets and urns through the Company-owned distribution network.

Metal caskets are made from various gauges of cold-rolled steel, stainless steel, copper and bronze. Metal caskets are generally categorized by whether the casket is non-gasketed or gasketed, and by material (i.e., bronze, copper, or steel) and in the case of steel, by the gauge (thickness) of the metal. Wood caskets are manufactured from nine different species of wood, as well as from veneer. The species of wood used are poplar, pine, ash, oak, pecan, maple, cherry, walnut and mahogany. The Funeral Home Products segment is a leading manufacturer of all-wood constructed caskets, which are manufactured using pegged and dowelled construction, and include no metal parts. All-wood constructed caskets are preferred by certain religious groups. Cremation caskets are made primarily from wood or cardboard covered with cloth or veneer. These caskets appeal primarily to cremation consumers, the environmentally concerned, and value buyers.

The Funeral Home Products segment also produces casket components. Casket components include stamped metal parts, metal locking mechanisms for gasketed metal caskets, adjustable beds and interior panels. Metal casket parts are produced by stamping cold-rolled steel, stainless steel, copper and bronze sheets into casket body parts. Locking mechanisms and adjustable beds are produced by stamping and assembling a variety of steel parts. The segment purchases from sawmills and lumber distributors various species of uncured wood, which it dries and cures. The cured wood is processed into casket components.

The segment provides product and service assortment planning, as well as merchandising and display products to funeral service businesses. These products assist funeral service professionals in providing information, value and satisfaction to their client families.

The primary materials required for casket manufacturing are cold-rolled steel and lumber. The segment also purchases copper, bronze, stainless steel, particleboard, corrugated materials, paper veneer, cloth, ornamental hardware and coating materials. Purchase orders or supply agreements are typically negotiated with large, integrated steel producers that have demonstrated timely delivery, high quality material and competitive prices. Lumber is purchased from a number of sawmills and lumber distributors. The Company purchases most of its lumber from sawmills within 150 miles of its wood casket manufacturing facility in York, Pennsylvania.

5

| ITEM 1. | BUSINESS, (continued) |

The segment markets its casket products in the United States through a combination of Company-owned and independent casket distribution facilities. The Company operates approximately 60 distribution centers in the United States. Over 70% of the segment's casket products are currently sold through Company-owned distribution centers. As part of the Memorialization group, the segment works with the Cemetery Products and Cremation segments to provide a total solution to customers that own and operate businesses in both the cemetery and funeral home markets.

The casket business is highly competitive. The segment competes with other manufacturers on the basis of product quality, price, service, design availability and breadth of product line. The segment provides a line of casket products that it believes is as comprehensive as any of its major competitors. There are a large number of casket industry participants operating in North America, and the industry has recently seen a few new foreign casket manufacturers, primarily from China, enter the North American market.

Cremation:

The Cremation segment provides the following groups of products and services:

|

·

|

Cremation Systems

|

|

·

|

Waste Management/Incineration Systems

|

|

·

|

Environmental and Energy Systems

|

|

·

|

Service and Supplies

|

|

·

|

Crematory Management/Operations

|

|

·

|

Cremation Urns and Memorialization Products

|

Servicing the human, pet and specialized incineration markets, the segment's primary market areas are North America and Europe. The segment also sells into Latin America and the Caribbean, Australia and Asia.

Cremation systems includes both traditional flame-based and water-based bio-cremation systems for cremation of humans and pets, as well as equipment for processing the cremated remains and other related equipment (ventilated work stations, tables, cooler racks, vacuums). The principal markets for these products are funeral homes, cemeteries, crematories, pet crematories, animal disposers and veterinarians. These products primarily are marketed directly by segment personnel.

Waste management/incineration systems encompass both batch load and continuous feed, static and rotary systems for incineration of all waste types, as well as equipment for in-loading waste, out-loading ash and energy recovery. The principal markets for these products are medical waste disposal, oil and gas "work camp" wastes, industrial wastes and bio mass generators.

Environmental and energy systems include emissions filtration units, waste heat recovery equipment, waste gas treatment products, as well as energy recovery. The principal markets are municipalities or public/state agencies, the cremation industry and other industries which utilize incinerators for waste reduction and energy production.

Service and supplies consists of operator training, preventative maintenance and "at need" service work performed on various makes and models of equipment. This work can be as simple as replacing defective bulbs or as complex as complete reconstruction and upgrading or retro-fitting on site. Supplies are consumable items associated with normal operations.

Crematory management/operations represent the actual operation and management of client-owned crematories. Currently the segment provides these services primarily to municipalities in Europe and private operators in the U.S.

Cremation urns and memorialization products include urns which support various forms of memorialization (burial, niche, scattering, and home décor). Merchandise includes any other family-related products such as cremation jewelry, mementos, remembrance products and other assorted at-need merchandise.

Raw materials used by the Cremation segment consist principally of structural steel, sheet metal, electrical components, combustion devices and refractory materials. These are generally available in adequate supply from numerous suppliers.

6

| ITEM 1. | BUSINESS, (continued) |

The Company competes with several manufacturers in the cremation and accessory equipment market principally on the basis of product design, quality and price. The Cremation segment and its three largest global competitors account for a substantial portion of the U.S. and European cremation equipment market. As part of the Memorialization group, the segment works with the Cemetery Products and Funeral Home Products segments to provide a total solution to customers that own and operate businesses in both the cemetery and funeral home markets.

BRAND SOLUTIONS PRODUCTS AND MARKETS:

Graphics Imaging:

The Graphics Imaging segment provides brand development, brand management, pre-media services, printing plates and cylinders, embossing tools, and creative design services principally to consumer packaged goods and retail customers, and the primary packaging and corrugated industries. With the acquisition of Schawk in July 2014, the Company significantly expanded its product offerings and capabilities related to brand development and brand management serving the consumer packaged goods and retail industries. The primary packaging industry consists of manufacturers of printed packaging materials such as boxes, flexible packaging, folding cartons and bags commonly displayed at retailers of consumer goods. The corrugated packaging industry consists of manufacturers of printed corrugated containers. Other major industries served include the wallpaper, flooring, automotive, and textile industries.

The principal products and services of this segment include brand development, brand management, pre-media graphics services, printing plates, gravure cylinders, steel bases, embossing tools, special purpose machinery, engineering assistance, print process assistance, print production management, digital asset management, content management, and package design. These products and services are used by brand owners and packaging manufacturers to develop and print packaging graphics that help identify and sell the product in the marketplace. Other packaging graphics can include nutritional information, directions for product use, consumer warning statements and UPC codes. The primary packaging manufacturer produces printed packaging from paper, film, foil and other composite materials used to display, protect and market the product. The corrugated packaging manufacturer produces printed containers from corrugated sheets. Using the Company's products, these sheets are printed and die cut to make finished containers.

The segment offers a wide array of value-added services and products. These include print process and print production management services; print engineering consultation; pre-media preparation, which includes computer-generated art, film and proofs; plate mounting accessories and various press aids; and press-side print production assurance. The segment also provides creative digital graphics services to brand owners and packaging markets.

The Company works closely with manufacturers to provide the proper printing forms and tooling required to print the packaging to the user's specifications. The segment's printing plate products are made principally from photopolymer resin and sheet materials. Upon customer request, plates can be pre-mounted press-ready in a variety of configurations that maximize print quality and minimize press set‑up time. Gravure cylinders, manufactured from steel, copper and chrome, can be custom engineered for multiple print processes and specific customer print applications.

The Graphics Imaging segment customer base consists primarily of brand owners and packaging industry converters. Brand owners are generally large, well-known consumer products companies and retailers with a national or global presence. These types of companies tend to purchase their graphics needs directly and supply the printing forms, or the electronic files to make the printing plates and gravure cylinders, to the packaging printer for their products. The Graphics Imaging segment serves customers primarily in Europe, the United States and Asia.

Major raw materials for this segment's products include photopolymers, steel, copper, film and graphic art supplies. All such materials are presently available in adequate supply from various industry sources.

7

ITEM.1. BUSINESS, (continued)

The Graphics Imaging segment is one of several providers of brand management, brand development and pre-media services and manufacturers of printing plates and cylinders with an international presence. The combination of the Company's Graphics Imaging business in Europe, the United States and Asia is an important part of Matthews' strategy to become a worldwide leader in the graphics industry in providing consistent service to multinational customers on a global basis. Competition is on the basis of product quality, timeliness of delivery and price. The Company differentiates itself from the competition by consistently meeting these customer demands, its ability to service customers both nationally and globally, and its ability to provide a variety of value-added support services.

Merchandising Solutions:

The Merchandising Solutions segment provides merchandising, retail graphics and printing solutions for brand owners and retailers. The segment designs, manufactures and installs merchandising and display systems, and provides total turnkey project management services. The segment also provides creative merchandising and marketing solutions services.

The majority of the segment's sales are derived from the design, engineering, manufacturing and execution of merchandising and display systems. These systems include permanent and temporary displays, custom store fixtures, brand concept shops, interactive media, custom packaging, and screen and digitally printed promotional signage. Design and engineering services include concept and model development, graphics design and prototyping. Merchandising and display systems are manufactured to specifications developed by the segment in conjunction with the customer. These products are marketed and sold primarily in the United States.

The segment operates in a fragmented industry consisting primarily of a number of small, locally operated companies. Industry competition is intense and the segment competes on the basis of reliability, creativity and providing a broad array of merchandising products and services. The segment is unique in its ability to provide in-depth marketing and merchandising services as well as design, engineering and manufacturing capabilities. These capabilities allow the segment to deliver complete turnkey merchandising solutions quickly and cost effectively.

Major raw materials for the segment's products include wood, particleboard, corrugated materials, structural steel, plastic, laminates, inks, film and graphic art supplies. All of these raw materials are presently available in adequate supply from various sources.

Marking and Fulfillment Systems:

The Marking and Fulfillment Systems segment designs, manufactures and distributes a wide range of marking, coding and industrial automation solutions, and related consumables. Manufacturers, suppliers and distributors worldwide rely on Matthews' integrated systems to identify, track, control and pick their products.

Marking systems range from mechanical marking solutions to microprocessor-based ink-jet printing systems that integrate into a customer's manufacturing, inventory tracking and material handling control systems. The Company manufactures and markets products and systems that employ different marking technologies, including contact printing, indenting, etching, laser and ink-jet printing. Customers frequently use a combination of these methods to achieve an appropriate mark. These technologies apply product information required for identification and traceability, as well as to facilitate inventory and quality control, regulatory compliance and brand name communication.

Fulfillment systems complement the tracking and distribution of a customer's products with automated order fulfillment technologies, motor-driven rollers for product conveyance, and controls for material handling systems. Material handling customers include some of the largest automated assembly, distribution and mail sorting companies in the United States. The Company also engineers innovative, custom solutions to address specific customer requirements in a variety of industries, including oil exploration and security scanning.

8

| ITEM 1. | BUSINESS, (continued) |

A significant portion of the revenue of the Marking and Fulfillment Systems segment is attributable to the sale of consumables and replacement parts required by the marking, coding and tracking hardware sold by Matthews. The Company develops inks, rubber and steel consumables in conjunction with the marking equipment in which they are used, which is critical to ensure ongoing equipment reliability and mark quality. Most marking equipment customers use Matthews' inks, solvents and cleaners.

The principal customers for the Company's marking and fulfillment systems products are manufacturers, suppliers and distributors of durable goods, building products, consumer goods manufacturers (including food and beverage processors) and producers of pharmaceuticals. The Company also serves a wide variety of industrial markets, including metal fabricators, manufacturers of woven and non-woven fabrics, plastic, rubber and automotive products.

A portion of this segment's sales are outside the United States, with distribution sourced through the Company's subsidiaries in Canada, Sweden, Germany and China in addition to other international distributors. The Company owns a minority interest in distributors in Asia, Australia and Europe.

Major raw materials for this segment's products include precision components, electronics, printing components, tool steels, rubber and chemicals, all of which are presently available in adequate supply from various sources.

Competitors in the marking and fulfillment systems industries are diverse, with some companies offering limited product lines for well-defined specialty markets, while others operate similarly to the Company, offering a broad product line and competing in multiple product markets and countries. Competition for marking and fulfillment systems products is based on product performance, ease of integration into the manufacturing and/or distribution process, service and price. The Company typically competes with specialty companies in specific brand marking solutions and traceability applications. The Company believes that, in general, it offers one of the broadest lines of products to address a wide variety of marking, coding and industrial automation applications.

PATENTS, TRADEMARKS AND LICENSES:

The Company holds a number of domestic and foreign patents and trademarks. However, the Company believes the loss of any individual or a significant number of patents or trademarks would not have a material impact on consolidated operations or revenues.

BACKLOG:

Because the nature of the Company's Cemetery Products, Graphics Imaging and Merchandising Solutions businesses are primarily custom products made to order and services with short lead times, backlogs are not generally material except for mausoleums in the Cemetery Products segment, cremation equipment in the Cremation segment, roto-gravure engineering projects in the Graphics Imaging segment and industrial automation and order fulfillment systems in the Marking and Fulfillment segment. Backlogs vary in a range of approximately one year of sales for mausoleums and roto-gravure engineering projects. Backlogs for the Funeral Home Products segment are not material. Cremation equipment sales backlogs vary in a range of eight to ten months of sales. Backlogs for Marking and Fulfillment Systems segment sales generally vary in a range of up to six weeks for standard products and twelve weeks for custom systems. The Company's backlog is expected to be substantially filled in fiscal 2015.

REGULATORY MATTERS:

The Company's operations are subject to various federal, state and local laws and regulations relating to the protection of the environment. These laws and regulations impose limitations on the discharge of materials into the environment and require the Company to obtain and operate in compliance with conditions of permits and other government authorizations. As such, the Company has developed environmental, health and safety policies and procedures that include the proper handling, storage and disposal of hazardous materials.

9

| ITEM 1. | BUSINESS, (continued) |

The Company is party to various environmental matters. These include obligations to investigate and mitigate the effects on the environment of the disposal of certain materials at various operating and non-operating sites. The Company is currently performing environmental assessments and remediation at these sites, as appropriate.

At September 30, 2014, an accrual of approximately $4.9 million had been recorded for environmental remediation (of which $1.1 million was classified in other current liabilities), representing management's best estimate of the probable and reasonably estimable costs of the Company's known remediation obligations. The accrual does not consider the effects of inflation and anticipated expenditures are not discounted to their present value. While final resolution of these contingencies could result in costs different than current accruals, management believes the ultimate outcome will not have a significant effect on the Company's consolidated results of operations or financial position.

ITEM 1A. RISK FACTORS.

There are inherent risks and uncertainties associated with the Company's businesses that could adversely affect its operating performance and financial condition. Set forth below are descriptions of those risks and uncertainties that the Company currently believes to be material. Additional risks not currently known or deemed immaterial may also result in adverse effects on the Company.

Changes in Economic Conditions. Generally, changes in domestic and international economic conditions affect the industries in which the Company and its customers and suppliers operate. These changes include changes in the rate of consumption or use of the Company's products due to economic downturns, volatility in currency exchange rates, and changes in raw material prices resulting from supply and/or demand conditions.

Uncertainty about current global economic conditions poses a risk, as consumers and businesses may continue to postpone or cancel spending. Other factors that could influence customer spending include energy costs, conditions in the credit markets, consumer confidence and other factors affecting consumer spending behavior. These and other economic factors could have an effect on demand for the Company's products and services and negatively impact the Company's financial condition and results of operations.

Changes in Foreign Currency Exchange Rates. Manufacturing and sales of a significant portion of the Company's products are outside the United States, and accordingly, the Company holds assets, incurs liabilities, earns revenue and pays expenses in a variety of currencies. The Company's consolidated financial statements are presented in U.S. dollars, and therefore, the Company must translate the reported values of its foreign assets, liabilities, revenue and expenses into U.S. dollars. Increases or decreases in the value of the U.S. dollar compared to foreign currencies may negatively affect the value of these items in the Company's consolidated financial statements, even though their value has not changed in local currency.

Increased Prices for Raw Materials. The Company's profitability is affected by the prices of the raw materials used in the manufacture of its products. These prices may fluctuate based on a number of factors, including changes in supply and demand, domestic and global economic conditions, and volatility in commodity markets, currency exchange rates, labor costs and fuel-related costs. If suppliers increase the price of critical raw materials, alternative sources of supply, or an alternative material, may not exist.

The Company has standard selling price structures (i.e., list prices) in several of its segments, which are reviewed for adjustment generally on an annual basis. In addition, the Company has established pricing terms with several of its customers through contracts or similar arrangements. Based on competitive market conditions and to the extent that the Company has established pricing terms with customers, the Company's ability to immediately increase the price of its products to offset the increased costs may be limited. Significant raw material price increases that cannot be mitigated by selling price increases or productivity improvements will negatively affect the Company's results of operations.

10

| ITEM 1A. | RISK FACTORS, (continued) |

Changes in Mortality and Cremation Rates. Generally, life expectancy in the United States and other countries in which the Company's Memorialization businesses operate has increased steadily for several decades and is expected to continue to do so in the future. The increase in life expectancy is also expected to impact the number of deaths in the future. Additionally, cremations have steadily grown as a percentage of total deaths in the United States since the 1960's, and are expected to continue to increase in the future. The Company expects that these trends will continue in the future, and the result may affect the volume of bronze and granite memorialization products and burial caskets sold in the United States. However, sales of the Company's Cremation segment may benefit from the growth in cremations.

Changes in Product Demand or Pricing. The Company's businesses have and will continue to operate in competitive markets. Changes in product demand or pricing are affected by domestic and foreign competition and an increase in consolidated purchasing by large customers operating in both domestic and global markets. The Memorialization businesses generally operate in markets with ample supply capacity and demand which is correlated to death rates. The Brand Solutions businesses serve global customers that are requiring their suppliers to be global in scope and price competitive. Additionally, in recent years the Company has witnessed an increase in products manufactured offshore, primarily in China, and imported into the Company's U.S. markets. It is expected that these trends will continue and may affect the Company's future results of operations.

Risks in Connection with Acquisitions. The Company has grown in part through acquisitions, and continues to evaluate acquisition opportunities that have the potential to support and strengthen its businesses. There is no assurance however that future acquisition opportunities will arise, or that if they do, that they will be consummated. In addition, acquisitions involve inherent risks that the businesses acquired will not perform in accordance with expectations, or that synergies expected from the integration of the acquisitions will not be achieved as rapidly as expected, if at all. Failure to effectively integrate acquired businesses could prevent the realization of expected rates of return on the acquisition investment and could have a negative effect on the Company's results of operations and financial condition.

In July 2014, the Company completed the acquisition of Schawk. In connection with the acquisition, additional risks and uncertainties could affect the Company's financial performance and actual results. Specifically, the acquisition could cause actual results for fiscal 2015 and beyond to differ materially from those expressed or implied in any forward-looking statements included in this report or otherwise made by the Company's management. The risks associated with the Schawk acquisition include risks related to combining the businesses and achieving expected cost savings and synergies, assimilating the Schawk businesses, and the fact that merger integration costs related to the acquisition are difficult to predict with a level of certainty, and may be greater than expected.

Technological Factors Beyond the Company's Control. The Company operates in certain markets in which technological product development contributes to its ability to compete effectively. There can be no assurance that the Company will be able to develop new products, that new products can be manufactured and marketed profitably, or that new products will successfully meet the expectations of customers.

Changes in the Distribution of the Company's Products or the Loss of a Large Customer. Although the Company does not have any customer that is considered individually significant to consolidated sales, it does have contracts with several large customers in both the Memorialization and Brand Solutions businesses. While these contracts provide important access to large purchasers of the Company's products, they can obligate the Company to sell products at contracted prices for extended periods of time. Additionally, any significant divestiture of business properties or operations by current customers could result in a loss of business if the Company is not able to maintain the business with the subsequent owners of the properties.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not Applicable.

11

ITEM 2. PROPERTIES.

Principal properties of the Company and its majority-owned subsidiaries as of October 31, 2014 were as follows (properties are owned by the Company except as noted):

|

Location

|

Description of Property

|

||

|

Cemetery Products:

|

|||

|

Pittsburgh, PA

|

Manufacturing / Division Offices

|

||

|

Elberton, GA

|

Manufacturing

|

||

|

Kingwood, WV

|

Manufacturing

|

||

|

Melbourne, Australia

|

Manufacturing

|

(1)

|

|

|

Monterrey, Mexico

|

Manufacturing

|

(1)

|

|

|

Parma, Italy

|

Manufacturing / Warehouse

|

(1)

|

|

|

Searcy, AR

|

Manufacturing

|

||

|

Whittier, CA

|

Manufacturing

|

(1)

|

|

|

Funeral Home Products (2):

|

|||

|

Monterrey, Mexico

|

Manufacturing

|

(1)

|

|

|

Richmond, IN

|

Manufacturing

|

(1)

|

|

|

Richmond, IN

|

Manufacturing / Metal Stamping

|

||

|

York, PA

|

Manufacturing

|

||

|

Cremation:

|

|||

|

Apopka, FL

|

Manufacturing / Division Offices

|

||

|

Manchester, England

|

Manufacturing

|

(1)

|

|

|

Udine, Italy

|

Manufacturing

|

(1)

|

|

|

Graphics Imaging:

|

|||

|

Des Plaines, IL

|

Division Offices

|

||

|

Pittsburgh, PA

|

Manufacturing

|

||

|

Antwerp, Belgium

|

Manufacturing

|

||

|

Atlanta, GA

|

Manufacturing

|

||

|

Atlanta, GA

|

Operating facility

|

(1)

|

|

|

Battle Creek, MI

|

Operating facility

|

(1)

|

|

|

Bristol, England

|

Operating facility

|

||

|

Budapest, Hungary

|

Manufacturing

|

||

|

Chenai, China

|

Operating facility

|

(1)

|

|

|

Chicago, IL

|

Operating facility

|

(1)

|

|

|

Chicago, IL

|

Operating facility

|

(1)

|

|

|

Chicago, IL

|

Subletting

|

(1)

|

|

|

Cincinnati, OH

|

Operating facility

|

(1)

|

|

|

Cincinnati, OH

|

Operating facility

|

(1)

|

|

|

Cincinnati, OH

|

Manufacturing

|

(1)

|

|

|

Des Plaines, IL

|

Operating facility

|

(1)

|

|

|

Duchow, Poland

|

Manufacturing

|

||

|

Goslar, Germany

|

Manufacturing

|

(1)

|

|

|

Grenzach-Wyhlen, Germany

|

Manufacturing

|

||

|

Hilversum, Netherlands

|

Operating facility

|

(1)

|

|

|

Izmir, Turkey

|

Manufacturing

|

||

|

Julich, Germany

|

Manufacturing

|

||

|

Kalamazoo, MI

|

Operating facility

|

||

|

Leeds, England

|

Operating facility

|

(1)

|

|

|

London, England

|

Operating facility

|

(1)

|

|

|

Los Angeles, CA

|

Operating facility

|

(1)

|

12

| ITEM 2. | PROPERTIES, (continued) |

|

Location

|

Description of Property

|

||

|

Graphics Imaging, (continued):

|

|||

|

Manchester, England

|

Manufacturing

|

(1)

|

|

|

Minneapolis, MN

|

Manufacturing

|

||

|

Mississauga, Canada

|

Operating facility

|

(1)

|

|

|

Monchengladbach, Germany

|

Manufacturing

|

||

|

Mt. Olive, NJ

|

Operating facility

|

(1)

|

|

|

Munich, Germany

|

Manufacturing

|

(1)

|

|

|

New Berlin, WI

|

Manufacturing

|

(1)

|

|

|

New York, NY

|

Operating facility

|

(1)

|

|

|

New, York, NY

|

Operating facility

|

(1)

|

|

|

Newcastle, England

|

Operating facility

|

(1)

|

|

|

Northbrook, IL

|

Vacant

|

(1)

|

|

|

North Sydney, Australia

|

Operating facility

|

(1)

|

|

|

Nuremberg, Germany

|

Manufacturing

|

(1)

|

|

|

Oakland, CA

|

Operating facility

|

(1)

|

|

|

Paris, France

|

Operating facility

|

(1)

|

|

|

Penang, Malaysia

|

Operating facility

|

||

|

Poznan, Poland

|

Manufacturing

|

||

|

Queretaro, Mexico

|

Manufacturing

|

||

|

Redmond, WA

|

Operating facility

|

(1)

|

|

|

St. Louis, MO

|

Manufacturing

|

||

|

San Francisco, CA

|

Operating facility

|

(1)

|

|

|

San Francisco, CA

|

Operating facility

|

(1)

|

|

|

Shanghai, China

|

Operating facility

|

(1)

|

|

|

Shanghai, China

|

Operating facility

|

(1)

|

|

|

Shenzhen, China

|

Manufacturing

|

(1)

|

|

|

Singapore, Singapore

|

Operating facility

|

(1)

|

|

|

Stamford, CT

|

Operating facility

|

(1)

|

|

|

Sterling Heights, MI

|

Operating facility

|

(1)

|

|

|

Swindon, England

|

Subletting

|

(1)

|

|

|

Toronto, Canada

|

Manufacturing

|

(1)

|

|

|

Vienna, Austria

|

Manufacturing

|

(1)

|

|

|

Vreden, Germany

|

Manufacturing

|

||

|

Wan Chai, Hong Kong

|

Manufacturing

|

(1)

|

|

|

Woburn, MA

|

Operating facility

|

(1)

|

|

|

Marking and Fulfillment Systems:

|

|||

|

Pittsburgh, PA

|

Manufacturing / Division Offices

|

||

|

Beijing, China

|

Manufacturing

|

(1)

|

|

|

Cincinnati, OH

|

Manufacturing

|

(1)

|

|

|

Germantown, WI

|

Manufacturing

|

(1)

|

|

|

Gothenburg, Sweden

|

Manufacturing / Distribution

|

(1)

|

|

|

Ixonia, WI

|

Manufacturing

|

(1)

|

|

|

Tualatin, OR

|

Manufacturing

|

(1)

|

|

|

Tianjin City, China

|

Manufacturing

|

(1)

|

13

|

Location

|

Description of Property

|

||

|

Merchandising Solutions:

|

|||

|

East Butler, PA

|

Manufacturing / Division Offices

|

||

|

Portland, OR

|

Sales Office

|

(1)

|

|

|

Corporate Office:

|

|||

|

Pittsburgh, PA

|

General Offices

|

| (1) | These properties are leased by the Company under operating lease arrangements. Rent expense incurred by the Company for all leased facilities was approximately $21.8 million in fiscal 2014. |

| (2) | In addition to the properties listed, the Funeral Home Products segment leases warehouse facilities totaling approximately 1.0 million square feet in 30 states under operating leases. |

All of the owned properties are unencumbered. The Company believes its facilities are generally well suited for their respective uses and are of adequate size and design to provide the operating efficiencies necessary for the Company to be competitive. The Company's facilities provide adequate space for meeting its near-term production requirements and have availability for additional capacity. The Company intends to continue to expand and modernize its facilities as necessary to meet the demand for its products.

ITEM 3. LEGAL PROCEEDINGS.

Matthews is subject to various legal proceedings and claims arising in the ordinary course of business. Management does not expect that the results of any of these legal proceedings will have a material adverse effect on Matthews' financial condition, results of operations or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

14

OFFICERS AND EXECUTIVE MANAGEMENT OF THE REGISTRANT

The following information is furnished with respect to officers and executive management as of November 15, 2014:

|

Name

|

Age

|

Positions with Registrant

|

||

|

Joseph C. Bartolacci

|

54

|

President and Chief Executive Officer

|

||

|

David F. Beck

|

62

|

Vice President and Controller

|

||

|

Marcy L. Campbell

|

51

|

Vice President, Human Resources

|

||

|

Brian J. Dunn

|

57

|

Executive Vice President, Strategy and Corporate Development

|

||

|

Steven D. Gackenbach

|

51

|

Group President, Memorialization

|

||

|

Steven F. Nicola

|

54

|

Chief Financial Officer, Secretary and Treasurer

|

||

|

Paul F. Rahill

|

57

|

President, Cremation Division

|

||

|

David A. Schawk

|

58

|

President, Graphics Imaging

|

||

|

Brian D. Walters

|

45

|

Vice President and General Counsel

|

Joseph C. Bartolacci was appointed President and Chief Executive Officer effective October 2006.

David F. Beck was appointed Vice President and Controller effective February 2010. Prior thereto he had been Controller since September 15, 2003.

Marcy L. Campbell was appointed Vice President, Human Resources effective November 2014. Ms. Campbell served as Director, Regional Human Resources from January 2013, and as Manager, Regional Human Resources from November 2005 to December 2012.

Brian J. Dunn was appointed Executive Vice President, Strategy and Corporate Development effective July 24, 2014. Prior thereto, he served as Group President, Brand Solutions since February 2010, and Group President, Graphics and Marking Products from September 2007 to January 2010.

Steven D. Gackenbach was appointed Group President, Memorialization effective October 31, 2011. Prior thereto he had been Chief Commercial Officer, Memorialization since January 2011 when he joined the Company. Prior to joining the Company, Mr. Gackenbach served as the Senior Director of Strategy for Kraft Foods' Cheese and Dairy Division from 2002 to 2010.

Steven F. Nicola was appointed Chief Financial Officer, Secretary and Treasurer effective December 2003.

Paul F. Rahill was appointed President, Cremation Division in October 2002.

David A. Schawk joined the Company in July 2014 as President, Graphics Imaging upon Matthews' acquisition of Schawk. Mr. Schawk served as Schawk's Chief Executive Officer from July 2012, and Chief Executive Officer and President for more than five years prior thereto. Mr. Schawk was a member of the Schawk Board of Directors since 1992.

Brian D. Walters was appointed Vice President and General Counsel effective February 2009.

15

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

Market Information:

The authorized common stock of the Company consists of 70,000,000 shares of Class A Common Stock, $1 par value. At September 30, 2014, 32,879,865 shares were outstanding. The Company's Class A Common Stock is traded on the NASDAQ Global Select Market under the symbol "MATW". The following table sets forth the high, low and closing prices as reported by NASDAQ for the periods indicated:

|

High

|

Low

|

Close

|

||||||||||

|

Fiscal 2014:

|

||||||||||||

|

Quarter ended: September 30, 2014

|

$

|

47.60

|

$

|

40.99

|

$

|

43.89

|

||||||

|

June 30, 2014

|

43.32

|

39.54

|

41.57

|

|||||||||

|

March 31, 2014

|

44.33

|

37.08

|

40.81

|

|||||||||

|

December 31, 2013

|

42.80

|

37.58

|

42.61

|

|||||||||

|

Fiscal 2013:

|

||||||||||||

|

Quarter ended: September 30, 2013

|

$

|

40.50

|

$

|

36.27

|

$

|

38.08

|

||||||

|

June 30, 2013

|

39.37

|

32.81

|

37.70

|

|||||||||

|

March 31, 2013

|

35.31

|

31.43

|

34.92

|

|||||||||

|

December 31, 2012

|

32.95

|

27.42

|

32.10

|

|||||||||

The Company has a stock repurchase program. Under the current authorization, the Company's Board of Directors has authorized the repurchase of a total of 2,500,000 shares of Matthews' common stock under the program, of which 965,881 shares remain available for repurchase as of September 30, 2014. The buy-back program is designed to increase shareholder value, enlarge the Company's holdings of its common stock, and add to earnings per share. Repurchased shares may be retained in treasury, utilized for acquisitions, or reissued to employees or other purchasers, subject to the restrictions of the Company's Restated Articles of Incorporation.

All purchases of the Company's common stock during fiscal 2014 were part of this repurchase program.

16

| ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS, (continued) |

The following table shows the monthly fiscal 2014 stock repurchase activity:

|

Period

|

Total number of shares purchased

|

Average price paid per share

|

Total number of shares purchased as part of a publicly announced plan

|

Maximum number of shares that may yet be purchased under the plan

|

||||||||||||

|

October 2013

|

509

|

$

|

40.83

|

509

|

1,194,161

|

|||||||||||

|

November 2013

|

86,287

|

40.95

|

86,287

|

1,107,874

|

||||||||||||

|

December 2013

|

15,381

|

41.67

|

15,381

|

1,092,493

|

||||||||||||

|

January 2014

|

6,428

|

42.39

|

6,428

|

1,086,065

|

||||||||||||

|

February 2014

|

-

|

-

|

-

|

1,086,065

|

||||||||||||

|

March 2014

|

-

|

-

|

-

|

1,086,065

|

||||||||||||

|

April 2014

|

-

|

-

|

-

|

1,086,065

|

||||||||||||

|

May 2014

|

3,806

|

40.17

|

3,806

|

1,082,259

|

||||||||||||

|

June 2014

|

452

|

41.09

|

452

|

1,081,807

|

||||||||||||

|

July 2014

|

-

|

-

|

-

|

1,081,807

|

||||||||||||

|

August 2014

|

46,060

|

45.12

|

46,060

|

1,035,747

|

||||||||||||

|

September 2014

|

69,866

|

45.63

|

69,866

|

965,881

|

||||||||||||

|

Total

|

228,789

|

$

|

43.29

|

228,789

|

||||||||||||

Holders:

Based on records available to the Company, the number of registered holders of the Company's common stock was 596 at

October 31, 2014.

October 31, 2014.

Dividends:

A quarterly dividend of $.13 per share was paid for the fourth quarter of fiscal 2014 to shareholders of record on November 24, 2014. The Company paid quarterly dividends of $.11 per share for the first three quarters of fiscal 2014 and the fourth quarter of fiscal 2013. The Company paid quarterly dividends of $.10 per share for the first three quarters of fiscal 2013 and the fourth quarter of fiscal 2012. The Company paid quarterly dividends of $.09 per share for the first three quarters of fiscal 2012 and the fourth quarter of fiscal 2011.

Cash dividends have been paid on common shares in every year for at least the past forty-five years. It is the present intention of the Company to continue to pay quarterly cash dividends on its common stock. However, there is no assurance that dividends will be declared and paid as the declaration and payment of dividends is at the discretion of the Board of Directors of the Company and is dependent upon the Company's financial condition, results of operations, cash requirements, future prospects and other factors deemed relevant by the Board.

Securities Authorized for Issuance Under Equity Compensation Plans:

See Equity Compensation Plans in Item 12 "Security Ownership of Certain Beneficial Owners and Management" on page 76 of this report.

17

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS, (continued)

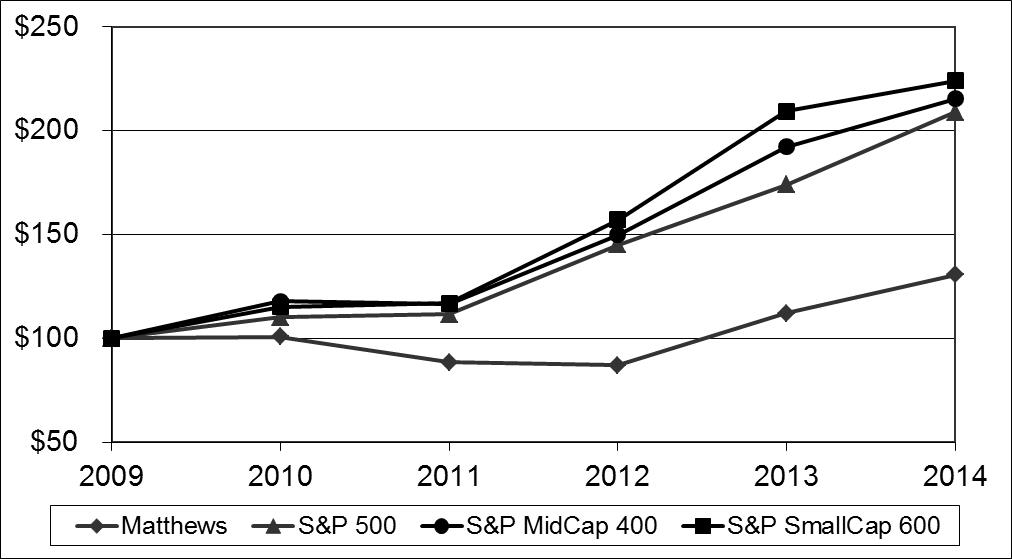

PERFORMANCE GRAPH

COMPARISON OF FIVE-YEAR CUMULATIVE RETURN *

AMONG MATTHEWS INTERNATIONAL CORPORATION,

S&P 500 INDEX, S&P MIDCAP 400 INDEX AND S&P SMALLCAP 600 INDEX **

* Total return assumes dividend reinvestment

** Fiscal year ended September 30

Note: Performance graph assumes $100 invested on October 1, 2009 in Matthews International Corporation Common Stock, Standard & Poor's (S&P) 500 Index, S&P MidCap 400 Index and S&P SmallCap 600 Index. The results are not necessarily indicative of future performance.

18

ITEM 6. SELECTED FINANCIAL DATA.

|

Years Ended September 30,

|

||||||||||||||||||||

|

2014(1)

|

2013(2)

|

2012(3)

|

2011(4)

|

2010(5)

|

||||||||||||||||

|

(Amounts in thousands, except per share data)

|

||||||||||||||||||||

|

(Unaudited)

|

||||||||||||||||||||

|

Net sales

|

$

|

1,106,597

|

$

|

985,357

|

$

|

900,317

|

$

|

898,821

|

$

|

821,829

|

||||||||||

|

Operating profit

|

82,891

|

95,792

|

93,577

|

118,516

|

116,581

|

|||||||||||||||

|

Interest expense

|

12,628

|

12,925

|

11,476

|

8,241

|

7,419

|

|||||||||||||||

|

Net income attributable to Matthews shareholders

|

43,674

|

54,888

|

55,843

|

72,372

|

69,057

|

|||||||||||||||

|

Earnings per common share:

|

||||||||||||||||||||

|

Basic

|

|

$1.54

|

|

$1.99

|

|

$1.98

|

|

$2.47

|

|

$2.32

|

||||||||||

|

Diluted

|

1.53

|

1.98

|

1.98

|

2.46

|

2.31

|

|||||||||||||||

|

Weighted-average common

|

||||||||||||||||||||

|

shares outstanding:

|

||||||||||||||||||||

|

Basic

|

28,209

|

27,255

|

27,753

|

28,775

|

29,656

|

|||||||||||||||

|

Diluted

|

28,483

|

27,423

|

27,839

|

28,812

|

29,706

|

|||||||||||||||

|

Cash dividends per share

|

|

$.460

|

|

$.410

|

|

$.370

|

|

$.330

|

|

$.290

|

||||||||||

|

Total assets

|

$

|

2,031,735

|

$

|

1,215,900

|

$

|

1,128,042

|

$

|

1,097,455

|

$

|

993,825

|

||||||||||

|

Long-term debt, non-current

|

714,027

|

351,068

|

298,148

|

299,170

|

225,256

|

|||||||||||||||

| (1) | Fiscal 2014 included net charges of approximately $39,569 (pre-tax), primarily related to acquisition-related costs, strategic cost reduction initiatives, and litigation expenses related to a legal dispute in the Funeral Home Products segment. Charges of $38,598 and $971 impacted operating profit and other deductions, respectively. In addition, fiscal 2014 included the unfavorable effect of adjustments of $1,347 to income tax expense related to non-deductible expenses related to acquisition activities. |

| (2) | Fiscal 2013 included net charges of approximately $14,095 (pre-tax), which primarily related to strategic cost reduction initiatives, incremental costs related to an ERP implementation in the Cemetery Products segment, acquisition-related costs and an impairment charge related to the carrying value of a trade name. The unusual charges were partially offset by a gain on the final settlement of the purchase price of the remaining ownership interest in one of the Company's subsidiaries and the benefit of adjustments to contingent consideration. |

| (3) | Fiscal 2012 included net charges of approximately $7,850 (pre-tax), which primarily consisted of charges related to cost reduction initiatives and incremental costs related to an ERP implementation in the Cemetery Products segment. In addition, fiscal 2012 included the favorable effect of an adjustment of $528 to income tax expense primarily related to changes in estimated tax accruals for open tax periods. |

| (4) | Fiscal 2011 included the favorable effect of an adjustment of $606 to income tax expense primarily related to changes in estimated tax accruals for open tax periods. |

| (5) | Fiscal 2010 included the favorable effect of an adjustment of $838 to income tax expense primarily related to changes in estimated tax accruals for open tax periods. |

19

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion should be read in conjunction with the consolidated financial statements of Matthews and related notes thereto. In addition, see "Cautionary Statement Regarding Forward-Looking Information" included in Part I of this Annual Report on Form 10-K.

RESULTS OF OPERATIONS:

The following table sets forth sales and operating profit for the Company's Memorialization and Brand Solutions businesses for each of the last three fiscal years.

|

Years Ended September 30,

|

||||||||||||

|

2014

|

2013

|

2012

|

||||||||||

|

Sales:

|

||||||||||||

|

Memorialization

|

$

|

508,420

|

$

|

517,911

|

$

|

492,867

|

||||||

|

Brand Solutions

|

598,177

|

467,446

|

407,450

|

|||||||||

|

Consolidated

|

$

|

1,106,597

|

$

|

985,357

|

$

|

900,317

|

||||||

|

Operating Profit:

|

||||||||||||

|

Memorialization

|

$

|

69,306

|

$

|

72,931

|

$

|

63,589

|

||||||

|

Brand Solutions

|

13,585

|

22,861

|

29,988

|

|||||||||

|

Consolidated

|

$

|

82,891

|

$

|

95,792

|

$

|

93,577

|

||||||

Comparison of Fiscal 2014 and Fiscal 2013:

Sales for the year ended September 30, 2014 were $1.1 billion, compared to $985.4 million for the year ended September 30, 2013. The increase in fiscal 2014 sales principally reflected the acquisition of Schawk, Inc. ("Schawk") in July 2014, higher sales in the Company's Graphics Imaging and Marking and Fulfillment Systems segments, the incremental impact of acquisitions completed in fiscal 2013 and the impact of significant projects in the Cremation and Merchandising Solutions segments. Consolidated sales for fiscal 2014 also reflected the benefit of favorable changes in foreign currencies against the U.S. dollar of approximately $6.2 million.